Usually I refrain from discussing personal news so you’ll have to forgive me for the following infraction.

First, Wednesday the 4th saw the birth of our daughter, Anna Laura Summer. A few days earlier than expected, she is healthy, strong, and, so far, pretty chill. I’m grateful to my wife, of course, for doing all the hard work. And I could not be more smitten with this little bundle that is currently sleeping on a big pillow next to me on the couch.

So. Much. Love. ❤️

Second, Unity acquired Parsec, a company I’ve been advising. When I first met its CEO, Benjy, I was immediately impressed by their providence. Long before working from home became a common practice, Parsec already had a strong client line-up that leveraged its technology.

Certainly, life seems easy when your product offering is superior. But history tells us that execution is at least equally important. Following two rounds of funding, the pandemic triggered demand for Parsec’s services. Practically from one week to the next, both big and small developers urgently needed to access high-end rigs remotely to keep production rolling. It may be hard to imagine the amount of pressure that puts on a startup crew.

In my experience, massive success can be one of the quickest way to kill an early-stage company. More so than the tech, it was the team that built this success. It’s been a privilege to work with such talent, and I can’t wait to see what’s next. Unity is lucky to have them. Well done, team Parsec!

August is barely halfway but I feel it has already met its action quota. I’m going to take a break and spend some time with the family.

On to this week’s update.

NEWS

Games Workshop looks to shut down fan animations

Following an update to its intellectual property guidelines, Games Workshop may find itself in hot water with players. Specifically, the following phrase is irksome.

“Individuals must not create fan films or animations based on our settings and characters. These are only to be created under licence from Games Workshop.”

What year is this? On the short term it creates bad press. Making fan films is precisely the type of affectionate expression that contemporary audiences prefer. More so, the degree of ownership that players feel with regards to their favorite games goes very deep. Trying to brutishly enforce legal boundaries isn’t just a cold gesture, it breaks the spell that binds players to the game.

On the long run, such a grabby stance flies right in the face of more recent trends in gaming: the boundary between creators and consumers is blurring. Games like Roblox and related third-party services like Mod.io and Overwolf speak should tell you that the industry is at the start of a new era in engagement and retention tactics. Manhandling players with terse terms isn’t part of the script.

The Fins keep on playing, developing

If you’ve ever wanted to read a 152-page report on the Finnish games industry, now’s your chance. Two observation jump out.

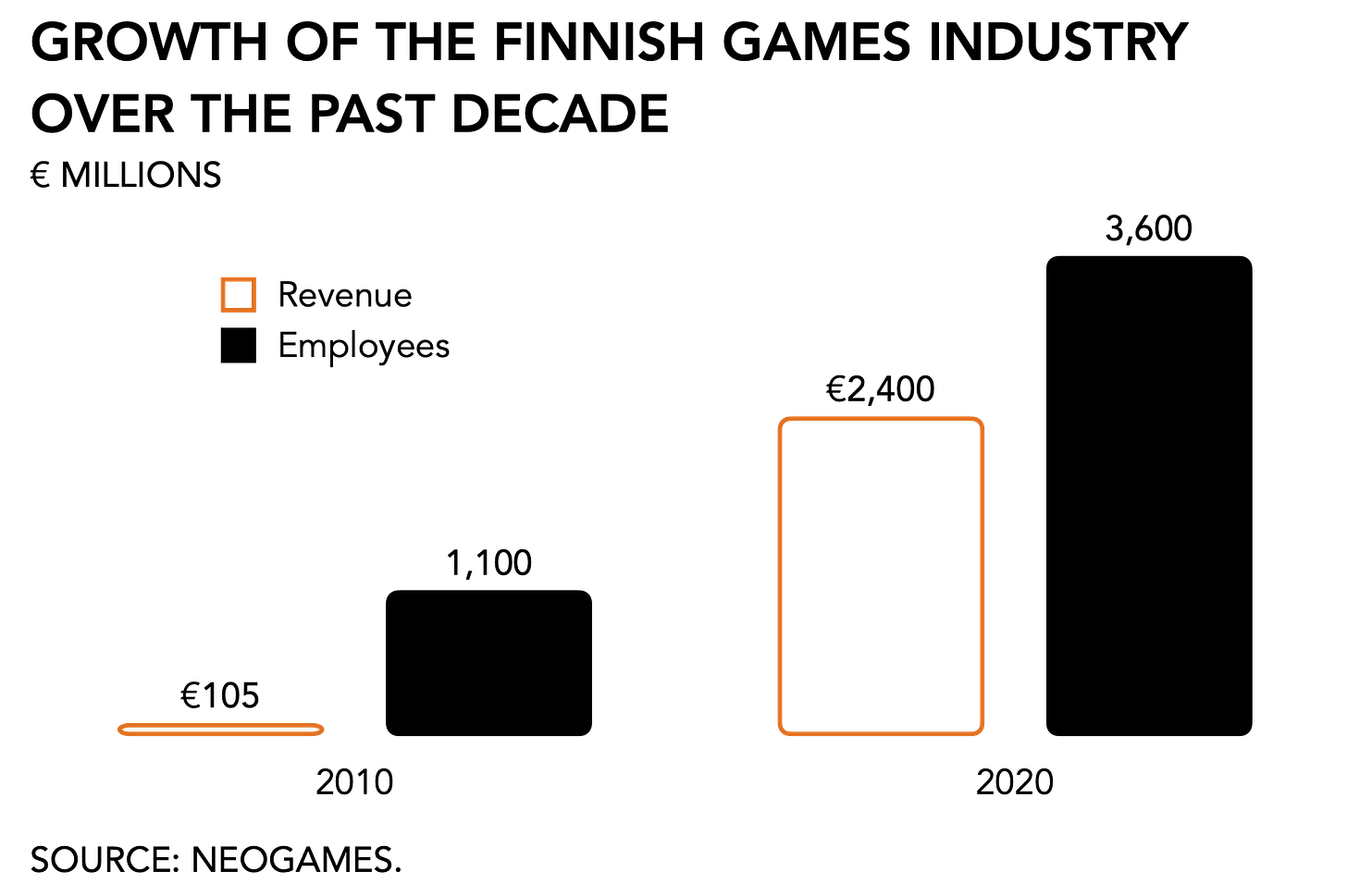

First, it is amazing to see the difference that government subsidies can make on a creative industry. It managed to grow the number of active studios from 40 and employing 600 people in 2004 to 260 and 2,500 a decade later. Since then the total number of outfits has come down a bit, to 200, “mainly because competing on global markets has become more difficult and the threshold for setting up a new studio is higher.” Even so, Finnish studios counted 3,600 employees in 2020.

Second, Finnish game studios have all but abandoned AR development, it seems. After over a third claimed they were working on an AR-type project in 2018, that number has since dropped to 5 percent.

Well worth your time provided you read it while eating large helpings of Salmiakki.

Esports not ready for the Olympics

The persistent decline in viewership for the Olympics invites a conversation on what’s next. Watching competitive video games has presented itself in recent years as an ambitious newcomer. But is it ready?

Different tribes taking a break from warring to engage in a competitive sports event in honor of the gods is but a distant memory. Today, the Olympics are a global spectacle to showcase the prowess and accomplishments of big and small countries. But considering that viewership for the games in Tokyo was down -42% compared to Rio in 2016, it is odd that ad spending held steady.

Some of it was incidental, of course. Covid kept audiences out and the time difference between Japan and Europe/North America meant large swats of viewers were asleep during many of the events. But viewership has been declining for years.

The economics are remarkable. The International Olympic Committee, a wretched hive of scum and villainy, generates 75 percent of its income from selling media rights. NBCUniversal is the largest spender and accounts for 40 percent of total: it paid the IOC $12.2 billion for the rights to broadcast the Olympics from 2014 through 2032. That’s because advertisers don’t care: despite the lower ratings, NBC expects to generate $1 billion in profit for this year’s edition. Even as television viewership has been in a clear decline, brands continue to spend about $66 billion every year as they have been for a decade.

Despite its inefficiencies, events like the Olympics and broadcast television in general continue to lurch forward without any fear of real competition. The popularization of watching other people play video games competitively threatens to disrupt the steady-on economics in sports entertainment. We’ve had this conversation before, and now it’s back.

The punch line: esports doesn’t need the Olympics; the Olympics needs esports. To that end several of the major media agencies have formed divisions that focus on video games. But unless game publishers find a way to convince advertisers to stop copying and pasting their media plans year after year, esports won’t make it to the main stage.

Krafton’s new battleground

After initially receiving a $3.8 billion valuation in the prelude to its public debut, the share price for PUBG-maker Krafton fell 20 percent. It has been an uphill battle the whole way. After cutting its valuation by 10 percent in the lead-up to the IPO following pressure from domestic regulators, the Chinese government made life worse by increasing its scrutiny of the video games sector. Representing 72% of sales, China is critical to Krafton, but not even Tencent is powerful enough to battle Beijing.

That leaves the Korean firm with two strategies: the first is to expand to large markets like India. So far that seems to be going well: Battlegrounds Mobile saw 34 million downloads in its first week. A second approach is more directly disproving skeptics that it is not a one-trick pony. Much of the criticism today stems from its reliance on a single title. Rolling out something new to assuage those concerns is the bane of most creative firms’ existence. But finding a new battleground would go a long way to do just that.

MONEY, MONEY, NUMBERS

Activision Blizzard came out on top despite turmoil. It was absolutely devastating to learn about the pisspoor work culture at ATVI, and for me personally it was the bravery of the victims speaking out that sparked hope. Certainly we can make the argument that after years on the fringes, we should expect growing pains: the industry today finds itself at the center of the entertainment universe and catering to mainstream audiences. Publishers should expect much greater scrutiny and a negative impact on the value of their catalogues if they don’t clean up their act. ATVI’s share price dropped below $80 a share following the news but has since started to regain momentum.

Earnings across its three divisions were as follows: Activision Publishing’s bookings fell -21% y/y to $789 million, Blizzard reported a -6% decline to $433 million and missed forecasts, and King compensated for both with a +15% increase to $635 million led by ad revenue which trailed above $300 million over the last four quarters.

Electronic Arts impressed everyone. Its bookings were $1.34 billion, well above a consensus of $1.28 billion and its guidance of $1.25 billion. The success of Mass Effect Legendary Edition (released 5/14) and It Takes Two (3/26) drove its momentum, and EA anticipates +20% y/y organic growth for Apex Legends based on averaging 13 million weekly players in Season 9. Following its spending spree, especially in the sports category, EA reported 140 million players engaged with its EA Sports games in the last twelve months, with FIFA accounting for 31 million players. The number of FIFA Ultimate Team matches were up +48% y/y, and FIFA Online 4 reported all-time records in China for monthly active players. Codemasters’ F1, one of its newly acquired assets, saw total active players grow +10% y/y.

Take-Two held steady. Total bookings came in at $711 million versus a consensus of $688 million and guidance of $625 – 675 million. As ever, GTA V drove growth, which sold close to 5 million units since the firm’s previous earnings call, and GTA Online grew its player base by +72% y/y. Cowboy simulator RDR2 sold an additional one million copies, partly on the momentum of Red Dead Online, adding +18% to its audience. Its top sports franchise, NBA 2K, is the most popular sports title in China where it claims 54 million users and reported +30% y/y growth among returning players. Finally, TTWO’s push into mobile is seemingly working, with WWE Supercard as its highest grossing mobile title reaching 24 million downloads, and its recent acquisition, Nordeus, further boosting revenues.

Zynga reported mixed numbers. Blaming its woes on a combination of the “Great Reopening” impacting player activity and Apple’s IDFA policy changes, Zynga lowered its 2021 guidance to $2.8 billion (down from $2.9 billion, but still up +23% y/y). There were some notable successes, however, as Toon Blast, Toy Blast, and Harry Potters: Puzzles & Spells delivered +37% growth in bookings. And Words With Friends drove ad revenue which grew +111% y/y. Nevertheless, Wall Street unceremoniously trimmed its estimates and enthusiasm accordingly, and Zynga’s share price dropped -16% to $8.20.

PLAY/PASS

Play. The Ariana Grande Rift Tour in Fortnite was a step up from what we’ve seen before. Well worth the 12 minutes to get a sense of what immersive experiences will look like in the future.

And now, baby time!