The Super Bowl has long been an annual celebration of my adopted nationality. Make no mistake, though: it’s not my sport. On three separate occasions have I tried to get into American football, and I failed every time. I am fatally hardwired for soccer.

Watching the spectacle that is the Super Bowl, however, offers a fascinating insight into the American psyche. Or at least what’s on the menu in the coming year for an economy that depends for 70% on consumer spending.

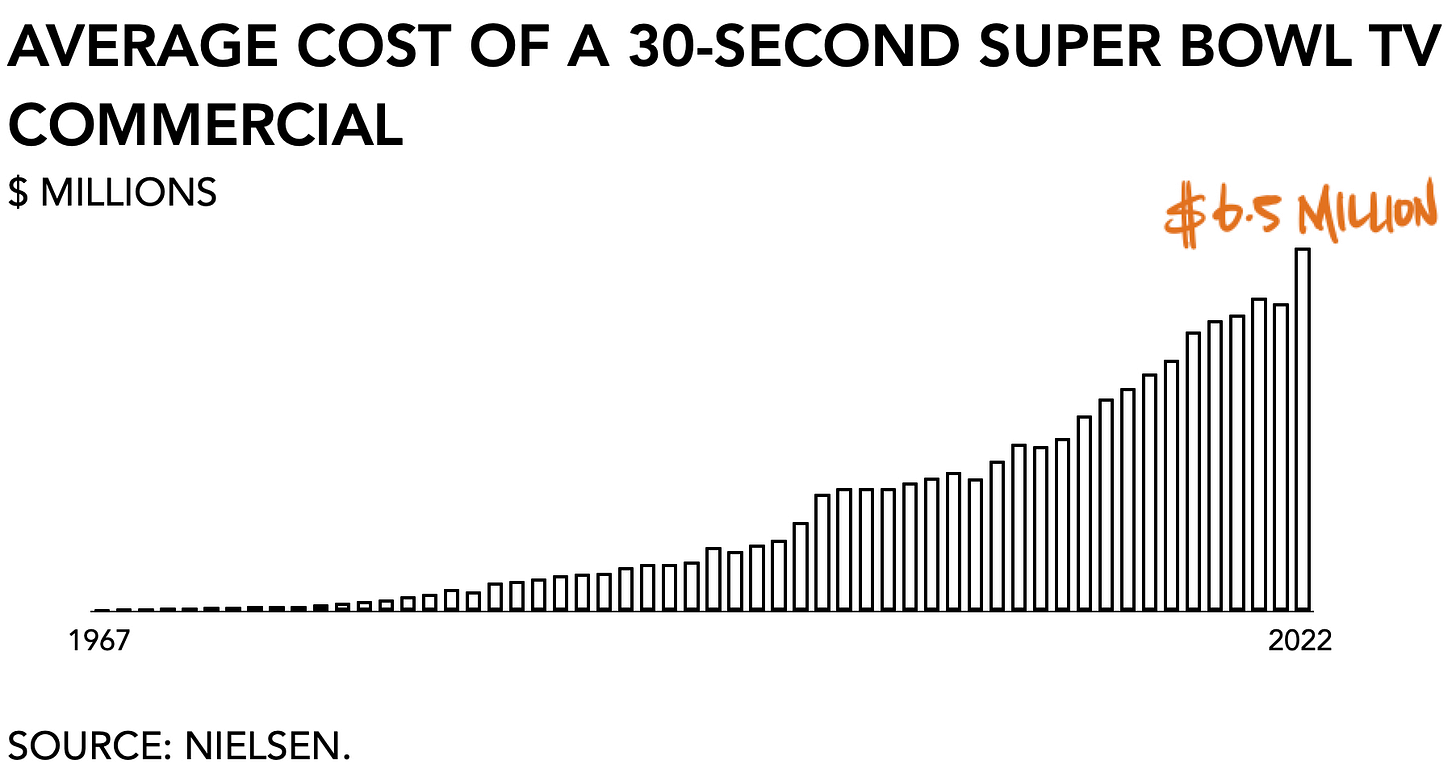

The key insight is that a take-over of multiple companies from the same industry that is not endemic to football (e.g., automotive, consumer packaged goods) means their viral user acquisition is starting to slow down. Throwing down $6.5 million for a 30-second commercial during one of the biggest television events in American culture is a covert plea for relevance. After a period of getting lots of free users to sign up for their services, the flood has started to die down, and now active acquisition becomes part of the daily slog.

Back in 2015 audiences watched Kate Upton prance around a fictional battlefield to promote Game of War. You’ll recall that this was before Pokémon Go surfaced and proved to the world that the actual number of gamers out there is much larger than assumed. People were blown away.

Similarly, this year’s abundance of crypto ads echoes the take-over of the airwaves by mobile game companies a few years ago. It is an attempt to validate a novel category by having 30-second ads on display and be more like the big brands. Just like those god-awful billboards we’ve seen in Times Square for months, buying a Super Bowl ad implies that a company or industry is big enough to play with the big dogs. Whatever, Coinbase. Maybe invest some money in product development instead.

Combined it presents evidence of the slowing influx of new users for all those crypto tools and platforms, alongside their growing need to become legit to keep the good times rolling. My guess is we are three to six months out from a significant slowdown.

My favorite part was watching the halftime show with Snoop Dogg and Mary J Blige. I remember thinking:

“Oh, how nice. They aren't playing old people's music for a change.”

And then it hit me.

On to this week’s update.

NEWS

Wordle saves hostage from a naked kidnapper

When her mother hadn’t sent her daily Wordle, a daughter on the other side of the US got worried and alerted the authorities who promptly rescued her from a deranged kidnapper. You can’t make this sh!t up.

More generally, though, it provides a glimpse into the way games provide the connective tissue between people who live far apart. The daily routine of playing a round of Wordle is enough of a signal to another person to let them know you’re doing fine and thinking of them without having to engage in a whole sit-down, how are you doing, ok great, what’s for dinner type of conversation. In strong relationships, you only need one word to let the other person know how you’re doing. A 5-letter word, to be exact.

Amazon Games finds success in publishing 3rd-party title Lost Ark

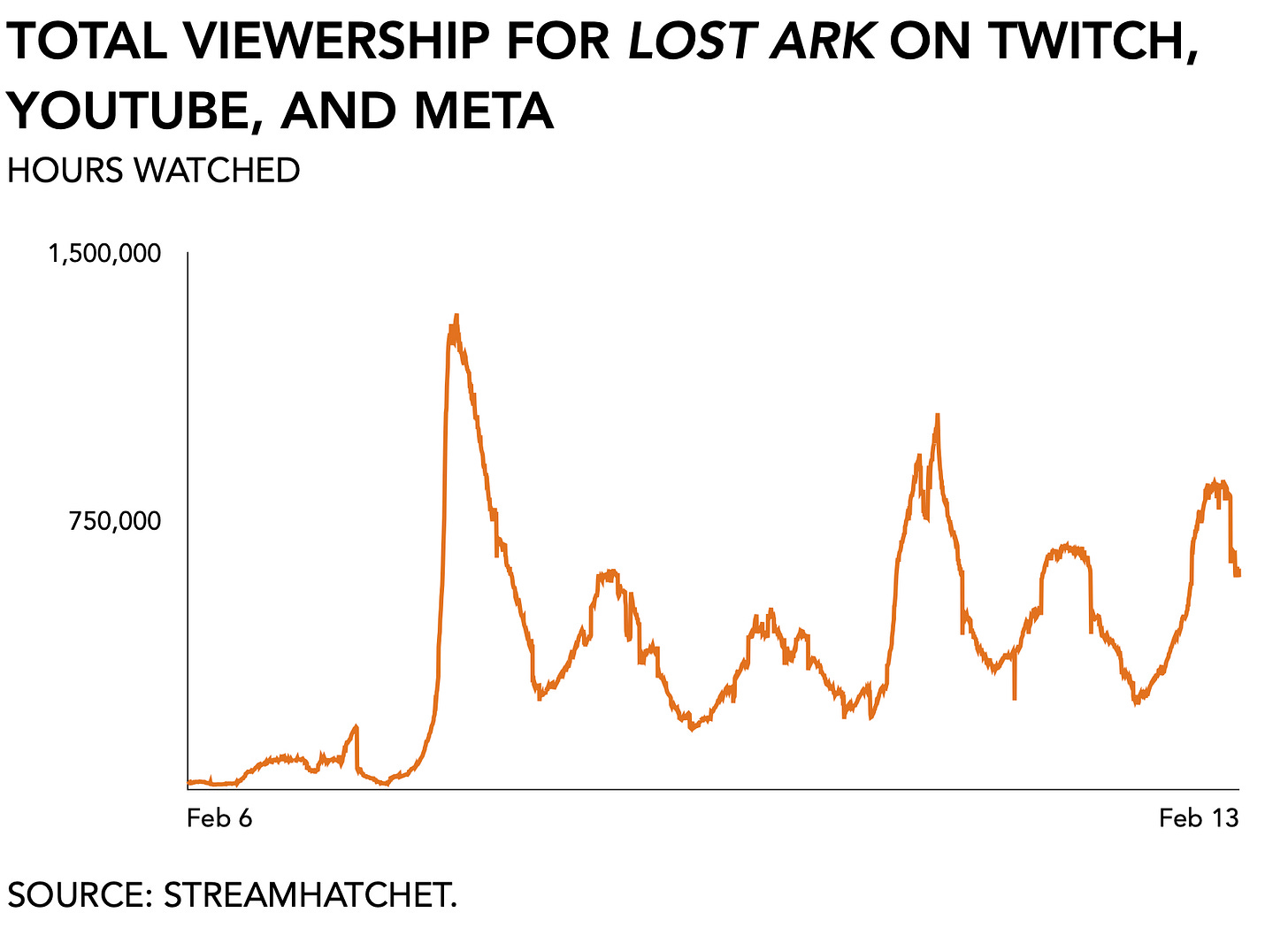

Every blind squirrel finds a nut sometimes. And so it seems that Amazon has found its groove. The release of Lost Ark, developed by South Korean game maker SmileGate, has resulted in rapid consumer adoption. Within 24 hours of release, the game reached a peak of 1.3 million concurrent players. That’s a big deal for Amazon, which has been mayor of Struggle City with the last few titles.

As for business strategy, it opens the door to the suggestion of moving away from developing in-house and, instead, becoming a publisher and, maaaybe possibly a platform holder with Luna. It’s been widely established that the corporate culture at Amazon, however well-oiled it may be for e-commerce, is restrictive to creative activity.

Lost Ark is beautiful and offers a rich MMO universe filled with loads of cool creatures that will try to kill you. According to Stream Hatchet (disclosure: I’m an advisor), Lost Ark has so far enjoyed 66,193,865 watched hours across Twitch, YouTube, and Meta, with a peak concurrent viewership of 1,333,295 and on average 394,283 concurrent viewers. It’s off to a healthy start. Let’s see if it can keep the party going.

I would go so far as to say that the game offers an innovative new take on the MMO genre if it weren’t for the clichéd, half-naked large breasted women in it. I hear Epic is hosting a workshop on digital fashion. Maybe check that out.

Epic hosts digital fashion workshop

See what I did there? Sure enough team Sweeney wants you to use their Unreal Engine. It makes sense for them to constantly look for new ways to inspire and remove entry barriers for new users, as the value of Epic’s engine is directly related to the number of people using it.

But there’s more to it. Ever since people proved comfortable buying digital items for their avatars, it has only been a matter of time before game companies started investing in expanding that practice. Building a unique Pokémon or Magic: the Gathering deck is a form of self-expression. It allows you to communicate to others what you’re about and tells you about yourself, thereby creating a strong emotional bond between you and the game.

Creating in-game assets has long been the job of professional designers. Mostly salaried employees or outsourced art studios create the various outfits, weaponry, items, animations, and hats necessary to customize your experience. But now demand for custom in-game items has started to outgrow the industry’s ability to supply. The emergence of professional user-generated content creators as in Roblox and similar games is one step toward a new future where users have greater input on their experiences. Another is the facilitation of high-end digital fashion workshops that may elevate the practice from hobby to profession.

MONEY, MONEY, NUMBERS

Roblox reported $770 million in revenues. Bookings were +20% y/y and +21% q/q due to a strong December ($370 million, +77% m/m). Audiences continue to love Roblox, based on the 49.5 million daily active users, which was up +33% y/y and +5% q/q. Player engagement was up, too, with a total of 10.8 billion hours which was up +28% y/y but down -3% m/m.

Roblox managed to attract an older age cohort, with 17-24 year-olds increases +50% y/y and reporting a healthy international expansion, especially in APAC. An important driver was the firm’s investing in developer exchange fees which totaled $538 million in 2021 (+60% y/y).

Despite all this growth, Roblox managed to disappoint investors by falling short of expectations because it was unable to repeat last year’s numbers. It was proof, according to analysts, that Roblox was going to have a harder time ahead. The “pace of growth deterioration” resulted in a reduction in their estimates. Subsequently, Roblox’s share price dropped by -27%, from a high of $73 to $53 a share.

Rovio revenue reached $90 million, up +15%

For all of 2021, the firm generated $325 in earnings. Rovio is growing, yes, but it remains squarely dependent on the success of its Angry Birds franchise. For one, income from brand licensing has dropped to about 3% of total. For a while, the firm imagined itself a rival to Disney, but that obviously didn’t happen. It raises a familiar strategic problem, however: how to capture lightning twice? A local competitor, Supercell, faces a similar problem (see below), and it is indeed a common problem for creative firms to get out from under their biggest success. To that end, Rovio recently acquired a Turkish studio, Ruby Games, in pursuit of the “hyper-casual” market. Considering the pace of consolidation in gaming today combined with Rovio’s current enterprise value of $456 million and the rising challenges in user acquisition, it’s probably only a matter of time before it finds a home at a bigger firm.

Supercell brings in $2.24 billion in revenue and $852 million in profit. Bluntness on results is part of Supercell’s formula. After the successes, its CEO soberly asks whether Supercell’s best days are behind or in front of it. It’s a bit of taboo, of course, to admit to this so openly but it characterizes Supercell’s leadership and explains how it got to where it is. Already has it been involving users in its design process, in the hope to crowdsource and get an early sense of what players want. I give them props for asking the hard questions, especially publicly.

Nvidia reported $7.6 billion in quarterly revenues, up +53% y/y. Gaming remains the firm’s largest market. Sales from its gaming business rose +37% y/y to $3.4 billion driven by GeForce sales. It bragged about adding 65 games to the GeForce NOW library, which now totals more than 1,200, and the collaborations with AT&T and Samsung, but I don’t think it is going to capture a leading position in cloud gaming. Its second-largest category, data sales, accounted for $3.2 billion and grew +11% q/q. For the full year, Nvidia generated $26.9 billion in revenues, up +61%.

PLAY/PASS

Play. Horizon Forbidden West looks sick. If only I could unthaw Sony’s mixed feelings for me and have them send me a PS5. Hermen, call me!

Pass. One wonders how much of that abundant investment capital went toward game studios with a diverse leadership team. Not nearly enough, I’m guessing.