This time the start of the semester was different.

After a decade of telling students that interactive entertainment is an exciting topic for study and a career path seldomly traveled by many, I found myself standing in front of the classroom having to entertain questions on what companies are likely to survive now that the games industry is showing a decline.

The steady cadence of layoff announcements that started to rain on the industry the past few weeks presents a different read on the ever-expanding video games universe. Despite record sales, including this week’s announcement by the Santa Monica Studio that its God of War Ragnarok had sold over 11 million copies, many of the major publishers are culling their ranks.

News of Rovio’s supposed acquisition had spread. Microsoft had announced its widespread layoffs. Sony, Microsoft, and Nintendo decided to abandon E3, the largest North American industry event, which, ICYMI, shouldn’t surprise you. And Electronic Arts suffered a downgrade this week after having to delay a marque title and discontinuing several mobile adaptations (see below).

You could say I was feeling a little vulnerable.

Worse, supposedly, the education-industrial complex, Big Teach, is entering its first real semester with artificially weaponized students. Somehow, during the winter break, generative AI broke out of its nerdy academic shell and became the coolest kid on campus as a widespread easy-to-use tool to help students write better papers with less effort.

Universities, in my experience, prefer to employ painfully dated technology. Due to their size and anxiety to run afoul of any permissible uses of content, higher education has always been at a disadvantage. Sure enough, I can run your paper against a massive database to see what phrases you borrowed without giving credit. To date, I’ve failed only a single student for plagiarism despite the university reminding me at the start of the cycle to impress on students how unethical it is. I guess that means it’s working, right?

But AI is changing that game completely. It felt sobering to realize that after I fed ChatGTP the entire text of my book, it came back with:

“One Up is a book about the video game industry. It talks about how video games are made, how they are sold, and how they have become an important part of our culture. The book also discusses the challenges and opportunities that the industry faces, and how big companies like Microsoft and Sony are trying to stay ahead in this fast-changing field. It is written by an expert who has studied and worked in the video game industry for many years.”

Two decades of painstakingly collecting data and developing expertise summarized in seconds. It would almost make you feel like you have nothing left to write or teach.

Except maybe one thing. This semester, grading is going to be a breeze.

On to this week’s update.

NEWS

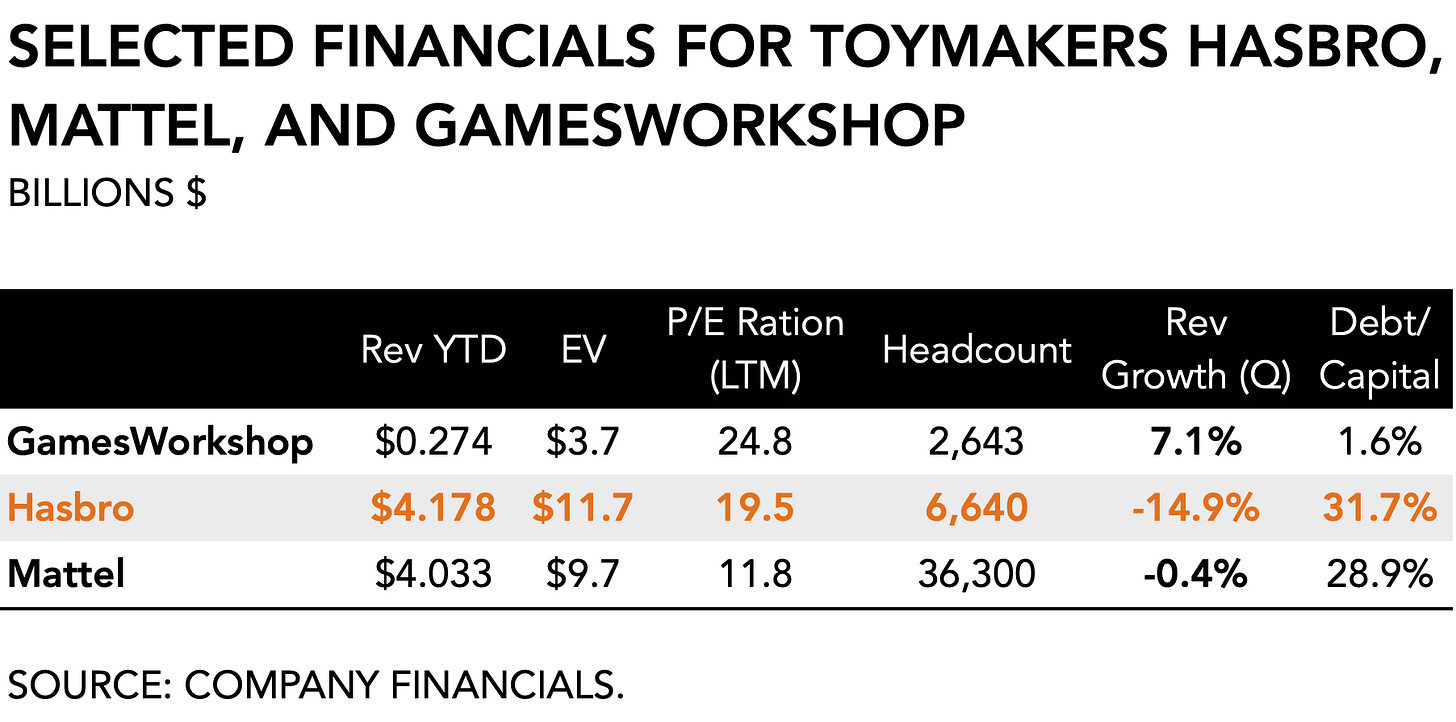

Wall Street debuffs Hasbro stock

Analysts reduced their estimates of Hasbro after it released preliminary results for 224Q. Following a "challenging holiday consumer environment," management adjusted its guidance to $1 billion for 22Q4 sales, a -26 percent y/y decrease, and a lowering of its implied forecast of $450 million for 2022. The firm also announced a workforce reduction of roughly 15 percent of its global headcount, which it expects to reduce costs by up to $300 million a year by the end of 2025. Finally, Hasbro’s President and COO, Eric Nyman, is leaving.

The overall toy market has suffered from supply chain issues like everything else, of course, but it casts a shadow over Hasbro’s ability to maintain momentum in the year ahead, especially as growth for its Wizards division slowed after providing a boon during the pandemic. A new trailer for the upcoming film production Dungeons & Dragons: Honor Among Thieves based on its well-known IP scheduled for release on March 31 garnered 13 million views on YouTube within its first week.

The company is undergoing a significant transition as the post-pandemic market environment has changed and its new CEO’s plans are taking hold, including the firm’s intent to sell part of the eOne TV and film business, which generates an estimated $800 to $900 million annually, that does not directly support its branded entertainment strategy. It had acquired eOne right before the pandemic for $4 billion, which subsequently became a drag on the company’s P&L due to inevitable production delays. Hasbro previously sold the accompanying music business in 2021 for $385 million.

Wizards recently found itself drawing ire from its D&D community after Gizmodo published leaked details about planned revisions to its Open Game License (OGL 1.1), which grants game makers the use of D&D’s basic game rules. Since the original license had remained unchanged since 2000, many of the more contemporary avenues for creative game design and monetization strategies (e.g., live-streaming, blockchain-based games) were not covered. To remedy this, Wizards sought to implement a registration requirement and royalty structure for top earners, ostensibly to prevent brand dilution. After the documents first surfaced outside the firm’s control, followed by a lot of outrage, Wizards changed its mind and stated it was “leaving OGL 1.0a in place, as is. Untouched.”

Analysts anticipate an increase in Hasbro’s dividends to follow when its board meets later this month.

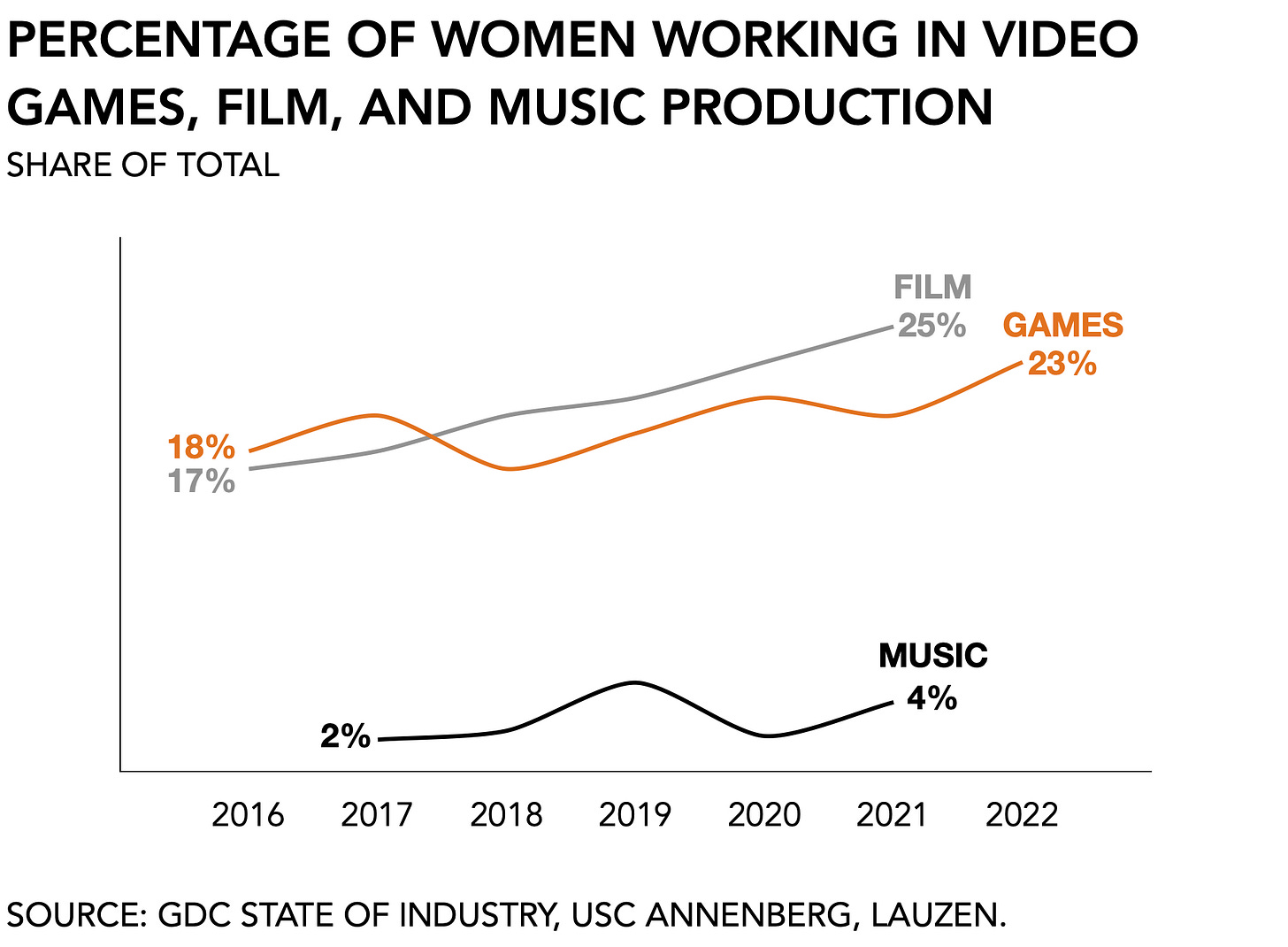

Share of women working in games increases, slowly

In the lead-up to its annual Game Developer Conference (GDC), the hosting organization released its annual State of the Industry 2023. Sourced among several thousand, self-selecting attendees (which necessarily skews the dataset of course!), the report generally quizzes people on basic demographic information and their opinions on the latest and dumbest technological innovations. We learned this year that game devs think the metaverse is “bogus” according to the Washington Post, and NFTs continue to be a bad word.

However, if you squint and put the findings for the past seven into a single chart, a distinct increase in the number of women working in video games emerges. Between 2016 and 2022, the percentage of women active in video game development, according to GDC’s report series, has increased from 17 percent to 23 percent.

Is that meaningful?

Yes, it is, actually. While it is an admittedly imperfect comparison, interactive entertainment does appear to keep pace with adjacent categories of film and music. In film production, for instance, one-in-four people working behind the scenes (as opposed to on-screen) identified as female in 2021, which is up from 17 percent in 1998. Most of these people work either as producers (32 percent), executive producers (26%), or editors (22%), but are less commonly found in creative roles like writing (17%), directing (17%), or cinematography (6%).

Much worse is the music industry where, according to a study by the USC Annenberg Inclusion Initiative and Spotify, the percentage of female producers fluctuated between 2 percent and 4 percent from 2012 to 2021. By comparison, video game companies have made notable strides in attracting a more diverse workforce. According to the GDC report, there are more non-binary people working in games, which increased from 2 to 5 percent. I was unable to find similar data for film or music.

My guess is that canceling booth babes and no longer hosting parties with dancers dressed as school girls is nudging the industry’s overall work culture in a more creatively productive direction.

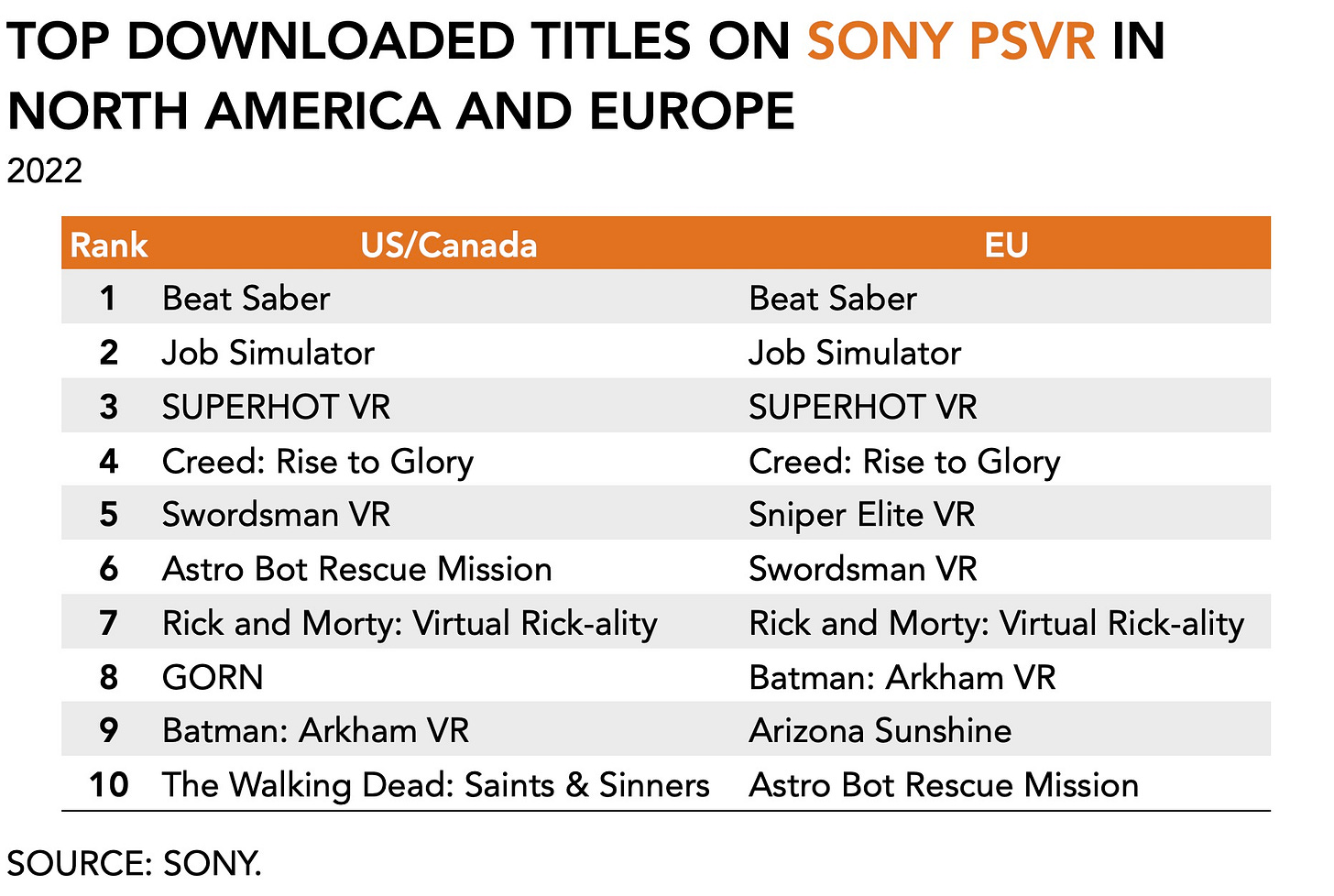

Discounting virtual reality futures

Sony and Meta, two of the most prominent makers of virtual reality goggles and accompanying applications, have issued discounts for their devices. The Meta Quest Pro is $400 cheaper this week and now *only* costs $1,099 in an effort to warm people up to virtual reality. Discounting hardware to subsidize adoption is a tried-and-true strategy in consumer electronics, of course, but the cool factor remains ubiquitously absent.

And Sony cut its PSVR2 forecast after pre-orders of the device disappointed, says Bloomberg. Sony apparently disclosed to a supply partner that it expects a reduction in the number of display panels and anticipates shipping 1.5 million headsets between April 2023 and March 2024. The device is part of Sony’s broader strategy to maintain a leading position in interactive entertainment as a consumer electronics firm.

Undoubtedly, supply chain issues and a depressed consumer market contribute to the sluggish take-off of virtual reality. The category further remains lukewarm despite both firm’s efforts and their recent move to target higher-end customers in the hope these early adopters would be willing to spend more to live in the future.

Looking at the top downloaded content for 2022, the available titles seem a bit stale, though. Sure enough, Beat Saber and Superhot are well worth your time. But they’re also been up there in the rankings forever. A novel platform needs a steady influx of new content or risks losing people’s attention. A two- or three-trick pony is only marginally more entertaining.

MONEY, MONEY, NUMBERS

Sony sold 7.1 million PS5 units in Oct-Dec, up +82 percent y/y (3.9 million), and attributed a +53% increase of its overall games division revenue from $6.3 billion to $9.7 billion in 22Q3 to the success of its first-party titles. Revenues for Digital Software and Add-on Content were up +18 percent at $4.0 billion, Network Services +19% at $1 billion, and Hardware +122% at $4.7 billion. It continues to heavily rely on interactive entertainment, accounting for 35% of total revenue, as offset a decline in its film division which had come down from its success of Spider-Man: No Way Home a year earlier. The Japanese consumer electronics firm further announced a changing of the guard as its current chief financial officer, Hiroki Totoki, will become the president and COO while Kenichiro Yoshida remains chairman and chief executive.

Electronic Arts disappointed Wall Street with $2.3 billion in earnings, a -9% y/y decline, and its EPS of $2.80 missed both its own EPS guidance ($2.90-$3.10) and consensus ($3.04). The announced delay by a full year of Star Wars Jedi: Survivor and the decision to shut down Apex Legends Mobile and Battlefield Mobile as evidence of EA’s difficulty in the mobile games market sobered expectations. All this despite posting a record year for its FIFA franchise, with Ultimate Team up +16%, FIFA Mobile +91%, and FIFA Online +112%. Overall, EA reported $468 million in full game downloads, down -19% y/y, $219 million in packaged goods (-32%), and $1.7 billion in live services revenues (-1%). For EA, physical game sales are winding down, and its digital sales are suffering from tougher macroeconomics. The publisher promptly issued a dividend increase of $0.19 per share to keep everyone on board.

Microsoft reported a drop in games revenue of -13 percent y/y for the quarter ending December 2022. Xbox content and services revenue was down -12 percent and hardware revenues came in at -13 percent y/y. However, the firm also claimed a record 120 million monthly active users across its gaming platforms. For the overall company, Microsoft reported $52.7 billion in revenues, up +2 percent y/y and just slightly below analyst consensus. Its profits declined -12 percent to $16.4 billion, which is expected to continue for the remainder of 2023 and is perceived to be the primary driver behind the firm’s recently announced 10,000 layoffs across its organization, including several studios including ZeniMax Media, Bethesda Game Studios, and 343 Industries.

PLAY/PASS

Pass. Rally, an Ethereum sidechain founded by former Kabam CEO, Kevin Chou, shuts down with only a day's notice, taking users’ tokens with it. Have some class on the way out, people.

Play. The UNBOXING Podcast is back this week! Catch up on last season’s episodes before we go live.