9/11

“How come we play war and not peace?"

"Too few role models.”

― Bill Watterson

On to this week's update.

NEWS

GameStop post biggest loss in its history but don’t get excited

At this point everyone will tell you they told you so. But here we are. The specialty retailer posted a full-year loss of $673MM, despite the $700MM sale of Spring Mobile. Dayum. Previously it had pledged to focus on collectibles, which was up +21.2%, but gaming was down overall.

Now, before we all rejoice in being right and use this to generalize about the retail industry, let’s take a moment. True, GameStop has had a sh!t year. And the most threatening component to its current predicament is that its used sales revenue are down. This has historically driven traffic to its stores and a unique differentiator. During this quarter’s earnings, GameStop officially acknowledged the mounting challenges of its pre-owned business model.

But here’s where everyone is likely jumping the gun on GameStop’s demise. Across the board the narrative is the same: Amazon is eating GameStop’s lunch.

Except it isn’t.

For console manufacturers, traditional retail continues to be critically important in helping them market and sell to consumers. Amazon has not managed to become as competitive as it has elsewhere: in the US it accounts for low single digits percentage on console hardware sales. Over the last few years it’s been Walmart, GameStop, and BestBuy that have sold upwards of 90% of consoles.

Next, it is also true that we’re at the end of the 8th hardware generation. But the console guys are not planning on going fully digital just yet. Nintendo is about to drop a new, lighter version of the Switch. And both Microsoft and Sony are busy putting together their next gen consoles.

And as far as cloud gaming is a relevant component, let’s not get too excited just yet. Cloud gaming and download services seem like an obvious last nail in the coffin for GameStop, but neither Microsoft nor Sony are expecting this to become a major part of their business any time soon. Sony’s cloud gaming service, which has been around for years btw, is only actively used by 3% of its current active players, and at E3 earlier this year Microsoft was mostly excited about project Scarlett (90%) and much less so about xCloud (10%). That is going to change, of course, but all of these devices around going to need a specialty retailer to help market and sell them. Link

Apple finalizes its Arcade announcement, launch

In the run-up to cloud gaming and other content services, Apple’s Arcade is a stand-out for me. Overall I’m bullish, even if, based on what we currently know, it won’t disrupt the overall mobile gaming ecosystem. In many ways, the Apple Arcade is complementary to the existing market place.

A price point of $4.99 suggests that Apple is keen on provoking a land grab in subscription-based game services. It also builds on its experience with Apple Music: after initially offering a 3-month free trial period, it reduced this to one month in July this year. The Arcade comes with just one month from the start. If we extend that logic we can safely expect around 50MM people to sign up within the first 24 months, provided Apple continues to add content.

For developers, the Apple Arcade will largely serve as a marketing and brand building tool for the game makers that are currently part of its service. It’s an enormous win for a small outfit to sell the mobile rights to Apple and be featured prominently as it rolls out this new service.

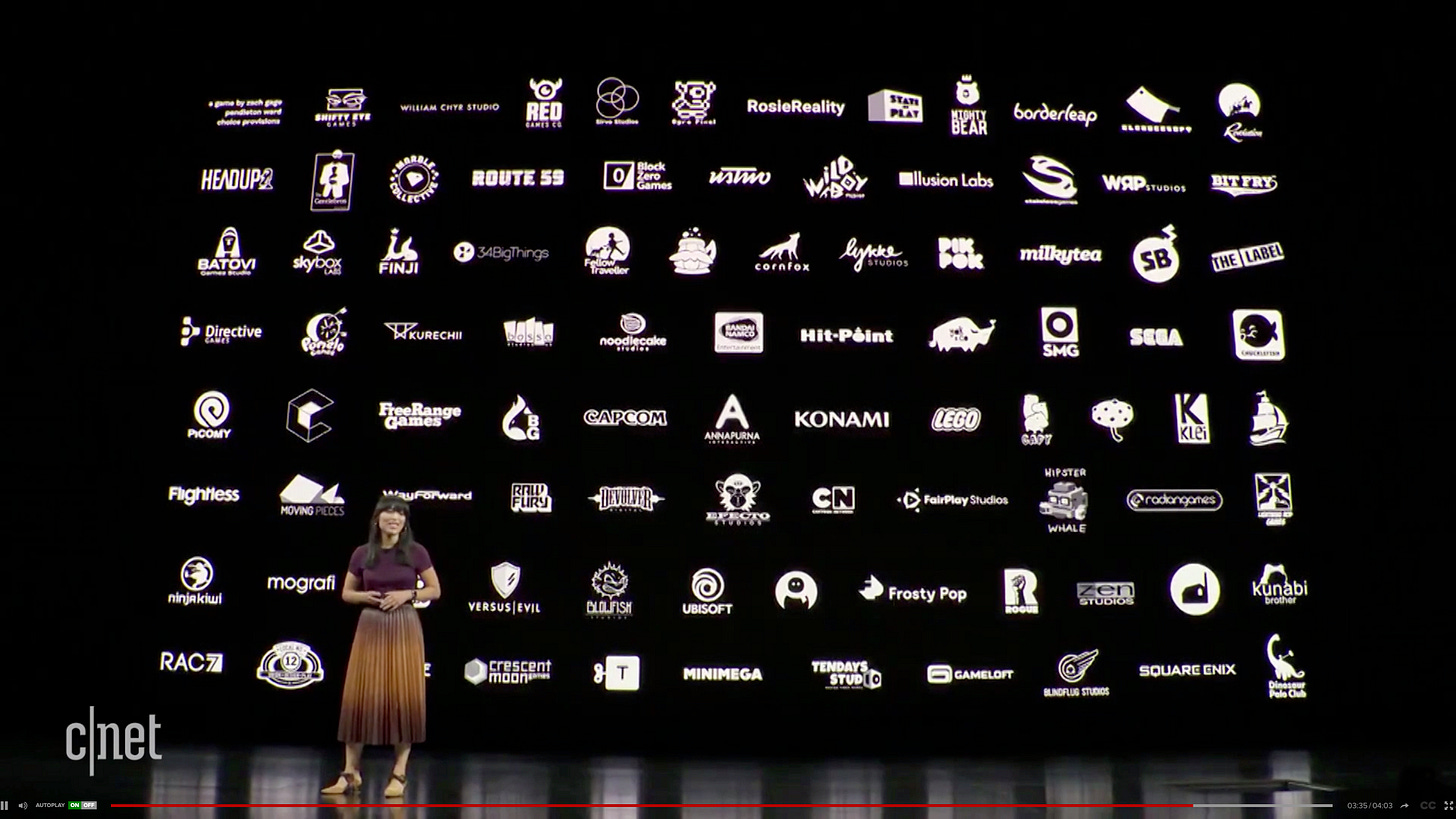

Even so, Apple’s list of publishers also includes several well-known names. In addition to Capcom and Konami, we saw Square Enix, Ubisoft, Gameloft, and SEGA. While these firms have an impressive presence in PC and console gaming, they are not exactly hard-hitting content creators on mobile. The share of their overall revenue coming from mobile has remained well under 10% for all of them. (According to its financial documents, Vivendi’s Gameloft generated $324MM in mobile revenue in 2018, which represents 2.1% of Vivendi’s annual earnings.) It’s fairly common for incumbent firms to release a port, or slightly updated or tailored version, of one of their major franchises on a new platform. But these firms also know full well that they cannot monetize audiences with micro-transactions and add-on content. As a result, the financial upside will remain relatively modest. This is similar to the cost-plus pricing we see in video (e.g., Netflix) and music (e.g., Spotify).

The challenge is to become the most popular title within a subscription in order to negotiate a better payment. But likely it will remain by and large a marketing effort for both the minor and major firms.

When it comes to the value for consumers I’m more torn. The optimist in me is excited about the growing availability of premium content at a fixed price. It makes the Apple Arcade less of a money-maker for large incumbents, and, as a result, I’d expect any innovation to come from the smaller fries, of which Apple has managed to round up plenty. It is not a play for the attention of the traditional hardcore gamer audience, at least not on the basis of the titles that will initially be available. The current offering should appeal in particular to parents because minors tend to be equally excited and confused about the costs of free-to-play games. As a parent I welcome this model with both arms.

The cynic in me always worries about the negotiating position for, especially, small creative firms. As a general rule, the platform must come first. This means that Apple effectively owns all the cards in negotiating rates, and you either play along or perish. Despite Tim Cook’s clamoring for better care-taking of personal data, like it various competitors, Apple is aggressively expanding on its service revenues. Wall Street loves recurrent revenue and rewards this with a much higher valuation than companies that are primarily transaction-based.

Finally, how does the Apple Arcade affect Google Stadia and Microsoft xCloud? Well, frankly, it doesn’t influence their efforts beyond normalizing the notion of buffet-style entertainment consumption. In this case, Apple has chosen to section off part of its content offering and free everyone—developers and consumers alike—from aggressive monetization tactics. That said, the Apple Arcade clearly targets a very different demographic and looks to engage a more mainstream audience with casual game play. Judging from the titles each have currently announced for their respective services, I expect Microsoft, Sony, and Google to maintain their focus on more dedicated gaming audiences. Link

EA is running a test on its cloud gaming service

I can’t decide if it’s mostly marketing or not. The fanfare around EA giving an “an exclusive external trial” suggests, nay, promises that EA is throwing its full weight behind its Project Atlas. Strategically, having its own, vertically integrated cloud offering makes a lot of sense. First, it frees EA from having to accept any ‘take it or leave it’ deals with major platform holders as they roll out their own bigger and better services. Having a stronger negotiating position will serve EA well. Second, EA has been relying a lot, and I mean a lot, on its ability to squeeze money using its “surprise mechanics” in its FIFA franchise. By relying too much on both this monetization approach and this franchise, EA is pushing itself into a corner. Having a cloud offering will offset some of the risk and possibly even present an opportunity to host third-party content as a possible testing ground for acquisition targets. And while we’re on the topic, I’m still a fan of the idea that Disney acquires EA. It would be one massive content bundling streaming subscription fest with everyone’s favorite IP. I’d sign up for it. Link

PLAY/PASS

Play. KFC released a dating sim called I Love You, Colonel Sanders! A Finger Lickin' Good Dating Simulator. Yes! This is how you use video games as a marketing vehicle. Link

Pass? Nintendo is about to drop another one of their weird projects. It’s a huge rubber wheel this time. Wut

Pass. Disney is considering selling off FoxNext. Certainly, a licensing strategy makes sense for the all-powerful Disney. But given how video games, AR, VR, and theme parks all play nicely together, I think this is premature.