Asmodee rolls dice on divestiture

Paper-based disruption

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

In 2025, I’m committed to sharing updates and insights more frequently.

By all measures, it is a fascinating time in the games industry. The relentless layoffs and bleak outlook have significantly raised the stakes, which historically also means we can expect a wave of innovation that will most likely break with tradition. During my first lecture this semester last Thursday, I realized that the industry’s decline presents a pivotal moment.

For all participants, the risk profile is considerable. With the launch of Grand Theft Auto 6 inching closer, we’re about to see a historic release. This is it. It’s what investors and players alike have been waiting for, and Rockstar’s deliberate silence is driving everyone into a frenzy. God, I hope it works.

At the same time, I’ve already predicted Ubisoft’s imminent privatization. Its Assassin’s Creed Shadows looks amazing but will also be partially censored in Japan and had major spoilers leaked online via an 832MB artbook on a hentai site (yeah, I’m not linking to that, thanks).

Given what’s to come, I don’t expect any shortage of industry drama and disruption.

On to this week’s update.

BIG READ: Asmodee rolls dice on divestiture

As part of its spin-off from Embracer and listing on Nasdaq Stockholm, Asmodee filed its prospectus. As is generally the case, the 163-page document is a treasure trove of information. I couldn’t resist.

Following a period during which Embracer acquired many of Europe’s most prominent studios and game makers, including board game maker Asmodee in 2021 for $3 billion, the firm was forced to divide into three parts. Now, as it is spun off, it is the most valuable and, therefore, the most debt-laden component.

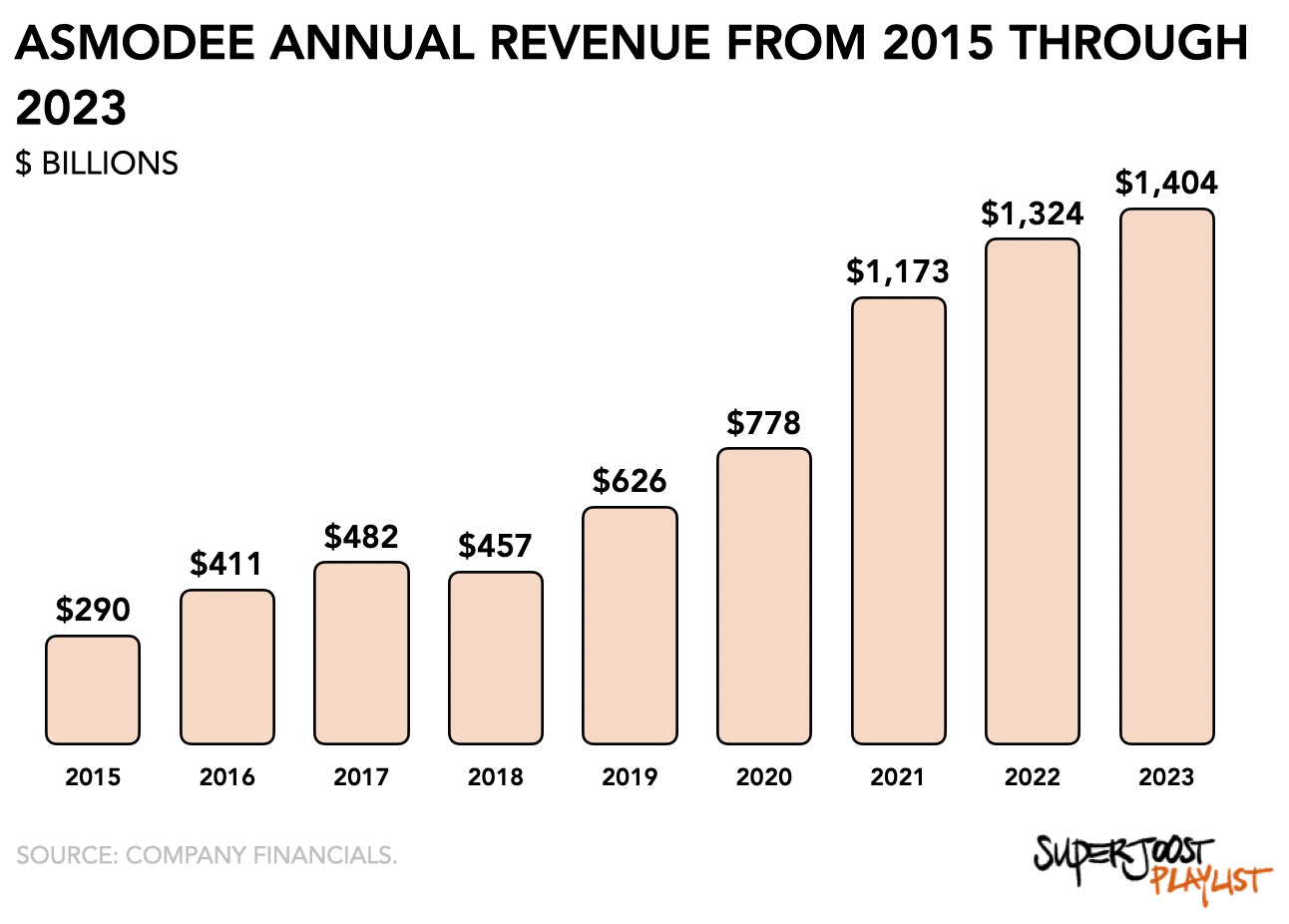

Asmodee's evolution within this expanding market presents a particularly instructive narrative of strategic acquisition and organic growth. From its modest beginnings as a French board game publisher in 1995, the company has executed over 40 strategic acquisitions. It has transformed itself into a global leader with net sales of approximately $1.42 billion in the financial year ending March 2024. The company’s growth has consistently outpaced market averages, achieving a 14% CAGR during 2017-2019, an exceptional 32% during 2019-2021, and 9% during 2021-2023, indicating an ability to capitalize on both steady-state market conditions and unprecedented growth opportunities.

In anticipation of the three-part divestiture, investor sentiment around Embracer has started to recover. Since last year, its share price has increased 30%, from $15.96 to $20.73, outperforming the Euronext 100, which is up only 3.5% over the same period.

The underlying thesis that carries Asmodee’s listing is the consistent growth of the global tabletop gaming market. Valued at $14.3 billion in 2023, consumer demand for tabletop gaming accelerated annually up to 19% during the pandemic and has since then rekindled the category’s popularity at a more steady rate of 5% annual growth. It offers a notable contrast compared to the digitalization and virtualization of interactive entertainment over the past decade.

Part of the firm’s growth strategy is a focus on increasing the proportion of owned IP, coupled with its Board Game Arena (acquired in 2021), which reaches 10 million players. In FY2024, games published by Asmodee constituted 30% of revenues versus 64% from partner-published titles (p. 34), according to the prospectus. Like on digital platforms, first-party releases have higher margins.

Overall macroeconomic growth looks good, too. The tabletop gaming market has demonstrated remarkable resilience, most notably during economic downturns. The category grew 5% annually during the 2006-2008 financial crisis. This resilience stems from the category's relatively low cost per hour of entertainment and its social connectivity value proposition. Industry projections suggest a 4% CAGR through 2028, potentially expanding the market to $17.2 billion, driven by increasing demand for social interaction experiences and the growing acceptance of gaming culture across demographic segments.

A recent paper appropriately titled Rolling the Dice explores how network effects influence product diffusion, particularly in markets characterized by partial network effects. It echoes the overall strength of the category. The paper's analysis of 19,432 board games between 2011-2017 demonstrates that products with network effects show 3.1 times greater variance in market performance. Its findings are particularly relevant to Asmodee's portfolio strategy, which includes both traditional board games and collectible network games. The researchers highlight how network products require careful strategic positioning, especially regarding market timing and competitive pressure.

Succinctly, part of the reason why the upcoming listing is looking strong has to do with several underlying growth drivers. These include a rising nostalgia for tangible, non-digital experiences that bring people together in an increasingly virtual world. It is a trend that has led to a resurgence in the popularity of classic games and spurred interest in new, innovative games that offer deep, immersive experiences.

In addition, the industry has benefited from the advent of crowdfunding platforms like Kickstarter, which have democratized the production and distribution of board games. These platforms allow independent developers to bypass traditional barriers to entry, connect directly with their audience, and secure funding based on community interest rather than conventional publishing routes.

More so, advancements in technology have also played a role, with digital integration allowing for hybrid games that incorporate apps and interactive elements to enhance gameplay and draw in a tech-savvy crowd. And, finally, the community aspect of board gaming—characterized by conventions, local game nights, and online forums—continues to thrive, reinforcing the social value of board games and continually attracting new players to the field. Together, these elements contribute to the robust growth and dynamic evolution of the board game industry.

It makes for a strong strategic positioning from Asmodee. The firm has developed a unique integrated ecosystem combining publishing capabilities, global distribution networks, and strong IP management. This model allows it to capture value across the entire value chain, from game development through to retail distribution, while maintaining strong relationships with third-party publishers and IP holders. The company's current market share ranges from approximately 6% in the United States to commanding positions of 40% and 43% in France and the UK respectively, highlighting both its current strength and potential for further market penetration. Sidenote: Judging by the pace with which the US has started imposing tariffs that will likely have a noticeable impact on imported video game hardware, I can see a future where we all go back to playing with dice and cardboard.

Overall, it presents a compelling case study of how traditional gaming formats can thrive alongside digital transformation, and, perhaps, a sign of what’s to come. In an era where many entertainment segments struggle to maintain relevance amid rapid digitalization, the firm’s trajectory may yet offer evidence that certain traditional formats can do more than just survive and instead thrive through technological disruption.

Asmodee is scheduled to start trading publicly on February 7th.

NEWS

Xbox announced a significant expansion of its cloud gaming service to LG devices, continuing its strategy of platform proliferation that began in 2021. The move reflects Xbox's broader vision of reducing hardware barriers, though current technical limitations around latency and internet speeds remain obstacles for multiplayer gaming.

Dream Games, developer of Royal Match, is pursuing approximately $2.5 billion in combined debt and equity financing at a $5 billion valuation. The company's performance metrics suggest robust fundamentals, with estimated annual revenue exceeding $2 billion and adjusted EBITDA of around $500 million.

Epic Games announced plans to include third-party mobile games on its store platform, expanding beyond its own titles in a strategic move to challenge Apple and Google's app store dominance. The company maintains its developer-friendly 88/12 revenue split and is actively working to reduce friction in the EU market despite Apple's implementation of deterrent measures.

Netflix revealed plans to release WWE 2K on mobile in Fall 2025, building on its successful acquisition of WWE Raw streaming rights. This development represents Netflix's continued expansion into gaming as a complementary service to its core streaming business, with initial WWE content performance showing promising engagement metrics.

PLAY/PASS

Pass. Sony issued a DMCA take-down of a popular mod on Bloodborne that increased the game’s framerate to 60 fps.

Play. The Video Game History Foundation launched early access to its digital archive of video game history research materials.

UP NEXT

The date and time for my annual talk at SXSW in Austin have been confirmed. This marks the fifth time I’m doing this conference and it is one of my absolute favorites because of the cross-section of the crowd. Come say hi!

Great note as usual - quick question though, wouldn't Chinese tariffs also hit board games since most of them (as far as I can tell) are made in China? Is hardware disproportionately affected?