I’ve been trying to wrap my head around the Epic/Apple/Google thing.

At the center, I believe that Epic is saying what many in the industry have been thinking for a long time. But as one publisher exec told me:

“Privately, we are all rooting for Epic but no one is going to publicly admit to that.”

Worse than the impunity with which Apple and Google govern their platforms, it is the absence of explicit solidarity that gives these firms their power. We can all complain about the mobile industrial complex as designed by Apple and Google. But they are not solely to blame. Part of why we are here now is the rest of the industry’s fault.

Like other media before, video game companies have acted naively in the face of digitalization. When the internet first started to emerge and became part of everyday business practices, it wasn’t much more than a novelty for newspaper publishers. According to a recent FT article on the news industry: “We were extraordinarily naive because the industry was so flush.” The explosion of wealth that followed the digitalization of content production and distribution resulted in many content creators overlooking the long-term repercussions of a new generation of middlemen.

“Premium content was given away for free, while the publisher’s role between reader and advertiser was left wide open for others to intermediate, or replace.”

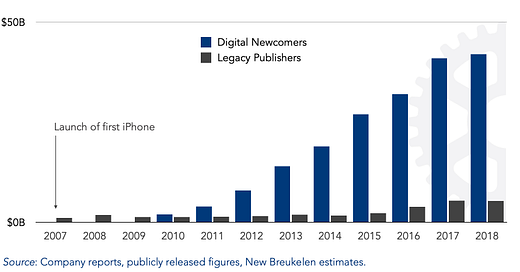

We can draw parallels with how we’ve arrived at the current state of affairs in gaming. The popularization of mobile gaming and the spectacular growth of the overall industry as a result of its digitalization (which, btw, is what my upcoming book is about) resulted in an enormous amount of wealth creation for the industry.

On the one hand, legacy publishers initially had little interest in mobile as it was a largely unproven category and they generally resented the idea of giving away content for free. Rooted in a premium revenue model, these firms had little interest in launching content free-to-play after Apple approved it in 2009.

On the other hand, and as a result, a generation of newcomers managed to quickly capture a lot of value for themselves. These firms were also largely indifferent to Apple's terms of service and eagerly agreed in order to capitalize on the vacuum.

In the throws of all this money flowing into the industry, it is quite possible that creative firms have simply glanced over the terms they agreed to when signing with Apple or Google to distribute on mobile. A gold rush of this sort is rarely a contemplative effort and allowed mobile platform holders to become immensely powerful.

Platform economics

Apple and Google’s actions are consistent with the broader behavior of Big Tech. Their arguments around consumer protection fall short of explaining their reliance on planned obsolescence. More so, Big Tech continues to struggle with the notion that content is king. And just this week we saw how Facebook attempted a land grab in a yet-to-mature technology, VR, by demanding that people use their Facebook accounts to use their Oculus. To protect the integrity of their ecosystems they must necessarily reduce innovation and creativity.

Epic’s challenge lays bare the emergence of this new cultural formation around entertainment, its underlying revenue models, and the insatiable thirst for power among large media and tech conglomerates.

Platform economics differ from conventional entertainment economics. Rather than creating efficiencies throughout their supply chain, platforms seek to establish themselves as the intermediary between the sellers of goods or services (complementors) and buyers. Most of us will remember that Nintendo didn't revitalize the games industry following its collapse in the 80s just by putting out Super Mario. It did so by enforcing strict rules about what type of content could live on its platform, what the responsibilities of its complementors were, and how everyone contributed to the marketing of the entire NES ecosystem.

What's relatively new here is the observation that platform holders will change the policies that govern access over time as their relative market share grows. At first, they aggressively subsidize third parties to, in this case, make their content available. In its early days, Apple lured game makers to its platform by greatly lowering the barriers to entry. In comparison to console game development, making a game for mobile was easier and a lot cheaper. Once a platform is more established, the emphasis of ecosystem governance switches to include more protective measures. A recent study found that

"as a platform becomes increasingly dominant, the platform sponsor's governance strategies shift from being largely supportive of the wider complement population to becoming more selective and geared toward end users."

As a result, "average demand for individual complements decreases and becomes progressively concentrated."

This invariably affects how creatives access capital and is highly influential to the success of, especially, small and medium-sized game makers (the kind that develops new intellectual property, novel experiences, etc.)

Take, for instance, Finish game maker Remedy Entertainment. As pointed out by Matthew Ball in this excellent podcast, Epic’s vision carries immediate benefits for creatives. Following its agreement with Epic, its margins have gone up and the company's value has doubled, without having released any new content. It also now has access to more capital. Since the announcement of the agreement with Epic, it instantly improved its financial situation. For one, it has better margins on its projects. More so, as a publicly traded firm, shareholders expect a greater return. Since the start date of the agreement, its stock price has tripled from €11 to €34 this week. Such an influx of capital affords creative freedom which, ultimately, can and should result in the development of innovative content.

Sure enough, there is a lot of money currently being pumped into the industry and just about every week we hear of another game-focused VC materializing somewhere. But that type of high risk/high return money ebbs and flows. To ensure long term innovation and creativity having access to a steady stream of income will go further to ensure creative independence.

Alea iacta est

So, is Epic going to win this? Maybe. It doesn't really matter. All it really needed to do is amplify the argument that platforms are taking too much to a broader audience of consumers and regulators.

In the end, taking a 30% cut is nothing new. In fact, it's how platforms have always done things. Which is precisely why change is necessary and inevitable.

It's not that a platform doesn't deserve a share of the action for its efforts. There are simply too many platforms available for all of them to maintain this pricing. They face a classic prisoner's dilemma: if everyone continues to agree, content creators won't stand a chance.

But all it takes is for one of them to drastically lower their rates, and game makers and audiences will flock to it. With a new generation of consoles coming out in the next few months and cloud gaming slowly making its way forward there's enough competition to put pressure on platform rates. Add that Amazon is likely to release its own digital storefront in the next 12 months, and we have full-blown retail war on our hands.

For once, it's not the game makers that are providing the most interesting entertainment.

Hopefully it'll embolden a few whistle blowers to leak documents proving price fixing.