This week the separation between digital and analog was thinner than ever. First, we witnessed the end of a three-decade-long partnership between Electronic Arts and FIFA (see below) that will benefit neither. And we watched digital currencies virtually disappear, which, hopefully, jolted people back into reality.

A malignant combination of rising inflation, supply chain issues, valuation haircuts for all of Big Tech, a de-pegging of a major stable coin (UST) that was heralded as the bridge between decentralization and conventional finance, and the collapse of a top 10 blockchain, Terra, made this a sour week for many.

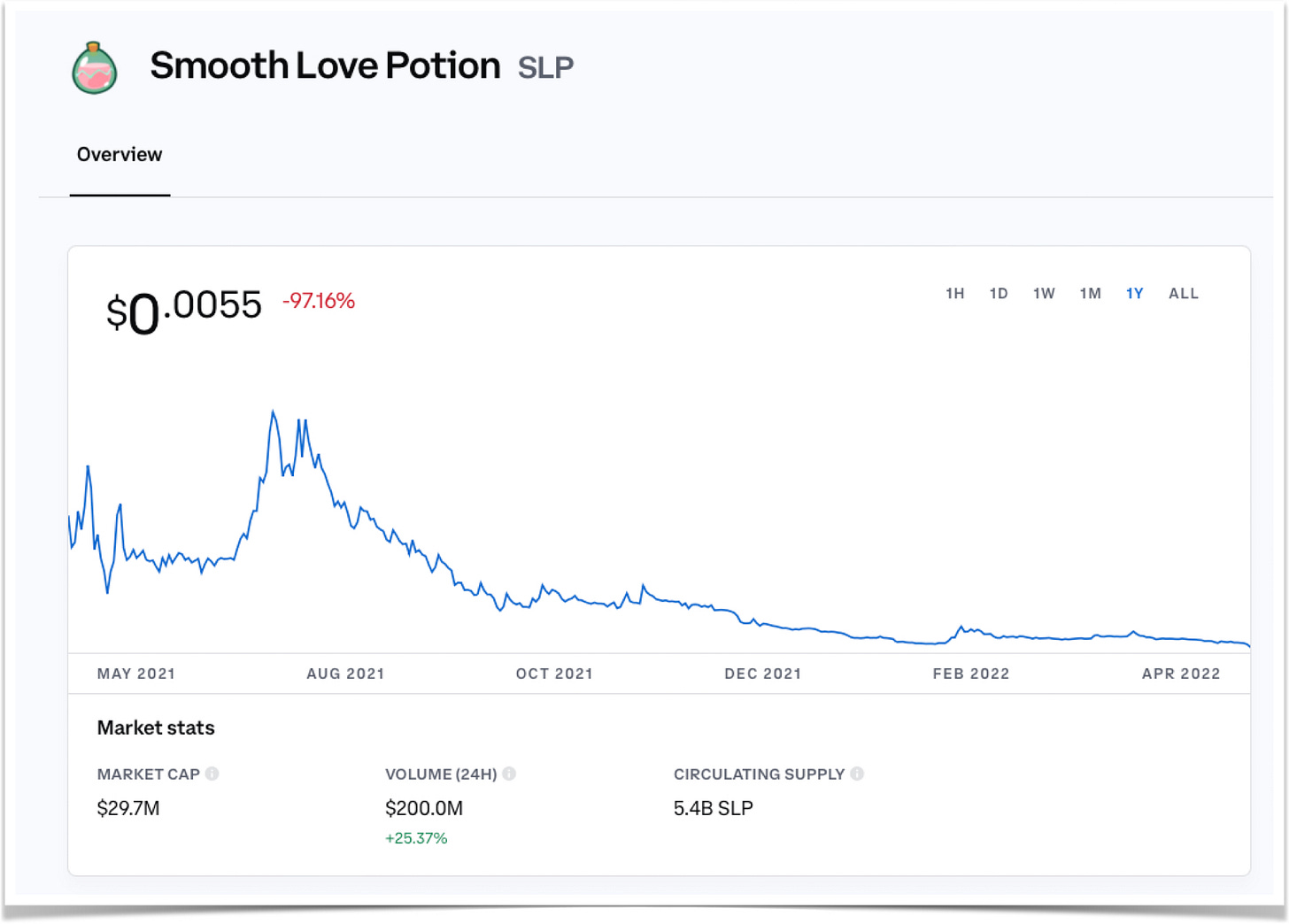

At the center, Coinbase, a publicly listed crypto-currency trading platform, saw its value drop down to $72, a -70% decrease from a year ago. And literally, every single cryptocurrency suffered mid to high double-digit declines. The poster child of crypto-gaming, Axie Infinity, which was already battered since the start of the year, saw its Smooth Love Potion lose almost 100% of its value.

Unsurprisingly, palpable schadenfreude ran amock online.

But not at last night’s crypto event.

At a mixer in Tribeca, New York’s swanky area where high tech likes to mingle with high fashion, I failed to spot even a single fly in the richly flowing chardonnay. No one was crying about their massive losses or what the current market collapse meant for the long-term financial outlook. Instead, chipper whippersnappers pranced around, excitedly explaining their current projects.

I had seen something similar before. When social media first grew to the point where large incumbent firms could no longer afford to ignore them, their first instinct was to hire someone young to ‘handle the Facebooks.’ A few of my students at the time, who could not have been older than 19 were heading the entire social media effort for large consumer brands. Unfamiliar and unaware of its longer-term potential, senior decision-makers equated young blood with new tech.

So, too, with crypto, it seems.

“I used to work in traditional finance but switched to DeFi because I wanted something more challenging.”

I swear that’s what someone told me.

No one in their right mind would sign up for any of this. Except, perhaps, the newcomers. Eager to make their mark and blaze their own trail, the suspiciously young crowd seems impervious to headlines and challenges ahead.

Watching all this play out in front of me, I felt jaded and full of crypto-cynism. Perhaps I was arrogant to feel empathetic about a group of presumably young, ambitious people. But then remembered I was there, too, during the first dot-com boom. An abundance of venture capital and a growing array of eager incumbents looking to get in on the internet in the late 1990s funded my first year in New York. We had a full-time bartender in the office who would serve you coffee or beer from noon on. We’d play Unreal Tournament with the IT team after six o’clock. There was a foosball table, and we had flat screens and laptops.

All of it collapsed, of course. In the process, many lost an illusion but gained a valuable experience. Perhaps this week was a rite of passage. No better teacher than failure.

On to this week’s update.

BIG READ: In FIFA v EA, fans lose

The announcement of an irreconcilable dispute between Electronic Arts and the football governing body FIFA means the end of a 30-year relationship.

Historically, sports video games have been one of the most robust genres. Fans of the FIFA series tend to buy the game religiously every year, granting Electronic Arts a very predictable revenue forecast which, in turn, makes it popular with investors. Everybody wins. But it is not immediately obvious how the end of the partnership will impact Electronic Arts.

One challenge that EA faces is the eternal conundrum of how to innovate without alienating its user base. Heavily restricted by its IP agreements, it is impossible to change anything about its different sports franchises. Its subsidiary, EA Big, released a slew of somewhat popular spin-offs under the Street label, including NFL Street, FIFA Street, and, you guessed it, NBA Street.

The series was meant to take professional sports out of the stadiums and bring them to an everyday setting with fewer conventional rules and a heavier focus on action. It did quite well for a few years until the publisher decided to pair down its efforts and focus on its biggest money-makers. In 2008 it shut down EA Big.

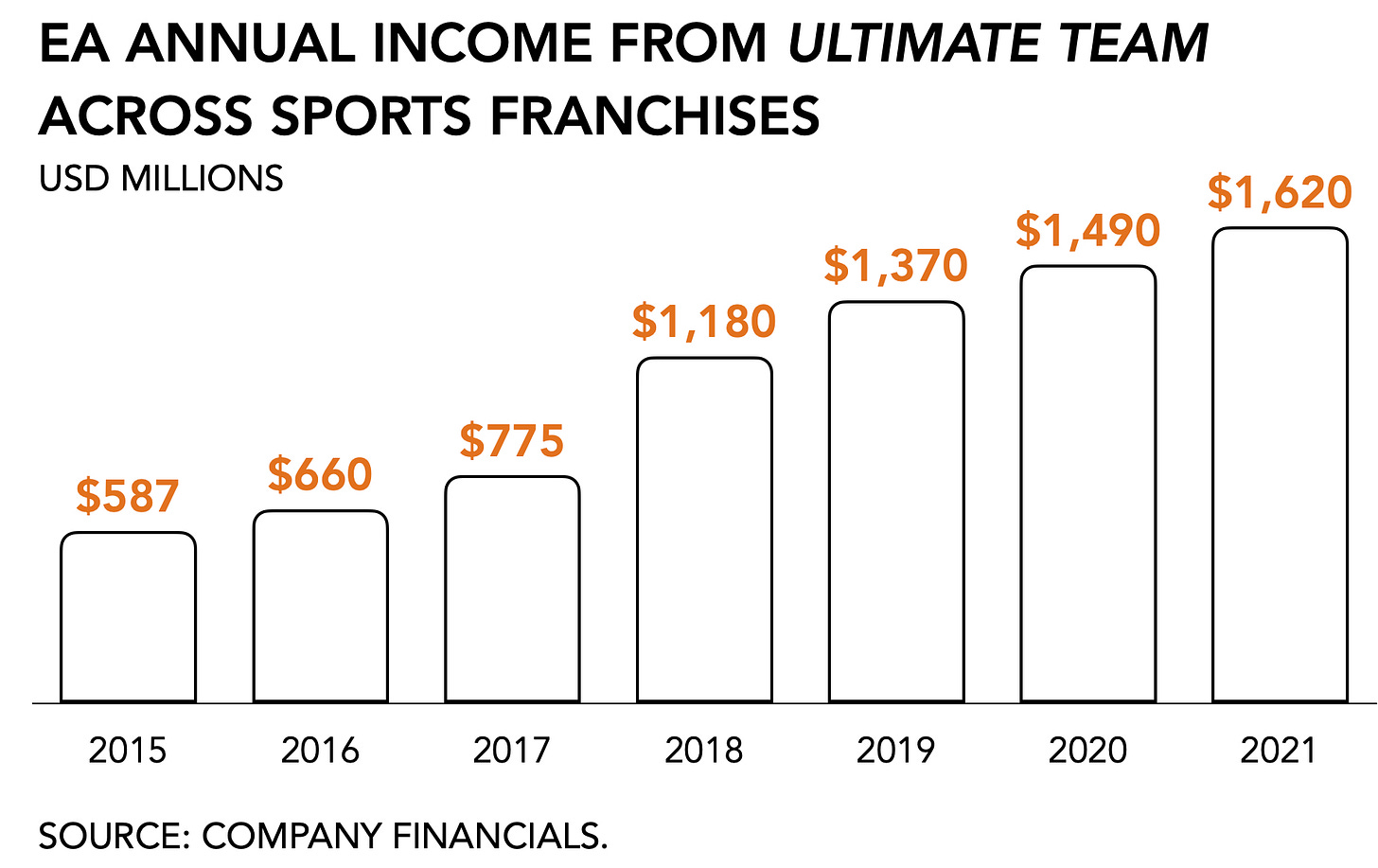

By pushing itself into a corner in terms of game design, EA started focusing on finding smarter ways to increase revenue. With the 2009 introduction of Ultimate Team in FIFA 09, EA discovered that it could drive the spending per player by offering a collectible card game as an additional game mode with its own progression system and economy. Revenues from the expansion grew rapidly and tripled from $587 million in 2015 to $1.6 billion in 2021.

As John Riccitiello, EA’s former CEO, came under increasing criticism because the firm was struggling in its transition to digital and losing market share, a new candidate presented himself. Bypassing even Peter Moore (EA’s former COO and currently SVP and GM of Sports at Unity) and Frank Gibeau (Zynga’s current CEO) as likely replacements at the time, the board elected the newcomer who had been the executive producer on the FIFA franchise and had greenlit the Ultimate Team game mode that was generating money for the firm: Andrew Wilson.

The publisher’s ability to find new monetization strategies is legendary, if not infamous. But losing the spearhead of its most valuable franchise won’t improve the publisher’s circumstances.

Electronic Arts is unperturbed. Already last year did it register a brand new (and wholly boring) trademark, EA Sports FC, as the new name for the franchise. It plans to lean on the rest of its portfolio as it has lots of other lucrative sports franchises, including Madden NFL 22, NHL Hockey, EA Sports UFC (mixed martial arts), PGA Tour (golf), and, after a $1.2 billion snatch ‘n grab of Codemasters from under Take-Two’s nose, F1 2021. It makes it less likely that consumers will abandon them immediately since they are already locked into the community and unlikely to jump ship, even if FIFA finds another developer to make an equivalent game.

The onus, I think, is on the football association, since FIFA isn’t doing itself any favors either.

Disputes around sports franchises are not new, of course. In fact, in more conventional forms of media, there are plenty of occurrences where fans stayed in the dark and were unable to watch their teams play because the leagues and the cable companies could not reconcile their differences. Some argued that such arguments were losing them a generation of fans in a both already aging and declining category.

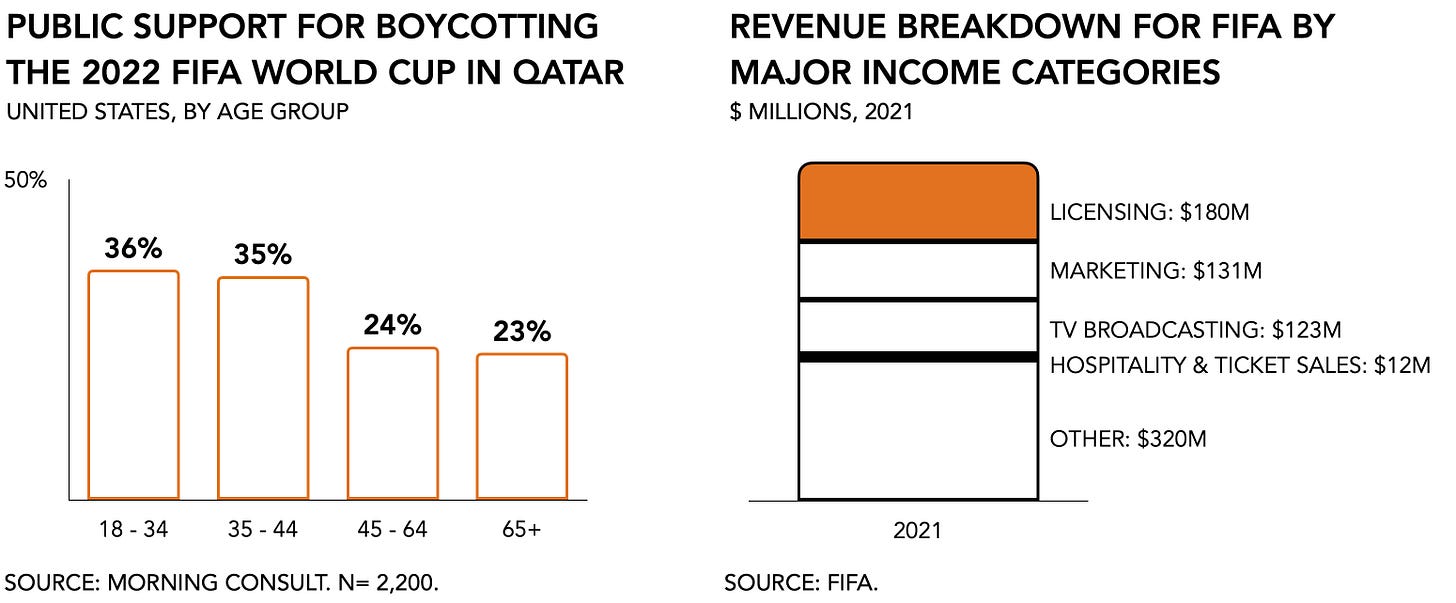

More so, its decision to host the next World Cup in Qatar does not sit well with everyone. The country is rich, certainly. But not in its history with the game itself nor with accolades for its human rights record. From the 30,000 migrant workers that it hired to build all seven of the stadiums to the question if LGBT fans will be allowed to attend any of the matches, things aren’t looking so welcoming.

Fans disapprove. According to one survey, one-third of people under 44 years old would be on board with a boycott of the tournament altogether. That’s bad for viewership numbers overall but especially scares off younger fans who are the obvious object of affection for advertisers.

Second, licensing is the organization’s largest income category. Larger even than marketing and TV broadcasting, EA’s contribution of $150 million annually makes up a sizable chunk of its revenue.

Before you get excited, the $320 million in ‘Other’ income was primarily the result of a lawsuit judged in FIFA’s favor as a victim of “decades of football corruption schemes,” which is not a sustainable income source. Perhaps because FIFA is feeling flush with its cash from Qatar, the payout from the lawsuit, and the upcoming quadrennial tournament it figured now would be as good a time as any to renegotiate. It all feels enormously self-serving and suggests FIFA’s insistence on ‘fair play’ does not exceed the limits of the field.

It is unlikely that the end of their partnership will be an improvement for either.

Ironically, with its largest licensing relationship now expiring, Electronic Arts becomes a more likely acquisition candidate. One of the largest obstacles in taking over the firm is its tangled web of licensing relationships. Licensors like guaranteed payouts and have little interest in dealing with a licensee under new management. But its grip on audiences and aggressive cornering of the sports games markets virtually ensures it retains its exclusive grip on a desirable audience, especially now that the category is becoming a linchpin for conventional media firms. In fact, rumor has it that the publisher has “hired bankers," suggesting it may indeed be entertaining offers. Against a background of continued consolidation that’s generally just good business practice.

But FIFA, in its pursuit of posh over popular, runs the risk of shooting itself in the foot. Ending its relationship with one of the most important channels to a young and loyal audience will prove an impediment, and not an improvement.

An own goal, if you will.

MONEY, MONEY, NUMBERS

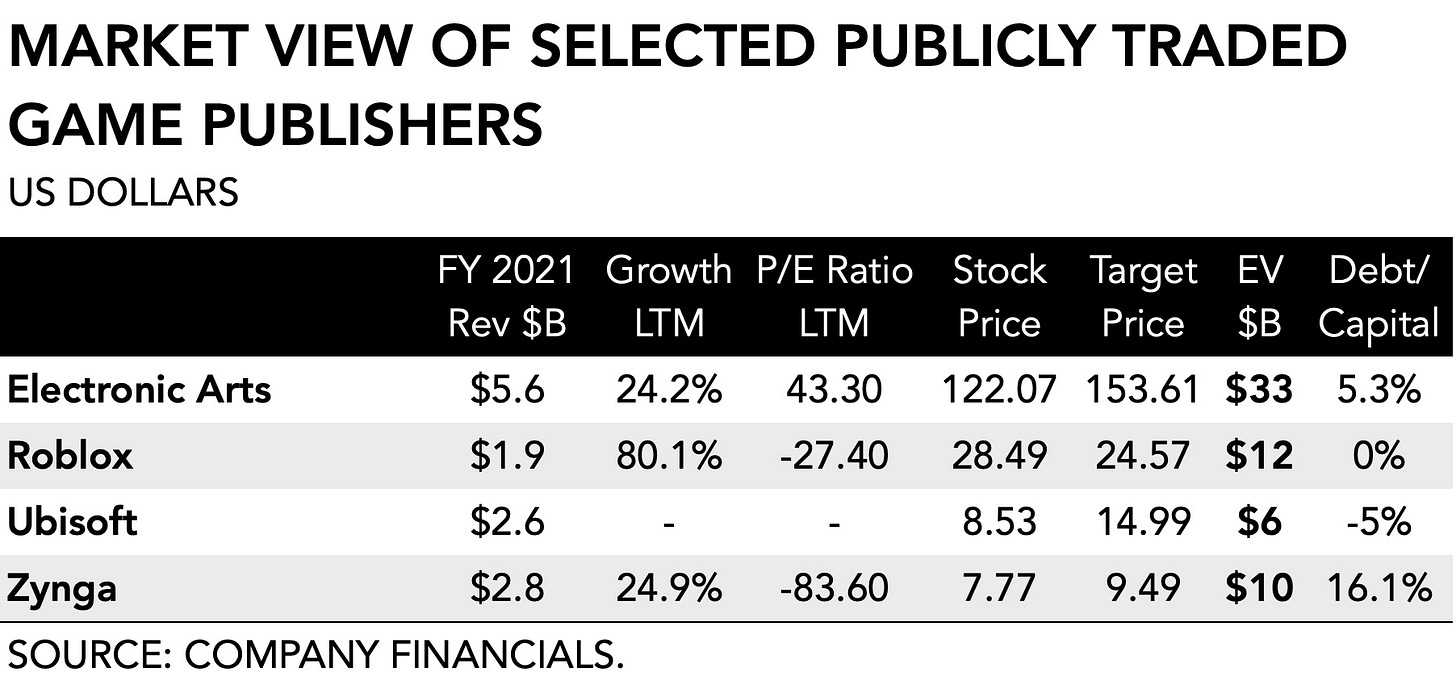

Electronic Arts came in at $1,751 million in bookings, up +18% y/y or about half excluding its 2021 acquisitions. Its revenue from Live Services, which accounts for 85% of total, grew +14% and was led by FIFA and Apex Legends, which grew +40% y/y. Apex Legends Mobile will release on iOS and Android in May.

Roblox's earnings in 22Q1 reached $631 million, which fell short of the consensus of $645 million. With its most recent daily active user numbers, Asia-Pacific (12.6 million) is now for the first time larger than its North American audience (12.4 million). The former also grew +94%, from 6.5 million, since the firm’s IPO in March 2021 compared to a slight -2% decline for the latter, which has remained around the same level since early 2020.

That means Roblox has so far made good on its promise to leverage APAC as a growth driver but leaves open the question of where to next. Specifically, users in APAC tend to be more numerous but less valuable on a per-user spending basis compared to western markets, which is consistent with the decline in Roblox’s average bookings per daily user from $15.48 in 21Q1 to $11.67 in 22Q1.

Ubisoft reported €664 million ($669M) in net bookings for its most recent quarter, which was up +37% but €50 million short of consensus and well below the firm’s guidance range of €710 million to €775 million. Full-year bookings reached €2.129 billion (-5% y/y). For the year ahead, Ubisoft is placing a lot of its eggs in a premium basket, arguing that Avatar: Frontiers of Pandora, Mario + Rabbids Sparks of Hope, and Skull & Bones will drive revenue growth and, to a lesser extent, its free-to-play titles.

Zynga booked $695 million in revenue versus a consensus of $745 million. Its daily active users grew +3% y/y for a total of 40 million, and its monthly active userbase increased +27% to 209 million. However, the increase in audience merely offset a decline in spending as average bookings per mobile daily active was down by -6% y/y. Notably, Zynga saw a +35% increase in Advertising & Other Bookings in 22Q1 for a record of $167 million. Take-Two’s recent acquisition of Zynga is expected to close on May 23. Bernard Kim, President of Zynga, is leaving to become CEO at Match Group starting May 31st.

PLAY/PASS

Play. Musicians are turning to video games to make ends meet. (h/t Sarah Needleman)

Play. Even the Romans had a d20, obviously to play Carceres et Dracones.