Irrelevant play

Games are all but absent from Hollywood's biggest acquisition. So what?

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author Joost van Dreunen.

In anticipation of The Game Awards, my prediction for the GOTY is Hades 2. I will be proven 100% correct, and no, I’m not taking questions at this time.

On to this week’s update.

BIG READ: Irrelevant play

Immediately evident about Netflix’s $82.7 billion agreement to acquire Warner Bros., and Paramount Skydance’s subsequent $108 billion hostile counter-bid, is the conspicuous absence of gaming from both parties’ strategic narratives.

The question is whether the games industry should care.

One of the games industry’s happiest memories must be when Netflix CEO Reed Hastings admitted in 2019 that Fortnite had become a competitive threat. The sheer recognition of games, showing up on the radar of one of the largest media and tech firms, validated the entire sector. It prompted an aggressive push into interactive entertainment, including a string of studio acquisitions. The attention elevated games to a new level of cultural and commercial relevance. The pandemic that followed catalyzed further growth, and the future looked bright.

Six years later, Netflix has apparently all but abandoned the effort.

The company has closed several of its studios: in October 2024, it shuttered Team Blue, and in 2025, Boss Fight Entertainment wound down. In the same week it made its bid for Warner Bros., it announced it was selling Spry Fox back to its founders.

The pattern suggests that Netflix’s retreat is less about a failure of gaming as a category and more about an underestimation of what success in this domain requires: a fundamentally different set of capabilities. Owning IP is not enough. Gaming demands long-term investment in development infrastructure, iterative workflows, and community management—capabilities Netflix has yet to build.

If that seems like an odd coincidence, Netflix’s acquisition deck provides further evidence. Games appeared only twice, both times in name only, without any substantive discussion. The first investor call didn’t mention gaming at all. And during a recent Q&A, Netflix co-CEO Gregory Peters dismissed it as “relatively minor compared to the grand scheme of things.”

He’s right, of course.

Warner Bros. presents a similar paradox.

The company holds genuine franchise strength, as evidenced by the commercial performance of Mortal Kombat and Hogwarts Legacy. Yet its games division has had its head on the chopping block for years. Most studio leadership has departed, and the portfolio has struggled to achieve consistent commercial or critical success. It’s hard to imagine why Netflix would even mention Warner Bros.’ games division as a top ten reason for acquisition.

Paramount Skydance’s eleventh-hour hostile bid adds an interesting wrinkle, though.

Skydance possesses credible gaming infrastructure: Amy Hennig, the industry legend behind the Uncharted franchise, leads Skydance New Media with Marvel 1943: Rise of Hydra in development alongside a Lucasfilm Star Wars title. Unlike Netflix, Paramount’s acquisition deck explicitly references its “Unique Interactive Capabilities” and the potential to combine WB Games with Skydance Games.

We have yet to see what it can do. Indeed, it’s been expanding its games team. But the effort here centers on developing adaptations, leveraging gaming IP to make, so far, an underwhelming series for its streaming service. The 2022 release of Halo disappointed. One hopes the recently signed movie deal with Call of Duty will fare better.

Here’s the stranger thing: Netflix’s gaming efforts are actually working.

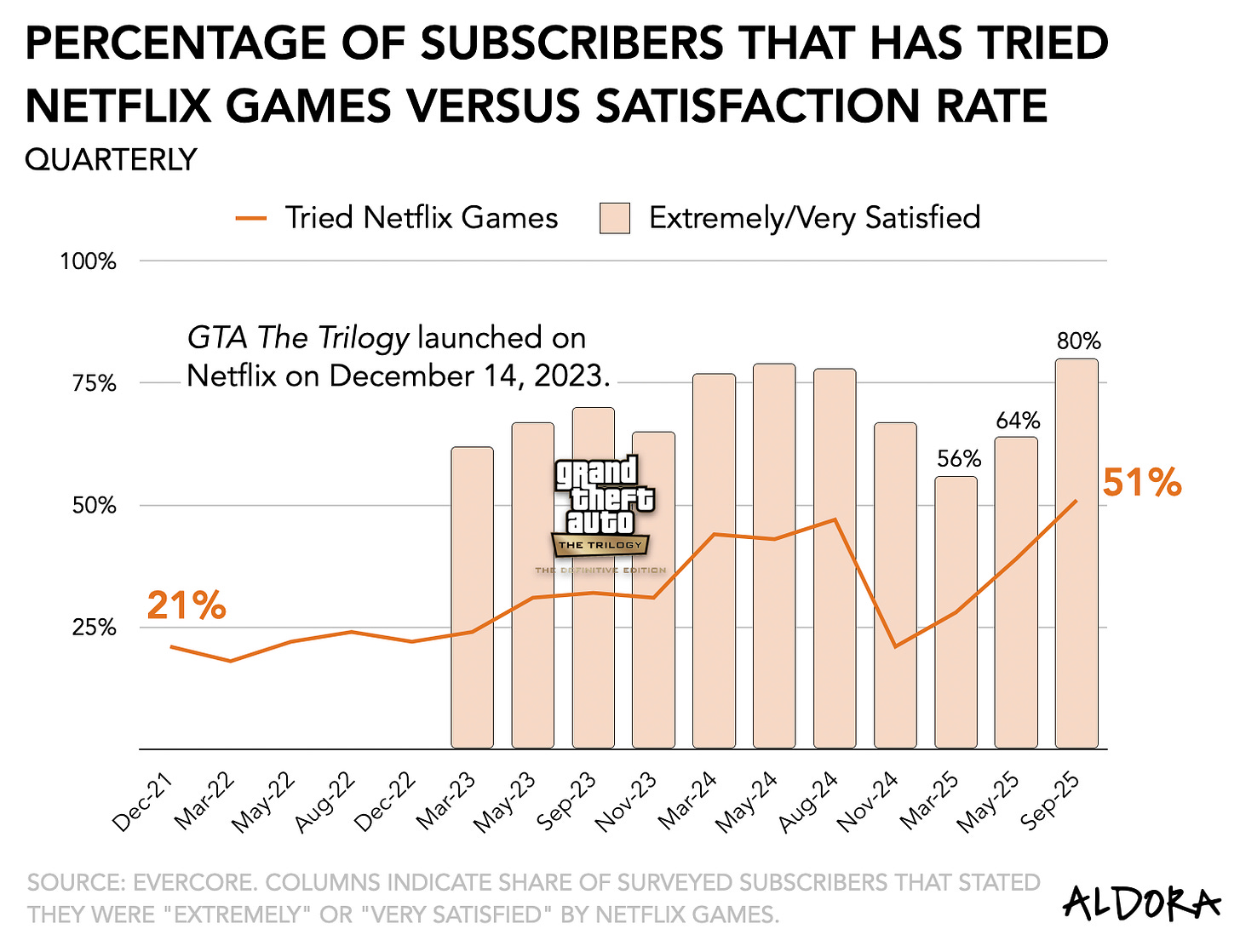

Recent survey data show that 51 percent of Netflix subscribers have tried Netflix Games, up sharply from 39 percent in May 2025. Four out of five are “extremely” or “very” satisfied—a 16-point gain quarter-over-quarter.

The addition of Grand Theft Auto V in December 2023 marked an inflection point, with engagement peaking at 47 percent penetration by Q3 2024. While that initial surge proved temporary, dropping to 21 percent by November 2024, the broader trend has resumed upward momentum.

And yet gaming barely warrants a mention in an $82.7 billion acquisition.

Well, so what?

Hollywood’s most-favored growth strategy is buying content. What it misses is the shifting relationship between creators and audiences.

Execs like to acquire discrete assets—movies, series—and release them with fanfare. Game production, by contrast, requires early access builds, live-service updates, Discord servers, and patch notes that create a continuous conversation between developer and player. Game companies treat audiences as collaborators rather than consumers.

Data bears this out. Games that support user-generated content generate 23 percent more revenue over five years than those without. Player retention is 64 percent higher at two years and 90 percent higher at five. Active modders are 2.4 times more likely to purchase premium downloadable content—meaning free user creativity complements rather than cannibalizes paid offerings. Roblox’s creator payouts have grown from $329 million in 2020 to $868 million in 2024, evidence of an economic model where players become stakeholders.

Netflix does seem to understand the value of facilitating a shared audience experience, as it’s been pushing into live events (e.g., boxing) as a key growth driver. But beyond passive viewing, it remains locked in an old media approach.

Meanwhile, the emerging logic in interactive entertainment focuses on establishing a flywheel of different touchpoints and activities. Players who engage with games by contributing to an online community, watching live streams, attending events, or building in-game items are more valuable customers. According to a Bain study, people who are involved in three or more activities beyond gameplay spend $0.80 per hour, five times the $0.16 paid by those who only play. Each dimension amplifies the others: watching brings in new audiences who seek connection in communities, inspiring them to create content others will watch. Unlike traditional marketing funnels that leak value at every stage, the flywheel accumulates it.

Yet Hollywood clings to its existing auteur-and-focus-group model—placing big bets years in advance, with audiences invited to react only after hundreds of millions have been spent. When Netflix or Warner Bros. acquires gaming IP, they’re buying the output of these systems without understanding the systems themselves. No amount of franchise ownership changes that.

So they fall back on what they know: economies of scale. Instead of future-proofing themselves, few executives will risk their careers on a fundamentally different way of making things. Better to rebundle everything into one gargantuan subscription-based TV buffet. You know, like cable.

Gaming isn’t material in this Hollywood-centered acquisition. Rather than feeling left out, game makers need to stop basing the worth of their creative efforts on a legacy business that’s clearly suffering a midlife crisis.

NEWS

Metaverse losing steam

After several years of insisting that virtual reality headsets and legless avatars would usher in a new epoch of computing, Meta is expected to reduce its metaverse budget by up to 30 percent. Naturally, this will involve layoffs, likely concentrated in Horizon Worlds and the Quest VR unit. Investors have been increasingly skeptical about the mounting burn rate for years, especially since Reality Labs has spent a whopping $70 billion since 2021, with only modest consumer adoption to show for it.

In fairness, it did produce some notable traction. A title like Beat Saber proved a sleeper hit and has performed exceptionally well, emerging as a key discovery platform for musicians. There’s also Marvel’s Deadpool VR, which is nominated this week at The Game Awards.

But the pivot is clearly away from virtual environments and toward AI. More specifically, AI glasses, wearables, and anything that aligns with the current industrial appetite for generative intelligence instead of speculative digital worlds. Meta insists this isn’t a retreat, just a reallocation. Of course it does.

The metaverse has so far failed to attract competitive pressure or cultural adoption, and Meta no longer has the confidence (or appetite) to drag it uphill alone. More generally, large tech firms cannot afford to miss out on the next technological wave, for fear of being left behind. It’s precisely what happened to Meta when it was late to mobile, and found itself at the whim of Apple’s rule-making. Being first to a new platform is gold, and second-runner-up is fine, too. Late means death.

So is the metaverse dead? Maybe. Kinda. It’s always been a strategic hallucination born of a company’s desperate attempt to escape its own past. As always in tech, what’s most important is what’s next.

Will hardware price increases impact the next console generation?

One of the more sobering truths about AI’s rapid ascent is how completely it depends on an enormous volume of processing chips. Like its appetite for energy, AI’s demand for computational hardware is both rising and expensive. This creates an ominous backdrop for the games industry as it nears its next hardware cycle. It raises a very different kind of “how will AI impact gaming?” question.

The gaming industry is heading into its next hardware cycle under unusual circumstances. Memory chip prices surged 25-30 percent at the end of 2025, with projections of another 30-50 percent increase each quarter through 2026. The shortage is expected to persist through 2027. For anyone tracking the business of games, the question is straightforward: What does this mean for the next generation of consoles?

The short answer: consoles are better insulated than you might think. But the broader hardware market will feel real pain.

Start with the supply side. Just three companies—Samsung, SK Hynix, and Micron—control 95 percent of the memory chip market. These suppliers are increasingly prioritizing high-bandwidth memory for AI servers, which commands better margins than components destined for consumer electronics. Big tech companies are locking up supply for data centers, creating intense competition for the remaining inventory. We saw a version of this during the 2020 crypto boom, when GPU prices spiked, and availability collapsed. At the time, NVIDIA deliberately made its high-end processors 50 percent less efficient to discourage crypto-miners from buying up all of their available inventory and to ensure that its hardware would “end up in the hands of gamers.”

Aww. That’s nice.

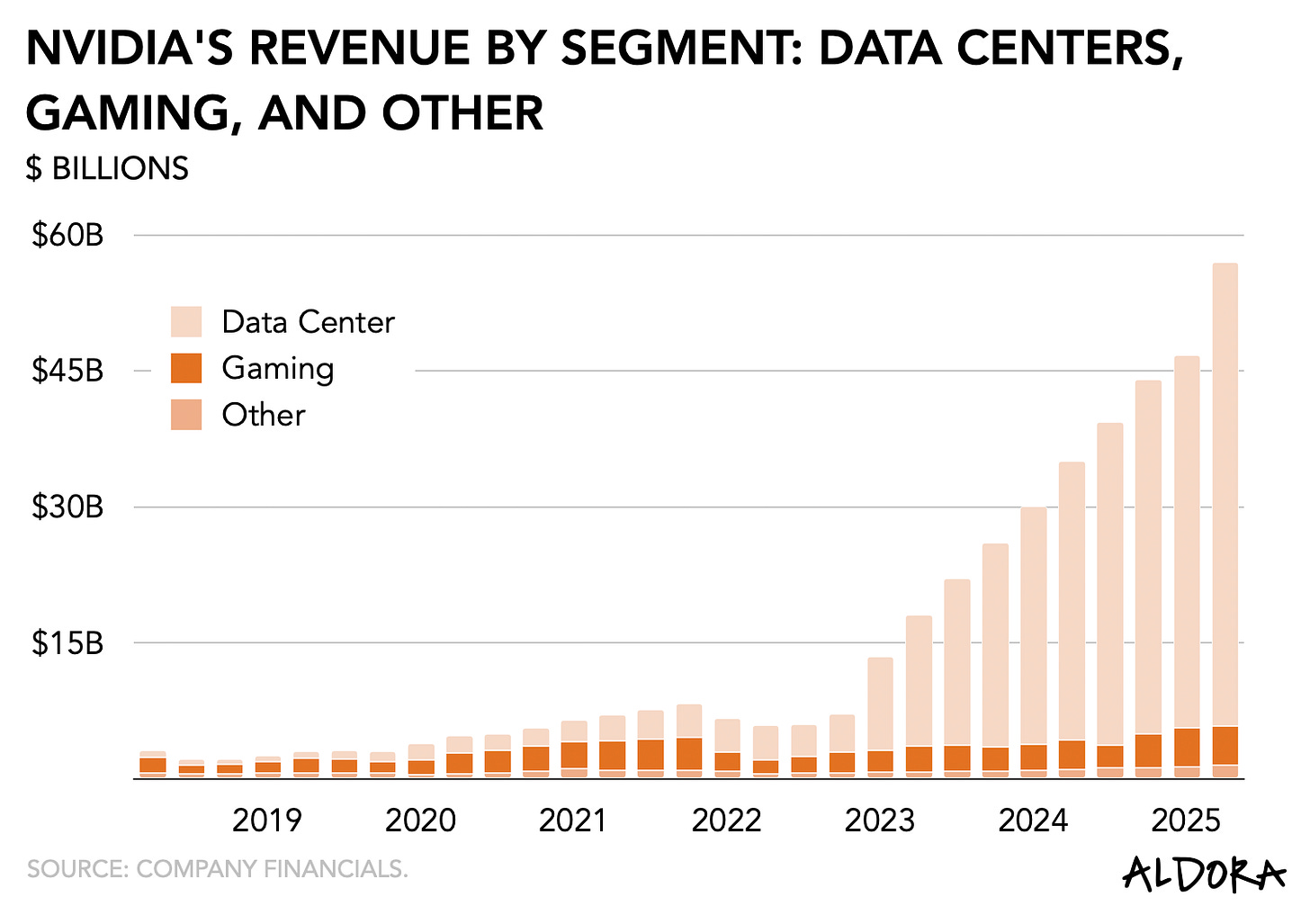

Since then, however, that relationship seems to have cooled, as gaming is now a notably more minor component of the NVIDIA empire. According to The Economist, the firm’s “early customers are feeling jilted.”

This time, the pressure is more structural and likely to last longer.

PC manufacturers face the worst of it. In general terms, memory represents roughly 20 percent of a PC’s bill of materials, and these companies operate in a brutal competitive environment. They can’t easily pass costs to consumers. Research shows PC demand is highly elastic, with a 1 percent price increase typically causing a 2-2.5 percent drop in unit sales. Hardware makers are caught in what analysts call an “asymmetric pricing trap”: suppliers can raise prices at will, but manufacturers absorb the hit or watch sales evaporate.

Console makers occupy a different position. Sony, Microsoft, and Nintendo have spent two decades learning to manage component volatility. They negotiate supply contracts years in advance of product launches and have deliberately extended console lifecycles to 7-8 years, reducing their exposure to any single supply crunch. That doesn’t make them immune, but it provides meaningful insulation.

The more interesting effect may be strategic rather than operational. As high-end hardware becomes prohibitively expensive for mass-market consumers, we should expect the market to bifurcate. Enthusiasts will continue paying premiums for top-tier specs. Everyone else will seek alternatives—whether that’s mid-tier consoles, devices like Valve’s Steam Machine (which promises PlayStation 5-level performance at a reasonable price point), or cloud gaming services that eliminate the need for expensive local hardware.

Crucially, this dynamic accelerates a broader shift toward distribution innovation—new access models, pricing schemes, and delivery infrastructure—echoing the industry’s recurring transitions from physical retail to digital storefronts and now toward cloud and hybrid device ecosystems.

It forces a simple but essential question: if AI demand keeps pushing component prices higher, will consoles stay a safe, steady part of the gaming business, or will they get squeezed out by forces they can’t control—and what does that mean for where the industry’s value will sit next? It explains why, for instance, Microsoft has partnered with AMD and Asus to develop its gaming hardware.

Console manufacturers face both risk and opportunity. The risk is that a delayed or overpriced next-gen launch pushes consumers toward substitutes. The opportunity is that consoles, with their fixed specs and subsidized hardware models, become even more attractive as the PC market prices casual players out.

My expectation: The next console cycle arrives roughly on schedule, but manufacturers will be conservative on specifications and aggressive on price positioning. The memory shortage won’t derail the generation, but it will most certainly shape it.

PLAY/PASS

Play. Speaking of listening to your audience, Activision announced this week that it will no longer release Call of Duty on an annual schedule back-to-back (h/t MB!). Its most recent release didn’t go so well, and the publisher is now switching back from volume to quality.

Pass. In case you were wondering what their priorities are, Wall Street investors are surprised to find that age verification isn’t proving a headwind for Roblox, suggesting it might even be a positive.

NEXT UP

I’m wrapping up the semester this coming week and will bring you the latest from the academic front. Spoiler alert: judging by this semester’s discussion and paper topics, indies are experiencing a renaissance.

Correction - GTA V was never offered on netflix, only a trilogy from prior games.

Interesting!