Netflix getting into games. Again. Or still. Oh whatever.

Ask not what games can do for you.

Happy to report that the pandemic hasn’t robbed me of my appreciation for a free lunch.

Since I had to miss all my friends who usually come out around E3, I instead attended a swanky lunch at the Tribeca Film Festival that featured a panel discussion on the state of comic books.

Two things fascinated me: first, comic books, or graphic novels as they prefer to call them, represent somewhat of a primordial content soup from which all kinds of entertainment springs. With relatively low barriers to entry compared to, say, film, it doesn’t take much to crank out a story. What makes it difficult is writing something that can permeate different media formats.

In Japan, video games and graphic novels (manga) are closely related and higher in the cultural caste system. That makes it easier for them to collaborate and develop franchises compared to, say, North America. Nevertheless, the panelists — Garth Ennis and Goran Sudzuka, for the fans — have been involved in some major projects like The Punisher, Wonder Woman, and The Boys, to name a few obvious ones. It suggests that perhaps we could be investing more in graphic novels if we’re really looking to build a long-term IP strategy.

Second, and tell me if this sounds familiar, diversity in graphic novels is still in its infancy. The rise in popularity as a result of digitalization and the massive successes of Marvel, has drawn the art form into the mainstream. As a result the die-hard fanbase found itself facing a broader range of topics and, shock, horror, strong female protagonists. A noticeable chill went through the room when someone asked about how each panelist presumably worked to improve race and gender representation.

A few years ago avid readers had taken a page from the games industry, which resulted in a harassment campaign targeting “women, people of color, and LGBT folk in the comic book industry.” You guessed it: Comicsgate. Naively I had assumed Gamersgate to be an episode isolated to the games industry. Unfortunately it set off a wave of misery elsewhere, too.

Needless to say, on my first trip out into the Great Outside, I was immediately reminded of why we go out at all: to broaden our horizons. I can’t wait to see what we’ll learn about the world when we rediscover it.

On to this week’s update.

NEWS

EA gets hacked

After tricking an EA employee to give up a login token, a group of hackers stole a bevy of data that it is now looking to sell. Between this and infesting oil pipelines with ransomware, I’m losing hope that hackers are benevolent misfits with a computer science degree. Whatever happened to wiping out worldwide debt for the greater good? Clearly, they’ve started to professionalize and formed for-profit businesses instead. One article reads: “according to a representative for the hackers.” Turns out the secret underground world of hacking offers above ground job opportunities for PR people. What’s next? Human Resources and quarterly earning reports? Go hack something interesting.

Roblox stock drops on decelerated metrics

What got Wall Street worried was the lower month-over-month numbers from April to May. Roblox’ bookings declined from $242 million in April to $216 million (which still was a +25% increase y/y btw). Its daily active users was slightly down: -1% from 43.3 million to 43 million, its average bookings per daily active users was down 3% y/y at $5.09. Roblox traded at $89.76 at close on Tuesday and is currently down -7.8% at $82.75 today.

Nothing too spectacular but it feeds the idea that Roblox’ initial market run is coming to a close. More likely this is the result of the end of the school year and the warmer weather. As the fanfare around Roblox has ebbed away a bit, it gets less exposure in mainstream media and the influx of new users deteriorates. We’ve seen the same before with Second Life which spiked when it received a ton of free exposure without materially changing or updating the experience itself. Let’s see how Roblox does after Labor Day.

Surprise appointment of Lina Khan as FTC chair

If you’ve been following the Epic/Apple court case, you’ll forgive me for geeking out for a moment. Having spent almost eight years earlier in my career studying ownership trends and its impact on media, I was really excited for Lina Khan to get appointed as a Commissioner to the FTC. Now she’s been named as its chair. Ms. Khan is one of the most eloquent and vocal critics of Big Tech and, dare I say it, not a middle-aged white guy. Her appointment on a 69-28 vote indicates strong bi-partisan support, and the expectation is that she will do away with the paltry fines that companies like Facebook have paid in the past. Enforcing change in key business practices will likely have a significant impact on the games industry and could spell bad news for any of your favorite platform holders that are refusing to oxygenate the market.

BIG READ: Netflix getting into games. Again. Or still. Oh whatever.

Ever since its CEO Reed Hastings confessed that it wasn’t HBO but rather Fortnite that kept him up at night, all eyes have been on Netflix’ imminent entry into gaming. So when a recent report emerged that the firm was looking for a ‘gaming exec’ to oversee a potential expansion into gaming, everyone got really excited.

The success of its various video game adaptations like The Witcher, Castlevania, Dota: Dragon’s Blood, undoubtedly drives a strategic narrative around pushing into gaming. Still to come are Angry Birds: Summer Madness, Assassin’s Creed, and Cyberpunk: Edgerunners. And then there are experiments like Bandersnatch, which offered an interactive narrative, and the fertile crossover potential of Stranger Things. For many the light went on when The Queen’s Gambit triggered a sales spike in chess boards.

The pandemic further fattened the already plump games industry which is expected to reach $200 billion in consumer spending this year. At the same time, the ubiquity of cheap capital has pushed the value of existing and promising intellectual property still in development to new records as publishers and platforms try to outbid each other. Getting into games now would allow Netflix to ride its current momentum and further broaden its reach. It’s a strategy that practically writes itself.

Except that it isn’t.

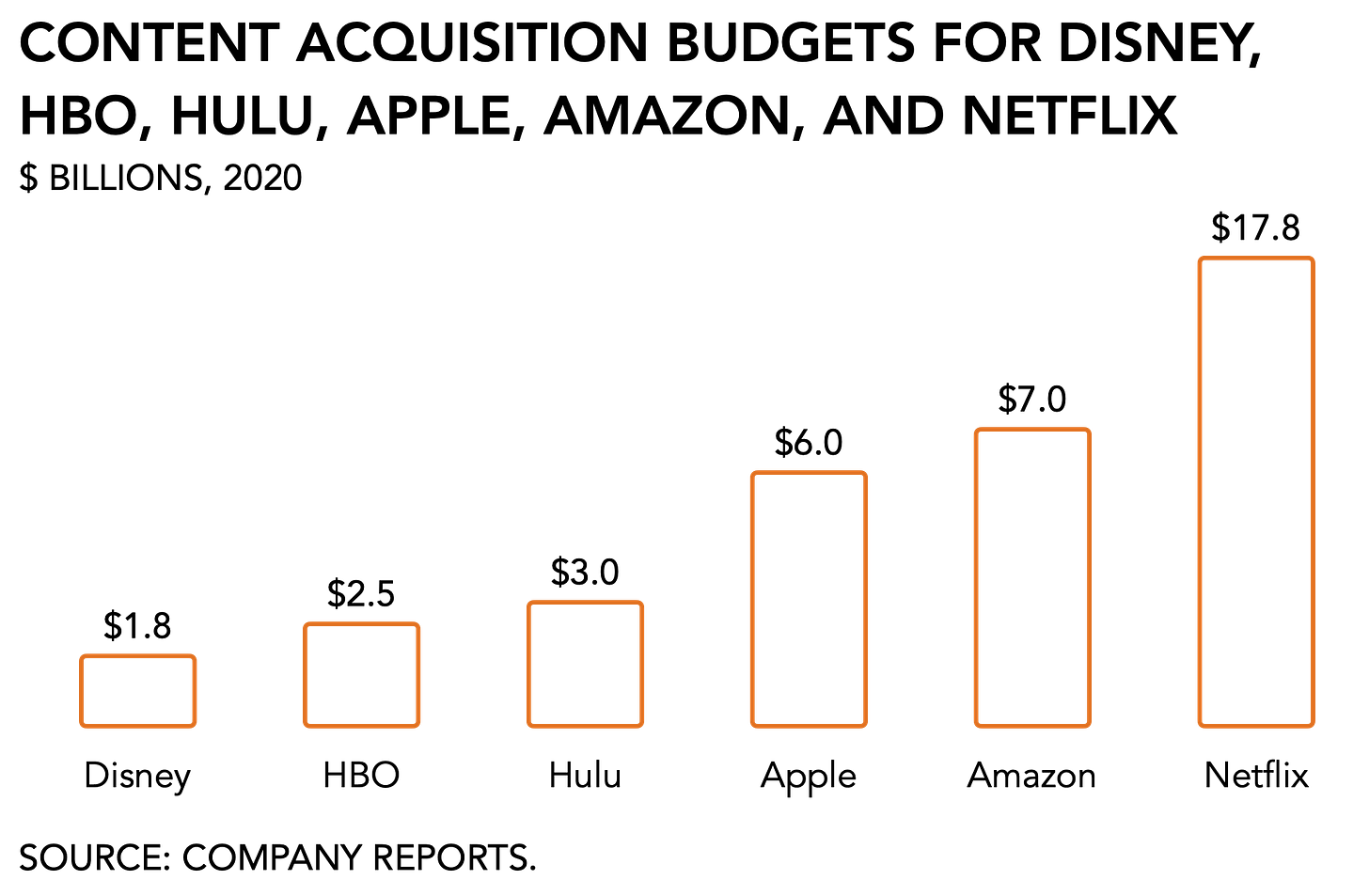

Netflix’ presumed entry into gaming is borne from the predictably naive mindset among decision-makers that have been enjoying themselves immensely the last few years. A swath of mid-level tech execs found itself living the dream: leave in the morning on a quick flight from Seattle or San Francisco, armed with their companies’ conspicuous budgets, to woo Hollywood celebrities who were all too eager to make a movie, any movie, really. What an ego boost that must be: playing financier in Tinseltown with tech dollars, securing the rights, and flying back to daddy Hastings with the good news. The $38 billion that the different streaming video competitors collectively invest in content have become a retirement plan for former A-listers who will gladly take a check to produce the streaming equivalent of straight-to-DVD. (I’m looking at you, Bruce Willis, for Hard Kill. Shame. 🔔)

By aggressively subsidizing content creators Netflix seeks to build the largest content catalogue available to stay competitive. In the first quarter of 2020 it released 11 new series and 19 returning series; in Q1 of 2021 it released 43 new series and 18 returning. This has earned it no fewer than 47 nominations for the Golden Globes, and 12 wins. As far as the supply-side is concerned, that strategy is working. As long as it keeps spending and keep everyone working, it will continue to rack up industry accolades.

Some question what the potential impact of Netflix will be on the games industry. Elsewhere, its appetite for more content has greatly expanded the growing global presence of Japanese anime. According to The Economist, Netflix acquired the rights to distribute 21 films produced by the renowned Studio Ghibli, and plans to launch 40 new anime titles this year, almost twice the number from 2020. I’m a fan, so that’s exciting. It also has facilitated the transition of anime from a niche category to a more mainstream form of content. In December last year Sony acquired Crunchyroll for $1.2 billion from AT&T.

Such growing demand puts strain on the supply side. In the case of anime, studio leads worry about the availability of talent to meet such rapidly growing demand. The billions of dollars that a Netflix brings into a creative industry to satisfy its strategic needs can change that industry permanently. It is therefore no wonder that many regard Netflix’ alleged entry into video games as a big deal, expecting it to impact the games industry’s ecosystem as it does with Hollywood and anime.

But that’s where an entry into video games will likely be different.

Up until recently the economics between film and video games looked very similar: high production costs spaced out over several years, followed by a hefty marketing budget, meant that a dwindling number of firms could stomach the risk profile. Productions like Grand Theft Auto resemble the blockbuster approach that is so common in Hollywood.

However, the world of gaming has shifted. Specifically, where film productions and TV series have remained discrete commodities, video games have become assets. Today large publishers focus less on the total number of units they sell and instead measure success by the number of active users and monthly revenue they generate. Instead of trying to sell as many copies as possible, game makers continue to invest in their titles post-release. In basic economic terms, popular games today are an asset that increases over time and requires continued investment and are no longer a simple commodity.

Another reason Netflix is unlikely to make a big splash is that it would be entering a space that has apex predators. When it transitioned from its DVD business to digital distribution, Netflix was the pioneer. Venturing into new territory allowed it to quickly build a name for itself and ultimately forced incumbent conventional media firms to develop a comparable strategy. For a while, at least, it had the kingdom to itself.

In the games industry that is not the case. There are several large platform holders—Sony, Nintendo, Microsoft, Tencent, Valve, Google, and Apple—that have no interest in yet another digital service competing for their customers. In fact, Microsoft has already claimed the moniker of becoming the “Netflix of gaming.” And it’s going well, too. It last reported 18 million subscribers for its Game Pass offering, which we may assumed has increased since then. Moreover, following the $7.5 billion acquisition of Zenimax Media in November, which gave it ownership of some of the most exciting IP in the industry, the Xbox team announced 27 new titles coming to its service just this week.

Finally, Netflix is considering a strategic move here under different circumstances. Among the various streaming video-on-demand services, it is currently on the higher end of the fee spectrum: charging $17.99 for its top tier offering puts it well above a myriad of other services, including HBO Max / Go, Hulu, Amazon and, of course, Disney+.

In the end, the question isn’t what impact Netflix will have on the video games industry but rather how Netflix is going to adjust to the games business to play a meaningful role. In other words: What would a successful gaming strategy for Netflix look like?

One path would be to follow the example of conventional media firms as they expand into other categories. For example, Fremantle, a TV production company, outsourced development of a mobile game based on quiz show The Price is Right to a Canadian studio. After working together for a while, Fremantle took a minority share in the studio, and acquired it outright not long after. By gradually getting more involved it was able to de-risk the effort and ultimately vertically integrate a game studio into its operations.

Another is going the opposite direction. Instead of developing and publishing games, which Netflix knows nothing about, there certainly is a market for providing more lore on popular game franchises. The adaptation for Castlevania was masterfully done and offered a welcome twist on the broader narrative universe.

Initially platforms rely on third-party content and service providers to accumulate value for their users. That strategy becomes very expensive over time, especially as competitors show up and the value of complementors increases. To offset those expenses, platforms generally develop their own first-party content. Becoming the to-go video content production firm for video game IP would go a long way with major publishers.

But if its insists on entering games as a publisher, then perhaps the most effective way to do so is by operating as a VC fund. By providing capital to promising studios and creative talent, Netflix could take a position in mobile and drive traffic, and revenue, from its video app, and vice versa.

It would give it a leg up on HBO, for sure. HBO is home to some of the most valuable IP in the world. Titles like Game of Thrones: Conquest on mobile do well and put HBO ahead of Netflix. But it has yet to follow up on this early success. The new Mortal Kombat was cool. And there’s a promising game based on its series Insecure (disclaimer: I’m an investor), but as an old school media firm it has only scratched the surface of what’s possible.

In spite of the enthusiasm, Netflix has been splashing cold water on the rumors. During a recent earnings call, Greg Peters, Netflix’ COO and Chief Product Officer, stated:

“We’re in the business of creating these amazing, deep universes and compelling characters and people come to love those universes and want to immerse themselves more deeply and get to know the characters better. We’re trying to figure out all of the different ways that we can increase those points of connection and deepen that fandom and certainly games is a really interesting component of that. Whether it’s gamifying some of the linear storytelling we’re doing like interactive with Bandersnatch and we’ll continue and we’ve actually launched games themselves as part of our licensing and merchandising effort and we’re happy with what we’ve seen. There’s no doubt that games are going to be an important form of entertainment and important modality to deepen that fan experience so we’re going to keep going.”

Nevertheless, there is a sense of inevitability about Big Tech elbowing its way into gaming. The question, however, isn’t “How will Netflix’ entry impact the games business?” Better to ask is: “How will Netflix reinvent itself in order to successfully compete in interactive entertainment?”

Sure enough it has proven to be capable of producing films and series that resonate with a gaming audience--Stranger Things over-indexed, predictably, with Dungeons & Dragons fans. But rather than looking at Netflix’ steps into new territory as a validation of video games as a popular pastime, what we’re actually witnessing is a subscription-based streaming platform trying to figure out how to future-proof itself as audiences invariably move to forms of entertainment that afford a higher degree of interactivity.

PLAY/PASS

Play. Oh lord yes: excel as an esport. Although living so close to the financial district probably means I’m way out of my depth.

Pass. In another excellent article by Cecilia d’Anastasio, fascists of all ages can fuck right off. Doubly so the ones infesting kids games.