The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Following the departure of Jim Ryan, Sony Interactive Entertainment’s former CEO, a new ruler has been elected. Or rather, two rulers.

Based on the announcement from interim CEO Hiroki Totoki, the PlayStation empire will be governed as follows starting in June. Hideaki Nishino, who has an engineering background and is a PlayStation veteran, will be in charge of Sony’s Platform Business Group. The division includes all technology (e.g., console, peripherals, services, and platform experiences) and third-party relations.

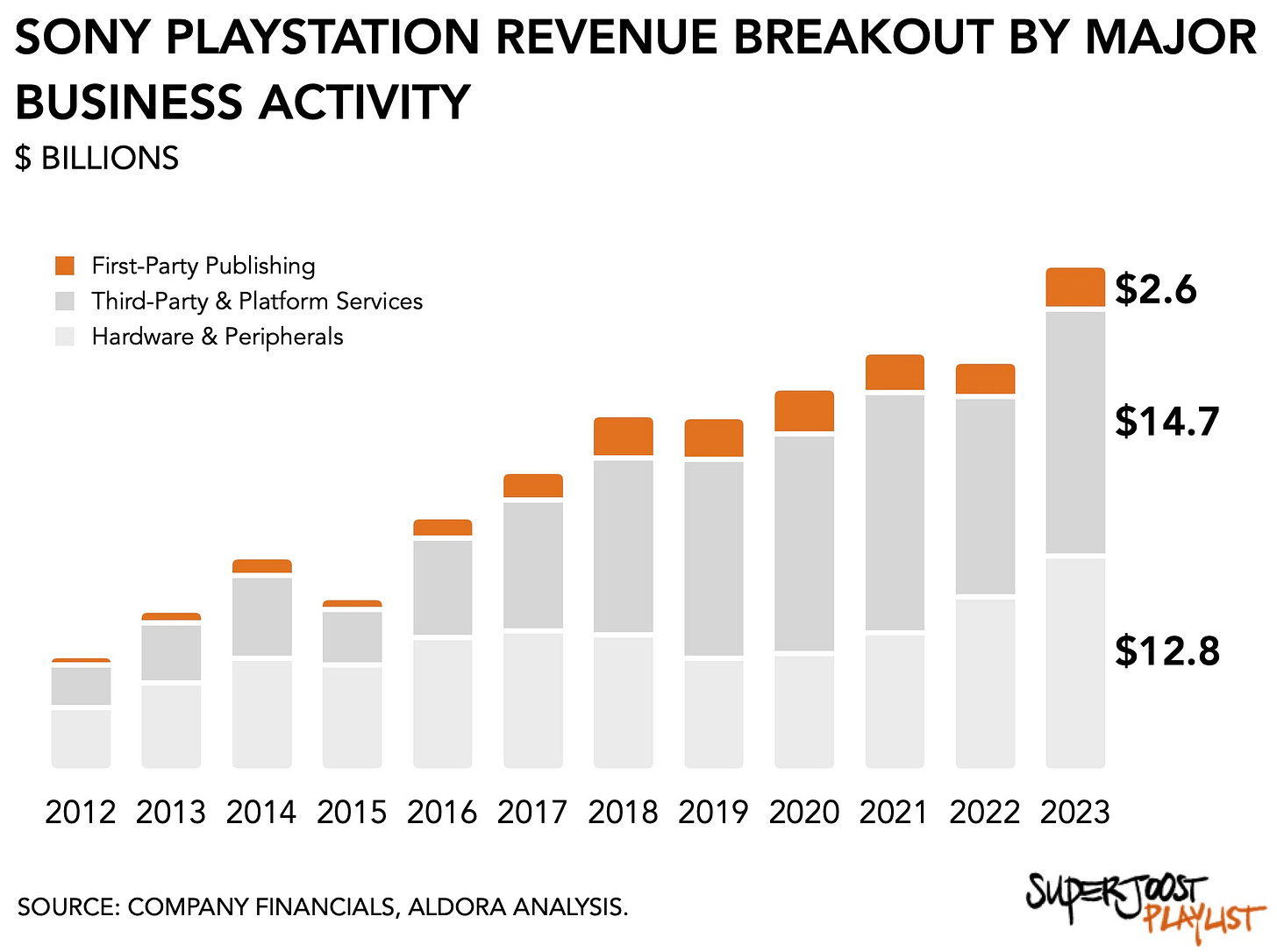

By my count for 2023 that covers $12.8 billion in hardware revenues and another $14.7 billion in services and third-party content sales. That also makes it by far the bigger piece. That’s not as exciting as it looks since it will be a lot harder to grow this segment. In fact, I’d argue that Sony can’t win with a hardware strategy alone, but, as we move into the next console generation, it can easily lose. Nishino landed the highly unenviable gig of having to hold the line and ensure Sony doesn’t lose market share in the midst of a transition.

Hermen Hulst, on the other hand, will run a much smaller but, I think, more potent part of the business. In his new role as the head of the Studio Business Group, Hulst is responsible for content development across devices—PC, console, and, I’m guessing, mobile. He’s also in charge of expanding Sony’s IP catalog into film and TV, in pursuit of similar successes as the adaptation of The Last of Us.

I’ve written before about Sony’s need to venture beyond the boundaries of the conventional console market. First, large tech firms want to break down the walls between hardware-based ecosystems. Microsoft announced this week that it is launching its Xbox mobile app store. According to Xbox President, Sarah Bond, it will offer first-party experiences “accessible across all devices, all countries, no matter what, and independent of the policies of closed ecosystem stores.” Rival Apple has similarly been exploring bringing AAA titles to its platform by featuring Hideo Kojima and other games industry icons at its press events. Since Sony can’t possibly beat Big Tech in size, it will have an easier time expanding its media activities.

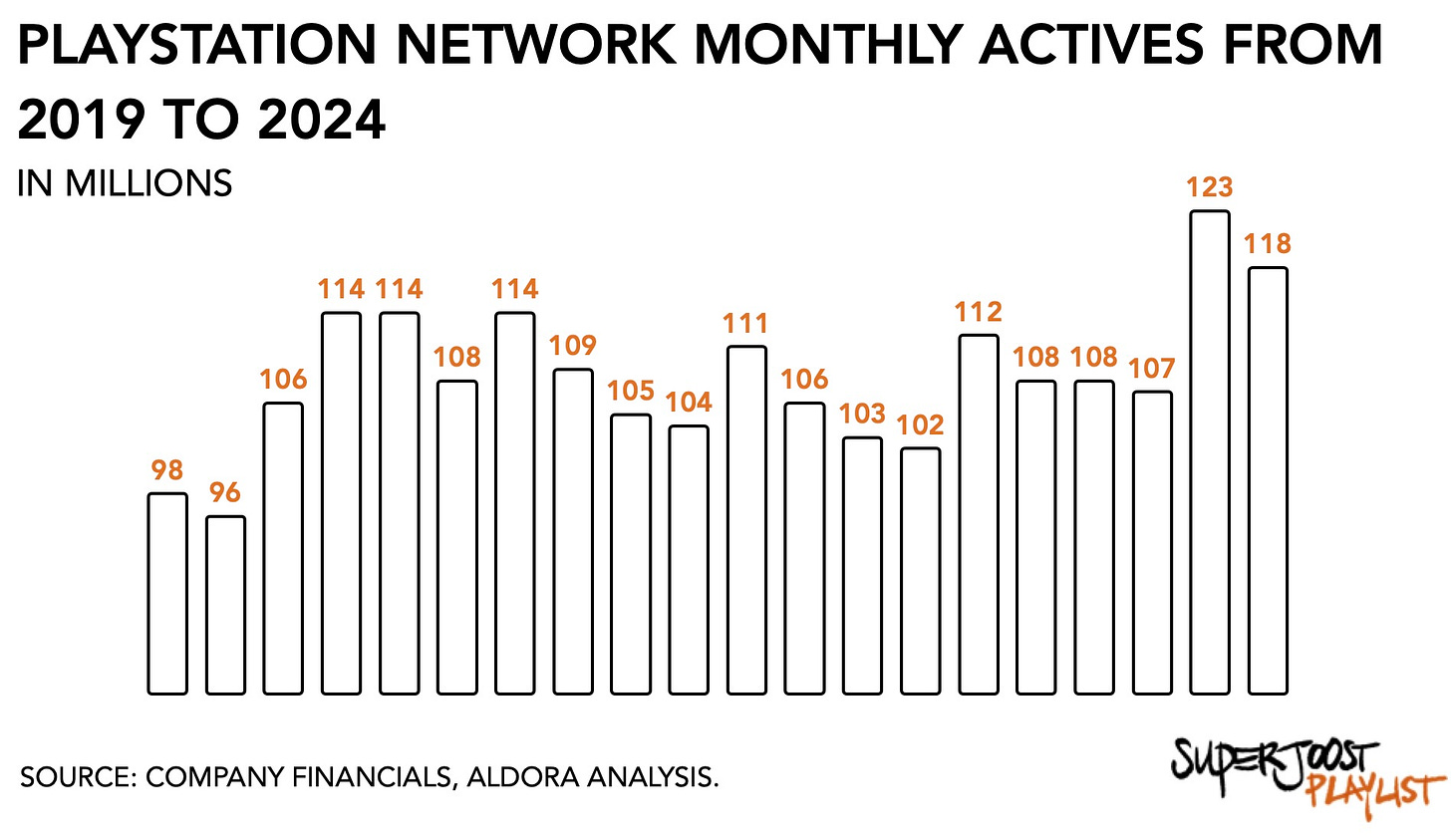

Second, despite the enthusiasm for interactive entertainment in recent years, the addressable audience for console gaming has been roughly the same size for the past decade. The total install base for all three major consoles combined sits at 250 million globally with very little growth in terms of headcount. Logically, a platform holder like Sony has expanded its services offering to increase the value per player. What sustains the firm is the notable increase in engagement. For the quarter it reported a 9 percent increase in the number of PlayStation Network accounts, and overall playtime was up 15 percent. Rather than looking to attract new users to its ecosystem, Sony is moving to monetize its existing player base.

In the three months ending in March, average revenue per user (here defined as the combined spend on digital software, add-on content, and network services) among PlayStation Network actives was $36.13, up from $30.68 in the same quarter a year before.

Sony is transitioning from an organization characterized by a walled garden of consumer electronics to one that manages entertainment brands across various platforms and ecosystems.

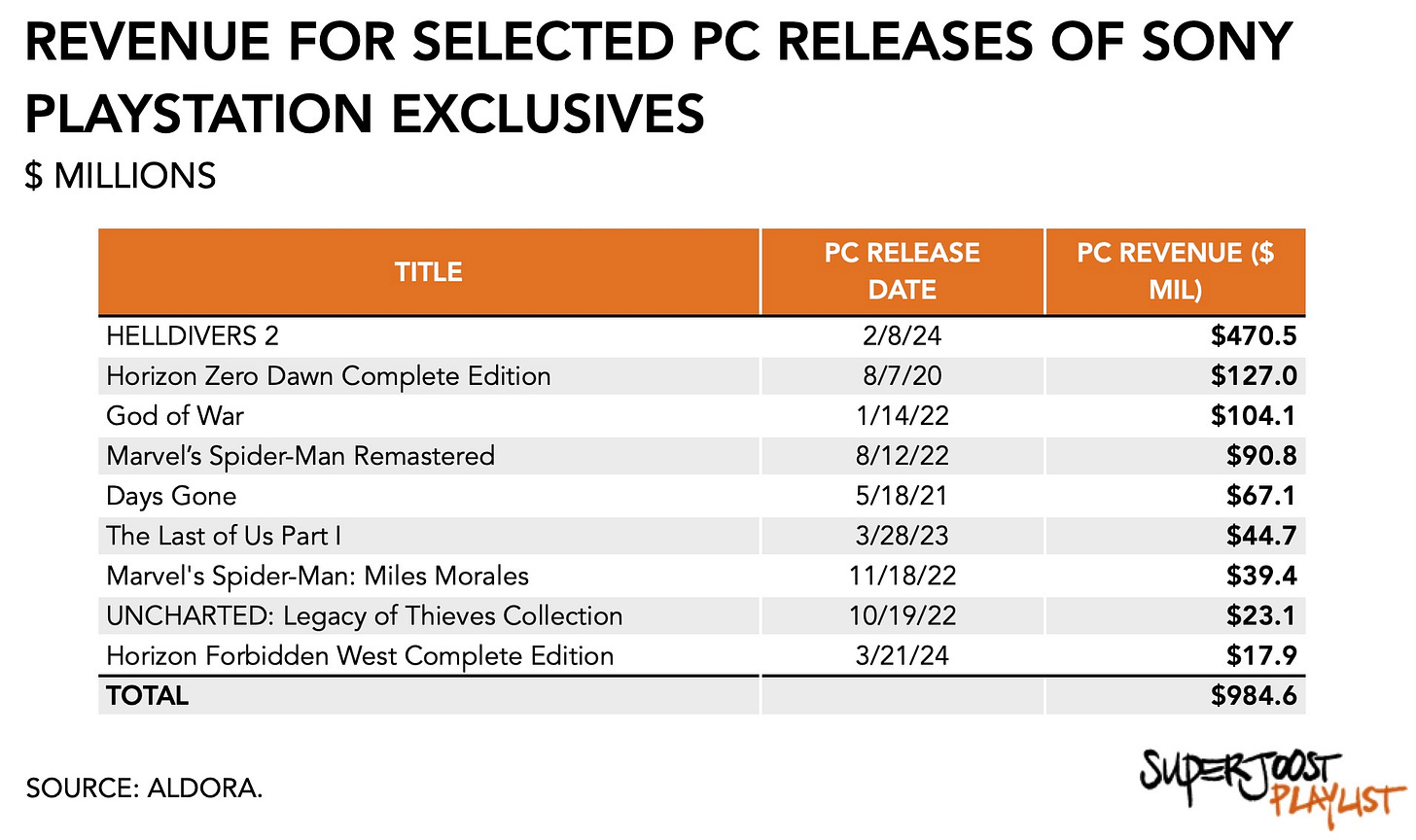

Its careful foray into the PC market, for instance, is characteristic of a firm learning on the job. Gamers were displeased with Sony requiring them to link to a PlayStation account to play Hell Divers 2 online. Sure enough, it does add extra steps and suggests that Sony prefers that you play in their backyard instead. It is also common practice among literally everyone else in the industry.

Despite these initial struggles, results have been encouraging. Releasing its premium properties on PC has so far netted Sony well over a billion dollars in additional revenues. The popular co-op shooter Hell Divers 2 is coming up on $500 million in aggregate PC revenues and, according to this week’s earnings, sold 12 million copies across PC and PS5 in its first 12 twelve weeks. It sets the stage for the upcoming release of Ghost of Tsushima, which, considering it sits on over a million wishlists on Steam, promises to be another success.

The fact that we now have two CEOs at the helm of the world’s most successful console maker suggests a strategy focused on more than just maintaining the status quo. Adding up Sony’s investments, acquisitions, recent failings, and now hiring decisions, shows a firm in the process of reimagining itself. Between buying Bungie in 2022 for $3.6 billion, investing in Epic Games, and taking positions in a few other non-console entities, a strategy emerges that goes beyond gaming. In a rather uncharacteristic move for, especially, a Japanese market leader, Sony is changing its organizational structure to better accommodate the development and release of content that perpetuates rather than relying on a blowout success immediately post-launch.

The change comes at a critical time for Sony. According to earnings this week, hardware sales were down 29 percent year-over-year, ending the year with 20.8 million PlayStation units sold. That is well below Sony’s initial target of 25 million and despite running a promotional campaign. In the March quarter, it sold 4.5 million units, down 30 percent compared to the same quarter last year.

Who knows, maybe Sony will even acquire Paramount Global with the support of private equity firm Apollo. The deal is rumored to total $26 billion in cash, which tells you we’re going to be hearing a lot about synergies and cross-media productions. And for good reason. Paramount owns several assets that would work well in interactive entertainment, including Teenage Mutant Ninja Turtles, SpongeBob SquarePants, Dora the Explorer (via Nickelodeon) and South Park (Comedy Central). As with all of these deals, you don’t know until you know, but at the very least it is clear that Sony is pursuing a content-driven strategy.

The PlayStation kingdom finds itself under the rule of two princes. One is responsible for ensuring its continuity, and the other for its expansion. PlayStation has an opportunity to change the course of its current strategy and capitalize on opportunities that extend well beyond just gameplay.

PLAY/PASS

Play. Laine’s fundraiser for the game history journal ROMchip blew right by its initial goal and raised almost $9,000. Well done!

Pass. Following a tweet (!) by meme stock-fluencer Roarin’ Kitty, GameStop’s share price spiked from $10 to $65.

Great analysis. I hold out a little hope that Sony might port some of its PS2 and PS3 games to PC .

🔥🔥🔥