Predictions, new rev models, and the 2021 video game flywheel

The next 10 years in gaming

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

I had originally started this week’s newsletter with a chipper hooray about the new year. And after watching CNN for the last 17 hours straight that stays the same.

In darkness you follow the light.

So here goes.

Happy New Year everyone!

Week one of 2021 has set the tone for what’s to come. The industry is at an all-time high and if we take Roblox’ series H valuation of $30 billion as a guidepost, things will be 7x times better for everyone.

Even so, there’s quite a few times between now and vaccination for everyone. So let’s stay busy.

On to this week’s update.

My TL;DR expectations for 2021

The momentum in games will sustain (+21%) due to continued access to cheap capital and a frothy market looking for the next big hit to

push the category further into the center of daily life and become integral to how people hang out together online, which will

grow the overall audience size and strengthen four novel revenue models—subscription, advertising, user-generated content, and crypto-currency—that impact

the type of content we can expect in the years to come and reconfigure how audiences interact with it and each other.

BIG READ: The next 10 years in gaming, part 1

To start I will answer the annual call for prognostication and provide my ‘21 take.

The development of hardware, including the recent release of the 9th console generation and the popularization of building your own PC, is historically considered the key driver of change. In 2021 I anticipate novel business strategies and revenue models to be the main catalysts for new types of content and establishing competitive advantages. To succeed game companies will have to formulate new ways to leverage their intellectual property, for instance, and engage audiences in a variety of ways beyond just selling them a copy of their game.

But before we get to all that, let’s start from the top.

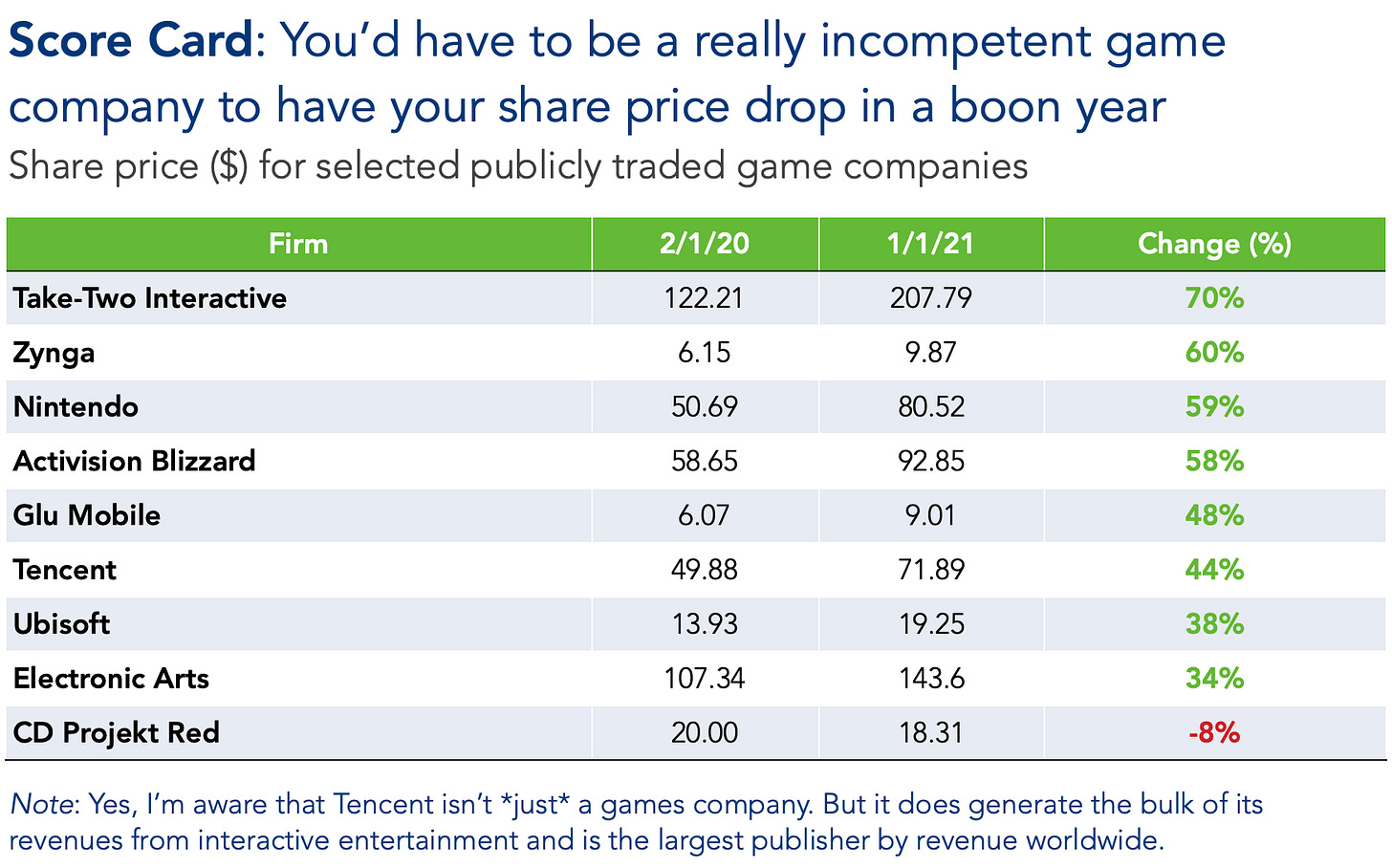

Will the boon continue?

The size, yes. The same ridiculous pace, we’ll see.

The moment we heard of a vaccine being almost sort of maybe ready, game stock dropped. The first inkling of this virus not governing our lives reads to financial investors as the moment when everyone will log off and out.

Undoubtedly people will be excited to go back to non-gaming activities. I, too, miss restaurants and general human interaction. But games as a whole have nevertheless become more widely accepted. As my colleague Jesper Juul wrote already a few years ago:

To play video games has become the norm; to not play video games has become the exception.

That means the video games pie is now bigger. Its current success and prominence is the result a slow change in its underlying economics over the past decade.

Here’s the short version of the last three decades. Video games have transitioned from a (1) PRODUCT-based model to (2) a SERVICE and now increasingly behave like (3) MEDIA. Digitalization, specifically the widespread penetration of broadband internet and the popularization of smartphones, has blown the industry wide open. (I wrote a whole damn book about this if you want to learn more.) What separates the winners from the losers is the ability to formulate novel strategies every time a market or category shifts.

The pandemic simultaneously accelerated changes that were already underway and encouraged behaviors (e.g., online socializing, increased spending, adoption of online game play as a pastime staple) that had been slowly emerging for years. The lowering of entry barriers for creatives and the vast expansion of available content for consumers has resulted in an explosive growth of said pie.

For the coming year several fundamental drivers remain the same. First, legacy firms have more titles scheduled for release than last year. In short order: Activision Blizzard should benefit from its new triple A title (Overwatch 2 most likely) and the release of Diablo Immortal; Electronic Arts has another Battlefield planned which is expected to add an additional $500 million in revenue; Take-Two looks like it’ll release another Bully or Mafia IV; Zynga has a healthy crop that includes another FarmVille mobile game, Puzzle Combat, and Harry Potter’s Puzzles & Spells, in addition to the acquisitions of Peak Games and Rollic; and Ubisoft, well, not so much, but I’m excited about the potential of their Ubisoft Plus program.

In aggregate, the release of (more) content in 2021 will benefit the overall industry. And we can also count on old switches and new playstations and xboxes to continue to sell well.

Second, Big Tech will continue pummeling its way into the industry. Both Luna and Stadia are still a work in progress (“New Year. New Games. From Last Year.”) but presumably both are in it for the long haul. That means we can continue to expect a red hot B2B market for content. Venture capitalists that specialize themselves in interactive entertainment did a record number of early stage deals in 2020: I counted at least 121 last year, which was up from 95 y/y and double the number from 2017. Legacy publishers are equally flush with cash and eager to buy content + crew to future-proof themselves.

Third, the price of content will go up. Buying IP is an arms race. For instance, Zynga paid top dollar for Peak Games. And Microsoft set a new personal high score with the second largest games transaction in the industry’s history of $7.5 billion for ZeniMax Media. Acquirers can expect to pay top dollar. For example, when Take-Two tried to buy Codemasters for $994 million, financial analysts speculated that it was underpriced. Almost immediately Electronic Arts swooped in and bought it right from under TTWO’s nose at a 20% premium ($1.2bn). Meanwhile, new empires are emerging in Europe where Stillfront and Embracer are using their access to cheap capital to buy up anything that moves. The latter announced 13 new acquisitions (!) during its most recent earnings report. And if that didn’t tell you anything, the fact that Nintendo just this week made its first big acquisition since 2007 should. The big dogs all have plenty of cash on hand, but everything now costs more, too.

Let’s put a few high-level predictions on the board.

In 2021 the global games market grows to $202 billion (+21% y/y). Let’s start with an easy one. Presenting: SuperJoost’s Fantastically Incorrect Market Estimates That Everyone Should Ignore (“SFIMETESI”). Succinctly, sustained growth in console, PC, and mobile in combination with innovative content and business models push the total market past a magical threshold. Sony, Microsoft, and Nintendo all report strong numbers for their console software sales ($25.6bn by EOY’21). The PC market is healthy as ever ($41bn) with Steam already reporting a new record of 25.4 million concurrent players on January 2nd. And on mobile we are at the start of what can only be described as triple A content releases (e.g., Genshin Impact), resulting in the category reaching close to $100 billion ($96bn). That leaves us with Live Streaming ($14bn), Hardware & Accessories ($18bn), and Mixed Reality ($8bn). Do with this information what you will, but it’s what I’m basing my year on.

Bifurcation of low-tech & hi-tech audiences. Spending among gamers follows the same K-shaped recovery that we’ll see in a broader economy. On the one hand we’ll see platform-specific audiences grow as people with white collar jobs spend more of their time at home and justify the investment in new equipment and premium content. On the other hand, the stranglehold of unemployment and the sluggish return to normal among people working in service industries results in finding cheaper alternatives like subscription-based content buffets and ad-based game services. What follows is a diversification of revenue models as content creators and platforms explore strategies to monetize the bulk of players that currently do not paying directly.

Remote everything becomes the norm. Following a quick run on secure, reliable ways to work with teams on large development projects, the marketing teams will soon see the light, too. Conventions are exhausting, crowded, high stakes, and increasingly cost prohibitive. Publishers had already started to migrate away from convention halls to host their own show for less. As a result travel to E3, Gamescom, Tokyo Game Show and others is greatly reduced and replaced with clever virtual events (“For the next three days, come play the first level of our new release.”) It will be surprisingly awesome for general audiences (e.g., no lines), loyal subscribers (e.g., premium previews) and marketers (e.g., much lower cost, broader reach).

A string of lawsuits and inquiries from regulators. In the US the FTC will kick off early in the year, and in Europe and Asia we’ll see the slow increase in protectionist barriers. Expect the predictable: data privacy, kids protection, and international trade agreements, and consolidation will all feature in the industry’s newfound attention from the government. Winners here are medium- and small-sized firms who gain more access to capital as anti-trust regulation forces platforms to share more of the pie. Did I mention Apple/Epic? I should.

More is different

One of my favorite phrases in understanding how industries changes comes from a 1972 essay titled “More is Different. On the Broken Symmetry and Nature of the Hierarchical Structure of Science.” It goes:

“The behavior of large and complex aggregates of elementary particles, it turns out, is not to be understood in terms of a simple extrapolation of the properties of a few particles. Instead, at each level of complexity entirely new properties appear, and the understanding of the new behaviors requires research.”

Given the meteoric ascension of games as both a cultur ialndustry and for-profit enterprise, it would be naive to merely regard it as bigger but otherwise the same as when it was small.

Microsoft touts three billion gamers as its addressable audience worldwide. Like a cultural benefactor, Amazon’s Luna promises to have something for everyone and squarely targets audiences that want to play occasionally. And big wig tech-based VC firms have entered the fray to see their investments go public and celebrate how the social strikes back. The size of the industry impacts how it functions.

Over the past few years the industry managed to reach a critical mass that demands new ways of doing things. Development is changing: game makers have adapted to managing their teams remotely. Publishing, too, has shifted away from old habits. Rather than quietly perfecting a title prior to its release, we saw the success of Hades which went through eleven iterations before it even hit early access. And marketing now relies on live-streaming more than ever. YouTube and Twitch posted impressive viewership numbers, and Tencent promptly consolidated the two biggest platforms in Asia to corner the market there.

Even so, let’s not brush over the obvious obstacles. Game companies can expect an increase in scrutiny and regulation. Companies like Roblox are massively popular among younger audiences, for one, which invites government attention. Relatedly, there’s a good chance that the wrestling between Apple and Epic will fuel more widespread anti-trust sentiment. And in a few days the US will also have a new president which raises the question if and how a Biden administration will undo any of the trade sanctions imposed by its predecessor.

In 2021 success and critical acclaim in interactive entertainment continues to shift toward a broader, interactive content strategy. And now, after a year of enjoying the winds in their sails, game makers should be turning inward and focus on improving their business by strengthening their content portfolio and developing new revenue streams.

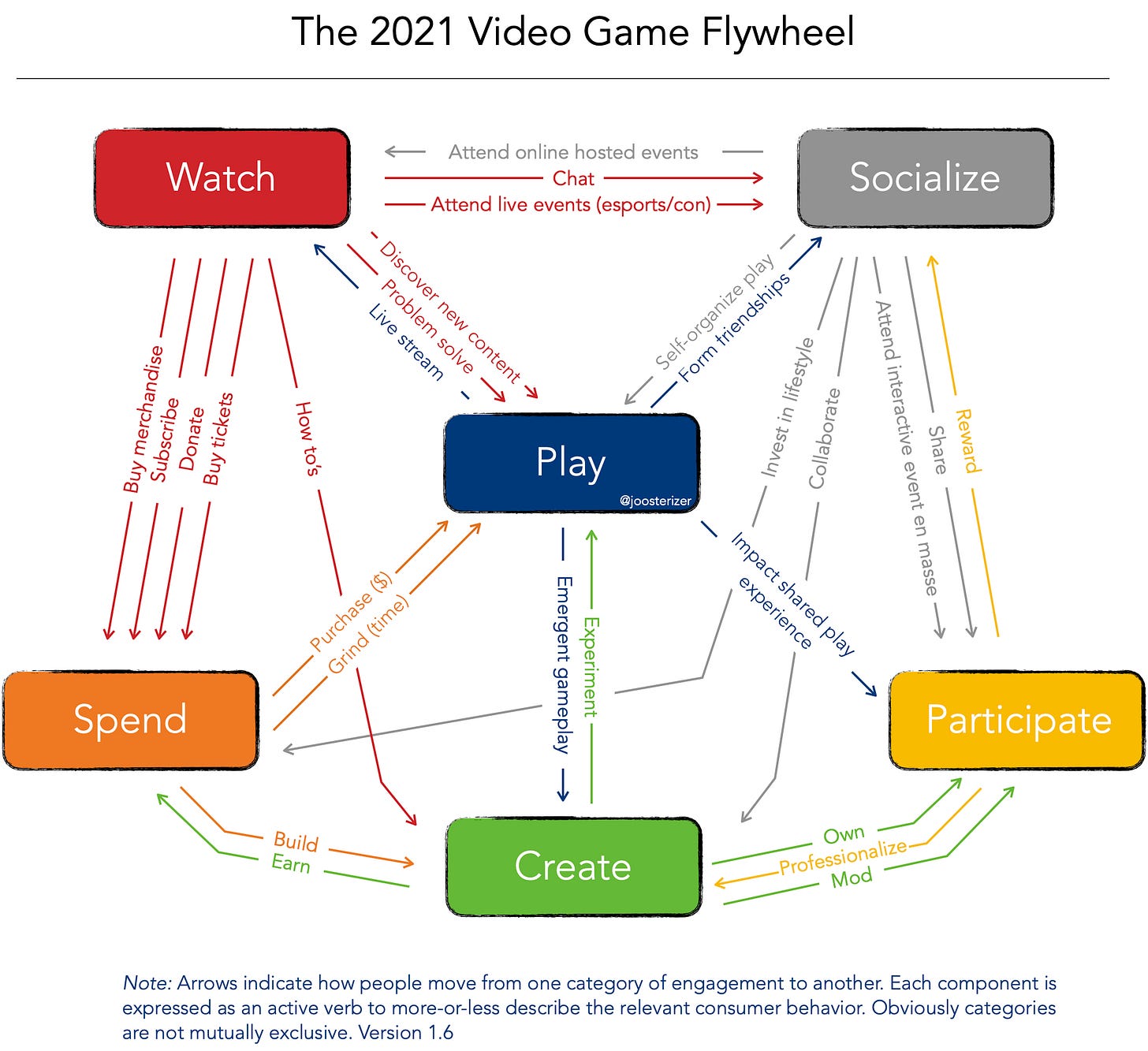

The video game flywheel

The coming decade promises the emergence of new revenue models. With a drastically different market environment and video games having re-entered the popular imagination, interactive entertainment will be monetized both in ways that are similar to conventional media (e.g., indirect) and via novel revenue models. It’s too much to cover all this in a single issue (I tried), but briefly put they are:

Subscriptions. Charging people a recurrent fee offers benefits to all: (1) consumers get cheap access to a lot of (hopefully curated) content, (2) it improves retention for content creators, (3) it results in a more predictable cash flow, and (4) it yields a higher valuation among investors for publicly traded firms.

Advertising. As traditional categories fail to attract especially younger audiences, advertisers are exploring novel channels and content, which major game makers and live-streaming platforms are eager to supply.

User-generated content. Paying amateur developers a cut of what they create will go a long way towards ensuring your game has lots of cool content coming out regularly and strengthens network effects.

Crypto-currencies. Furthest out but closer than you’d think, crypto-currencies facilitate a practical solution to online monetary exchange, helps establish secondary markets, and makes fractal ownership of digital assets possible.

Each of these serve as a way to facilitate and monetize different forms of interaction with gaming content.

No longer reserved exclusively to the conventional transaction at retail, consumers now interact with games in a myriad of ways which subsequently corresponds to novel ways to monetize those audiences.

For now, the thing to know is that interactive entertainment is shifting. Specifically, the relationship between consumers and content is broadening and allowing for different ways to engage.

Here’s a diagram to summarize my thinking.

Key to understanding the notion of a flywheel in the context of business is that as it rotates, it increases output or revenue without increasing input or cost. A decade ago, to sell more meant having to produce more discs and then ship them to retailers. Today, even in a service-model, you’re still constantly releasing updates and organizing sales events. Soon, key competitive advantages emerge from facilitating and harnessing the creative energies that naturally emerge around game play.

Success in the years to come will depend on developing innovative content that leverages an effective combination of these different components. Or, as EA’s CEO Andrew Wilson put it during an investor call in June:

“As we think about our future and we think about growth, a big part of it is choosing games that not only themselves have appeal, but can benefit from secular trends in our communities that we think will grow them even beyond our initial expectations.”

Sure enough, your game is fun to play and the best ever, but can people watch it, too? And if they do, can they impact the game’s progression somehow? Like the item drops in Hunger Games, can viewers send you weapons or a health pack? Is the connective tissue between players strong enough? And, what is your plan to facilitate self-organized play or social clustering?

Different types of engagement closely associate with a specific revenue models. We are well past unit sales and are now venturing into new territories which I will explore further in the weeks to come. Most importantly, in 2021 we’ll see a reset of the strategic challenges for creative firms and an opening of new areas for innovative user engagement and interactivity.

That sounds like a great way to start the new year.

I’m in total agreement with this prediction. I will also add that in 2021 the disruptive and irrelevant banner ad will morph into a more user-friendly reward ad that is an extension to game. As advertisers shift budgets, antiquated game ads will give way to new models that are relevant, safe, fraud proof and blockchain verified.