RAMpocalypse comes for Steam Machine

Rising memory costs threaten console ambitions and margins.

✈️ I’ve decided to book a last-minute trip to Vegas for DICE.

If you’re there, let’s connect!

Different from my usual newsletter, I fell down a rabbit hole between Nintendo’s earnings and Valve’s announcement that it’s now unsure about the pricing for its upcoming Steam Machine. In short, the combination of global tariffs and AI companies' voracious appetite for compute is pushing up consumer prices.

That’s nothing new, of course.

When cryptocurrencies were all the rage, NVIDIA deliberately limited people’s ability to use its hardware to mine Ethereum. It tells you where their loyalties lie. Since its early days, NVIDIA has all but abandoned the gamer audience. In my December write-up, I argued that volatility in hardware components would shape the next generation of gaming hardware. And this week, we see that reflected in both Valve and Nintendo.

And so, before I board my flight to Vegas, I wanted to share a few thoughts on an important reframing of the conventional games industry and how large-scale geopolitical events are shaping contemporary play.

BIG READ: RAMpocalypse comes for Steam Machine

On Wednesday, Valve announced it would need more time to set the initial consumer price for its upcoming Steam Machine.

Since its original announcement last November, the firm’s entry into the console category has sparked growing speculation about its impact on the current market structure. Both Sony and Microsoft have been raising prices on their hardware, and the cost of RAM and other components suggests a future in which these legacy firms will outsource hardware development to third parties. It could mark a meaningful shift in console gaming.

That market has already been shifting significantly over the past year.

Microsoft, for one, is clearly on a path that greatly reduces its exposure to hardware development. Claiming “overall weakness,” the tech giant is shifting its strategy and pushing into its digital services, where risk is lower and margins are higher.

Its Japanese rivals, Nintendo and Sony, have also made notable moves. Both have sought to offset global trade volatility by prioritizing their domestic markets. But despite these efforts, firms like Nintendo still rely for 40 percent of hardware sales on markets like North America. After a strong release of its Switch 2 device, selling 14.7 17.4 million units in the first nine months, investors are becoming skeptical of Nintendo’s ability to maintain margins. After its earnings this week, Nintendo’s share price dropped 11 percent (more below).

Along the same lines, Sony stunned the market last month with the announcement that it is exiting the TV business and handing control of its home entertainment division to Chinese group TCL Electronics. It means the PlayStation will soon be its primary hardware device, signaling a shift in the games industry’s hardware foundation.

What has many excited about Valve’s plans to enter the console market is this relative moment of weakness, as incumbents are in the midst of their own transitions. As I wrote in November, the Steam Machine looks less like a one-off hardware play and more like a Trojan horse for expanding the reach of SteamOS, using hardware as a lever to rewire how games reach players. But as component costs have skyrocketed, it raises the question of how this will impact Valve’s plans.

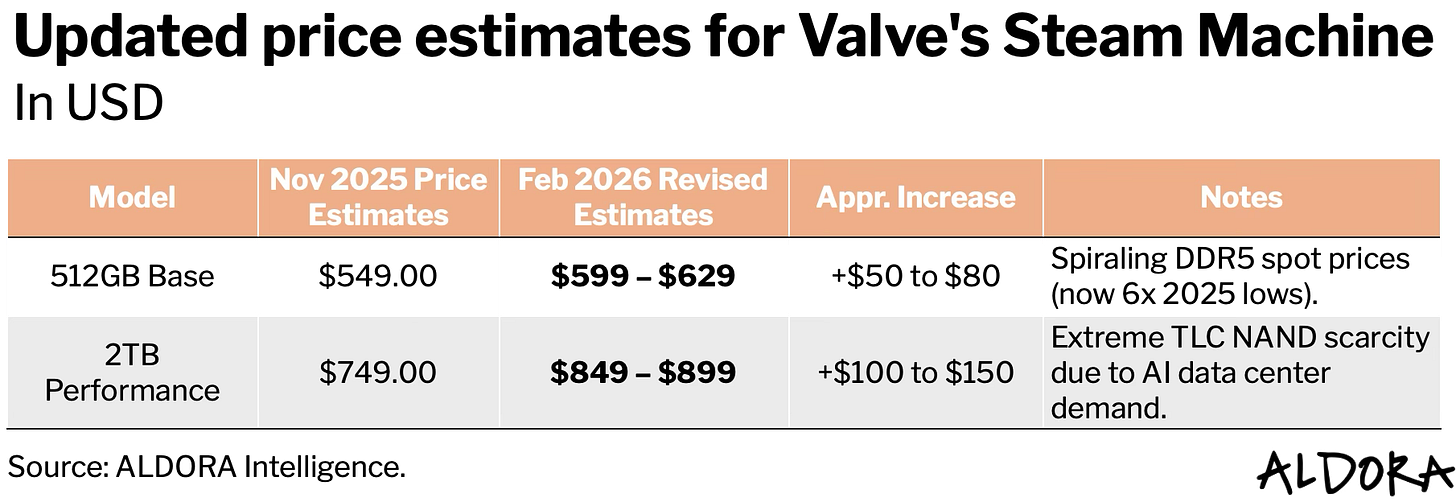

When I first analyzed the Steam Machine in November, I expected pricing around $549 for the 512GB model (without controller) and $749 for the 2TB version. Those estimates assumed a competitive positioning roughly on par with console pricing, which made strategic sense given Valve’s new objectives.

Since then, the cost picture has deteriorated rapidly. DRAM and NAND spot prices have spiraled well beyond normal cyclical peaks: DDR5 is now 6-8x above pre-September 2025 levels, and TLC NAND is trading at over 3x its pandemic highs, with no signs of peaking.

Much of this is structural rather than cyclical: chip fabricators are reallocating wafer capacity toward high-margin HBM memory for AI data centers, thereby squeezing the supply of consumer-grade DRAM and NAND. That means this isn’t a spike that will self-correct on a normal timeline. For a device like the Steam Machine, which Valve has confirmed uses standard, user-upgradeable memory and storage, these cost increases are passed directly into the hardware price.

Valve confirmed as much, stating that “memory and storage shortages” have “rapidly increased” since the November announcement, forcing them to “revisit exact shipping schedule and pricing,” particularly for the Steam Machine and Steam Frame. They’re still targeting a first-half 2026 launch but are no longer committing to specific dates or prices.

My revised expectation is that the 512GB model will likely land $50 to $75 higher than originally planned, closer to $599 to $629, while the 2TB SKU could see an even larger adjustment, potentially $100+ above target, pushing toward $849 to $899. Valve may also consider lowering storage tiers rather than passing along the full cost increase. Making storage and memory user-upgradeable is strategically smart as it allows them to ship a lower-spec base model at a more reasonable price while letting enthusiasts upgrade on their own.

Valve is not alone in feeling the squeeze.

Nintendo's most recent earnings underwhelmed investors, with net sales of $5.3 billion and operating profit of $1.0 billion both trailing consensus estimates. The cumulative sell-in of 17.4 million units outpaces sell-through by roughly 2.4 million, suggesting retailers over-indexed on early demand.

On the cost side, contract prices for the LPDDR5X memory used in the Switch 2 have surged roughly 40 percent, adding an estimated $18 per unit in RAM costs alone, a structural displacement driven by the same reallocation of chip fabrication capacity toward AI datacenter memory. It compresses Nintendo’s hardware margins from a healthy 18 percent at launch to roughly 13.5 percent before factoring in tariffs.

The same cost pressures affect console makers and PC OEMs, so the competitive landscape may not shift as dramatically as the raw numbers suggest. But Valve, as the newcomer, has the least margin to absorb it, and that weakens its pitch of "console convenience at PC value."

Valve’s Trojan Horse may yet prove its worth, but the cost of entry to Troy just went up.

NEXT UP

Regularly scheduled programming: Take-Two’s earnings, Ubisoft’s restructuring, and a bit about Disney.

Really sharp analysis on the structrual vs cyclical distinction here. The reallocation of wafer capacity toward HBM for AI datacenters is basically reshaping the entire memory market, and I've seen this play out with PC builds lately where componet prices just keep creeping up. What's wild is how this puts console makers in a bind they can't really engineer their way out of.