Regulating virtual reality

When novel legislation meets innovation

Talk about climate change.

Usually, the dog days of summer are quiet because it’s too hot to move too quickly. The average pace of a Brooklyn pedestrian is noticeably lower, and the spotty presence of colleagues makes any business dealings move molasstically slow. It’s generally a period that is void of major news and what the Dutch call “komkommertijd” (cucumber time).

Not this summer.

The FTC is suing Meta. Inflation has gripped people’s wallets. Earnings are coming in soft.

Give me a minute to refresh my cold drink and I’ll be right there.

On to this week’s update.

The Federal Trade Commission goes after Meta’s virtual fitness plans

From the top, it seems rather odd that the FTC would go after some tiny acquisition by Meta with the argument that it is trying to “illegally acquire a dedicated fitness app that proves the value of virtual reality to users.” Just a week earlier, Meta announced it planned to acquire Supernatural, the developer behind a breakout VR fitness app for an alleged $400 million. It is also the sixth and by far the largest purchase in this category, which is what set off the FTC’s alarm bells.

An invigorated degree of regulatory attention for tech and gaming has been building for some time now. Tech, on the one hand, has been taking way too many liberties and committing doublespeak when it shouldn’t have. Their ability to suffocate smaller, promsing rivals early in their life-cycle squeezes innovation. Gaming, on the other hand, has become more prevalent as a cultural industry and, in turn, is receiving increased scrutiny related to workplace toxicity, representation, monetization strategies, and international trade. Painful as it may be, it is part of becoming a mainstream form of entertainment.

The FTC’s lawsuit is odd for at least two reasons.

First, this is an entirely imagined market. It seems premature for a regulator to come down this hard on a tiny consumer category, virtual reality fitness. It is, however, the point of Kahn’s revision of existing anti-trust legislation. She argues that regulators have historically waited too long to intervene and jeopardized their efficacy by only addressing issues once firms had reached billions of dollars in market cap. The multi-sided business models these organizations employ make it difficult to tease out where consumers are at a disadvantage and where large tech firms wield monopolistic power.

Further, companies like Meta have ramped up their spending on lobbyists along with their revenue growth. The combined spending between Meta, Amazon, Alphabet, Microsoft, and Apple totaled $68 million in 2021, compared to $16 million a decade earlier. In aggregate, no fewer than 443 lobbyists actively advocate for their interests. This is just tech, of course, but a colleague at NYU, Thomas Philippon, concludes that “competition has declined in most US industries over the past twenty years.” If markets are ecosystems, a climatological shock in the opposite direction seems exactly what’s needed.

Still, the FTC’s current move to sue Meta feels premature. Virtual reality is hardly an established market. It is true that hardware unit sales have increased as the devices get better, cheaper, and wireless. But that’s what Zuckerberg’s $10.2 billion write-off on Reality Labs has subsidized. Both the aspiring platform holders and VR content creators are hoping that this is a foray into the future of entertainment. Sure enough, the percentage of American men that are overweight, obese, and severely obese has more than doubled from 20% to 43% between 1988 and 2018. Being the top provider of fitness-related technology on what could become the next big platform makes for an easy argument. Perhaps Meta is merely banking on making people healthier by strapping goggles to their forehead. Maybe. But all that market value has yet to materialize.

Second, fitness apps on a proven platform with millions of installs like the Nintendo Switch are equally dominated by the platform owner. The most popular fitness titles there are Ring Fit Adventure, Fitness Boxing, Fitness Boxing 2: Rhythm & Exercise, Jump Rope Challenge, and, arguably, ARMS. All of them are published by Nintendo. Even so, there’s also Just Dance 2022 (Ubisoft) and Zumba Burn it Up! (505 Games).

Has it discouraged competition? Maybe. Is it gravely limiting consumer choice or people that like to move their bodies using an unnecessary amount of technology? Nope. But it does challenge the FTC’s market definition.

It is clear that the FTC is beta-testing its new policies. If taking legal action against large conglomerates at an early stage proves effective, it’ll send a chilling signal through the industry at large. Failure, however, will make the FTC seem like it is spending a lot of time on the wrong things.

Either way, none of it is particularly reassuring for the proposed acquisition of Activision Blizzard by Microsoft. As the largest in the firm’s history, Microsoft stands to solidify its position in interactive entertainment as it transitions to a cloud-based reality. That technology, too, is at a relatively early stage of development. If the FTC can make the case that it’ll give Microsoft disproportionate market power over cloud gaming in the same way that it currently reasons Meta will dominate VR Fitness, the legal team in Redmond is going to have a busy end of the year.

Mixed earnings spell ebbing boon for gaming

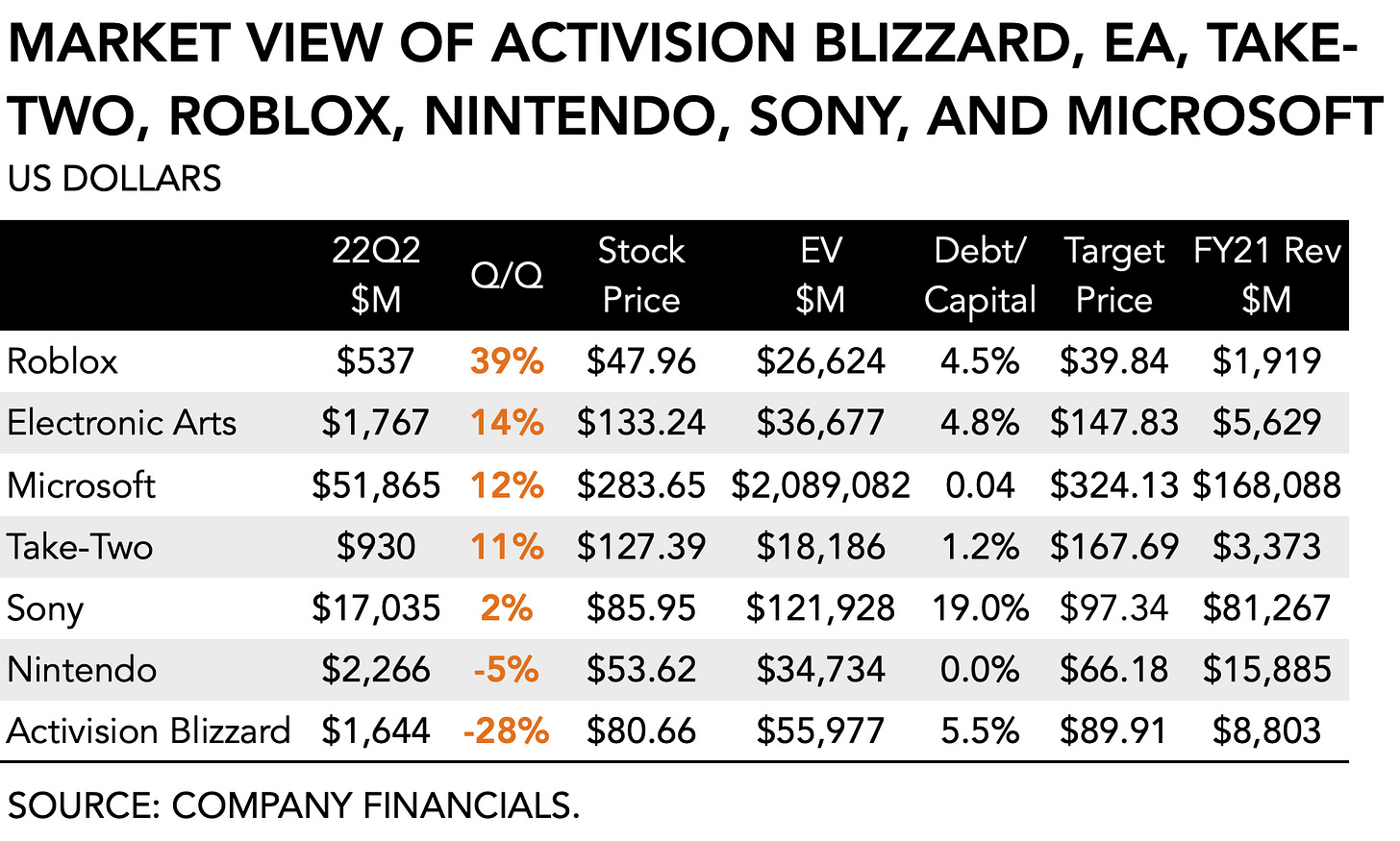

The success of the games industry due to the pandemic and the release of a new console generation has started to normalize. Earnings reports among the top firms show a return to a less-frenzied market dynamic.

Earnings came in low for Activision Blizzard because of a difference in success between the most recent Call of Duty release and its predecessor. Similarly, Blizzard’s revenue declined -7 percent compared to last year when it released Warcraft: Burning Crusade Classic in 21Q2. It does not suggest, however, that player activity has decreased. Spending on ATVI’s mobile division, King Digital, was up +6% in terms of direct consumer revenue via micro-transactions and up +20% in ad revenue. Subsequently, Wall Street analysts have raised their price targets as bookings for Diablo Immortal and Overwatch 2 are expected to be substantially higher at around $400 million and $170 million for the year, respectively.

Nintendo predictably reported a slowdown from $2.42 billion in sales a year to $2.31 billion (-5%) due to supply chain issues for several specific components for its Switch console. A bigger surprise came from management’s accuracy in predicting a decline in software sales. Wall Street had initially felt Nintendo’s forecast of 210 million software units sold this year, down from 235 million last year, was overly conservative. However, based on a drop to 41 million units for the quarter, down from 45 million y/y, Nintendo’s estimates are right on the money. The explanation is that major successes like FIFA and Call of Duty increasingly rely on crossplay but traditionally don’t release on the Switch platform. A softening of third-party content in combination with slower hardware sales means all eyes are on The Legend of Zelda: Breath of the Wild 2, which is expected to launch a little under a year from now.

Sony lowered forecasts for its games division by -1% to $27.2 billion, and a -16% drop in operating income. Following its recent push into a revamped subscription program, total subs inched up to 47 million, a one million increase year-over-year, but the firm relented on monthly active users which declined from 105 million to 102 million. Even as management argued that supply continues to fail to meet demand, keeping its hardware forecasts at 18 million, it completed the acquisitions of Bungie and Haven Entertainment.

For Electronic Arts, a reduced release slate combined with high inflation depresses expectations both among consumers and investors. In fairness, it is impossible to expect the same growth momentum as in prior years, but now starts the period where we'll see if EA has managed to make use of its good years and access to abundant capital to insulate itself from what's to come.

Microsoft’s decision to push into subscriptions is proving timely as its newfound revenue stream is offsetting its broader declines across software and hardware sales. It reported $16.2 billion in gaming revenue for 2022, an $860 million (+6%) increase y/y led by its subscription services. Hardware revenue grew by +16 percent. Subscriptions tend to provide more value to consumers during periods when the economy is proving softer and inflation high. It remains to be seen, however, how Game Pass will stack up as rival Sony ramps up its offering, and a broader array of entertainment services in adjacent categories like video and music compete for wallet share.

Relatedly, despite coming in softer than expected in some cases, several of the top firms are hiring. Roblox, which traded at $47 a share and down from $100 at the start of the year, is aggressively looking to attract talent. According to Business Insider, Roblox has 200 job openings and is willing to pay well over $400,000 annually for a base salary. Activision Blizzard, which struggles with workplace toxicity, has been rumored to have difficulty with recruiting, but nevertheless managed to grow its developer headcount by 25 percent year-over-year.

One explanation is that the rapid growth of gaming has opened up opportunities for people with experience in interactive entertainment in other categories that were previously unavailable. For instance, the growing presence of Big Tech in interactive entertainment and the push by brands to get in front of gaming audiences means the talent pool is becoming more competitive. Like social media before, we’re now seeing the emergence of ‘Head of Gaming’ and similar titles at non-endemic organizations. Locking down talent will be critical to the long-term success of especially major publishers and IP holders.

The evidence of a slowing industry is there. Macro-economic influences like the supply chain crunch, a talent frenzy, more expensive capital, and historic inflation rates are bound to limit growth potential. After two years of being at the literal center of the universe, the honeymoon is now over.

A changing climate indeed.

PLAY/PASS

Play. Since we don’t have enough cat videos on the internet, now there’s Annapurna’s Stray for all you feline fans out there.

Pass. Free startup idea: flipping foreclosed Metaverse properties.

Play. Cool off with Power Wash Simulator and pretend you’re not a grimey slob.

Yes, that's a really big step. Interactive games and entertainment are becoming increasingly popular in today's world. People of all ages are attracted to the exciting and interactive experiences that these games offer. With advances in technology, these interactive games can now be enjoyed almost anywhere.

https://servreality.com/