The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

The anxiety that first took hold in November last year is now starting to manifest.

I’m talking, of course, about tariffs. But before I dive into my commentary on how last week’s reveal of the Switch 2 exposes the irrationality of the broader trade war and how it might impact gaming and other entertainment, I should point out two events this week that might be of interest.

Games and Advertising Intersection Panel: Join me, Zoe Soon from IAB, Pete Basgen from Wavemaker, and Itamar Benedy from Anzu, as we discuss the evolving role of advertising in gaming. Mark your calendars for Tuesday, April 8th.

C-Suite Fireside Chat at NYU Stern: I'm thrilled to host Hasbro CEO Chris Cocks this coming Thursday, April 10th. We'll discuss how traditional toy industries are integrating digital gaming into their business models. This event is open to the public (sorry, no press), though registration is required.

BIG READ: Second thoughts on Switch 2

The first thing that came to mind when I watched the reveal of Nintendo's upcoming gaming console, the Switch 2, was excitement.

Granted, the device offers a reasonable but not overly impressive technical upgrade from its predecessor and there's no Mario or Zelda game to complement the launch. Its tent pole game, Mario Kart World, does look like a lot of fun and seemingly presents a new take on the franchise. The new device also comes with a large existing catalog of backwards compatible games, several of which are now playable at higher resolution and offer a glossy new remake of their original. And the emphasis on playing with others, by way of offering integrated chat functionality and allowing players to stream their game play to each other, tells you that Nintendo is looking to bolster its position at the center of contemporary play practices.

And, who am I kidding. Of course I'm getting one, like I always have.

The second thought that came to mind, however, was the sobering realization that video gaming just got a lot more expensive.

Last week's tariffs announced by the US government are highly disruptive, especially considering the delicate period during the release of new hardware. Succinctly, if a new device doesn't sell the same or more units than its predecessor, industry observers and investors are quick to judge it a failure.

In this context, it is important to know that Nintendo's hardware margins sit at around a third of its wholesale price. For the Switch 2 that suggests a manufacturing cost of around $300 per unit. Since most components and assembly occur outside the United States, the device will likely face minimum import tariffs of 22%.

For Nintendo, this could have dire consequences. Throughout its history it has traded at an oddly low multiple, considering its margin and the strength of its brands and IP. When the WiiU failed to deliver a success on the same scale as the Wii before it, the firm seemed doomed. A repeat of such a scenario, at least to the degree that the Switch 2 may be too pricey to draw a large crowd out of the gate, may reverberate throughout the broader games market as an indicator of a broader decline.

A shift in Nintendo's economic strategy

Priced at $449.99—a whole $50 above my initial prediction—Nintendo is breaking with its historical pricing approach. The Japanese game maker likely anticipated tariffs from the moment Trump came into power. During his first administration, Nintendo had found itself teaming up with Sony and Microsoft to plea against looming tariff increases. Fool me once, shame on you. Fool me twice, shame on me, Nintendo must have thought.

However, the extra $50—The “Trump Tax”—suggest they were expecting a 10% to 20% increase. It would give Nintendo a buffer against market uncertainty and still remain deliberately 'lower tech' and cheaper than Sony's PlayStation and Microsoft's Xbox.

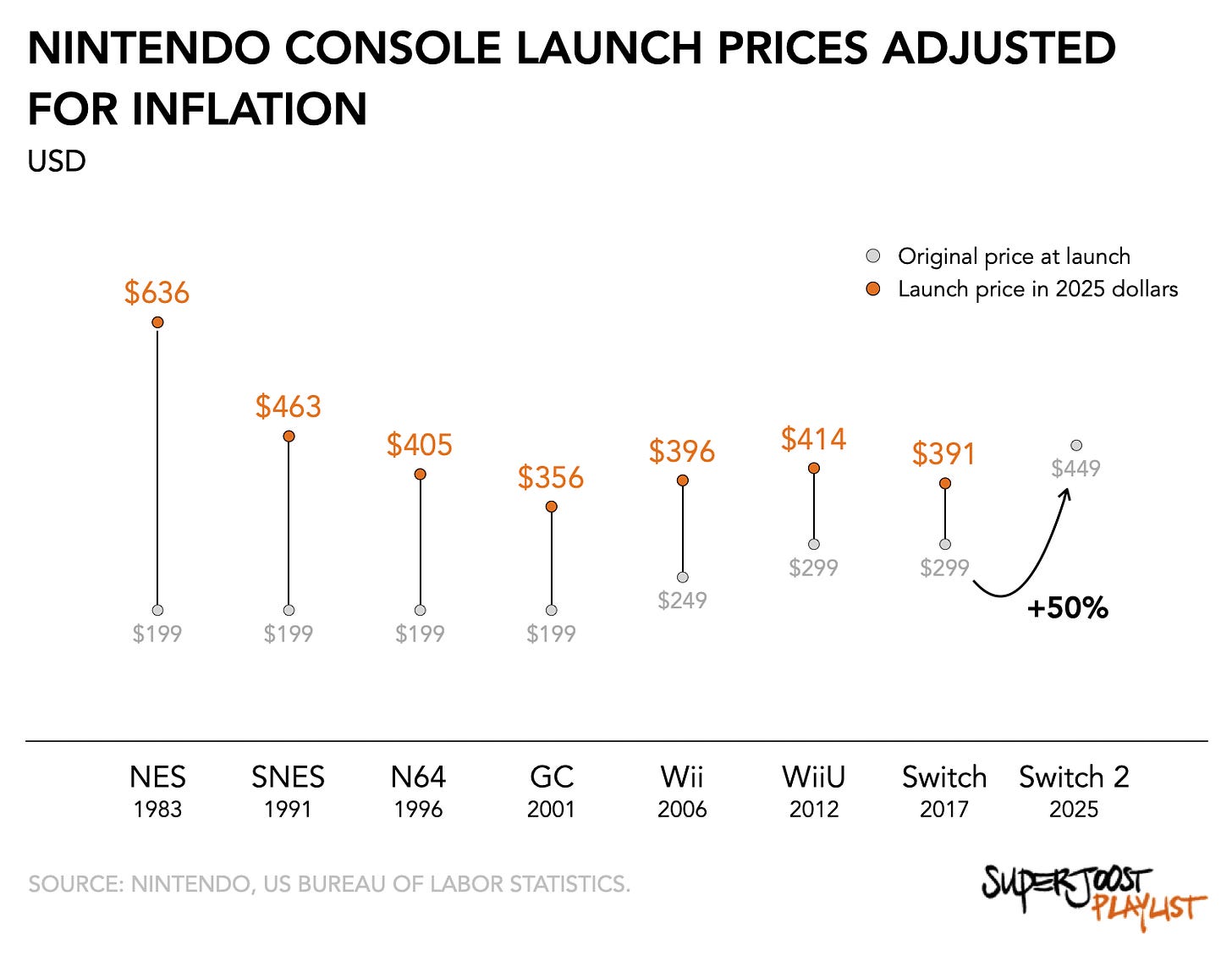

Nintendo has historically emphasized accessibility, including in what it costs to play its games. While the nominal launch prices of its consoles have more than doubled from the NES ($199 in 1983) to the Switch 2 ($449 in 2025), the inflation-adjusted figures tell a different story. In 2025 dollars, the NES was actually its most expensive console at $636, with subsequent generations generally becoming more affordable in real terms.

It is important to note that over the past several decades the type of available content and range of pricing models has changed considerably. For instance, premium console titles now compete with free-to-play substitutes and across a much broader variety of platforms. Even so, its pricing trajectory suggests Nintendo has strategically balanced technological advancement against economic accessibility, maintaining relatively stable inflation-adjusted price points around $400.

The higher launch price for the Switch 2 is a clear deviation from its established pattern and suggests a strategic balancing act by the Japanese console maker.

Next, with the $80 asking price for a digital copy of Mario Kart World, Nintendo is pushing to raise the ceiling on its prized IP. Here, I'd have to defer to my smarter colleague, Matt Ball, who observed that the cost of game development has not kept track with what a publisher can charge for a game. He correctly points out that other entertainment categories like film, music concerts, and streaming video have all kept pace with inflation and argues that

"no other major leisure forms have seen their products become worth less nearly every single year for decades."

To a degree we are witnessing Nintendo flexing its market power in real time as its most popular franchises are revered and manage to capture a disproportionate share of value. Nevertheless, the higher prices have invited an understandable recoil and threaten the success of Nintendo's hardware. It dampens initial excitement among players and investors.

Beyond charging higher prices, Nintendo now also finds that the 10% to 20% expected tariff increase is now a best case scenario. It forces the firm to also maximally leverage its supply chain to mitigate any further negative impact.

Demand side economics: brand equity and price resilience

By all accounts, Nintendo's fan-base is enormous and fiercely loyal. Mario is just about as recognizable as Mickey Mouse, inviting the comparison of Nintendo as a Japanese version of Disney. It means that on the demand side, die-hard fans are relatively price inelastic.

Able to command a comparatively high price point, even as the games industry at large finds itself riddled with abundant free-to-play offerings, is the result of Nintendo's decades-long careful curation of high-quality, family-friendly games. Its brand promise is clear and signals quality while other platforms overwhelm with abundant yet undifferentiated content. Relying on well-established franchises, the colorful look and feel, accessibility, and toy-like experience offer a cohesive user experience centered on quality rather than quantity.

The most recent release in the Mario Kart franchise, for instance, has sold 67.4 million copies against a 150.86 million Switch consoles, suggesting an attach rate of 45 percent across Nintendo's ecosystem.

For parents, many of whom themselves have grown up playing video games, Nintendo caters both to their sensibilities (i.e., by evolving childhood franchises into more grown up and emotionally meaningful experiences) and provides a sense of safety for their children. Where other franchises suffer from bad actors in their online ecosystems, predatory pricing practices, and toxic player behavior, the Nintendo experience is uniquely safe and consistent. It presents a predictable and secure play environment.

This allows Nintendo to maintain a high average selling price and offer comparatively few discounts. The 2017 release of Zelda: Breath of the Wild which coincided with the launch of the first Switch has since only been discounted 17%, from $60 to $50. By comparison, publisher-based breakout titles like Elden Ring, which released in 2022 at the same price, now retails at a 45% discount. Nintendo rarely sells games at a discount and insists on premium pricing.

Supply side mastery: the hidden strength

What distinguishes Nintendo from its peers is a dedication to parts of the business consumers rarely see. Its ability to tightly manage its supply chain and an insistence on quality control are why the firm has managed to prosper since it first entered the US market and even survived several poor hardware releases.

Following the collapse of the 1983 video game crash, Nintendo pushed forward when others exited the market. As part of its strategy to rebuild the value proposition for consumers it realized it needed a close relationship with retailers. Large chain stores had just watched the games industry collapse and were mostly skeptical on the category's long-term prospects. Even so, Nintendo offered to stock stores for free and required them to pay only for the units they had actually sold. With no upfront risk, big chains were willing to try things out in a few locations initially, and nationwide once the strategy had proven itself.

As a platform holder, Nintendo also closely controls inventory and product allocation. Instead of flooding the market with cartridges it has historically refused to fulfill demand even at the request of retailers. In 1988, for example, right as the NES gained popularity, retailers ordered around 110 million games in the expectation of selling around 45 million units. Nintendo, instead, held its ground and shipped only 35 million, thereby preventing saturation and a premature decline in average selling prices.

Less than a day after the announcement, Nintendo issued a delay on its pre-orders in the U.S. in response to the Trump administration's tariffs, raising concerns that it may yet increase the price of its new device even further. While Nintendo has indicated a commitment to maintaining the initial price point, the economic pressures from abrupt policy changes present a real risk of necessitating price adjustments.

The future: industry-wide price elasticity testing

I have no doubt that the die-hard fans will complain and then buy it anyway. My projections show a relatively strong first-year performance—around 12 million units globally in the first year post launch—driven largely by the installed base of 151 million Switch owners looking for an upgrade path that preserves their existing game libraries.

I also don’t expect the $80 price tier for premium games to become universal across Nintendo's lineup as this is something reserved for its crown jewel franchises. The next Zelda title will almost certainly command this premium, as will a new Mario release and the inevitable next Super Smash Bros installment. Nintendo's creating a tiered system where their most valuable IP generates premium revenue while mid-tier and smaller releases maintain traditional pricing.

It is a sign of the times, however.

Against the background of lower consumer demand and increasing costs (exacerbated by those dreaded tariffs), Nintendo isn’t the only firm pushing the boundary on price elasticity. Elsewhere, Take-Two is inching the price of its imminent release, Grand Theft Auto 6, upward. (Relatedly, at this year's GDC I was repeatedly told that the entire industry is salivating at the prospect of Take-Two releasing a $100 game, thereby granting everyone else the legitimacy to do the same.) It tells us that the conditioning of consumers to accept higher prices has been gradual until now, but the coinciding of the Switch 2 reveal and the Trump tariff announcements just accelerated the timeline significantly.

In effect, the games industry has been running at a deficit for a while now. And despite the momentum since the pandemic, fueled by demand, high valuations, the entry of venture capital, and Big Tech’s subsidizing of novel technologies in search of audiences, that momentum has slowed. With a 7% decline in the past two years, headwinds have managed to bend even the tallest trees in the industry. Tariffs could well break them.

The tension between the Trump Tax and the Switch 2 exacerbates the bifurcation that is already underway. It makes gaming a luxury expense, affordable to an increasingly smaller audience, which goes counter to its mainstream ambitions of becoming a global entertainment industry.

One alternative I’ve previously suggested is the emphasis on low tech, low cost alternatives. Just because games become expensive, people don’t stop playing.

As the gaming industry approaches another pendulum swing from content to distribution innovation, Nintendo's Switch 2 pricing strategy exists at a critical inflection point. The $449.99 price tag signals not just economic recalibration but a fundamental shift in how the industry perceives its value proposition.

The future of gaming may well be 'low tech' rather than high tech. While the industry chases increasingly powerful hardware, we're simultaneously witnessing a renaissance in handhelds, browser-based games, and even board games. Nintendo's approach reflects this tension—balancing technological advancement with accessible play experiences that emphasize connection over computational power.

The dichotomy between Nintendo's high-priced Switch 2 and emerging low-tech alternatives mirrors the broader bifurcation happening across the market. For dedicated gamers, premium pricing and experiences will continue to command their share of wallet. For everyone else, innovation in distribution models, accessibility, and pricing tiers will determine which companies thrive in the next cycle.

History tells us that these transition periods—particularly when coinciding with economic headwinds like tariffs—often produce the most transformative innovations in how games reach players. Nintendo has navigated these waters masterfully before, and their success in the coming years will depend on whether they can maintain their delicate balance between innovation and accessibility in an increasingly polarized market.

Great article Joost thank you

@Jim Acosta I never played Nintendo ever I know who does on Alyssa 43147 @Anne Applebaum @Andrew Weissmann @Alan Dershowitz VOZZA’s friends 146 ,121,131,126,101,111,161,96,86,76,66,46,61.51,146156,everyone except me