As the next earnings season kicks off, a major theme will be the games industry’s exposure to the shortage economy.

Growing delays in the supply chain combined with a shortage in hardware components in the midst of a period of unrivaled consumer demand for interactive entertainment are bound to impact especially conventional game makers.

Worldwide, a reported 584 container ships are stuck at ports. That is a doubling from January, according to the Financial Times, which has resulted in a tripling in the average cost of a shipping container to $10,000 (source: paper edition). Compared to the start of the pandemic, prices have increased ten-fold.

Under normal circumstances, one publisher tells me, delivery takes 37 days from China. Today it takes 110.

Dang.

To get rid of the backlog at the ports, Biden’s remedy of allowing the ports to operate 24/7 will help, yes. But once on land the cargo still has to make it onto trucks and trains. There, too, are labor shortages and delivery problems.

Certainly the games industry has transitioned to being mostly-digital. Content development, publishing, marketing, and distribution is increasingly digital and no longer requires physical supply lines. But an important part still does. Console makers, manufacturers of accessories and peripherals, and retailers all still have feet firmly in the physical world.

Demand, yes. Supply, no.

It comes at an unfortunate moment. Games have never been more popular. For one, a whopping $10.4 trillion in global stimulus has fueled, among many things, entertainment spending.

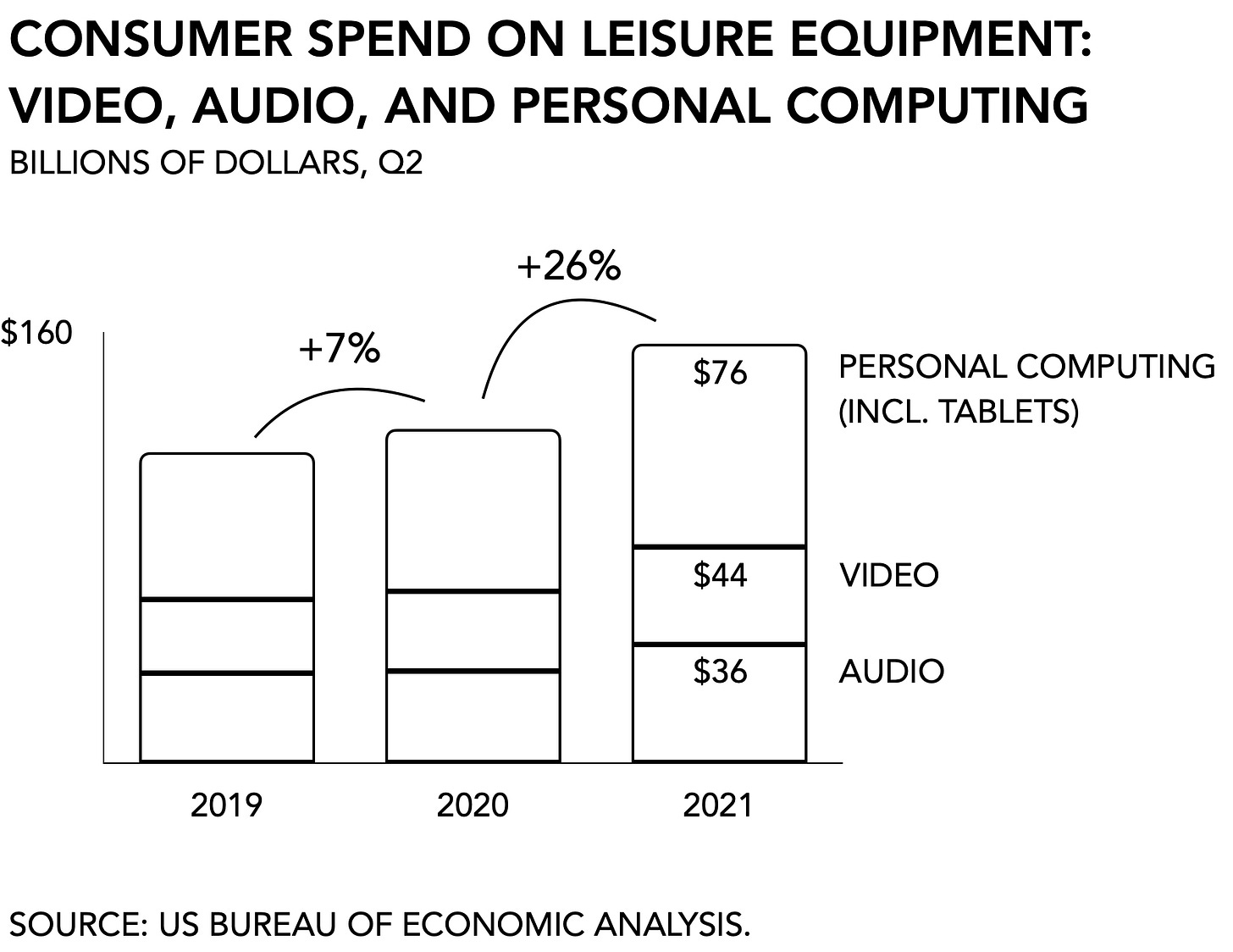

According to the US Bureau of Economic Analysis, consumers spent $156 billion on leisure equipment in the second quarter of this year. That is a +26% increase compared to last year when quarterly spending was $124 billion, and a +35% increase from pre-pandemic levels in 2019. According to NPD, consumer spending on video game hardware through August was up +49% and +12% for accessories. Such a surge in demand is great news as long as you can fill the orders.

Console makers are poised to have an especially difficult time. First there is the inevitable build-up in demand around the release of a new hardware generation. Even under normal circumstances does the start of a cycle come with slow rollout. But the end of last year had even the smartest of Wall Street analysts dumb-founded. In the US hardware sales were roughly double their consensus expectations, when the PlayStation 5 sold over 815,000 units, the Xbox X/S 696,000, and the Switch 2.1 million units.

Overall sales of the new hardware generation are record-breaking. The Xbox Series X and S outsold the Xbox One launch sales by 23%, reaching 6.45 million units sold in its first 8 months. And Sony announced in late-July that it had sold over 10 million PlayStation 5 consoles, making it the fastest-selling console in the firm’s history. And despite an aggressive transition to digital services both Microsoft and Sony will have a bit of a tough time. The Japanese giant generated approximately $2.4 billion in console and peripherals sales.

The persistent chip shortage is a second reason why this holiday season may be different than we’ve seen before. The immense popularity of the PlayStation 5 continues to frustrate a lot of players who feel, incorrectly, that Sony is deliberately releasing too few units to keep its marketing momentum and price point high.

It is simple economies of scale, however. The first batch of consoles is also the most expensive one to produce due to expedited shipping and a low margin on manufacturing. Only after a while do console makers have an accurate sense of demand, allowing them to negotiate better rates and ordering bigger batches. And the complexity of a chipset reduces over time: smaller, slimmer models only show up later in the lifecycle.

This takes places against a background of a global shortage in processing chips. Already in September Xbox boss Phil Spencer indicated that supply issues would continue into next year. This doesn’t just impact consoles. High-end PC components (e.g., Nvidia’s RTX graphics cards) sell out quickly, too.

It’s fascinating to see how the system buckles under pressure. Even relying on European manufacturers has quickly caught up to the same delays. In response, American entertainment firms are trying to find domestic manufacturers, but that, too, is proving difficult. Printing presses and manufacturing have moved to China, making it slow to reboot abandoned plants in the US. Finding people to do the work has also proven challenging which, in turn, will cut into margins.

One anticipated outcome is a push in Latin America. To ensure sufficient inventory levels, entertainment publishers are looking to Mexico, for instance, because at the very least shipping doesn’t involve boats. It is unlikely to remedy all of the issues on the short term, but it will alleviate some of the backlog in the first half of next year.

Winners and losers

Unlike toilet paper and bread, consumers are unlikely to hoard video games. But money will flow only where it can and entertainment providers that rely mostly on digital distribution and non-tangible goods can expect some of that extra consumer cash to fall their way. The stress of empty shelves at retail will discharge in online entertainment and drive the segment’s numbers. In turn, the big dogs will claim most of the extra, and we’ll likely see one or two unexpected hits, as we did during the earlier stages of the pandemic.

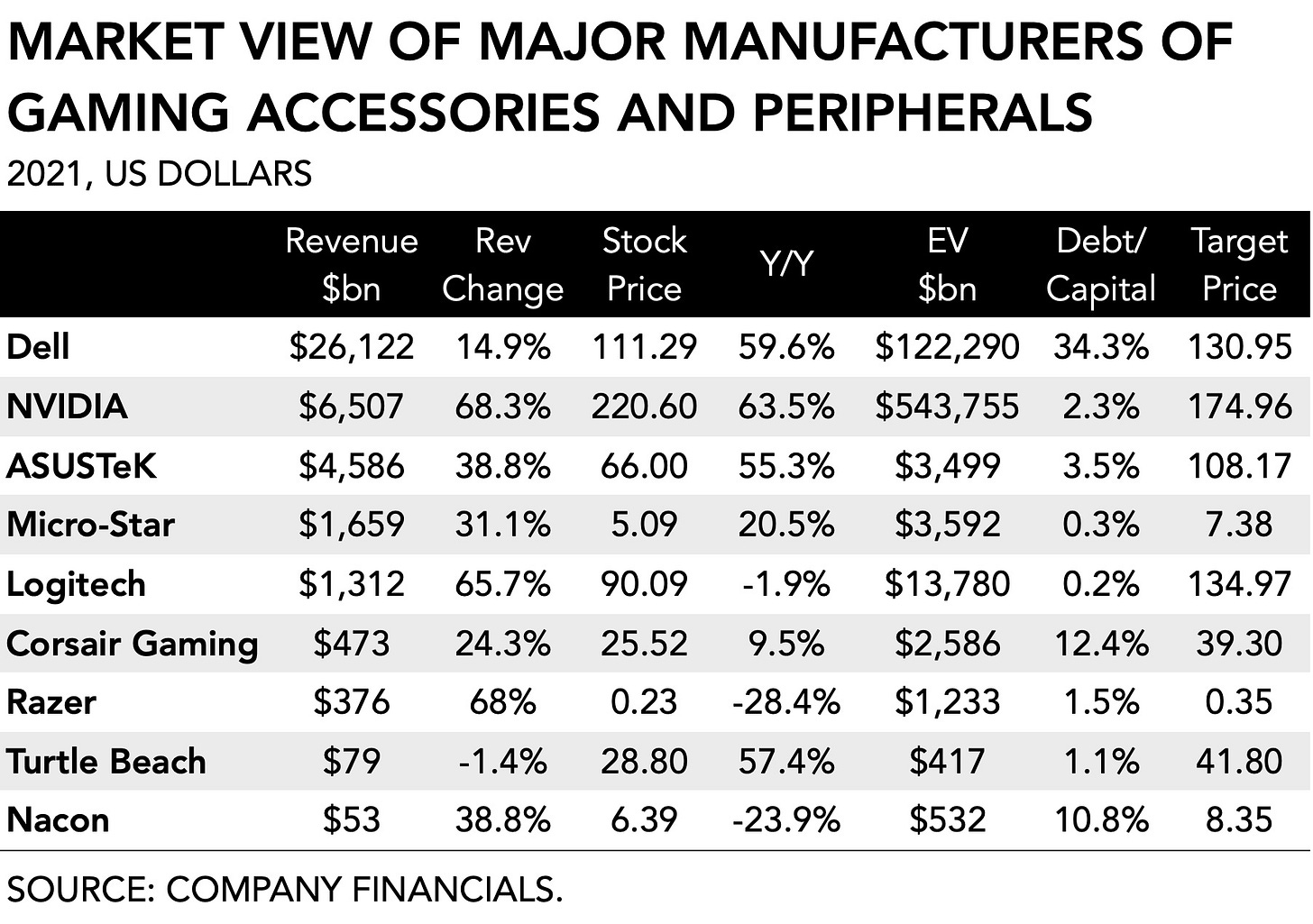

Manufacturers of peripherals and accessories are likely to have a hard time. Wall street analysts dropped their price target for Corsair, an American maker of computer peripherals and hardware, from $45 per share to $39 after it issued preliminary 3Q results and lowered its '21 revenue forecast. It previously had a banner year in 2020 in which revenue grew +55% from $1,097 million to $1,702 million. Today both management and sell-side analysts agree that it wasn’t the supply chain issues that are surprising. Rather, the impact was much greater than expected.

It doesn’t spell anything good, although the effect may be felt to different degrees depending on the firm. Despite the fact that Logitech’s gaming division is growing rapidly, +80% y/y, the firm has a reduced exposure to supply chain issues. That is because, according to most recent 10-K filing, its 20Q3 acquisition of StreamLabs managed to double revenue, allowing it to offset declines or shortages elsewhere. By comparison, Logitech is arguably better insulated than its peers.

It’ll be a worthwhile to watch the coming earnings call with an emphasis on logistics and delivery of product. But if you can’t make the calls, here’s a tip for the holidays: buy toys for your kids at the store now. Even if you order it online, it’ll most likely be late.

On to this week’s update.

NEWS

Valve bans blockchain to the surprise of would-be disruptors

Late last week, Valve shocked game makers when it became clear that it will not facilitate the trade of NFTs in games on its platform. Specifically, “applications built on blockchain technology that issue or allow exchange of cryptocurrencies or NFTs” are not allowed.

One read is that Valve is taking a conversative stance and relegating itself to the sidelines as the crypto-wave washes over us. Could this be the beginning of the end of the once industry-leading innovator Valve?

Hardly.

Here’s another read: blockchain game makers are fair weather captains. Following a plump period in which valuations have only gone ‘up and to the right,’ many of the newcomers are slamming into incumbents. For all their excitement, many of the newbie game makers lack institutional knowledge.

Blockchain gaming simply isn’t quite as disruptive as it likes to think it is. Not yet anyway. Many crypto-games rely on established game mechanics, have obscenely high entry barriers, and offer cumbersome onboarding for players. “Did we really need crypto to make this game?” is a question more devs should ask themselves. It’s old metal wrapped in a thin layer of shiny chrome.

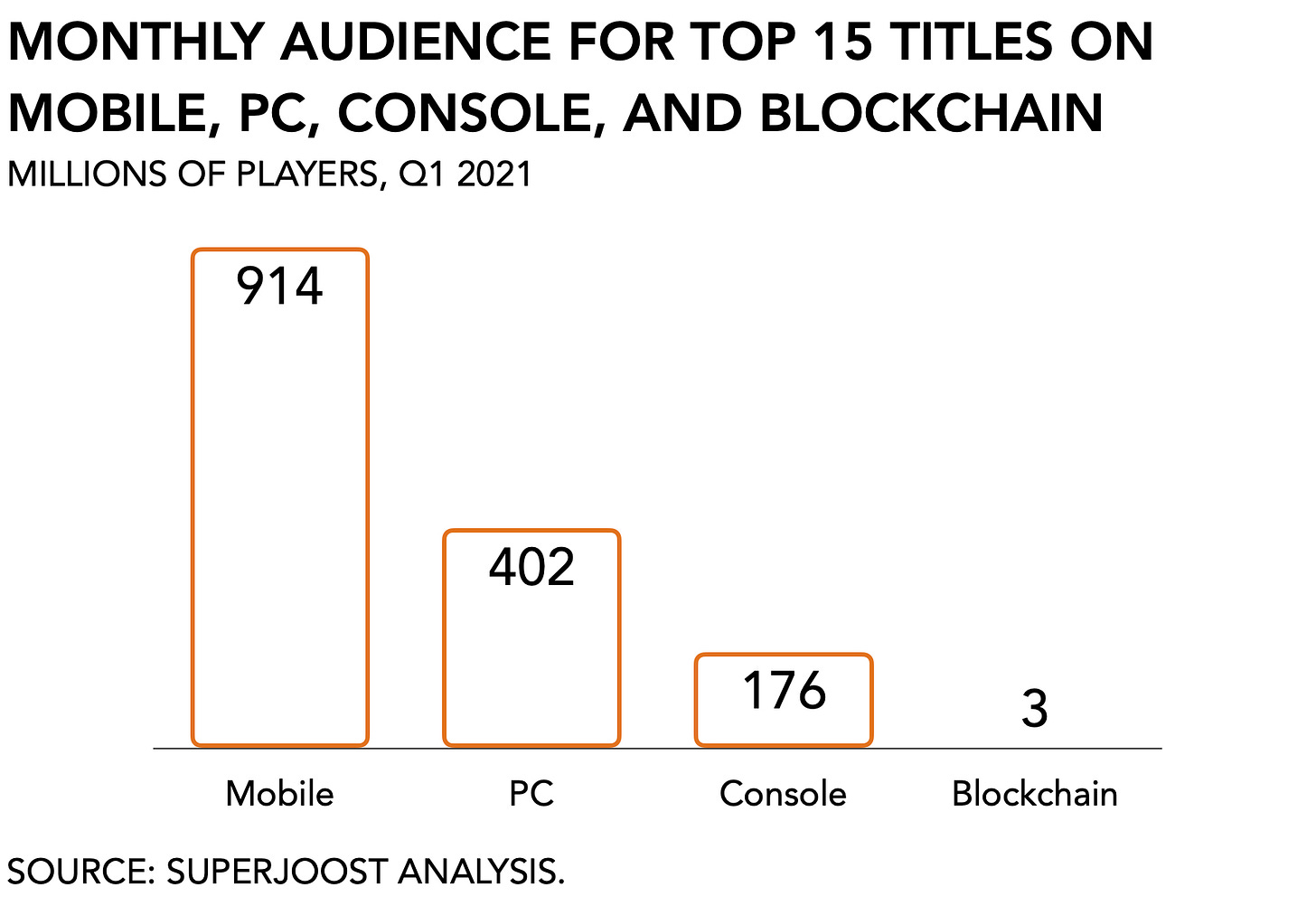

Valve’s decision is a setback. For one, the addressable market for blockchain games just got much smaller. Valve is the leading distributor on PC which is the second largest platform after mobile.

Also, two-thirds of blockchain games are built for PC, according to DappRadar. Without Valve’s support, it will be more difficult to penetrate not just the a sizable consumer audience, but one that is historically considered the early adaptor crowd. Players on PC tend to be the canary in the coal mine among gamers. It robs blockchain gaming of an important and necessary validation as a viable category. At least for the foreseeable future.

Anyway, ICYMI, Valve already declared its stance on blockchain tech back in 2017 when it stopped supporting Bitcoin “due to high fees and volatility.” Just because you showed up just now with all of your venture millions, doesn’t mean that everyone’s excited to see you. It’s where the work starts.

MONEY, MONEY, NUMBERS

Xbox falls short of its Game Pass subscriber goal. According to its most recent filing, Xbox Game Pass subscriber growth came in at +37%. That’s pretty good but still under the self-imposed goal of an 48% increase. The most recent confirmed figure is 18 million, as of January.

You can instantly understand why Microsoft doesn’t disclose things more clearly and explicitly, since they’d be on the hook for real numbers rather than forecasted growth percentages. However, it’s really slim pickings. It is unclear whether this due to a waning interest in the service itself, or a more general slowing in signups for entertainment services. Of the 4.4 million new subscribers reported by Netflix, only 70,000 were from the US.

BTW, my colleague at NYU, Aswath Damodaran, coincidentally had a few things to say about disclosures, namely that they “have become more bulky, while also become less informative.” Worth a read.

LeBron gets into gaming, raises at $725 million valuation. The SpringHill Company, LeBron James’ consumer and entertainment business raised a round at a $725 million valuation. Investors included Nike, Epic Games, and Redbird Capital Partners. After launching TV shows, podcasts and a movie, the NBA star’s entertainment company is on track to generate over $100 million in revenues in the next year. By selling more shares, SpringHill is funding new ventures in “fashion and gaming.” Link

Two-third of Netflix subscribers watched Squid Game. It did not, however, add a lot of new subs to the service. According to the letter to its shareholders, “a mind-boggling 142m member households globally have chosen to watch the title in its first four weeks.” Keep in mind here that Netflix counts anyone watching more than two minutes. That’s a pretty low bar. According to CNBC, Netflix’ growth is slowing. And Bloomberg reported Squid Game is adding $900 million in value to Netflix. Here’s a prediction: the jumpsuits will be the winning costume during this year’s Halloween in New York. Bet your life on it.

Scopely acquires GSN Games from Sony for $1 billion. After 14 years of alleged success and glory, the Japanese firm is excited to see GSN Games get a chance of even greater success. That’s PR speak for: Sony is off-loading business units that don’t sit at the center of its strength. Scopely, on the other hand, is bolstering its presence in the casual category. Half of the purchase price is to be paid in cash with the remainder in preferred equity. The deal leaves Sony a minority interest in Scopely. Previously Scopely acquired FoxNext.

Blockchain gaming saw another flurry of investments.

First, there was the $65 million series by Animoco after it previously raised $139 million in July. The firm is now valued at $2.2 billion. For the current round we also noted Ubisoft’s participation. Unlike many of its counterparts, the French publisher has its fingers in a growing number of crypto pies.

Next, Superplastic raised a $20 million series A round ($38 million raised in total) to build its cartoon influencer universe. The firm has a substantial following across social channels and likes to use cuss words when talking to the press.

IMHO the most notable round this week in blockchain gaming came from Concept Art House (CAH) which raised $25 million from a whole host of investors led by Dapper Labs. My thesis for blockchain gaming is that it’s rich in capital but starving for talent. CAH has been in business for almost 15 years and works with everyone who’s anyone. Add the recent hire of Robert Winkler (ex-Scopely, 5th Planet Games) and it starts to look like Dapper Labs is combining games industry credentials with top sports IP.

And, finally, a double whammy with two venture firms raising the blockchain stakes. Bitkraft announced a shiny new $75 million fund focused on crypto that’s already closed on several deals. Its vision of “synthetic reality” is worth a read. And Galaxy Interactive revealed its second fund totaling $325 million. The crew there is the perhaps most native to crypto among gaming venture firms thanks to a connection to parent Galaxy Digital, a digital assets management firm, which has them deep crypto pockets.

PLAY/PASS

Play. In the absence of available console, scalpers have moved onto selling those Xbox Series X mini-fridges at a hefty 2-3x markup on eBay. You’re either a fan, or you're not. There is no try.

Pass. Facebook’s imminent rebrand. I get it. In startup years Zuckerberg just reached his early 50s and he’s ready for a change. That midlife crisis hits different.

Play. I (finally?) found out about PICO-8, a fantasy console that you should absolutely try.