Testing the flywheel

Rampant inflation threatens to grind gaming's platform economics to a halt.

Over the summer I was fortunate enough to spend a few weeks in upstate New York. Known for its skiing during the winter, it is during the hottest months of the year that a far more dangerous activity takes place there: pickleball.

I had no idea.

According to a recent NY Times article, its popularity has been growing. Last year there an estimated 4.8 million played pickleball in the US, up from 2.5 million in 2014.

Turns out that pickleball, a combination of big paddles, small courts, and a whiffle ball, is also a major cause of injuries among the aged. One study found that 91 percent of people injured playing pickleball are over 50 years old.

I, too, only narrowly escaped a pickleball injury myself.

As my 9-year-old and I were enjoying a lackluster game of tennis on the court next to them, a growing group of what seemed to be pickleball-inclined retirees started to become increasingly disruptive. After getting lectured on “etiquette” because my kid send a flyball across their court, we decided to play closer to the net and do some easy volleys instead. Moments later two Subarus pulled up and spit out eight more seniors in bright-colored shorts and shirts. Within moments we overheard them loudly discussing when we were going to be done playing, whether we had previously stated when our game would be completed, or what the hell was going on.

I decided to pack it in. I don’t need my ass paddled by a parliament of retirees.

Ball is life, eternal.

On to this week’s update.

BIG READ: Testing the flywheel

Among platform-focused businesses, network effects spin up a magical momentum that allows the building of adjacent businesses.

Apple’s App Store, Amazon Prime, and Microsoft Game Pass are examples of activities that feed into their primary business model. For Apple, which earns its money from selling pricey devices, content services are there to make its ecosystem stickier and discourage users from leaving. The same goes for Amazon which thrives on the margins from shipping uncountable boxes the world over. And Microsoft sells its Xbox consoles at a loss to drive software sales and services business. Different organizational divisions, each responsible for their own product or services and, ultimately, revenue stream, all work together to create a singular momentum and sit at the heart of the digital platform economy.

That model is currently being tested.

Inflation and supply chain shortages are slowly peeling away the layers of the flywheel onion to expose its inherent weaknesses. For the first time in its history, Sony recently announced a price increase of 10% in non-US markets on its PlayStation 5. This is an unprecedented decision in an industry that historically relies on selling devices at a loss to generate a profit on software and services. Despite its success in subscription offerings and its transition to digital gaming, Sony still needs to manage the traditional fixed-cost business that sits at the center.

An anchor equally provides stability and weighs one down. As consumers start to take inventory of the different subscriptions they’ve accumulated during the pandemic, it is especially younger generations that are keen to make cuts. Roughly a third of Gen-Z and Millennial entertainment subscribers have been eliminating monthly expenses compared to just 16% of Boomers, according to one study.

The answer to stagnating subscriber growth and flywheel momentum is, as it always has been, blockbuster hit productions.

It explains why large platform firms are spending an increasing amount of money on content. Amazon Prime is releasing its adaptation of the Lord of the Rings, with a rumored budget of $465 million, the highest entertainment production on record. It provides an indication of how generously platform companies are willing to subsidize content: by comparison, its video streaming competitor, HBO Max, which does not rely on flywheel economics, recently launched House of the Dragon, spent $200 million for ten episodes, or less than half.

A secondary strategy is expanding the addressable audience by offering lower-priced or advertising-funded tiers. Both Netflix and Disney are experimenting with different pricing models to keep their momentum going. In the case of Netflix, it is looking to regain some of the 60% market value it lost by posting job openings for its gaming division, even as only 1.7 million of its subscribers convert to playing its games.

The logic isn’t unique to streaming video and film productions. As a growing portion of the video games industry has transitioned to a subscription model, it, too, will soon face the decision of where to double down and where to make cuts.

Of course, digital video games with their battle passes and micro-transactions monetize quite differently than more conventional entertainment. Microsoft spends handsomely to acquire new content, as we recently learned that Xbox spent $600,000 for indie dev Big Cheese Studio’s Cooking Simulator. But a major piece of its persuasion for small and medium-sized devs to join its Game Pass program is increased visibility and the ability to upsell expansion packs and digital items to a game’s biggest fans.

Currently, the global economy isn’t looking so hot. This week Jay Powell, the Chair of the US Federal Reserve, declared “war on inflation” after it had been largely ineffective over the past 18 months to curb a decline in consumer purchasing power. And the ongoing war in Ukraine continues to put pressure on basic necessities throughout Europe, where some of its richest economies are staring down a tripling in the monthly cost of energy for average households.

It will inevitably put pressure on entertainment services. Can Microsoft sustain its momentum with Game Pass? Maybe. For now, Sony can afford to raise the price of its consoles, of course, because it is itself a blockbuster hit, but will its recently renewed subscription service prove the boon it thinks it is?

The expansion into a broader variety of related activities to establish a self-sustaining momentum during the pandemic is about to undergo its biggest challenge yet. But thus far, none of it, however, has managed to dethrone the content king.

NEWS

Airbnb upgrades its anti-fun software

Generally speaking, I work with data in the context of making games. The objective is to make it possible for people to have a good time. But this week I learned that data can also be leveraged to minimize fun.

Airbnb recently upgraded its “anti-party technology” to identify (mostly young) people who are likely to rent your place and have a good time. The problem, as they see it, is that some renters go wild on your property and create a lot of headaches with neighbors and local regulators.

It offers some useful insight into the behavior of platforms, too. Companies like Apple, Amazon, Valve, Tencent, Epic, and others find a balance between attracting third-party creators to release applications for their platforms that will, in turn, attract users, and releasing their own, first-party, content. That relationship tends to shift over time. As platforms become more popular and accumulate more users, their need to placate content providers diminishes. It becomes easier and cheaper to both release their own content, by acquiring development studios and IP and skewing the rules that govern third-party creators in their own favor.

Airbnb is different, however, which is disproportionally reliant on complementors (ie. property owners). Unlike digital platform holders, Airbnb isn’t in a position to start buying up real estate everywhere and reduce its dependency on third parties. That forces it to placate especially the professionals on its platform who hold multiple properties and rent those out for a living.

The data science behind it seems rather unsophisticated. Granted it is an upgrade from its previous model which outright targeted renters under 25 years old and prescribed that anyone “with less than three positive reviews are not able to book entire home listings that are close to where they live.” But somewhere out there is a parent having this conversation:

“Daddy, what do you do for a living?”

“I develop anti-fun software, son. To retain the value for property owners that don’t want people having a good time.”

Sony (finally) gets into mobile

With the acquisition of Savage Game Studios, a Berlin-based developer, Sony is launching its PlayStation Studios Mobile Division. (Disclosure: Makers Fund, where I’m an advisor, led in Savage Game Studio’s $4.4 million seed round. I hold no stake in this deal.)

Sony has been binging on enablement. Knowing that it was weak in online multiplayer, it bought Bungie, a deal it recently confirmed had gone through without any problems. And now it is pushing into mobile. Better late than never, I suppose. Literally, everyone else has already made the bets on mobile.

Savage’s team seems solid enough and I know it hasn’t been very long yet, but it does seem rather quick for a team pursuing a dream of independent creativity to become the smallest team in one of the world’s biggest platforms. I do have to ask: if its founder, who has run the popular podcast, Deconstructor of Fun, knows what makes a great game, where is it?

The cynic in me says they’ll probably spend a few months getting introduced to everyone to discuss skinning their mobile shooter with Sony’s IP. But their jobs will mostly consist of optimizing ongoing projects around user acquisition and monetization.

But credit where credit is due. It’s a strong team and so I’ll listen to my hopeful self instead who looks forward to Hermen Hulst making this mobile push a priority by appropriately funding it and bolstering his portfolio with more acquisitions.

Facebook terminates its gaming app

As it prepares to lead the metaverse, Meta is shedding operations that didn’t make the cut. Starting October 28, Facebook Gaming will no longer be available on mobile for either Apple iOS or Google Android. Users got a 60-day notice and a “heartfelt thanks.”

Read: we couldn’t build a big enough ad business around it and our stock price dropped from $379 a year ago to $168 today so we’re killing it to save cost. Have a nice day.

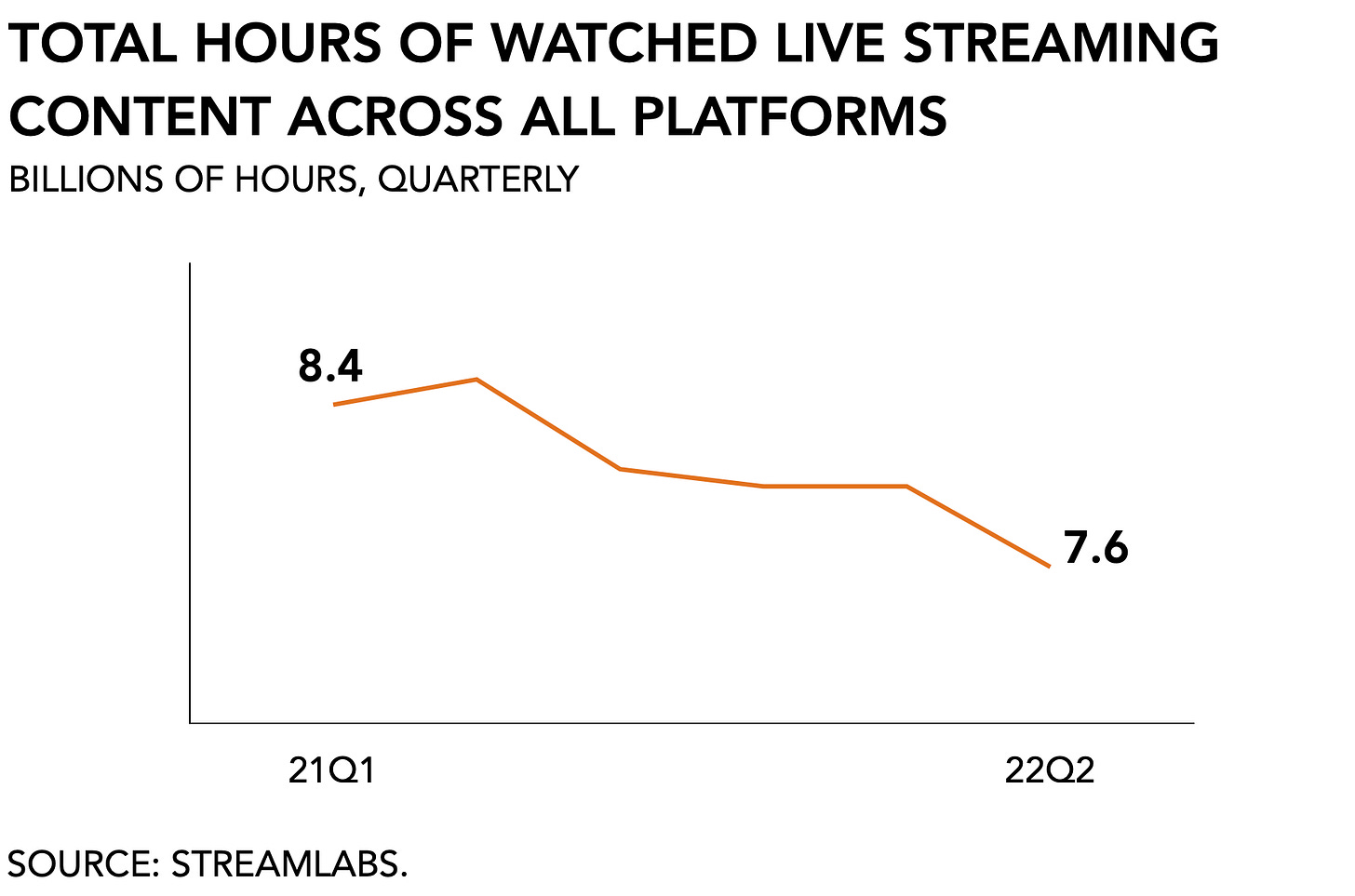

A shallow read would tell you that live streaming doesn’t have room for a third platform, which is why Meta is taking its mobile app offline. Certainly, viewership has declined since the peak of the pandemic. According to StreamLabs, the total number of hours watched was down by 8% for the period April through June compared to the previous quarter. Obviously, audiences want to watch their favorite streamers, who become disproportionally popular, and ultimately have a strong preference for a specific platform where they are familiar with the programming and community.

A deeper read suggests that this is what you get when big tech firms dabble in content categories in which they aren’t fully vested. If they don’t like the metrics, they’ll pull the plug and any users/players/viewers still on there get hosed. We’re still waiting to see what Google plans to do with Stadia, which has been awfully quiet. Will I get to keep my copy of Red Dead Redemption 2? What about my achievements? Certainly, big tech can bring big scale. But that doesn’t always work out for the early adopters.

NetEase acquires Quantic Dream

China’s second-largest game maker, NetEase, acquired French developer Quantic Dream for an undisclosed amount. After previously taking a minority share in the firm, it now swallowed it whole, but both promise the studio will operate independently.

Chinese game makers have been dealing with a shrinking domestic market. Total revenue for 22H1 declined -1.8% to $22 billion, according to the China Audio-Video and Digital Publishing Association. Publishers suffered an eight-month freeze on new title approvals, increased censorship, and more stricter rules around playing times for minors. According to Niko Partners (disclosure: I’m an advisor), “A mere 172 new titles have been approved so far this year, while 755 were issued by this same period last year.” No wonder they’ve set their sights elsewhere.

Quantic Dream is a unique animal and makes deeply immersive experiences. During my first year of teaching, we discussed how interactivity can provoke emotions. One student presented the finger-cutting scene from Heavy Rain to make their point. I will let you Google that one yourself, but predictably the whole class got quite emotional.

MONEY, MONEY, NUMBERS

The ESA, IDFA, and a handful of other acronyms claiming to advocate for gamers and game makers are still insisting on doing their own siloed research, leaving the painstaking work of putting it all together to industry writers. Shoutout to Brendan Sinclair for completing the job by extracting comparisons and explanations as we inch ever so slowly towards a comprehensive, international collaboration on rudimentary industry data.

A 16-year veteran from Bethesda, Jeff Gardiner, started his own studio, Something Wicked Games, and raised $13 million to develop an open-world role-playing game in Unreal Engine 5 by the name “Wyrdsong,” which casts players in a dark historical fantasy where every decision has a consequence.

A startup in Estonia called Ready Player Me raised $56 million in funding to create dynamic, animated avatars to use across virtual worlds.

MultiVersus, the free-to-play Super Smash interpretation released by Warner Bros. claims to have over 20 million users since its late-July release.

Will Wright raised $6 million to develop a blockchain game called ‘Proxi’. According to Wright, “The rough idea is that you can just tell the system a story from your past. And it will try to extract the meaningful keywords and then create a scene automatically, that represents that memory, like a little snow globe or a diorama or crystal ball, which you can go into and correct.”

Limit Break, the new venture from former Machine Zone CEO, Gabriel Leydon, raised $200 million. According to Leydon, "Free-to-Play gaming is ending and Limit Break is coming to replace it."

PLAY/PASS

Pass. Snoop Dogg and Eminem’s performance during the Video Music Awards in YugaLabs’ Otherverse metaverse universe where they transitioned back and forth between their real selves and 3D animated bored apes selves. I’m old and tired. Or high af.

Play. Don’t just give me some of the characters, Fortnite, give me errbody. (h/t Sam Barberie)