The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

The man is on the mountain.

I’ve been driving a red pickup truck to fetch my kid from camp and doing supply runs. It has almost 65,000 miles on it and lurches like a boat. There’s a pair of starter cables behind the driver’s seat, which adds an element of adventure, but it takes us to the local grocery store. Deciding what’s for dinner is easy because the selection is limited. Which is the point, I suppose. One ascends the mountain to leave behind complexity.

Subconsciously, I continue to aggregate contextually relevant data. So far, I’ve counted 17 deers, two woodchucks, one bunny, a smattering of chipmunks, and one couch-sized black bear. That thing was enormous and just as surprised to see me. A clear observational outlier.

Anyway, I’m happy to report the data supports my thesis that I am, in fact, a Disney princess. While here, I plan to take full advantage of this new status and will be frolicking unapologetically in between my remote work trips to that other summit: the mountain of data. Check it out below.

On to this week’s update.

BIG READ: The $250 billion video games market

In the lead-up to Gamescom later this month, the crew at ALDORA and I have put together our annual market forecast. It is downloadable and eager for comments.

It’s been a rough ride across the industry, to be sure. Layoffs continue to haunt everyone as game makers collectively focus on efficiency and profitability in an effort to stay alive long enough to make it to 2025. The long-term implications of this bloodletting will show themselves soon enough. A growing share of people in my network are swapping their corporate jobs for startup life and raising successfully. The other silver lining so far has been the broader acceptance of unionized labor, which I believe is a long-term gain for everyone.

For now, there are signs we may have bottomed out and are slowly moving in an upward direction.

You can download the free report here and should 100% contact ALDORA directly if you’re interested in the full data set.

From the top:

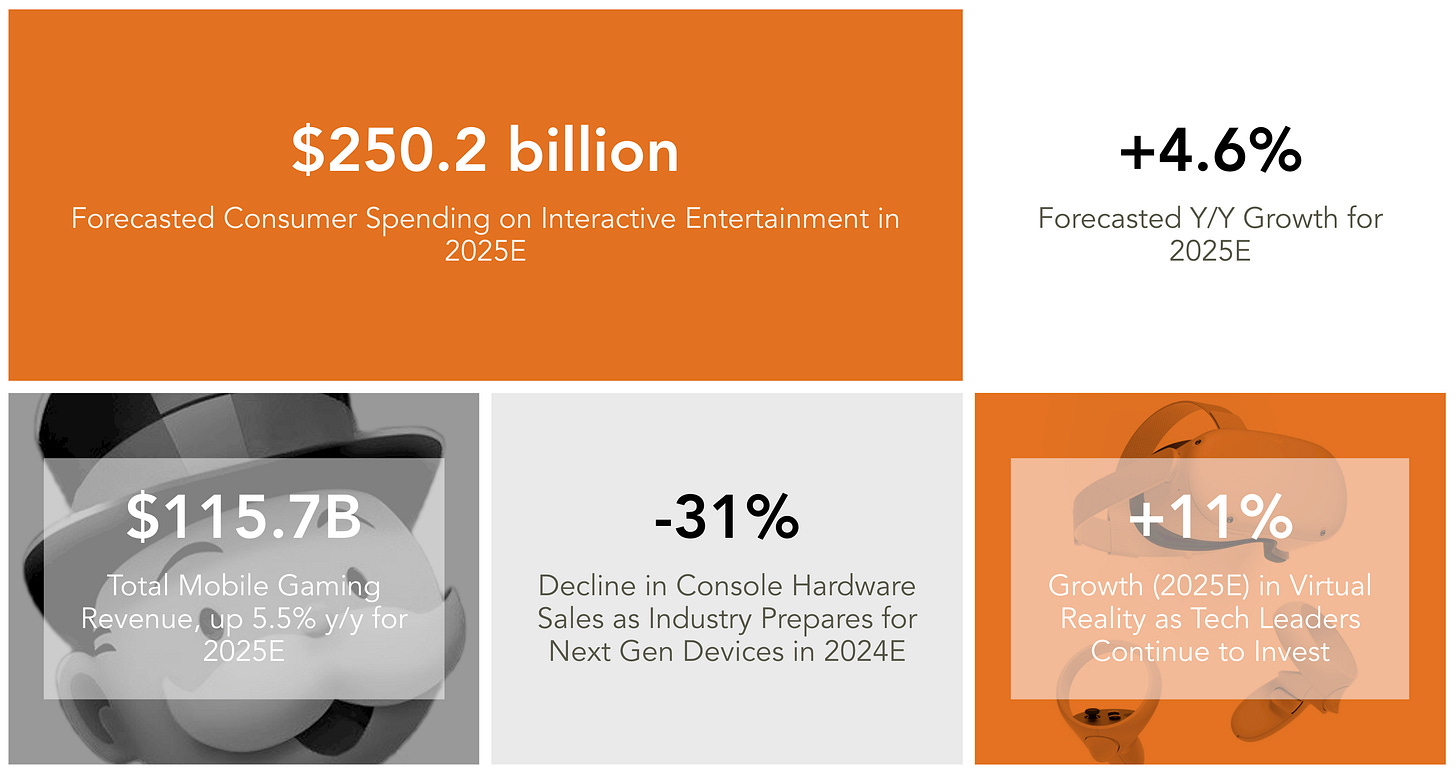

The global market for interactive entertainment is on course to reach $250.2 billion in consumer spending in 2025E, up 4.6% year-over-year.

Content stays king. Software publishing remains the primary revenue generator, forecasted to grow 3.6% year-over-year to $186 billion in 2024. Mobile gaming continues to dominate this category, accounting for $109.6 billion (3.6% growth), and is forecasted to reach $115.7 billion (2025E) despite market saturation and escalating user acquisition costs. Console gaming is on track to reach $44.9 billion (3.1% growth), while PC gaming shows the strongest growth at 4.2%, reaching $31.4 billion in 2024E, both with a healthier outlook for 2025.

The second-largest segment in terms of revenue, Hardware & Accessories, presents a mixed picture. Console hardware sales are projected to decline sharply by 31% in 2024 and another -11% in 2025E, due to the end of the current console generation cycle. However, this downturn is partially offset by the resilience in the gaming PC and laptop market. Notably, accessories sales are expected to grow by 8%, indicating sustained consumer interest in peripherals and personalization.

Emerging Technologies show promise, due to aggressive investments from large tech firms (ie. Apple, Meta) and benefitting from currency fluctuations.

Virtual Reality is expected to grow 11% in 2025E, driven almost single-handedly by Mark Zuckerberg and Tim Cook. Blockchain gaming, while growing at 21% year-over-year in 2024 as a result of the appreciation in major crypto-currencies remains a niche market at $651 million. And Web-based gaming is reinvigorated, growing +5.8% to $2.9 billion in 2025E

Esports & Live-Streaming face ongoing monetization challenges. Despite generating substantial revenues, major platforms like Twitch continue to struggle with profitability. Esports revenue is expected to decline by 3% to $173 million in 2024 and another -8% in 2025E, highlighting the difficulties in effectively monetizing competitive gaming audiences.

Major game makers show defiance. Despite acknowledging the current economic uncertainty, CEOs remain optimistic about their long-term prospects, hoping their focus on efficiency, diversification, and upcoming major releases will return growth.

Among the more notable trends on the horizon are the expanding efforts around transmedia strategies, as major entertainment companies adopt cross-platform approaches. They are looking to leverage their IP across various media to create interconnected experiences and maximize revenue potential. Microsoft, for instance, recently set up a team dedicated to building out its recently acquired IP, including Overwatch and Warcraft.

Similarly, non-endemic brands are pushing into gaming. Companies outside the traditional gaming sector, such as toymakers like Mattel and retailers like Walmart, are finding success with activations on platforms like Roblox, indicating the growing importance of interactive entertainment as a new way to build a connection with consumers.

Overall growth rates for 2024 are modest and interactive entertainment is poised for a transition period in the lead-up for next-generation experiences and devices. Companies with strong IP portfolios and diversified revenue streams across multiple segments are better positioned to weather short-term market fluctuations.

Finally, despite near-term challenges, long-term growth prospects remain strong. Companies that can successfully navigate the evolving landscape, leveraging established IP across multiple platforms and embracing new technologies, will have a better chance to emerge as winners when 2025 rolls around.

NEWS

Hybe makes further investments in interactive

Generally speaking, whatever happens in South Korea tends to occur in Western markets a few years later.

Hybe Interactive Media, the video games division of South Korean entertainment powerhouse Hybe, has secured a significant $80 million strategic investment led by Makers Fund (disclosure: I’m an advisor), with participation from IMM Investment and Hybe itself.

It is a substantial funding injection that aims to bolster Hybe IM's position in the global gaming industry by expanding its publishing and development capabilities. Since its formation in April 2022, Hybe IM has already made notable strides in the mobile gaming space, releasing titles such as Rhythm Hive and BTS Island: In the SEOM, which leverage the company's music and entertainment IP. The combined revenue between these two first titles totaled around $120 million by my calculation, serving as an obvious avenue for growth and evidence for continued investment.

The investment also follows Hybe IM's strategic moves in the Korean game development scene, including investments in studios like Aqua Tree and Action Square. With this new capital and the backing of industry-focused investors, Hybe IM is hoping to accelerate its growth by leveraging the overlap in interests between K-pop fandom and gaming.

Disney elaborates on Epic Games’ investment

During its earnings call, Disney CEO Bob Iger shed a bit more light on the firm’s recent $1.5 billion investment in Epic Games. Iger stated:

“We are reaching consumers in innovative new ways – such as working with Epic Games to bring together Disney's beloved brands and franchises with the hugely popular Fortnite in a transformational new games and entertainment universe. Disney's licensing games business is the largest in the world, and through our collaboration with Epic Games, we are leaning into this area even more, capitalizing on a transformative industry-wide shift toward converged gaming ecosystems."

Regular readers will know that I give Bob props for investing in games. As a leading entertainment firm, Disney is forced to constantly innovate and find novel ways to connect with its audience. Real-world theme parks will continue to thrive, I have no doubt, but increasingly virtual worlds and digital environments play an important role in terms of establishing more regular touchpoints with consumers and staying relevant. Here is a recent write-up that explains why interactive entertainment is critical to Disney’s long-term success. Mostly, Bob and I agree.

Where I disagree is his observation that Disney’s licensing business is the largest in the world. Not so. As per my last email, Bob, the largest brand holder by consumer spending on licensing games (across all platforms) is Hasbro. Disney generated $1.7 billion in 2023, compared to Hasbro’s $3.3 billion, due to the breakout success of its Monopoly Go! and Baldur’s Gate III. Sure, Star Wars and MCU are evergreens. But where’s my Mickey Go! on mobile? Maybe Big Mouse has a few more things to learn about interactive, yet.

PLAY/PASS

Pass. Apple is introducing a two-tiered system of fees for apps that link out to a web page: (1) an Initial Acquisition Fee, and (2) the Store Services Fee. I’m starting to think Apple will literally do anything else rather than make things more transparent.

Play. According to a multi-year study published by Rutgers University, playing video games increases the likelihood of taking on a career in IT. Researchers refer to it as a “hobby-to-career-reckoning," and encourage parents to support their children’s hobbies. Are you reading this, Mom? I told you.

How would you compare the gaming data set from Aldora vs. Newzoo's global games data? Strengths/weaknesses etc?