Ubisoft’s subscription play

A data collaboration with Antenna on the state of gaming services

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Last weekend, in lieu of the Gamescom aftermath, I found myself at Afropunk, a counter-cultural festival that “celebrates Black culture and diversity through music, art, and community.”

It felt a lot like a Renaissance fair from the future. I counted several people in chainmail, one lady dressed as the sky complete with a cloud, and over the course of several hours did not encounter the same hairstyle twice. It made the cosplay I’m more familiar with seem mundane.

Being a distinctly white dad to a bi-racial son, who is a budding artist, I’m wrestling with the responsibility of exposing him to things that lie well beyond the boundaries of my own experiences. It’s been incredibly enriching for us both.

What if the people from the future in chainmail were the norm. I wonder what games they would dream up.

On to this week’s update.

BIG READ: Ubisoft’s subscription play

Last week Ubisoft inserted itself into the largest acquisition in interactive entertainment ever. By obtaining the exclusive worldwide cloud gaming rights to all Activision titles outside the European Economic Area, the French publisher propelled itself to the foreground of a red-hot discussion about the future of gaming. Investors liked it. Ubisoft’s share price promptly jumped 10 percent, from $26.87 to a high of $29.55, within a day of the announcement.

How’s Ubisoft’s subscription revenue doing, really?

In all categories of entertainment, breakout hits claim a disproportionate share of overall consumer spending. Publishers that are unable to produce a blockbuster success rarely recover and at the very least find it more difficult to convince investors. This risk profile makes it particularly attractive to establish a steady income stream in the form of subscription revenue. Moreover, financial investors generally value companies that can rely on steady income higher than those whose economics depend merely on itemized transactions.

Since the firm doesn’t report subscriber numbers, I've instead relied on Antenna, a data firm focused on entertainment subscription services (full disclosure: I’m an investor and advisor).

A few observations.

Getting subscribers is easy. Keeping them is hard

Subscribers flock to a service whenever they can get something for free.

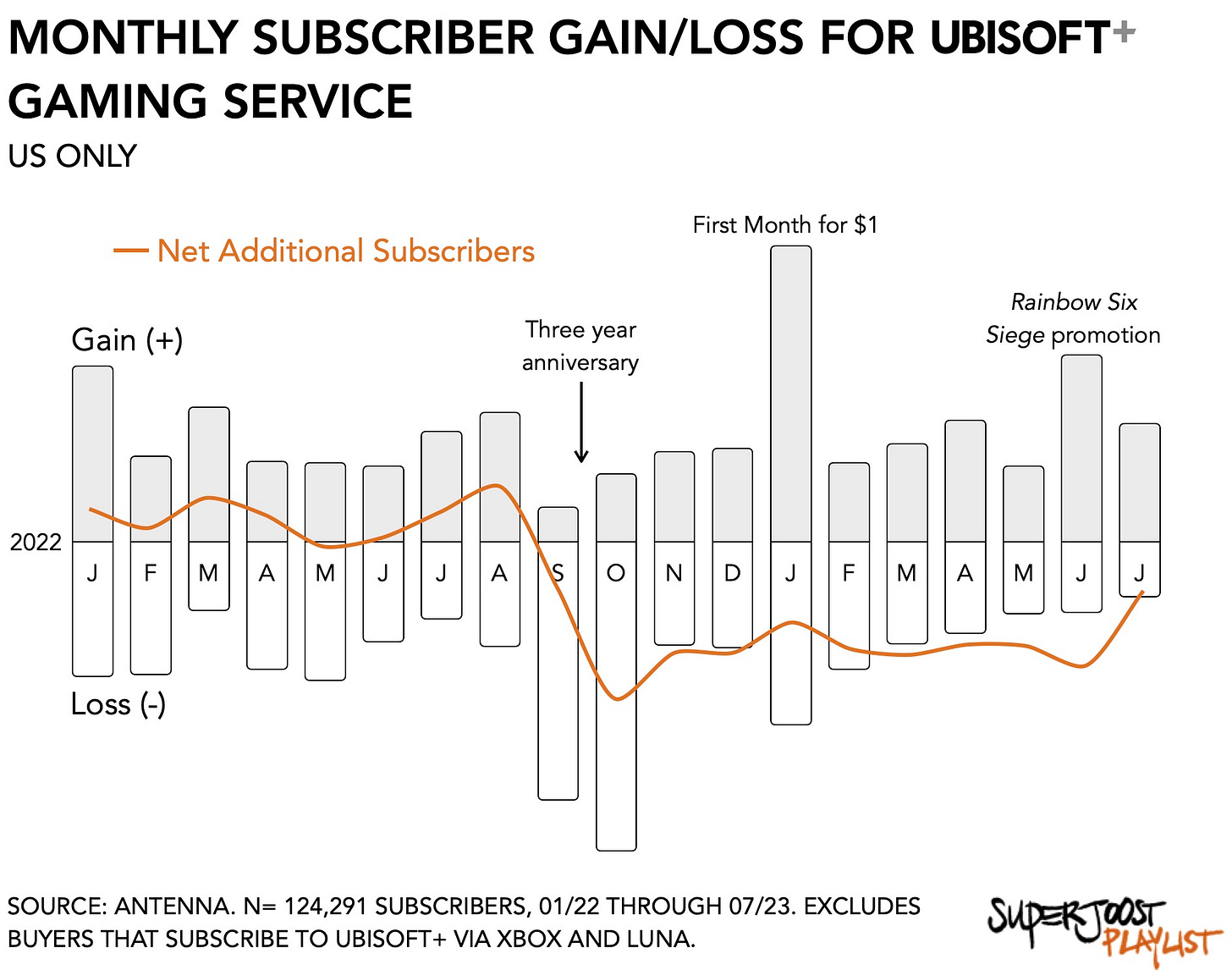

Ubisoft+ saw the influx of new signups swell during months when it, arguably, gave away the most value. In January 2023 it ran a campaign for $1 for the first month, and in June of that year, subscribers could play Rainbow Six Siege, arguably one of its most popular titles, for free. Such a strategy risks giving away the store for free, because like most publishers, Ubisoft depends heavily on the success of its most popular franchises. Just this week investors reacted promptly to fans’ disappointment with the latest update to Rainbow Six Siege and Ubisoft’s share price dropped 3 percent on the news.

To celebrate the three-year anniversary of its service, Ubisoft made Ubisoft+ available for free in September and part of October in 2022. The deal included PC, Amazon Luna, and Google Stadia, and gave players access to Far Cry, Assassin’s Creed, and Ghost Recon, in addition to new releases on day one, premium editions, and downloadable exclusives. It didn’t stick, however. After the campaign ended, the number of subscribers dropped at three times the rate and wiped out any gains leading up to the previous months.

Similarly, at the start of 2023, it ran another campaign offering Ubisoft Plus for $1 for the first month. Despite many new subscribers joining, an almost equally sized cohort canceled their membership. New signups spike around extensive campaigns but almost immediately drop off once they’ve had their fill.

Overall, there are fewer subscribers at the end of the period than at the start. Over the course of 18 months, Ubisoft has effectively lost subscribers, forcing it to continuously subsidize marketing campaigns and discounts to draw in new players. It is a far cry from the notion that a subscription model provides Ubisoft with steady, recurrent revenue.

Publisher-based subscriptions struggle to compete

Further casting a shadow over publishers’ ability to successfully develop a subscription service based on their own titles is their relative size to platform holders.

Throughout the entire period in terms of monthly sign-ups for Ubisoft+, Sony registered, on average, 48 times more new subscribers. Its ability to drive traffic and showcase the value of its own first-party content is a great benefit and makes it a lot harder for publishers to compete. It also renders a gaming service a nice-to-have revenue stream for major publishers.

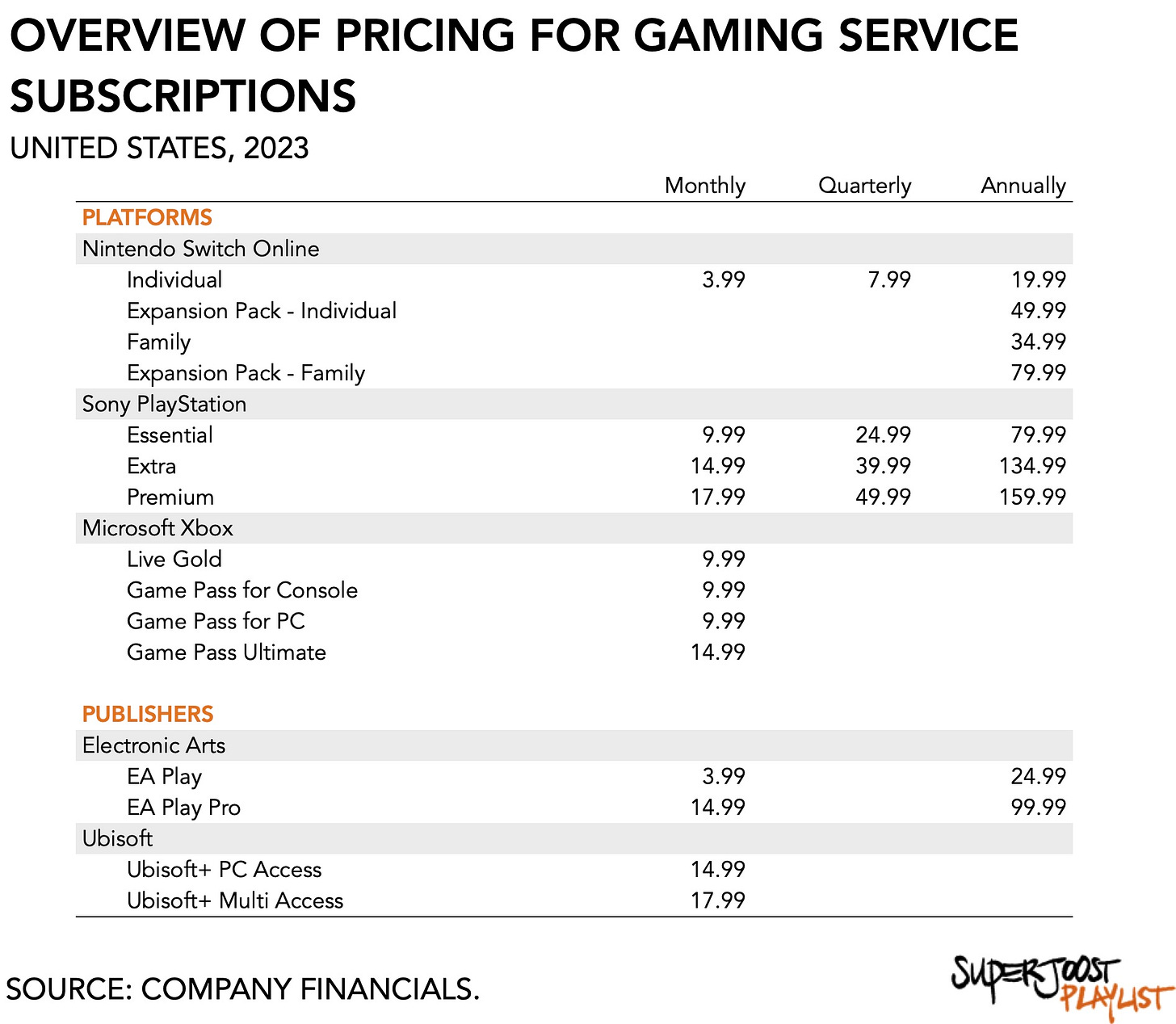

Subscribers to game services like Ubisoft are highly cost-sensitive. They flocked to Ubisoft+ when it was (mostly) free of charge, and quickly abandoned it afterwards. But comparing Ubisoft+ to other offerings shows that it is charging $17.99 for the highest tier, which is the same as Sony’s PlayStation Premium, and more expensive than any of the others. Sony, perhaps in anticipation of what it’ll cost to host Activision titles as part of a subscription promptly increased its annual pricing tier by 33 percent across the board, starting next week. It was a nice touch to downplay such a price hike by listing it at the bottom of another announcement. Especially vexing is the observation that game makers like Devolver Digital and TinyBuild are receiving smaller checks from platform holders for their content.

By comparison, Electronic Arts, which deploys different pricing tiers, reported 13 million subscribers early this year. Its highest price tier is Ubisoft’s lowest. The lower cost (and annualized pricing!) of EA Play explains why it has managed to build a bigger subscriber base.

Now that it holds the license to Activision’s titles, will Ubisoft be able to leverage its new position as a non-exclusive cloud gaming provider and offset what Naavik/InvestGame called the firm’s “diversification problem”?

Maybe. If it can get them to stay.

PLAY/PASS

Pass. The Financial Times ran an article that argued MrBeast to FaZe Clan are doomed to stay in their respective lanes. Perhaps its writers should get out more.

Play. Authorities were baffled to find out that it was a 17-year-old armed only with an Amazon Firestick in a hotel room that managed to steal the Grand Theft Auto 6 footage and leak it. As am I.