This week saw a lot of action in the European games market.

Simultaneously, the European Parliament is making a case to invest more in interactive entertainment and UK anti-trust legislators disclosed a 76-page document explaining why it believes a deeper investigation of the Activision Blizzard acquisition by Microsoft (ATVI/MSFT) is necessary.

Major mergers deserve to be scrutinized. Having started my own career in media ownership and concentration trends, I’ve spent years looking into different deals and how they may impact consumer choice, democratic debate, and diversity in cultural expression.

The problem with ATVI/MSFT, as I see it, is the knowledge vacuum that exists among regulators. Having barely paid any attention to gaming for decades, interactive entertainment now suddenly emerges as a relevant cultural industry, and legislators evidently don’t play games. It harks back to the days when parents and politicians got caught in a frenzy over the alleged connection between violence and video games to such an extent that they even forget to check whether their assumptions and comparisons made any actual sense. (Spoiler: they did not.)

The current debate on video games lays bare a lot of the insecurities among people that have little understanding. This week’s activity among European lawmakers shows they have both failed to invest appropriately to protect their precious cultural values, and are hurriedly trying to make themselves heard to stave off their own irrelevance.

On to this week’s update.

❤️🎙Thank you for a successful start to UNBOXING

We’re six episodes in and I wanted to send out a quick thank you. Laine and I have gotten a ton of positive feedback on our little podcast project. Subtitled “play and profit for the gaming curious” it’s been a lot of fun to discuss key developments in the industry and provide both historical perspective and analysis.

Don’t be shy. Check it out, and tell us what you’d like us to discuss next.

NEWS

European Parliament to increase funding for its games industry

The Culture and Education committee is formally asking for additional funding and the rollout of a strategy for the European game sector, arguing that the financial growth and increasing cultural relevance of interactive entertainment make it an important sector. Worried that Europe will lose intellectual property as well as talent to other markets (read: United States, Canada, and the UK), more money is needed to bolster the European video game ecosystem.

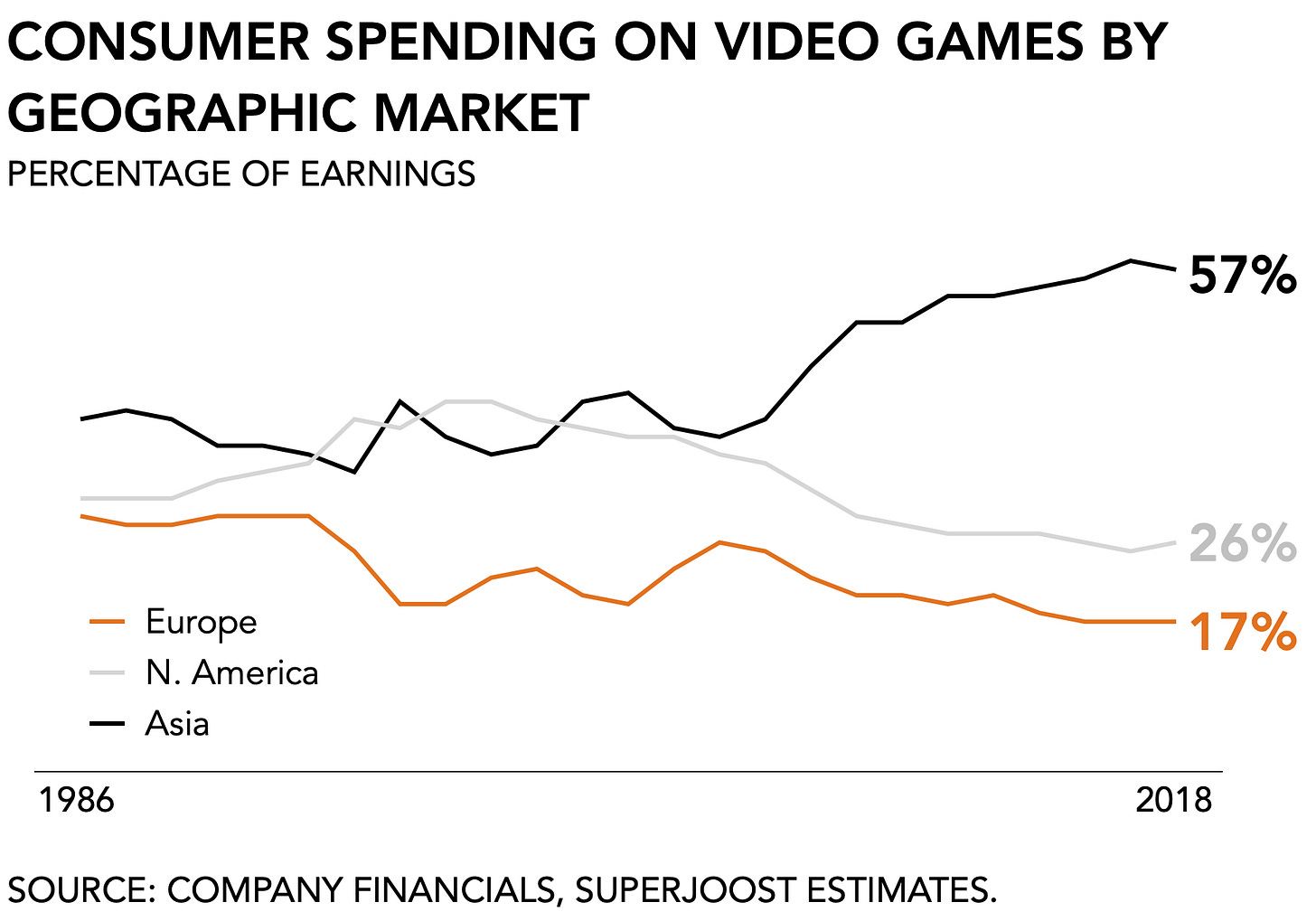

According to the financial data of the largest 200 game companies, Europe represents a relatively small consumer market and accounts for only 17% of global consumer spending on video games. That naturally makes it a less attractive region for game makers to invest. By comparison, Asia accounted for 57 percent in 2018.

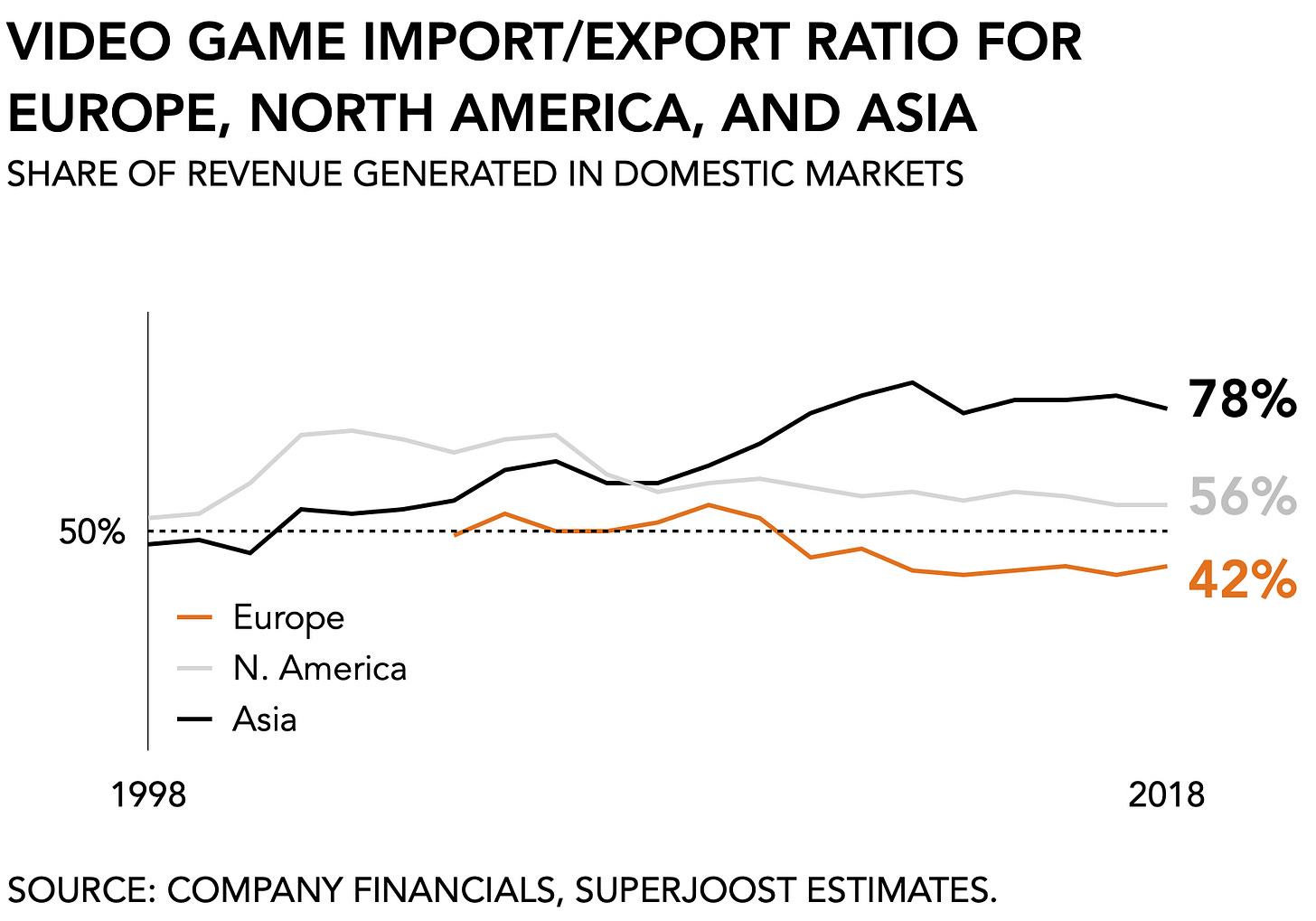

Granted, these are pre-pandemic numbers. But the rise of mobile in combination with the emergence of the Chinese market has resulted in a negative import/export ratio for European game makers. Specifically, European game makers relied for 42 percent of their revenue on domestic markets within the EU. The rest comes from selling to players elsewhere. For North America, that number is 56 percent, which has also slightly come down.

The biggest shift we find in Asia. Historically, Japanese firms like Nintendo, Sony, and a slew of publishers there exported consoles and software to western markets. As local audiences came online in China and South Korea, the total revenue generated by Asian firms in their regional markets increased from 47 percent to 78 percent.

The problem seems to be that non-European publishers want access to creatives from markets like France and Finland and sell their work elsewhere. The combination of rich literature and design talent that originates in Europe produced well-known franchises. Netflix announced that it is establishing a game studio in Finland just a few weeks ago, and Tencent raised its stake in French publisher Ubisoft. In the short term, the influx of capital from non-European entities will strengthen the European games market.

In the absence of government subsidies, however, the European game scene runs the risk of becoming dependent on foreign capital, which may undervalue domestic consumer markets and ultimately change the cultural impetus of the fastest-growing entertainment industry.

European Commission needs help on ATVI/MSFT

In a sign that it does not understand the video games market at all, EU antitrust regulators are circulating a set of no fewer than 100 questions to get a handle on if and how the proposed MSFT/ATVI acquisition may impact the industry. According to the leaked document obtained by Reuters, the CMA is quizzing other firms on how Microsoft may benefit from Activision Blizzard’s user data, how it would impact their ability to negotiate publishing agreements with the platform, and whether there would remain “sufficient alternative suppliers” post-acquisition.

The news of the industry survey came a few days prior to the UK’s Competition and Markets Authority (CMA) releasing the full document of its September 1 decision to push the proposed merger into phase 2 where it will face increased scrutiny. Microsoft has responded by stating that the CMA adopted Sony’s standpoint without the “appropriate level of critical review.”

With the decision deadline slowly approaching, we can expect things to heat up. Rumor has it that Microsoft flew out to Japan to find a solution with Sony directly, proposing to grant the Call of Duty license for an additional three years. The Japanese console maker asked to get a license in perpetuity instead. I mean, really tho.

Since then, anti-trust regulators in Europe have acted as a sort of mediator in the negotiations and the expectation among investors is that an arrangement around a specific license like CoD will remove any obstacles. Currently, however, Sony is apparently still asking for a 15-year license. I don’t know how much of that is true. But according to page 41, item 172 of the CMA document, Sony will possibly agree to the deal if Microsoft agrees to no extra content unavailable on PlayStation, no enhanced interoperability with console hardware, and no benefits from Game Pass membership.

In criticizing Microsoft and managing to sway the CMA to its interests, Sony may face some intense scrutiny itself. Indeed, its PlayStation has been the dominant console device globally, consistently outselling the Xbox two to one. Throwing stones over Call of Duty does seem a bit rich for Sony which has been increasing the price of its own games and consoles without facing any scrutiny.

Game Pass on Oculus VR headsets

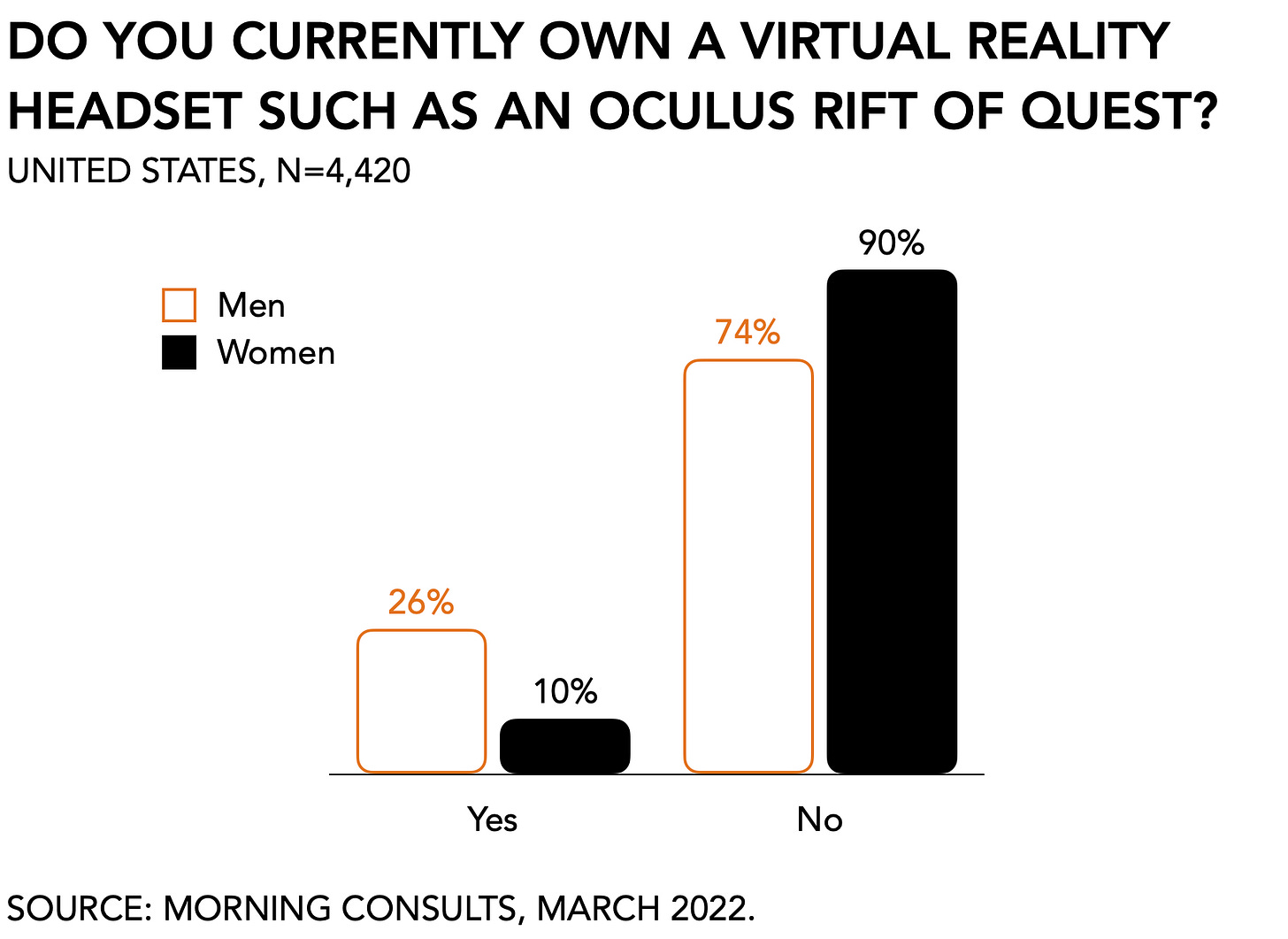

Meta announced the next iteration of its VR headset, the Meta Quest Pro, and several new titles at its annual Connect conference. The new device carries a more powerful chipset, improved graphics, and features eye and face tracking. To boot, Microsoft CEO, Satya Nadella, joined Meta CEO Marc Zuckerberg during the online event to discuss a partnership between the two companies to bring Microsoft’s popular Game Pass subscription to Meta’s new device. While there’s no confirmed release date, the plan is to allow people to play Game Pass titles on a 2-D screen inside of virtual reality.

Here’s what is odd about it. First, the new headset is going to cost $1,500, which is intentional according to Zuckerberg, who is targeting “enthusiast, prosumer folks -- or people who are trying to get work done.” I get that Meta is going after the early adopter crowd but both the technology and its raison d'être remain largely unproven. We have been hearing about virtual reality for decades.

I maintain that Zuckerberg first experienced the feeling of fear when it looked like Facebook had missed out on mobile. He managed to catch up to it, of course. But then found himself running headfirst into the perimeter around Apple’s walled garden when it changed its IDFA policies. It cost Facebook an estimated $10 billion.

To safeguard its sovereignty, Meta needs to own a hardware platform. It is part of the reason why a firm like Valve, to name a non-obvious example, has kept pushing into hardware as well. With the exception perhaps of PC gaming, most ecosystems in digital services feature an oligopoly on a distribution level. There are only a few handset manufacturers, three console makers, and, as of last week, one less cloud gaming provider. No wonder Zuckerberg is going all in. If the virtual becomes a reality, Meta hopes to become its lord and master.

The tension in this week’s announcement comes from the measly $1.5 billion that has been spent on games and apps in the Meta Quest Store to date and the push into integrating the Xbox Cloud Gaming service. Microsoft is deliberately hardware-agnostic, of course. But it is also targeting mainstream consumers. That excludes the kind that will shell out $1,500 for a slightly fancier set of goggles. Meta would be far more credible if it were to spend the same amount of effort and investment on data privacy and solving issues in the current state of the internet rather than trying to own the next ecosystem.

Ultimately, we can’t lose. Either we end up with a photo-realistic super universe full of cool stuff to do, or we get to watch one of the most powerful companies in the world burn its riches on a bonfire celebrating its founder’s ego.

Meta’s share price closed at $128 today, down -61 percent from $325 a year ago.

PLAY/PASS

Play. Megan Thee Stallion twerking on-stage with Master Chief at TwitchCon.

Play. Dutch painter Jurjen Tiersma held an exposition of his “Pokémon paintings.”

Pass. An up-and-coming 19-year-old talent, Hans Moke Niemann, is being called out for cheating by the world’s best chess player following an investigation.