The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

During a 20-minute podcast (which was really a video but whatev), Phil Spencer and Sarah Bond offered very little news. Following a frenzied week of speculation as to what the world would look like if Microsoft were to release its exclusives on rival platforms, it turns out, nothing happened.

“We made the decision to take four games to other platforms […] for specific reasons. I’m not going to name those games. They are not Starfield and Indiana Jones.”

The acquisition aftermath obviously amounted to a turbulent few months and I suspect Xbox’s leadership has been having the same conversation with a lot of its new studio teams. So much so, perhaps, that they’re just filling the air with noise rather than signal. And that’s okay. It’s also okay to not make statements about things. Like Sony, whose leadership is currently transitioning (see below) and we hear absolutely nothing.

Anyway, the most notable data point we gained was the updated Game Pass subscriber number which now sits at 34 million, up from 25 million previously. It’s not clear if that’s a big win, but at least it’s not flat or less than before. Given that Take-Two’s investor deck suggested that there are 77 million 9th-generation consoles sold and that Sony sold 50 million, leaves 27 million total units sold for the Xbox Series X and S. It tells you that there are Game Pass subscribers across different device generations, which is as a good way to increase average revenue per player and extend the average life-cycle.

Maybe team Xbox can extend my personal life cycle next time and send an email instead.

On to this week’s update.

MONEY, MONEY, NUMBERS

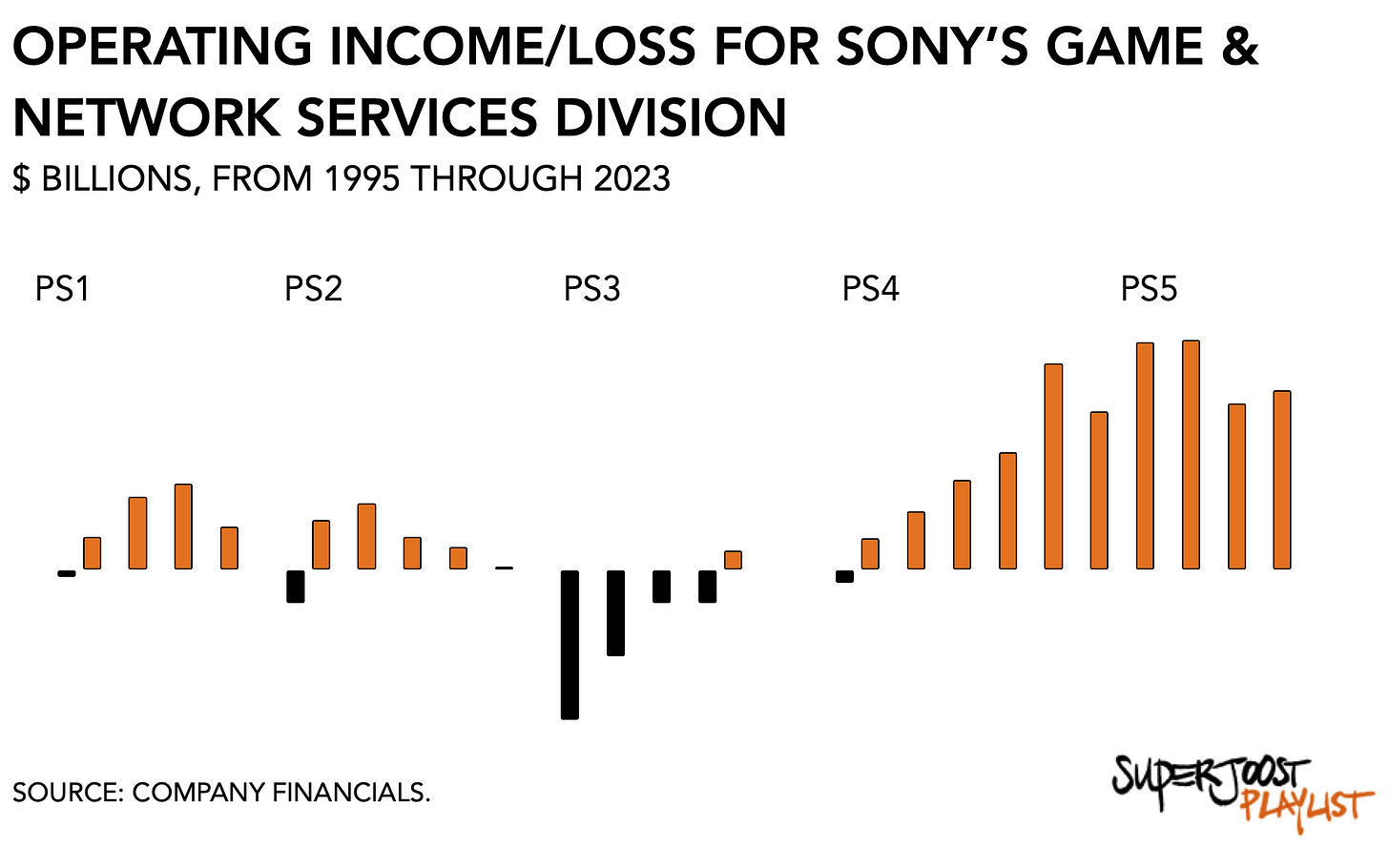

Earnings for Sony’s gaming division totaled $9.3 billion in its most recent quarter, up 16 percent. However, the firm lowered its full-year sales estimate for its PlayStation 5, from 25 million to 21 million units sold.

Digital software and add-on content accounted for $4.2 billion, or 46 percent of total revenues, for its Game & Network Services segment, which was up +23 percent y/y. Now having entered the final stage of its current life cycle, Sony no longer has plans to release major first-party titles in the short term. According to Sony President Hiroki Totoki, the platform aims

“to continue to focus on producing high-quality works and developing live service games, but, while major projects are currently under development, we do not plan to release any new major existing franchise titles next fiscal year.”

It doesn’t have to. We learned last week that Nintendo believes it’ll sell units anyway. And while PlayStation did cut the forecasted units sales of its console, there is little incentive to double down and spend a bunch of money. Digital sales are doing well and the PlayStation 5’s healthy install base suggests a strong last stretch based on digital downloads and add-on content. Since the release of the PS4, Sony has managed to break through the cycle that historically resulted in taking a loss around the release of a new device. With a revamped subscription offering and shift in management following the departure of Jim Ryan, I’d expect Sony to lay low this year before ramping things back up in 2025.

Hasbro reported $5 billion in full-year 2023 revenues, and $1.3 billion (down 23 percent) for the quarter, which fell short of Wall Street analysts’ forecasts.

Here, too, does digital income continue to grow both in relative and absolute terms. Its Wizards division generated $1.5 billion in revenues in 2023, up from $1.3 billion a year earlier (+10 percent). Quarterly revenue was up 7 percent at $363 million thanks to the success of Baldur’s Gate III and Monopoly Go! and in spite of a 2 percent decline for Magic: the Gathering. Its licensing deal with Belgian developer Larian Studios earned Hasbro $90 million, suggesting a 10 percent royalty fee based on 15 million units sold.

By comparison, sales for its toy business dropped 25% year-over-year to $754 million. As overall income has declined, Wizards now accounts for 29 percent of Hasbro’s total income, up from 16 percent in 2019. Conventional businesses like the toy industry are under pressure to find new avenues to reach their audience: Hasbro’s legacy business (excluding its Entertainment group) reported the lowest fourth-quarter sales since 2006.

PLAY/PASS

Play. InvestGame issued its most recent game investment report. Worth a read!

Pass. During its earnings, Embracer’s management said the quiet part out loud: "Our overruling principle is to always maximize shareholder value in any given situation." Oof.