Later today I find out if United Airlines remembers me. My last flight was in February 2020. I think. But I’m excited and grateful.

Here are my pre-boarding announcements.

I joined Niko Partners as an advisor. Lisa Hanson leads what is hands down the #1 insights provider on the Asian games market, and I’m excited to join the effort.

Listen to NYU colleague Scott Galloway trying to pronounce my name. Also, I said a few things about Netflix.

a16z has a shiny new website (although that blue is a bit too blue for my taste) and asked me to pen 1,000 words on user generated content. There’s more on its way, but this is a good start.

After two years my co-applicants and I finally received word on having won a grant from the Social Sciences and Humanities Research Council. Under Dwayne Winseck’s supervision, we embark on a study called the Global Media and Internet Concentration Project to establish whether or not media – collectively and individually – are becoming more or less concentrated. Previously I worked on media concentration at Columbia University and contributed to the current’s project predecessor.

No hot girl summer here. Just busy middle-aged man summer.

On to this week’s update.

NEWS

Disney gets back into games. What. Why?

Despite its legacy of being one of the first traditional entertainment organizations to enter into gaming decades ago, it would be an overstatement that Disney has had much success in interactive. But large corporations tend to forget things. After Disney Infinity cratered and effectively led to the company’s decision to ditch games altogether, it is now back with a new plan. Hoookay.

That plan seems to mostly revolve mostly around getting third-party developers excited about being granted access to Disney IP and “making their dreams come true.” Ah, so they’re not making actual games, but publicly pandering their franchises to the highest bidder. Got it. That’s actually pretty smart. Ubisoft seems to already have bought in, judging by its trailer for Avatar: Frontiers of Pandora. It’s the markably better strategy than having Disney trying to do this on its own. We all know that the best game featuring their characters is Kingdom Hearts by Square Enix, and Star Wars Battlefront II as a possible second.

The enormous appetite for IP means that Disney is quickly becoming a kingmaker for any publisher or studio. With the top brass buying up mid-sized shops left and right (see below), quality franchises are the new multi company online battle arena. Disney clearly learned a lot from licensing out Star Wars for a battery of mobile game developers over the past few years and is ready to broaden its scope to other projects and platforms. Why develop the cow when you can have someone send you milk?

EA acquires Playdemic

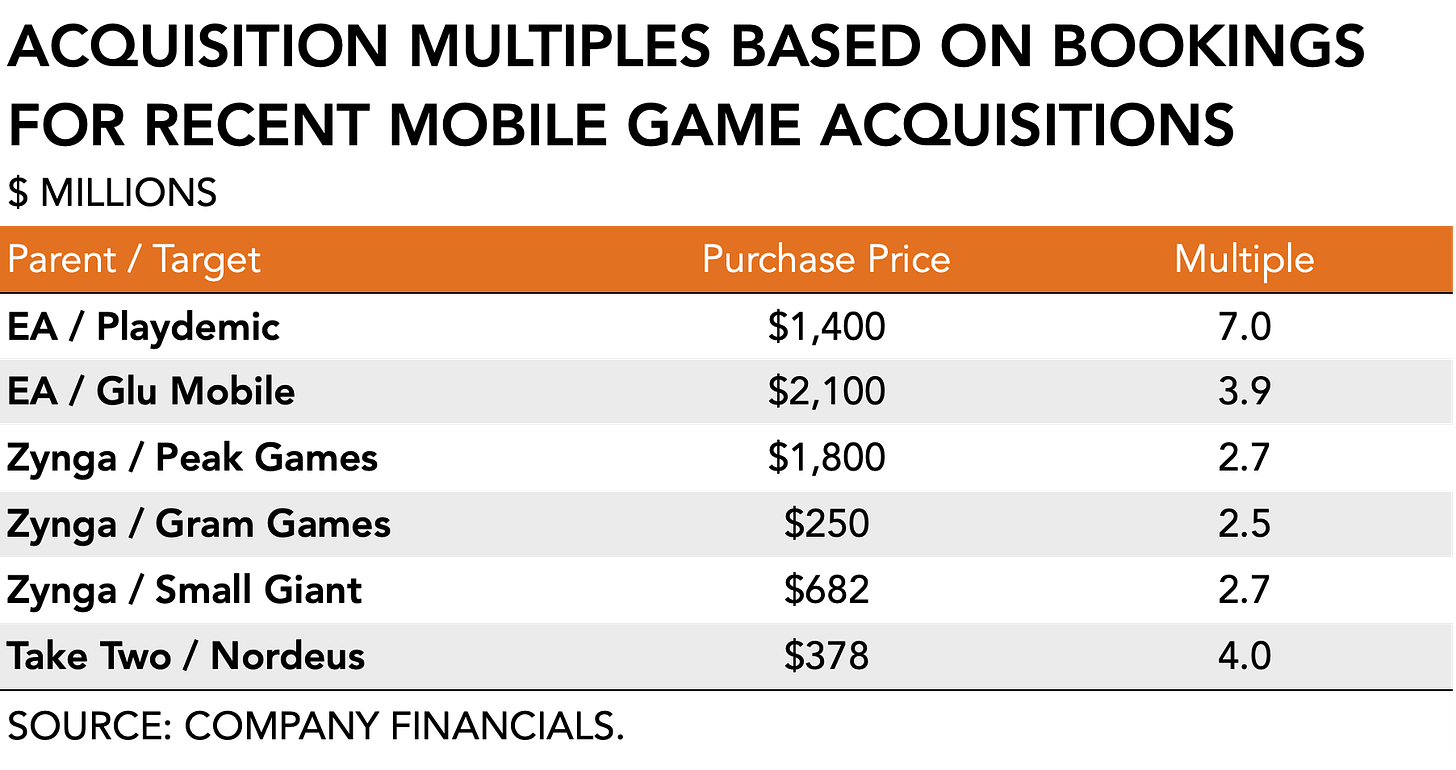

Not much to analyze here: large publisher looks to build out its mobile games division and adds another sports franchise to its already super-sportsy catalogue. The $1.4 billion price tag tells you that money is still abundant. EA has now spent $4.7 billion on M&A in the past twelve months which included Codemasters ($1.2 billion) and Glu Mobile ($2.1 billion). What is different this time is the much higher multiple EA is paying for Playdemic.

Given the momentum in mobile gaming and EA’s cash reserves, Wall street is unconcerned. The risk here is, of course, that it runs into managerial problems. An expanding portfolio of subsidiaries puts strain on back-end logistics and management. Presumably all these studios will plug into the same corporate reporting structure. But that’s easier said than done because once the glow from the headlines wanes, previously privately-held creative firms run the risk of having to adhere to the unforgiving quarterly cadence of a publicly traded parent. Given Playdemic’s history as a subsidiary at WarnerMedia, I’m sure it is accustomed to fill out P&L reports every three months. I wonder though whether EA can synthesize something cohesive.

More generally, it is currently clearly easier to spend a sloppy billion dollars or so on IP and purchase a studio outright (see: Zynga) than it is to muddle through the lengthy process of developing a franchise from the ground up and dealing with user acquisition. It further fortifies EA’s position as it faces the ever-growing power dynamic of new platform overlords in the form of Apple and others. Historically it’s been able to strike great deals for itself with Microsoft and Sony, as the conventional console market asked that both platform and publisher work together more closely. Following the Epic/Apple lawsuit it is clear that the politics of old need not apply to the circumstance of present. Bulking up means giving itself more leverage in dealing with an array of digital platforms that value content creators much less.

Facebook doubles down on VR as first ad partner quits

Virtual reality is quickly becoming Zuckerberg’s Achilles heel.

The proposed intercourse between immersive environments riddled with ads is perverse, and if creative firms won’t stay away from it themselves then, it seems, consumers will. Following the announcement of a test with Blaston, a game under development by Resolution Games, the studio received some harsh words from players and decided to abandon the effort a few days later.

Before you point out that I have, in fact, been bullish on in-game ads previously (and still am), I will give you two reasons why this is different.

First, virtual reality isn't some established medium just yet. Indirect revenue in VR immediately and fatally marries a novel technology to a prerequisite from its maker. In this case Facebook’s reliance on ad revenue means that everything it ships has to figure out a way to draw revenue from users indirectly. By comparison, video games have reached a worldwide audience of 3 billion, which means that advertising can make its entrance on the fringes at first and later more prominently because people are totally fine watching an ad in exchange for content.

Second, Facebook totally bullshitted everyone. When it acquired Oculus from Palmer Lucky, the Wunderkind stated that

"We are not going to track you, flash ads at you or do anything invasive.”

Mr. Lucky has long since left the company and now builds long-flying drones and surveillance towers for the US military, which are obviously also not going to track you nor do anything invasive.

Meanwhile Marc is trying his best though. At VivaTech, he disclosed that the company currently has 10,000 people working on its VR/AR effort. That is a lot. By comparison, Facebook employs about 15,000 content moderators today after all that high-profile criticism.

He is likely encouraged by the recent success of the Oculus Quest 2 which, in fairness, is a big step forward in the evolution of VR. Assuming that the Oculus accounts for the bulk of Facebook’s non-advertising income, which reached $732 million in 21Q1, we can infer that the technology is starting to find traction.

Zuckerberg wouldn't be the first to blow a bunch of money on a technology that never delivers on its promise. Obviously a little baby project needs the support of a firm’s leader or its chances of survival are greatly diminished. But hanging onto something without a rational justification is a bad idea. Nintendo pulled the same with its Virtua Boy but it wisely decided to walk away before it got out of hand. Let’s see if Marc does the same.

It is unclear whether Facebook can ever go the distance: VR is well outside of the required skillset to develop consumer electronics (remember Facebook’s Portal video device?). Whatever this technology may become, the inescapable ad revenue model will seep into the immersion and, thereby, render it shitty. More generally, even despite his role as the majority decision-maker, Zuckerberg does himself no favors of running down a pet project in the midst of growing criticism and antitrust legislation around Big Tech. As they like to say in corporate lingo: is VR a hill Zuck wants to die on?

Amazon pretends to lower platform fees

Following the hubbub around different platforms and their legal arguments with high profile publishers, Steam, Apple, Google, and now Amazon have all started to compromise on their fees. That is according to their press releases, of course.

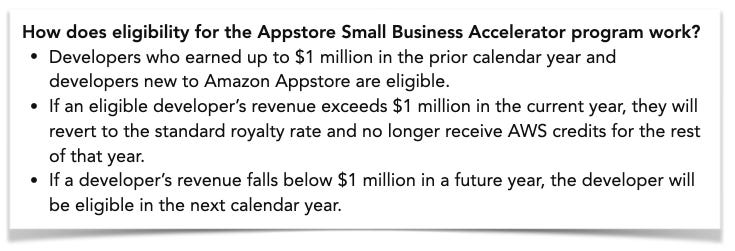

Now Amazon claims to do small fry devs a favor with the launch of its Appstore Small Business Accelerator Program: the platform will only charge 20% to any firm that makes less than $1 million annually in the prior calendar year. But you’re not getting cash: you get a promotional credit for AWS services.

Basically, the platform oligopolists are slowly arriving at what we know elsewhere as a “Manufacturer Suggested Retail Price,” which isn’t really a suggestion because if you sell it for cheaper, they’ll stop sending you shipments. They must think that in-store credit is worth the same as cash (it’s not). I just hope Lina gets organized soon.

PLAY/PASS

Pass. No, thank you. Keep your casual violence against Arab people to sell your shooter game.

Play. 🇳🇱 ⚽️ As usual I’m more melancholy than usual and filled with nationalism when there’s a soccer cup underway. This year’s Euro Cup is no different. Watching the orange jerseys bob up and down the pitch the past few weeks has opened a portal straight back to the heart of my motherland. Sports has this uncanny ability to do away with rational decision-making and renders me a mess of emotions. Together with my beautifully pregnant wife and our 8-year old, I watched the Dutch team play against the Ukrainians. I’m the wealthiest man alive.