On Tuesday I woke up to the news of a deadly train crash in the town where I grew up in the Netherlands. One person died and another nineteen ended up in the hospital after a freight train and a passenger train collided with construction equipment.

It is an odd experience seeing your childhood hometown all over the news. Despite living 3,628 miles away, it felt close by. The crash site was across the street from where I had a summer job many moons ago. In fact, in a few days, the 10-year-old and I have a trip scheduled to the Netherlands that includes a dinner with friends a few blocks from it.

Train accidents are, fortunately, quite rare.

This week’s incident was the first in several years. Even in the US, which covers a lot more territory, there are around 60 train collisions every year compared to well over 500 derailments. (The US Department of Transportation provides some fascinatingly detailed data that goes back decades here.) More so, it seems to be getting safer. Over the last ten years, the number of fatalities related to train crashes has declined from 1,145 to 747.

Historically, there is a strong parallel between the ways in which societies move people, goods, and ideas. Going faster isn’t everything.

The introduction of trains in the 19th century met with protest. As a novel mode of transportation, many initially regarded the railroad with deep skepticism. Used to moving about on foot or by horse, a much faster mode of transportation also separated newly minted passengers from their environment. The alienation of a traveler from the landscape amounted to a change in perspective as train windows became the lens through which they saw the landscape fly by. Both information and people started to move much faster and the world became smaller. The technologies that sit at the center of our social and economic life have a way of altering our perceptions.

A similar disruption of its pedestrian culture caused Parisians this week to ban electric scooters. An overwhelming 90 percent favored their removal in a referendum called in response to concerns about the number of people being injured and killed. As one of the first cities to adopt the new mode of transport, its three main operators—Lime, Dott, and Tier—will no longer be able to rent out scooters as of September. A rash of incidents and deadly accidents with people speeding on the sidewalk means Parisian traffic will be slowing down a bit.

In the UK, the Information Commissioner's Office fined social media app TikTok $13 million for breaching data protection laws related to the protection of children's data. Its rapid growth had resulted in it failing to appropriately protect minors. The regulator estimated that as many as 1.4 million UK children aged under 13 had used the app in 2020, despite TikTok's rules forbidding children in this age group from creating accounts and had failed to gain parental consent to use children's data.

And the ravenous entry of artificial intelligence as a novel method to generate more content faster crashed into Italian regulators. Italy became one of the first Western countries to shut down OpenAI’s ChatGPT due to a suspected breach of Europe's strict privacy regulations. Its Data Protection Watchdog cited concerns over data breaches, lack of age restrictions, and potential misinformation. The EU is expected to take a more restrictive stance on AI, while the US has yet to propose formal rules to bring oversight to AI technology. China, which predictably does not allow ChatGPT, has introduced regulations on deep fakes and synthetic media.

And, finally, there was the call to slow down the development effort behind AI for fear of wreaking havoc on society and the economy. Over 1,000 prominent AI experts signed an open letter that urged everyone to take their foot off the gas a little. The ceaseless march of faster, better technology has seemingly caught up with itself.

After a period of fast-paced adoption, a growing chorus is calling for a deceleration of encroaching quotidian technologies.

Press the button. This is my stop.

On to this week’s update.

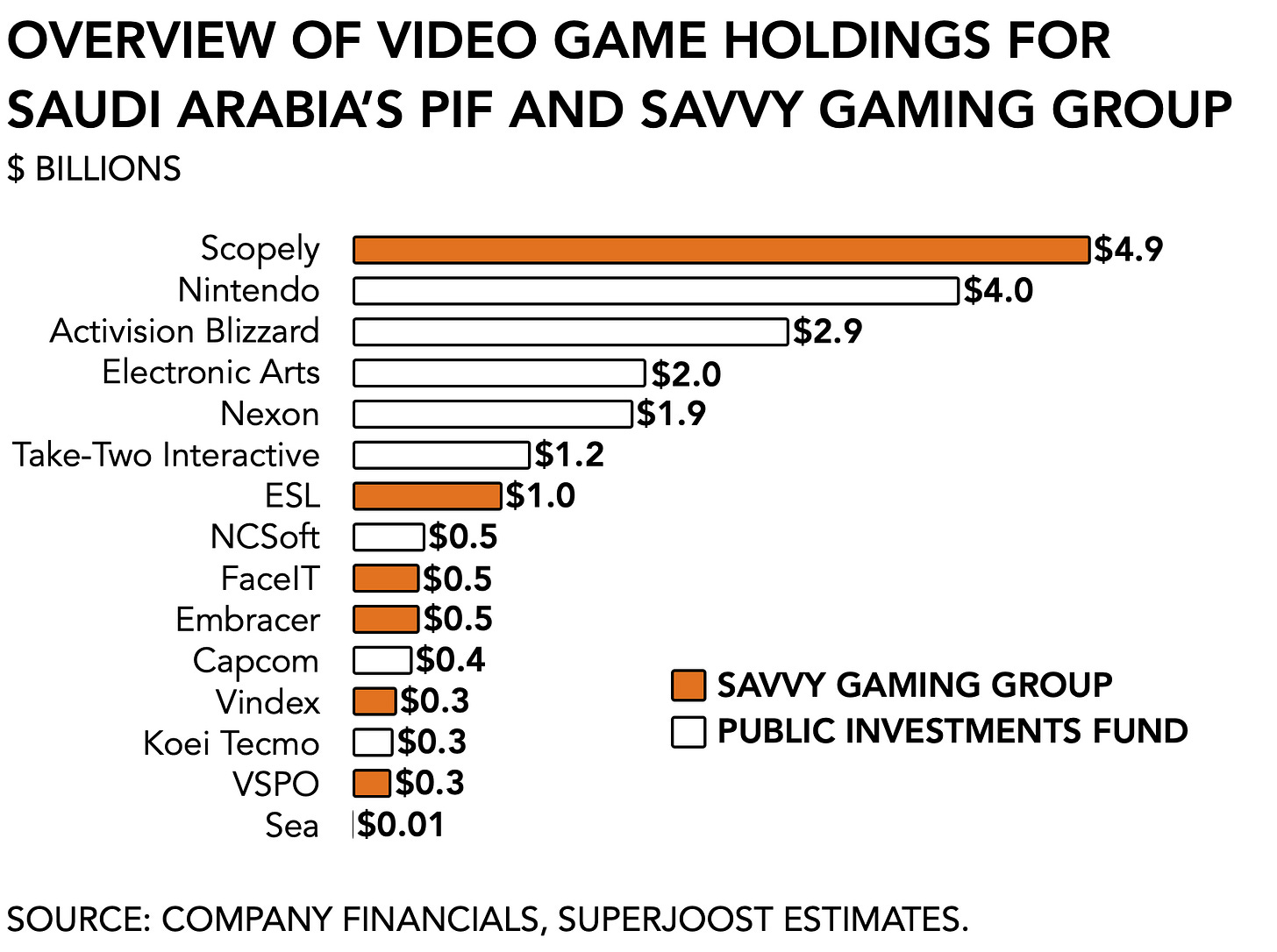

BIG READ: The Saudis’ big play

This week Savvy Games Group, a subsidiary of the Saudi Arabian government’s Public Investments Fund, announced that it agreed to purchase Scopely, a privately held mobile game publisher, for $4.9 billion. That makes it one of the largest acquisitions in the industry to date and puts its roughly between Activision Blizzard’s $5.9 billion purchase of King Digital in 2015 and last year’s acquisition of Bungie for $3.6 billion by Sony. It is also the fund’s biggest spend so far, which is part of its $38 billion push into gaming.

As expected, consolidation in gaming continues well into 2023. Known for its free-to-play games like Yahtzee With Buddies, Stumble Guys, and Marvel Strike Force, Scopely raised a fantastic amount of money, which it used, in part, to grow through strategic acquisitions of FoxNext and GSN Games, a unit of Sony Group. In its series E round in 2020, the LA-based game maker raised $340 million at a $3.3 billion post-money valuation.

The acquisition is part of a larger effort. PIF is funding the construction of Neom, a futuristic city, which it has earmarked as the region’s first gaming hub, according to Bloomberg. Savvy Gaming previously acquired all of the non-publisher-owned esports tournament organizers ESL, FaceIt, and Vindex. The current transaction is a clear indication that is also building a content catalog.

Across its portfolio of publicly traded stocks like Nintendo and Activision, and its holdings in private assets through its Savvy Gaming Group subsidiary, the Saudi Public Investments Fund currently holds $20.3 billion in video gaming assets globally.

The PIF equity portfolio has been growing, too. It currently holds $13.1 billion in publicly traded stock, totaling just 4.9 percent of its $267 billion portfolio. Compared to March last year, the value of PIF’s game holdings, excluding Nintendo, has increased 9.3 percent, from $8.3 billion to $9.1 billion. Nexon and Take-Two Interactive were the biggest contributors with a value increase of +27% and 19%, respectively.

Not everyone is equally excited. Among my investment bankers friends, I’m told, some fundraising game makers have expressly stated wanting nothing to do with the Saudis due to the country’s track record on human rights violations. It is an opinion shared in other entertainment categories and it got pro-golfer Phil Mickelson in hot water. Claiming the moral high ground when others take Saudi Arabia’s oil money does feel a bit trite, however, as long as China, home to the world’s largest publishers, openly supports Russia in its war against Ukraine. But I welcome this newfound attention for geopolitics as its plays out in gaming.

Nevertheless, the Saudi growth spurt is well underway. The PIF has so far deployed about half of the $38 billion it earmarked for interactive entertainment, leaving it plenty of runway. Niko Partners calls Saudi Arabia “the gaming powerhouse of the region”, and the Boston Consulting Group forecasts the country’s gaming market to total $6.8 billion by 2030.

My take: I’m told the Saudis are smart and discerning investors. It is remarkable how many contacts in my network have been flying to the middle east for business over the last few years, and I don’t expect that momentum to die down. PIF and Savvy have managed to grow their investments handsomely and are in a position to buy up assets at competitive valuations. It is the kind of domestic investment push that European governments can only dream of. After mobile gaming and digitalization redistributed the geography of the global games market, we now enter the next phase in which interactive entertainment matures as a mainstream pastime. That means new markets and new masters.

NEWS

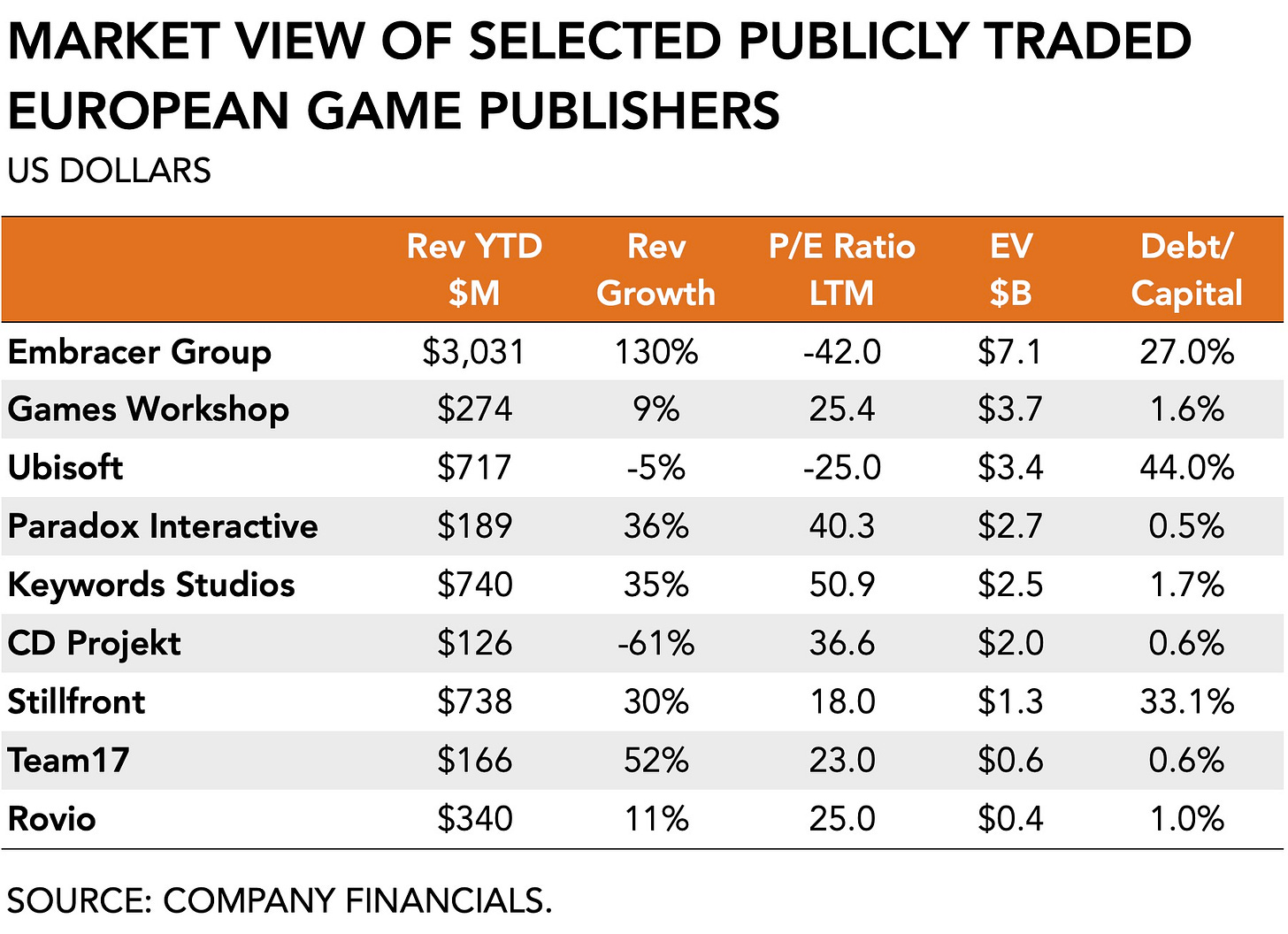

Embracer fends off critics

Europe's largest gaming company, Embracer, faces criticism of its approach to integrating the various businesses it acquired over the past four years. The numbers are spectacular: Embracer’s sales have increased from $17 million in 2014 to $1.6 billion last year. It acquired Perfect World Entertainment, Dark Horse, and Asmodee, among others, during a period of low-interest rates and readily available capital, and aims to expand the reach of its intellectual property beyond video games into board games and comic books by creating a unified entertainment family, capitalizing on cross-pollination and transmedia potential.

On paper that makes sense. But I’m not a fan.

As I’ve argued previously, managing a consortium of creative teams, totaling 15,731 employees, that are collectively working on more than 237 individual projects is asking for trouble. The mothership seems particularly keen on maintaining a laissez-faire attitude and actively avoids “forced synergies.” It is no wonder that a lot of creative shops have found this appealing. All of the benefits of being part of a global conglomerate with none of the corporate meddling is hard to resist. Accordingly, of the 108 business owners that have come under Embracer’s ownership, 106 remain.

Its more recent revenue figures remain impressive. Embracer reported $899 million in 23Q2 net sales, an +190 percent year-over-year increase that includes +35 percent organic growth. It outperformed Wall Street’s consensus of $847 million. That must have also been the reason why the Saudi Public Investment Fund’s subsidiary, Savvy Gaming, is the second-largest holder of Embracer’s outstanding shares with 8.4 percent. CEO Lars Wingefors is the largest shareholder with 17.6 percent, roughly valued at $955 million.

However, some hedge funds and investors are now expressing concern about Embracer's financial performance and accounting practices, suspecting that these factors might conceal the company's actual performance. Critics argue that Embracer's complex structure and shifting accounting could indicate future problems. Moreover, the firm reported last week that several of the deals that had been in the works would be pushed back for completion from several months ago to the end of June.

A seemingly growing number of investors is unimpressed. As of mid-March, there was short interest totaling 11 million shares, up +20.9 percent from late February.

CD Projekt reports $77 million in revenue, upcoming expansions

The Polish game maker grew revenues +21 percent year-over-year and surpassed Wall Street expectations due to cost cutting and higher returns on Cyberpunk 2077 and a new version of The Witcher 3. Its digital storefront, GOG.com, contributed $13 million, up +8 percent y/y.

The company is working on two projects at once. Investors are excited about the upcoming expansion of its Cyberpunk franchise with an anticipated release of Phantom Liberty in 2H23. The marketing campaign is scheduled to kick in June. And there’s also Project Polaris, a new Witcher game. It’s come a long way since losing half of its market cap value.

PLAY/PASS

Play. Anticipating a hefty jetlag next week in Amsterdam, I’ve bought tickets for a late viewing of the Super Mario movie with the kid. Having lived through the entire Minion franchise and every movie even remotely kid-oriented, critics be damned.

Pass. E3’s cancellation is both unsurprising and deeply disappointing. Maybe the big platforms can step up and host something?

Regarding the Parisien electric scooter ban. It has been widely reported that nearly 90% of voters chose to ban the scooter. However, around only 8% of the voters chose to vote: a very small proportion Parisiens. Perhaps apathy towards them is the real headline.