The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Welcome back.

On my return flight from Munich, I fought my jetlag by starting the outline for another semester. It never ceases to surprise me how much changes from one season to the next, and I find myself constantly having to add new topics to my lectures. It’s not *just* to keep the material relevant. But it’s largely unworkable to propose an entire class about the intercourse between entertainment and technology without having at least a somewhat informed opinion on the latest fad.

Anyway, my reason for being in Munich was a conference called DLD. It takes place the week before the World Economic Forum in Davos where the power elite fly in on private jets to discuss climate change and make predictions that are, remarkably, always wrong. DLD differs in that it brings a wider range of more diverse thought leaders, environmental technologists, politicians, tech journalists, startup founders, and engineers together to set a more-or-less shared agenda for the year. I’ve spoken at two now and find them well worth my time, mostly because my own head can be a relentless echo chamber during the winter months.

This year my focus was the intersection between gaming and music. You can watch the full discussion here. What generally drives growth and widespread consumer adoption is a combination of meaningful, native new art forms that organically emerge from novel technologies and innovative business ideas. More to the point, globally, the video games market totals around $200 billion while the music industry generates $50 billion, split evenly between recorded and live music. For any vision of a deeply immersive, meaningful online experience to come true, music and play provide fundamental social components.

What to make of virtual concerts, especially now that they’re starting to graduate from pure marketing events to financially and culturally more meaningful occurrences There is a myriad of examples of the fruitful cross-pollination between music and games. Beyond the obvious superstars like Ariana Grande, Travis Scott, and Lil Nas X, concerts in mobile online worlds are also starting to bring visibility to smaller artists and lesser-known games.

Last summer the performance of Korean K-Pop band, Blackpink, inside one of the world’s most popular video games, PUBG, attracted almost 16 million viewers. At the release of Call of Duty: Modern Warfare, fans on TikTok shared clips of the game with a song called Limbo by Canadian rapper Freddie Dredd, resulting in a nine-fold increase in plays across streaming services. There was also The Notorious B.I.G.’s virtual reality concert where we saw a digital rendering of the artist in whose childhood neighborhood I moved over the summer perform alongside contemporary artists like Latto. One of my music industry sources says it was a straight cash grab, but that its reach is limited as older audiences are less tech-savvy and a lot less likely still to sit with a headset on. The upside, I’m told, is that “it makes a creator’s estate into an evergreen business and that Biggie’s family doesn’t have to just rely on old relics and his life story. They can now build a completely new one.” And, finally, in late December, the performance of Norwegian singer-songwriter AURORA in an open-world indie game titled Sky: Children of Light saw 1.6 million viewers during its first showing. Online viewership for the game on a live streaming platform increased more than four-fold and the game hit 160 million total downloads.

Much of the challenge in wrapping my head around understanding how creativity, commerce, and culture intersect, and then trying to relay it back to my students, lies in synthesizing a few handrails along the way. It won’t be long now before some startup announces generative AI that has been trained on the predictions and analyses by anyone who’s ever had a professional opinion on entertainment markets.

Until then all I’ve got to work with is this organic intelligence.

On to this week’s update.

My TL;DR expectations for 2023

Disney buys a crypto asset

Unionization takes root and bears fruit

Generative AI is everyone’s favorite thing, then turns

Esports faces its toughest year yet

Much of it remains in line with my previous prognostication as the games industry ferries between developing novel business models and building bridges with other entertainment categories.

Predictions for 2023

The last thing most of us need is another middle-aged white guy mansplaining the future. So here goes.

Prediction 1: Disney buys a crypto asset

Wait, what? Yes, in 2023 (possibly 2024) we’ll see the first acquisition of a blockchain-based entertainment company by a legacy entertainment firm. The most obvious case I can think of is Disney acquiring a Dapper Labs-type company. The 2022 collapse in both value and credibility of cryptocurrencies and their associated business models has left a lot of talented outfits quite affordable. Their reliance on a now wildly devalued token has decimated many of their financial coffers, leaving them prone to acquisition. Fiat currency still has a voice here.

For Disney, there are at least two benefits to buying its way into the blockchain. Firstly, there is an easy case to make for use of blockchain for digital collectibles. A vast library of Marvel Comic Universe superheroes and other intellectual properties await to generate revenue in the same way that Dapper Labs’ TopShot has done with digital images and gifs of key moments in sports. The continued marketing of MCU and other properties via digital distribution easily spills over into digital goods that can be bought, collected, and sold.

Secondly, Disney has an opportunity to use blockchain to enhance their theme parks. Specifically, its "theme parks, experiences, and products" business generates around $29 billion annually and is the company's second-largest revenue stream after media and entertainment. Blending real experiences with digital purchases—e.g., collectibles, battle passes that provide VIP access, and loyalty tokens—makes the Disney experience more immersive. Team Mickey Mouse isn’t the only one exploring the novel cross-pollinations between the digital and the real. Niantic Labs is developing what it calls the real metaverse by combining geo-location data and augmented reality experiences. And in mid-2022, former FourSquare CEO, Dennis Crowley, raised funding for his next big idea called Living Cities, which, according to its pitch, mirrors the real and the digital world.

Overall, live event operators and venue owners will start poking around and I expect even a large ticket seller like Live Nation, which reported $6.3 billion in FY21 revenues, is likely experimenting with digital loyalty programs that combine real-world tickets with non-fungible counterparts.

The net result will be the reinvigoration of crypto-currencies and the validation of digital entertainment more broadly.

Prediction 2: Unionization takes root and bears fruit

Finally, it seems. After talking about it on the final episode of the podcast during season 1, we’re barely a few days into the new year and a new video game union has emerged.

Specifically, 300 quality assurance workers at Microsoft subsidiary ZeniMax Media, which it acquired in 2020 for $7.5 billion, voted to join ZeniMax Workers United/CWA and have union representation. According to one anonymous source, “the benefits are fine I just don’t make enough money for them to matter.” Hypergrowth in recent years across the games industry together combined with rampant inflation has put pressure on salaries.

The Communications Workers of America union expressed its support for the $69 billion acquisition of Activision Blizzard after Microsoft agreed to honor the collective bargaining rights of its workers in June last year. I’ve argued that post-acquisition it would go a long way toward a healthier ecosystem in the video games industry, especially given Microsoft’s position as one of the largest firms in the space, even if it is unclear how much this will win it any favors with antitrust regulators who generally focus exclusively on consumer benefit.

It is easy to dismiss Microsoft’s support as an attempt to placate regulators, but it is a stark contrast with other major platform holders who are not so keen. In fact, one could demonstrably argue that in addition to their poor practices around privacy and monopolistic behavior, Big Tech hasn’t really contributed to the economy in the way you’d think they do. According to an excellent book by my colleague at NYU, The Great Reversal, large tech firms such as Google, Amazon, Apple, Meta, and, yes, Microsoft show higher profitability, hire fewer people, and pay fewer taxes. That, and the fact that Microsoft just announced the layoffs of 10,000 employees, makes the recognition of collective bargaining rights all the more meaningful.

The impact of unionization will be felt, however, in more than one way. Sure enough, there will be important guarantees and recognition of the work done by people working in game development. There will also be a more strict delineation of what people can and cannot work on. For example, quality assurance has historically been a part of the development process that everyone at a studio would share. Everyone, from the managers to the QA testers, would test software and do playthroughs to make sure the end result matched their shared creative vision. With unionization comes stricter rules, which means that unless your contract says so, you’re not allowed to do any QA testing. As unionization finally takes hold in 2023, the operational impact will be significant among the 429,000 or so people working in video games in North America.

Prediction 3: Generative AI is everyone’s favorite thing, then turns

It’s hard not to have an opinion on artificial intelligence and its uncanny ability to generate a broad range of digital assets varying from character backgrounds to commodified in-game items (e.g., potions) and artwork. There are two immediate and short-term benefits. The first is the incredible time savings AI will afford. What used to take a week for a small team to accomplish (e.g., put together a demo as part of a pitch) can now, ostensibly, be achieved in a day. When you need to look bigger than you are, having some automagical process that generates cool copy for your website and a flock of tweets will make it easier to generate buzz. AI will accelerate the bottom part of the industry where an extra day, a more efficient tool, and a cheap alternative to more involved, human-created assets can mean the difference between keeping the dream alive or having to look for a job.

The second application is making open worlds more immersive. Perhaps the fastest way to break the spell in an online game is by hearing NPCs say the same handful of phrases over and over. I recall how one dev on the Grand Theft Auto series explained in my classroom the effort a shop like Rockstar makes to ensure that when you bump into a random pedestrian in, say, Hove Beach in GTA 4, which is based on Brooklyn’s Brighton Beach where there’s a lot of people with Eastern European heritage, they respond in a language you’d find there. More so, NPCs will have a wide range of phrases available to respond which prevents mind-numbing repetition. Generative AI will help boost the writing of seemingly innocuous aspects of the game. It is, however, unlikely that legacy publishers will immediately embrace AI. Many of their projects are well underway and a retroactive integration is likely to get downvoted internally for fear of delays.

More important, however, is the deceiving exuberance on the topic of generative AI. Every new technology comes with social questions. For instance, what to make of OpenAI using Kenyan workers for $2 per hour to filter toxic content from its training data. As with the Metaverse, the ‘new’ is generally presumed ‘better’ as a host of self-interested forces conflate a change in technology with progress. Mostly, the proposed applications are presumed positive. Certainly, generative AI will be a transformative technology. But similar to the games industry’s transition to digitalization and, later, the popularisation of mobile, such transitions come both with novel tech *and* a bunch of new problems. The expansion of the addressable audience and available channels came at the cost of lowered entry barriers which resulted in the commodification of gaming content, piracy, and cloning. And incumbent copyright owners should not be discounted. This week alone saw the filing of two AI-related lawsuits: one from Getty Images and another from Matthew Butterick against Stability.ai, Midjourney, and DeviantArt, both roughly arguing the unchecked use of images on the internet as raw training data has resulted in copyright infringement. It is unlikely that risk-averse publishers will hurry to embrace a technology that potentially exposes them to a legal nightmare.

Nevertheless, the prospect of playing with or, better, against specific AI is exciting. In the same way that experienced chess players can tell when someone is cheating by using a computer to dictate their moves rather than making human decisions, I anticipate that soon we’ll see complex gameplay where you try to outsmart the equivalent for Deep Blue but for Marvel SNAP. Sure, you’ve been on a raid with your clan before. But have you tried taking on the smartest artificial Dungeon Master in the history of the game?

Prediction 4: Esports faces its toughest year yet

Despite having survived the pandemic, competitive gaming has fallen rather flat more recently. Declining numbers and a softening market are felt doubly in a nascent segment. But now that brands are getting more serious about sponsorships, their money comes with rules and a need for professionalization. However, selling inventory to brands continues to be an arduous process, reliable measurement has yet to be resolved, and talent is prone to abandon ship once individual players reach star-level status and go solo. Top esports teams are now focusing on non-esports content creation for their live-streaming channels to attract brands.

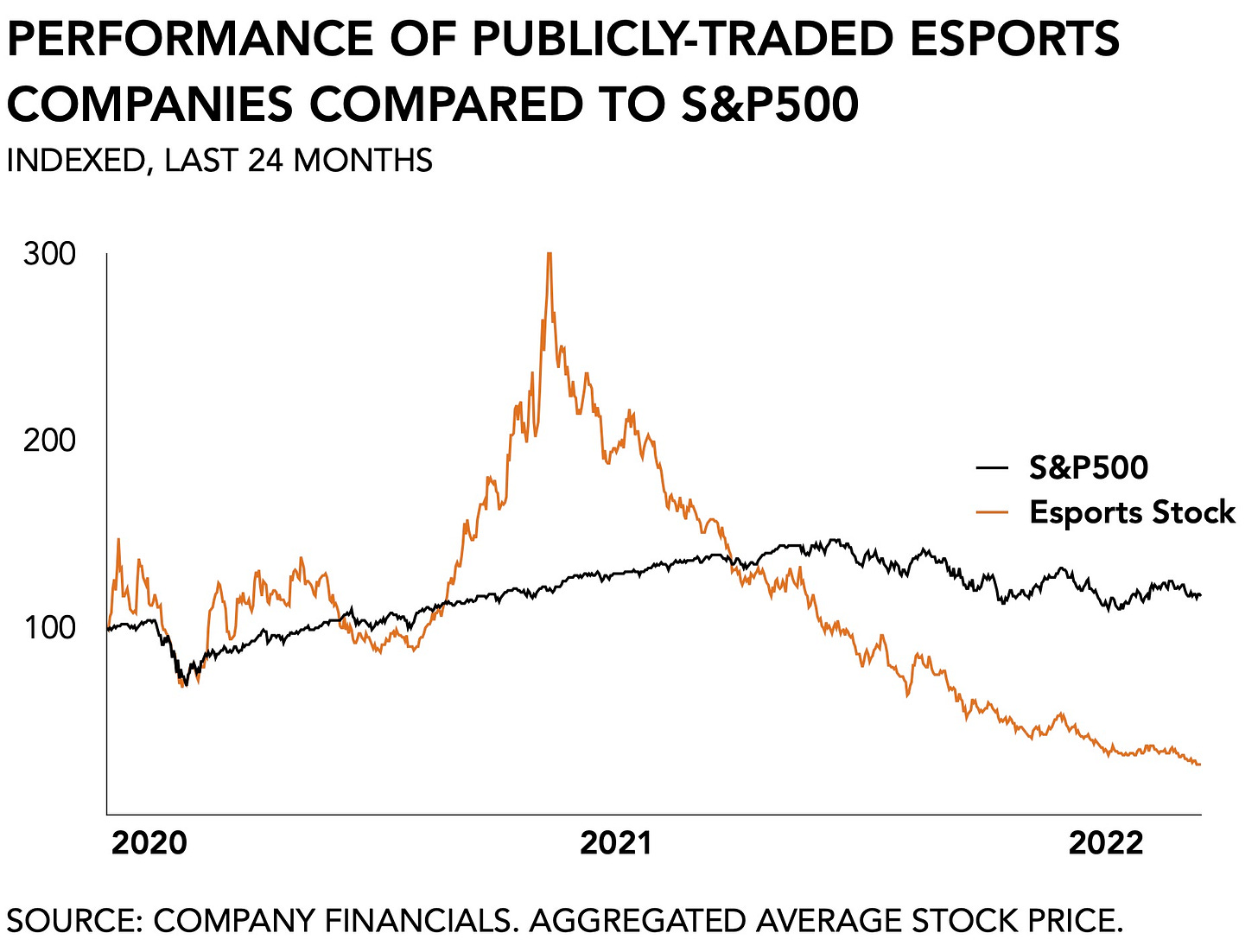

On the consumer side, there is more bad news. For one, there is a notable decline in crowdsourced prize money for events like The International, the world championship for Dota 2. The combined prize pool for the 2022 edition totaled $18.9 million and dropped 37 percent y/y, which is in the same order of magnitude as it was in 2016. As a result, esports firms' share prices are currently trading at about half of what they were two years ago, and down six-fold from their peak in late 2021. For some organizations it is disastrous: after a rally from $4 a share to $13, Esports Entertainment Group saw its value crater and now trades at $0.11 cents. Adding insult to injury, it finds itself roiled in conflict with its former CEO about, you guessed it, money.

Starting the year with a heap of bad news will bring a diaspora of talent, who, like Faker before them, flee the nest to go solo or explore other avenues of monetizing their celebrity. It may negatively impact publishers’ willingness to invest further in the category and look for a buyer.

My expectation is that a top-tier org like Modern Times Group, which still sits at the top of the esports food chain with an enterprise valuation of $467 million, will be a likely candidate for acquisition and be re-homed. A buyout by the Saudi-Arabian Public Investment Fund or Savvy, for instance, to invigorate esports in the MENA region may not be too far off. And if it’s any indication of what’s to come, Messi signing with Sorare as its new ambassador and FIFA pursuing its own NFT project now that it’s divorced from EA, perhaps a hybrid model may emerge. Likely, 2023 will be esports’ lost year.

Rest-predictions for 2023

Yes, Microsoft’s acquisition of Activision Blizzard will go through.

Yes, consolidation in the games industry will continue. Especially smaller firms that have talent (think: Poland) or intellectual property (think: Rovio) will be likely acquisition targets.

Likely, we’ll see a few surprising spin-offs this year, as publicly-traded firms realize their games portfolio isn’t keeping pace with other, more lucrative activities, and that disintermediated assets are better able to capture value than vertically integrated ones.

Likely, gaming venture capital will cool and reshuffle its talent deck.

No, I still won’t get paid *just* to play video games. Damnit.

MONEY, MONEY, NUMBERS

Ubisoft is having a tough start to the year. The firm announced the delay of its Skull And Bones and canceled three other unannounced projects. Wall Street was not impressed and promptly slashed its expectations. Ubisoft’s share price dropped to $4 bucks a share, a price level not seen since 2016. The French publisher is also reducing its workforce. In response, one union representing French video game workers is now calling for a strike to take place on January 27th, stating that the firm has done nothing to account for inflation despite the “hundreds of millions of Euros obtained from Tencent.” I can’t wait to play Assassin’s Creed: Unionization.

Roblox reported its December figures, which were well above expectations. Its DAUs totaled 61.5 million, up +18% y/y, hours engaged were up +23% y/y at 4.7 billion, and average bookings per daily active were flat (-1% y/y) at $7.07. Because the firm has been reporting its key metrics on monthly basis, Wall Street was disappointed to learn the gravy train is ending in April when Roblox will switch over to quarterly reporting and reduce the volatility of its stock.

Microsoft is laying off 10,000 employees, admitting that it, too, is vulnerable to macroeconomic changes. Job cuts related to gaming fell at 343 Industries and Bethesda. It was not a popular decision among industry observers who pointed out that the firm had just committed $10 billion to an investment in AI and reported $198 billion in revenues for 2022 (+18% y/y) at a 68 percent gross margin.

Steam broke a new record of 10 million concurrent in-game players. According to the tracker SteamDB, team Valve keeps on growing its audience. On the same day (January 8), Steam also posted a new record of 33 million online concurrents.

PLAY/PASS

Play. Legendary game investor Mitch Lasky started a podcast called Gamecraft and it is excellent. Strongly recommend.

Play. Last night, Stadia shut down, but not without leaving us with a parting update that renders its controller capable for use with other systems, allowing it to live on.

Play. The writers for Immortality, a film-based crime game that was a lot more creepy than I needed it to be, won an award from the Writer’s Guild of Great Britain. Congrats!

Play. The HBO premiere of The Last of Us broke a bunch of records by drawing over 10 million viewers in its first two days. Seems like mainstream audiences are finally catching up to gamer sensibilities and their affinity for stories that aren’t told anywhere else.

Keeping a class current with how fast games, music, and tech collide is a grind. You could try Mails ai to spin up quick outreach and pull in fresh voices for guest talks or case studies. It makes staying plugged into real examples a lot easier, and your students feel the difference.

Hmm it is interesting to read your first prediction knowing that Disney has been in an official Partnership with Veve (NFT Platform running on IMX Blockchain) since Nov 2021 and releasing premium 3D Digital NFT Collectibles almost weekly there, including many of their IPs such as Marvel, Star Wars and Pixar. With the apparent deep relationship they have with Veve (and the amount of revenues they have generated through their platform) it seems unlikely for me that they would acquire another platform. Veve has even been the official partner of Marvel at ComicCon.