This week two major New York events took place.

The first was the annual marathon. Most Newyorkers gladly put up with the massive logistical disruption to facilitate what is really a massive congo-line snaking through their five boroughs. Less than a block away from where I live in Brooklyn people spent all day along the track to cheer and hang out. In terms of social-cultural relevance, the marathon sits somewhere between Halloween and the Fourth of July.

It has two faces, of course. There’s the party, and then there are the blood, sweat, and tears. Hearing from friends who ran this year, traveled from afar, and, in some cases, literally carried their brother across the finish line was inspiring. Not enough of a reason for me to go running, of course, but inspiring nonetheless. For all the effort these marathoners make, the least you can do is cheer them on.

The second major event was the midterm election. New York historically votes Democrat, with the exception of maybe Staten Island, which voted Republican (again) this time. They are welcome, too.

As a recently naturalized immigrant, I take voting seriously even if it doesn’t really feel like I have any impact on the outcome. New York isn’t a swing state. But there’s something really electric about walking into your designated voting station and watching the excitement. Dozens of volunteers spend their day getting everything set up, following protocol, keeping the lines moving, and answering the same handful of questions over and over. For all the work they do, it would be insulting to not at the very least cast a vote, any vote.

Participating is more important than winning.

On to this week’s update.

BIG READ: The FTX collapse and impact on web3 gaming

It was another big week for crypto schadenfreude as one of the major exchange platforms, FTX, saw its liquidity melt by 80 percent, following $6 billion in withdrawals, forcing the firm to take an acquisition offer from its competitor, Binance. After the world’s fastest due diligence process, Binance pulled out of the deal.

The now seemingly unavoidable crash has the potential to cast a long shadow over crypto-based gaming. In February, FTX announced a $2 billion fund focused on interactive entertainment, arguing that “there are 2 billion+ gamers in the world who have played with and collected digital items, and can now also own them.” By catering to gamer audiences, which often behave as a vanguard consumer group, large stakeholders in crypto-currency have been looking to grow the addressable audience.

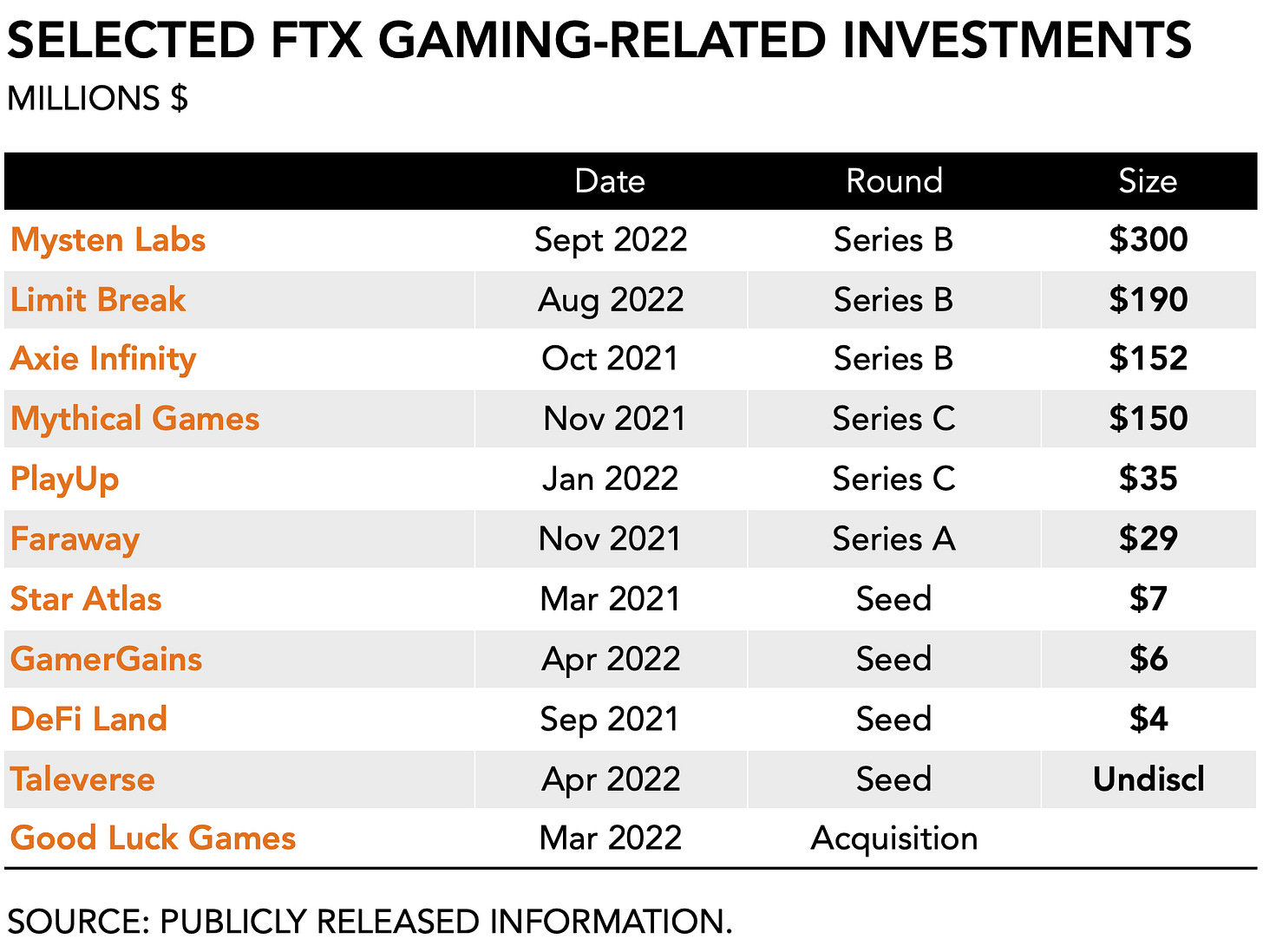

FTX promptly acquired its own in-house studio, invested in Solana-based Faraway and an AI-powered metaverse game called Delysium, toyed with the idea of getting involved with an Indian mobile developer (a games market that I covered last week, ICYMI), and signed the largest sponsorship deal in esports by rebranding one of the top teams to TSM FTX for $210 million. According to FTX boss Sam Bankman-Fried, “taking a huge industry and then reimagining it in a digital age: that’s sort of what e-sports are to sports, and it’s sort of what crypto is to investing and to finance.” The firm’s broad grasp and push into offering a white-label solution for legacy publishers that are crypto-curious but lack the courage to invest directly suggests that its many tentacles may drag down the already sparse set of believers in the novel technology.

My take on the collapse is quite simple: sometimes the worst thing that can happen to a firm is success.

The rapid rise of the FTX’s fortunes resulted in it taking on too many projects. With seemingly infinite resources and limited only by his imagination, Bankman-Fried quintessentially embodied the anti-CEO. But, honestly, you have to wonder how much of it is manufactured. Seeing Bankman-Friend flanked by his Head of Fashion, Lauren Remington Platt, and Brazilian fashion model, Gisele Bündchen, at a conference on altruism feels more like staring at a vertical shit sandwich than an otherwise naturally occurring phenomenon.

As for in-house antics, after initially hiring a string of seasoned executives to help manage the firm’s rapid growth, Bankman-Fried changed his mind. Instead of conceding control to mid-level managers, he insisted on being personally involved in everything. It is the classic telltale sign of a leader who is in over their head and on a path to squander a market opportunity.

The FTX gaming portfolio feels scattered with positions across different asset types (e.g., infrastructure, content creation) and involvement at various growth stages. It suggests a lack of a clear investment thesis beyond sheer involvement. A lack of cohesion combined with massive growth can be challenging.

In the 1980s, Atari lost track of its quality control because of its rapid growth, from $200 million in 1978 to $2 billion five years later. Having to hire hundreds of people to meet consumer demand for its products, meant its corporate culture never had a chance to develop the necessary soft tissue between its 10,000 employees spread across 50 different office locations.

Similarly, toymaker Hasbro, which sought to exploit its competitive advantage of having a leg up on retail relationships and logistics, managed to acquire third-party content so quickly that it utterly failed at installing a proper reporting structure. After losing control over its various divisions, Hasbro’s gaming ambitions became a weakness that left it financially exposed when the Dotcom bubble burst.

And more recently, Mark Zuckerberg seems intent on driving his personal vision of pioneering the metaverse, which he is able to do because he is the primary decision-maker. Despite owning only 13 percent of Meta’s class A shares, Zuckerberg holds the majority of its class B shares, giving him control over the firm. Following a quick catchup to mobile, only to get T-boned by Apple’s ecosystem governance and changes to its IDFA policies, Zuckerberg has set his sights on establishing a first-mover advantage over the next internet. Since its peak of $380 per share in September 2021, Meta currently trades at $90 and announced this week the layoff of 11,000 employees representing about 13 percent of its workforce.

It raises the question of how these large-scale yet poorly-managed bets impact the broader creative environment when they collapse. A billionaire founder losing billions of dollars in net worth makes headlines but what of the small fry outfits toiling to realize their creative vision?

The demise of the FTX does have ramifications for the nascent web3 gaming category. Already a contested space, as both games journalists and developers insist that the technology is exploitative and unnecessary, it would seem that FTX’s decline sets back the goodwill for cryptocurrency and blockchain further. That makes it more difficult for web3 game makers to raise funding, for one.

But the larger problem is yet to manifest. With FTX falling, it takes down with it several other adjacent ecosystems. Bankman-Fried’s firm was an early backer of Solana, which offers faster speeds and lower transaction costs than Ethereum, making it a more suitable cryptocurrency for game developers looking to establish a thriving in-game economy with lots of micro-transactions. According to Chainplay.gg, a web3 game aggregator, there are 148 Solana-based projects. It also notes that 37 percent of investors active in crypto-gaming prefer Solana. That may not be for much longer. Solana’s SOL token has already dropped from $39 last weekend to $16 on Wednesday.

By playing an integral role in the broader crypto-universe, FTX is now dragging several key ecosystems down with it. Ironically, the collapse coincided with the announcement of a $300 million investment Series B round in Mysten Labs, which is led by FTX Ventures, includes NCSoft, a16z, and many of the other usual suspects, and values the firm at $3 billion.

The promise of brilliance can be blinding. Flying close to the sun is par for the course among disproportionally successful entrepreneurs. Just ask Elon. But, maybe once the dust settles, blockchain technology can finally earn its raison d'être if we release some of the hot air and cease the idolization of tech entrepreneurs. As my co-founder likes to say, you can’t argue with results.

NEWS

Esports streamers transition to mainstream content

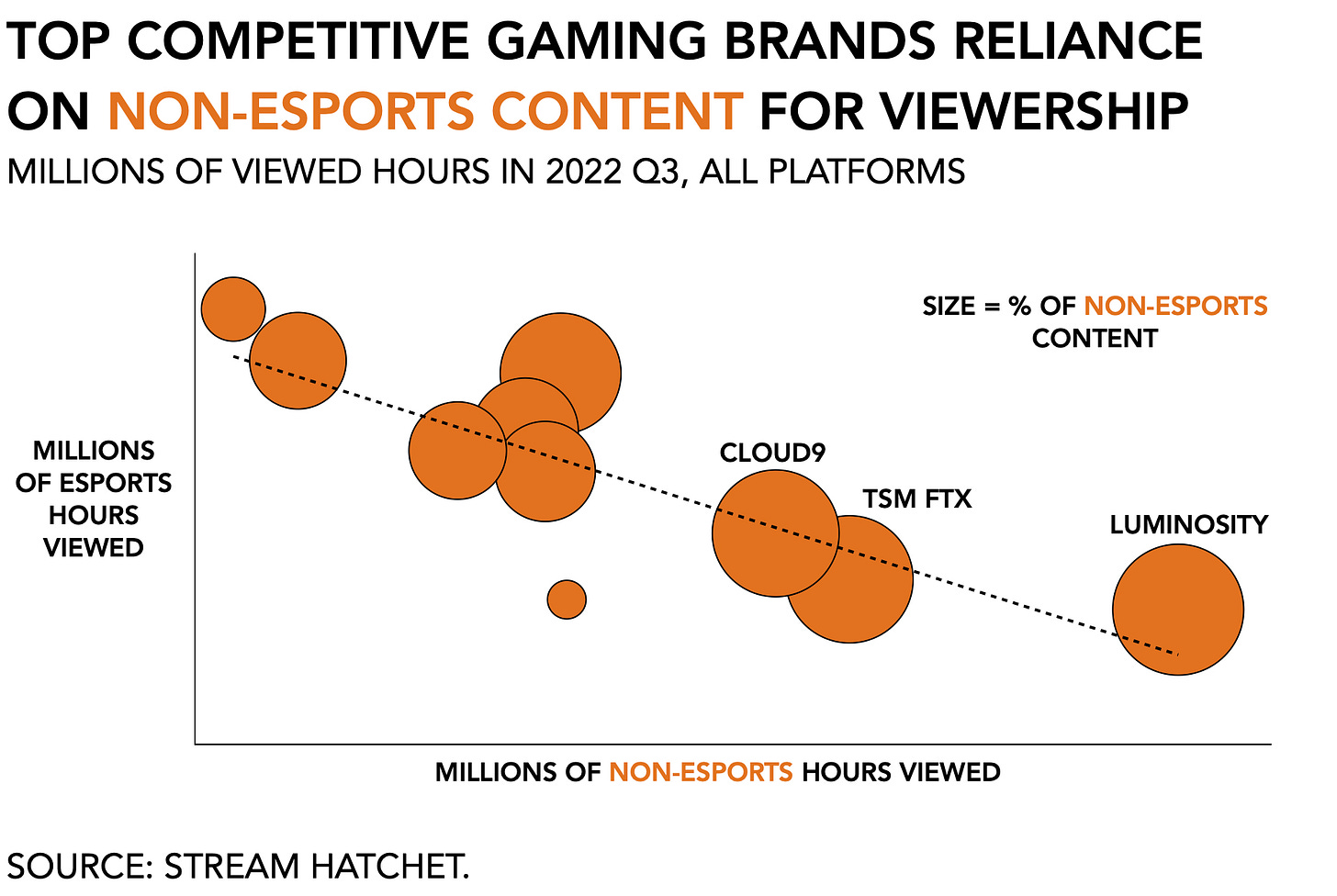

According to streaming tracker Steam Hatchet, 8 out of the 10 most popular esports organizations generated more than half of their total viewing content in 22Q3 based on non-competitive gameplay. Instead of broadcasting competitions and tournament-related footage, leading names like Luminosity, TSM FTX, and Cloud9 rely for 98%, 93%, and 83% on non-esports content, respectively.

It was already clear, of course, that competitive gaming had taken a hit during the pandemic and that FaZe Clan’s overly optimistic $1 billion valuation had to come down back to earth when its financiers defaulted in October. Generating revenue in esports requires a degree of financial finesse and many of the major brands rely on a revenue mix that includes sponsorships, brand activations, and original content creation. Winnings are a modest bottom-line contributor at best.

In total, audiences watched 385 million hours of content across the ten largest esports organizations, roughly two-thirds of which had nothing to do with competitive gaming.

Stranger Things VR game inbound

Together with Netflix, developer Tender Claws announced the 2023 arrival of a virtual reality experience based on the popular show. As a twist, players will take on the role of the fourth season’s arch-nemesis, Vecna. It is unlikely that this one application will prove to be the killer app for VR.

We also learned that the video streaming platform is working on an animated series based on the Gears of War franchise, a post-apocalyptic third-person shooter game riddled with hypermasculine men toting enormous weapons.

It seems Netflix is going to continue issuing press releases around its growing spectrum of interactive activity until we believe that it is, indeed, a formidable game maker deserving of our attention. The main question that emerges from its divergent initiatives in gaming is whether there is going to be a cohesive strategy, or whether we’re just throwing things at the wall here to see if anything sticks.

MONEY, MONEY, NUMBERS

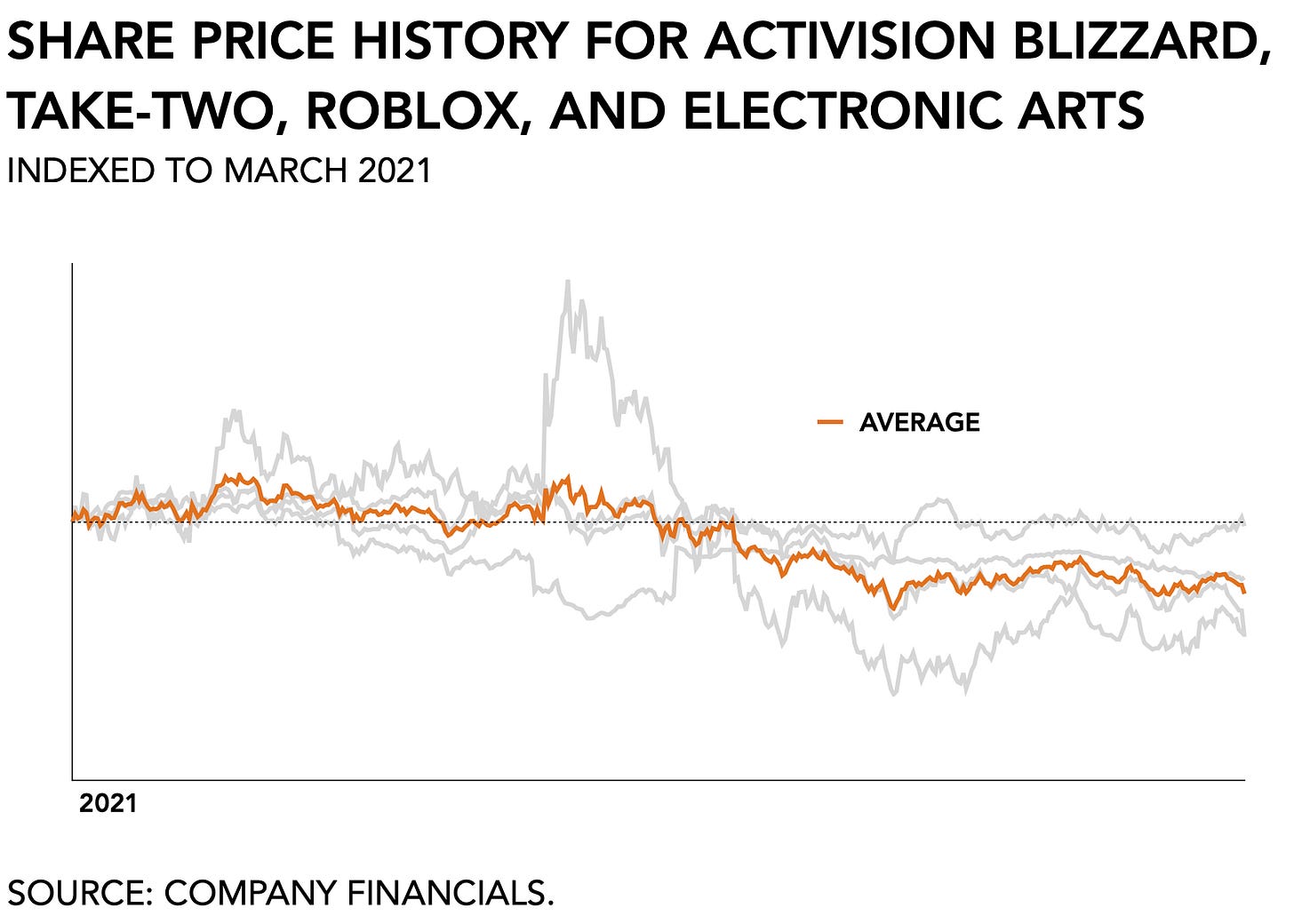

Big themes during earnings calls were weakening macroeconomics (e.g., inflation) and foreign exchange rates. Despite most companies reporting numbers as promised, investors are increasingly weary about the future. Major publishers continue to hold plenty of cash as they enter a rougher period, but softening consumer demand is haunting investors and forcing game makers to lower expectations in the immediate future.

Take-Two Interactive took a beating on the stock market despite reporting $1,505 million in net bookings, compared to a consensus of $1,549 million and a guidance range between $1,500 and $1,550 million. The sell-off was the result of its increased exposure to mobile following the $12.9 billion acquisition of Zynga, and the subsequent $400 million lower guidance Take-Two had to issue for FY23 from $5,850 million down to $5,450 million. Digital revenue represented 94 percent of total net bookings (versus 95% q/q and 89% y/y). As Take-Two’s share price has steadily declined over the course of the year, it has attracted more investors and encouraged analysts to recommend the stock, all because of the high expectations for Grand Theft Auto 6 which should put the stock in the $120 range, up from $94 today. According to Stream Hatchet, GTA V was the top title across all live-streaming platforms with a total of 443 million hours watched in 22Q3. In an interview with CNBC, CEO Strauss Zelnick made a few notable comments, including that (1) he believed the likelihood of the ATVI/MSFT deal going through to be lower than he thought at the initial announcement, (2) the deal would not meaningfully impact the competitive landscape and that there really was only one “big company” who thought otherwise, and (3) we will not be spending our day in the metaverse.

With $1.829 billion in net bookings, which was down -3 percent y/y, Activision Blizzard came in above Wall Street’s forecasts. In particular, the firm’s mobile bookings impressed with a +20 percent increase compared to an industry average of -13 percent y/y. Drivers of its mobile success were Candy Crush with a +8 percent increase in bookings y/y and Diablo Immortal. Its three divisions generated revenue as follows: Activision Publishing earned $480 million, Blizzard $543 million, and King Digital $692 million. But, yeah, let’s talk about Call of Duty the whole time. Wall Street’s share targets remain at $95 a share, consistent with Microsoft’s $69 billion buyout offer, even as both anti-trust watchdogs and the acquirer are fortifying their respective stances. On Tuesday, the European Commission issued a statement stating that its preliminary investigation showed the merger may significantly reduce competition and that it would give Microsoft the ability and economic incentive to make life harder for Sony. A week earlier, Microsoft said it would not make any concessions, probably because it’s been telling everyone that it wouldn’t disadvantage Sony on Call of Duty but regulators aren’t listening. Overall, Activision Blizzard is doing well as Call of Duty: Modern Warfare II reported $800 million in revenue within its first three days, compared to Call of Duty: Black Ops II which took 15 days to reach that number. The publisher generously compared itself to other blockbuster entertainment releases like the movie Avatar. (Of course, even a success like Avatar was the first release in the franchise’s history, where CoD has been publishing a new edition every year for an extended period, allowing it to build a loyal fanbase and mitigate a lot of its associated capital risk.)

Roblox reported $701.7 million in bookings, versus a consensus of $686 million, and up +10 percent y/y (and +15 percent on a constant currency basis). The game’s audience continues to grow, evidenced by an average daily active user base totaling 58.8 million in 22Q3, up +24 percent y/y from 47.3 million in 21Q3, and a total of 13.4 billion engagement hours, up +20 percent y/y from 11.2 billion. However, with its user base expanding, Roblox appears to be attracting less valuable users, since average bookings per DAU were down -11 percent at $11.94. In digital service-based games there generally exists a downward push on per-user earnings as the total player base expands. Ultimately this pushes a publisher to explore accretive revenue streams (e.g., advertising) even if at first the audience expansion brings positive network effects. The momentum of user-generated content seems to keep track, with developer exchange fees in 22Q3 up +17 percent compared to 21Q3. In the firm’s own terms, there were 1,520 content creators that each created experiences generating more than 100,000 hours of engagement, up +54 percent y/y.

Social casino developer Playtika reported $648 million in 22Q3 revenue, above a consensus of $642 million, and up +2 percent y/y. Its casual portfolio drove its gains, with a +14 percent y/y increase, and now accounts for +55 percent of the total company earnings. Its star titles were June’s Journey, which was up +33 percent y/y, Bingo Blitz (+15 percent y/y), and Solitaire Grand Harvest (+14% y/y). By comparison, its casino portfolio declined -10.2 percent y/y, with revenue from Slotomania down -12.7% y/y. Its monthly active user base totals 30.2 million in 22Q3 compared to 35.4 million in the same quarter last year.

PLAY/PASS

Pass. Former Oculus developer, Palmer Luckey, is now exploring VR experiences so immersive that if you die in virtual reality, you die in real life, too. I’m hereby issuing a formal Bond-style villain alert.

Play. Here’s a Minecraft-style Pokémon game called Pokewilds that “uses procedural generation to create large worlds with different biomes, each with their own unique monsters” and is playable on Windows, Linux, and Mac. (h/t Bastiaan Vroegop)