Following a week of watching one of the most powerful tech execs have full-blown midlife crisis, combined with earnings season, I refuse to use the M-word. It’s like I’m stuck in that restaurant in Being John Malkovich where everyone is John Malkovich. Oy.

On to this week’s update.

NEWS

Devolver Digital floats IPO with a $950 million valuation

The maker of Hotline Miami, Loop Hero and the Shadow Warrior raised almost a billion dollars on the London Stock Exchange. Following an undoubtedly massive year in 2020, which earned the firm a bundle due to the acquisition of developer Mediatonic’s Fall Guys by Epic Games for which Digital Devolver had been the publisher, the firm is now using the momentum for its floatation. Details remain limited as they are restricted to UK-based investors (thanks Brexit!).

However, the Twitter-verse tells us that Devolver Digital has proven rather successful in putting together a diverse portfolio. In 2020 the top 5 titles accounted for 41% of revenues; the top 10 accounted for 62%. This makes the firm less vulnerable to fluctuations traditionally associated with hit/flop releases. Similarly, the firm also has a risk-mitigating spread across devices: 46% of 2020 revenues came from PC, 37% from console, and 17% from mobile. The firm plans to release between 12 and 15 titles annually. In terms of geographical markets, it relies predominantly on North America and Asia which account for 26% of sales each. It should serve the firm well that it has the support of both NetEase and Sony, which hold an 8% and 5% ownership share, respectively.

Roblox flatlines for three whole days

The muffled sighs of a thousand parents screaming was heard across Brooklyn when Roblox went black. It is a rather major event, of course, to have a $50 billion go offline, especially because it prides itself on having its own infrastructure. I expect a not insignificant amount of seasonal revenue was lost during the Halloween weekend. Link

Netflix switches on game offering on Android

Judging by the zany announcement, Netflix game lead Mr Verdu was in his glee about the accelerated rollout of five of titles based on Netflix IP. I’m guessing the firm got itself a sweetheart deal with Google, and soon, too, with Apple, as the service pushes you into the Google Play Store to download the games. Currently the biggest draw is undoubtedly the fact that Netflix got into gaming in the first place, but the longer term success will depend on whether these will be merely spin-offs as a shallow attempt to keep you in the app longer.

BIG READ: Crypto games culture war

Change generally comes with a bunch of people yelling.

A decade after the slow process of begrudgingly accepting free-to-play monetization, the games industry now steels itself to fend off another foe: blockchain gaming. Following a surge in activity around cryptocurrencies and non-fungible tokens over the past months, the games industry is proving deeply divided on whether or not to adopt the novel technology.

Two camps have started to emerge.

To some blockchain technology offers novel game play mechanics, most eminently in the form of ‘play-to-earn’, and a much-needed redistribution of control to the benefit of the player. Bolstered by skyhigh valuations and abundant venture capital, these firms already fancy themselves a generation of disruptors. Crypto good.

Others abhor the idea. Here we find a familiar argument that games should necessarily live outside of real-world economic pressures and any form of integration monetization invariably corrupts the experience. Trade publications endemic to the industry have so far largely echoed the sentiment, arguing that Ubisoft drank the crypto Kool-Aid when it announced plans to develop blockchain games. Crypto bad.

Both camps are wrong, of course.

Despite their current momentum, blockchain game makers aren’t as disruptive as they think they are. Supercharged by their belief they have already conquered the games world (they haven’t), crypto-gaming firms are merely at the start of a longer trajectory. The number of people actively playing this new category of games is growing, certainly, but it can’t hold a candle to the size of the more traditional markets of PC, console, and mobile.

Simultaneously, an outright dismissal of blockchain is to throw the baby out with the bathwater. The technology is pregnant with promise, especially around the facilitation of digital ownership. Just a decade ago few believed that audiences would be willing to pay for downloaded titles. Why, they argued, would anyone give up owning a physical copy of their games? Along the same lines, free-to-play was no one’s favorite until it was: because consumers wanted it.

It has nevertheless resulted in a rather vigorous response from game makers who risk missing out on a potentially new watershed moment in gaming because they are hung up on blockchain’s weaknesses.

Throwing rocks at crypto

Many forget that one of the fundamental drivers behind the industry’s current success has been the ability of game companies to embrace innovation and technological change where other entertainment industry did not. Music executives fought for years against digital distribution but it was streaming that ultimately allowed the industry to return to growth. During its early years Netflix used to get laughed out of the room. Game companies, however, built their success on figuring out how to create new experiences and business models around emerging technology.

ICYMI, Valve created its digital distribution platform Steam way back in 2004 and opened it up to 3-party content creators which, in turn, reanimated the presumed-dead PC gaming category and allowed it to flourish. Sony managed to transition its now $23 billion a year games division from a predominantly product-based model to a digital one in which packaged software sales now represent just 4%. At its peak in 2018, Epic Games’ Fortnite generated $5.5 billion dollars after successfully convincing every single platform holder in the industry to allow for crossplay. The reason why games are a mainstream form of entertainment today is because its industry decision-makers see opportunity where their colleagues from adjacent amusement categories did not.

Ponzi play

The first tenet of the general criticism is that crypto-gaming is no more than a Ponzi scheme. Its growth depends on a continued influx of new players that are expected to spend. This, in turn, increases the price of different crypto-currencies and non-fungible digital assets which ultimately benefits the people that got there earlier, including, in some case, the developers themselves. It sets off a fear of missing out on a global scale as players, developers, and investors hurry to get into the pool.

At face value that seems accurate. The entry fee for crypto-gaming’s poster child, Axie Infinity, runs around $1,000 as aspiring players find themselves having to purchase not one but three of the game’s creatures to get started. French collectible card game unicorn Sorare does the same. You can see how this makes a clear argument that games, and the broader market for NFTs, center on ‘getting there early’ in the hopes of flipping creatures, cards, and collectibles to the next available customer.

It also positions blockchain games as opposite from, say, mobile gaming. Different from their peers in console gaming, mobile game developers prided themselves on making games as widely available as possible. We were told that Zynga, a firm valued at $8.2 billion today, was “connecting the world through games.” And Candy Crush-maker King, really just wanted to “make fun and simple games for everyone” right until its $5.9 billion acquisition by Activision Blizzard.

It was all part of the mythology, of course, because even though contemporary gaming likes to think it is so very different from blockchain gaming, it really isn’t.

The bulk of contemporary game makers target a narrow subset of disproportionately high-spending players. The free-to-play economy relies heavily on an underlying system of unit economics that drives its digital marketing and user acquisition. Its use of short time periods of, say, thirty days, to accurately target and acquire high-spending users is different from conventional marketing campaigns that throw money in all directions in the hopes it leads to purchases. Digital marketing lives and dies by monthly cycles where next month’s budget is determined by how well your campaign performs today. Free-to-play gaming on mobile and PC pretends to focus on the largest possible audience but really don’t.

And as for the high entry fee, it goes to the credit of Apple and its peers that we’ve become entirely accustomed to the fact that smartphones cost $1,000 to $1,500. Somewhere along the line we became okay with the idea of paying the equivalent of three consoles or a tricked out PC for a phone. These services are only democratic if you manage to squint past the price tag.

Cheaters

Rampant fraud, rug-pulls, and the subsequent volatility presents a second source of contempt for crypto. For all its trustless innovation, a lot of people still seem to be losing their hard-earned money to others. It ranges from those who would take advantage of weaknesses in the technology itself to luring newcomers with promises of free digital money, only to rob them of their real money. That’s too bad and may yet have far-reaching consequences as it deters a wider audience from transitioning to web3 for fear of getting taken for a ride.

But let’s not forget how web2 hasn’t really served audiences either. The clumping together of several tech titans that now govern and encroach on practically all aspects of daily life is, to put it lightly, alarming. One interpretation of last week’s rebrand of Facebook to Meta (smh) is that it’s a big distraction from the firm’s infractions against user privacy rules and its contribution to the decay of online life. Instead of facing those challenges and properly resolving them we are treated to a broad scale PR campaign that’s trying to get us to look in a different direction.

Is it petty theft conjured up by some bedroom hackers? No. Is it profitable lying? Yes. One of the great affordances of web3 is that it puts users in charge of their own data: you connect your wallet which contains your crypto-currencies and NFTs to a service to access it. You can also disconnect it. Log out of Facebook and you lose everything but the platform retains all.

The worry about fraud in blockchain gaming, then, reads a lot like the anxiety around digital distribution. What if it’s just a temporary market inefficiency? A decade ago, Steam prided itself for finding a way to supply games to the Russian market. Its CEO, Gabe Newell, considered piracy nothing more than “a service problem.” More conventional product-focused publishers abhorred emergent markets for their lack of respect for and enforcement of copyright law.

And staying with Steam, it’s been a leader in user-generated content and the facilitation of payouts to hobbyist creatives. But only to the extent that it serves its own interests. In recent years startups like Mod.io (disclosure: a Makers Fund portfolio company where I’m an advisor) and Overwolf, which recently raised $50 million, are looking to establish a fair and transparent exchange between publisher, player, and modder. Here, too, web3 technology could provide a significant acceleration and facilitation of user-generation content. Steam rejects all things crypto because it does not serve the platform’s interests and not because it is to the benefit of its user base.

For-profit play

A third point of criticism is what I’d like to call the Wizard of Oz problem: once you see behind the curtain, the magic disappears. But so often do game developers take a pure-play position when their players don’t quite care as much.

Certainly, when it comes to play, establishing a deep sense of immersion is both necessary and often the objective itself. Corrupting this with earthly realities like a revenue model that drags you out of the mindspace and interrupts your flow is one of the most haunting things for game makers.

It’s understandable then that many take offense with the tagline we see everywhere in crypto, namely that YOU CAN MAKE MONEY. Foregrounding the ability to earn changes one’s motivation and makes it almost impossible to recover a more noble motivation. The parallels between blockchain gaming and gold farming are obvious.

But let’s not pretend that most creative talent is in it just to have a good time. The profit motive is a form factor to game design as much as hardware specifications are. Great games find a unique blend between how it entertainment and generates revenue. In a 2012 post-mortem on arcade games, Ed Logg, a former arcade game designer for Atari, shared the results of a 1985 field test of Gauntlet, a multiplayer arcade game, compared to its contemporary peers. By allowing up to four people to play together, a single arcade cabinet would generate several times more than its single-player counterparts.

Contemporary games are equally difficult to separate from their financial underpinnings. In mobile gaming we have literal ad networks and back-end tech firms like AppLovin, valued at $37 billion, that have started to vertically integrate by acquiring content studios rather than merely providing their services. Machine Zone’s stellar success during the earlier days of mobile gaming was a result of its incredible back-end infrastructure and much, much less so because of its amazing design.

Games, in effect, are microcosms of the broader socio-cultural contexts in which they occur and, as such, built on pervasive practices and principles. Figuring out how to maximize return in exchange for fun has been part of the industry’s blueprint since the literal beginning. Considering game development some pure artform that exists outside of an economic reality is naive.

Green games

Critics of crypto have pointed to the negative environmental impact of the technology. As more people come online, the energy necessary to keep ledgers uptodate increases. The two biggest crypto-currencies, Bitcoin and Ethereum, are relative energy hogs. So much, in fact, that the Chinese government ordered 26 local Bitcoin mining facilities to cease operations because its claimed almost 10% of available hydropower in the region of Sichuan.

The problem with this argument is two-fold. First, games rarely use Bitcoin or Ethereum. The former, which currently trades around $62,000, is too expensive and cumbersome. The latter does sit at the center of a lot of NFT action, but the success of Dapper Labs and Axie Infinity operates on top a so-called layer 2, or L2, chain. Precisely because using Ethereum directly meant that trades in Axie Infinity became slow and far too expensive, its publisher Sky Mavis introduced Ronin.

And it’s a bit like the pot calling the kettle black. The games industry has always had an environmental impact. According to one 2019 study, gaming in the US represents $5 billion per year in energy expenditures, the equivalent of 85 million refrigerators or over 5 million cars. It amounts to around 2.4% of residential electricity nationally.

More so, smartphones continue to use a slew of components such as gold, cobalt or lithium and produces more greenhouse gasses than any other consumer electronic. As is customary practice among Apple and their ilk, planned obsolescence has created a constant hunger for newer, better, and more. And while the device maker has committed itself to greener ways, the environmental impact of the existing 3.5 billion or so handsets currently in use will take some time to whittle down.

Venture hype

A fifth and final accusation originates in the VC-funded frenzy around crypto. In their thirst for new markets and the next new thing, investors have been deploying massive amounts of capital in crypto. And, from my perch as an advisor to Makers Fund, I can attest that startups are getting peppered with questions of NFTs and related accoutrements. Such is the frenzy that ‘fun’ has seemingly ceased to be the primary objective.

And it’s not just VCs, of course. Immediately following the Facebook rebrand on October 28th, you could hear the cogs spinning. Suddenly all things metaverse increased in value. For example, Decentralaland, which describes itself as “a virtual world owned by its users,” recently hosted its Metaverse Festival. Investors must have felt that anything associated or labeled as metaverse prior to Facebook’s announcement would turn to gold. Subsequently the price of Decentraland’s crypto-currency, MANA, shoot up from about $0.79 to $3.55.

That is surprising because neither Deadmau5 nor Paris Hilton, both of whom featured at the Metaverse event just a few days earlier, managed to move the needle on MANA. Also, DappRadar recorded an underwhelming peak of 184 users over the last 30 days. Oof. MANA is priced on anticipated future performance rather than current activity. At the time of writing MANA is trading at $2.50 and continuing to decline. It provides evidence to the claim that valuations are wildly exaggerated and disconnected from any type of meaningful activity.

Certainly the amount of money sloshing around is substantial. But not unparalleled. In fact, that’s what venture capital is for: it funds both the creation and excitement for novel businesses. To blame it for creating hype around what they believe to be a disruptive technology is to misunderstand venture capital completely.

And how is this different from the 16-year long climb that current industry darling Roblox took to get to where it is today? For a solid decade it had been dismissed and ignored until, suddenly and rapidly, it found its groove.

Change write large

Blockchain game makers are enjoying a moment in the sun. It’s understandable that they believe they are on top of the world. But just because you show up just now what all your millions does not mean you have all the answers quite yet. One thing that would go a long way toward finding common ground is to build some institutional knowledge and not dismiss the lessons from the past 30 years too easily. Blockchain would deliver something unique if it kept a focus on fun rather than finance, and made an effort to solve some of the issues that have been haunting the industry.

One way is to position blockchain gaming as a harbinger for a broader shift. It offers a way for audiences to familiarize themselves with a new technology and web3 at large. Among its different manifestations is, for instance, decentralized finance, or DeFi, which promises to do away with many of the existing inefficiencies and self-serving practices imposed by the conventional banking system.

There is also the budding phenomenon of decentralized autonomous organizations, or DOAs, in which a group of like-minded or similarly-interested individuals can participate by way of voting on how the group spends its resources and prioritizes activity. Built on trustless tokenization, DOAs rely on a ledger system that allows people to hold currency that facilitates governance. These emerging social structures no longer rely on the often haphazard social connectivity and politics that characterize many of the dominant existing hierarchical organizations.

Even mobile’s disruption was a trickle before it was a flood. Mobile gaming grew as fast as it did, and is having a much harder time today, because it enjoyed a massive influx of new users in its early years. There was the novelty of a glitzy smartphone that had materialized directly from Steve Jobs’ galaxy brain. Naturally, it proved irresistible to consumers. But for all its disruption it lacked basic functionality such that you’d have to purchase a separate app to obtain copy-and-paste functionality. And the early days of the App Store were a hot mess as Apple found its bearings. Even the quintessential text book example of a disruptive technology was riddled with errors and inconsistencies during its early stages.

Finally, the angry response and vilification of a brand-new baby technology distracts from a range of endemic problems. How quickly have we moved on from toxic work environments, a total lack of unionization in the largest entertainment industry in the world, a shameful absence of diversity when it comes to board seats and decision-makers, and, oh, crunch time. It seems ironic that a senior technical engineer from Bungie would call a novel way to extract value like NFTs “harmful to games” while working at a studio that admittedly struggled with crunchtime for well over a decade.

Much of the critique of crypto seems unfounded, poorly researched, and a distraction from bigger issues. Understandably, many of its critics have spent years on the fringes themselves. Now, as the incumbent creative class, it must be odd to admit and recognize the ascension of a new generation that holds different ideas. Blockchain game makers are exuberant and naive, certainly. But these are baby steps. And first stumbles may yet turn into a stride.

MONEY, MONEY, NUMBERS

I’m told it’s called “earnings szn” because we’re paying by the letter, apparently. Anyway, first nmbrs are in. Letsa go.

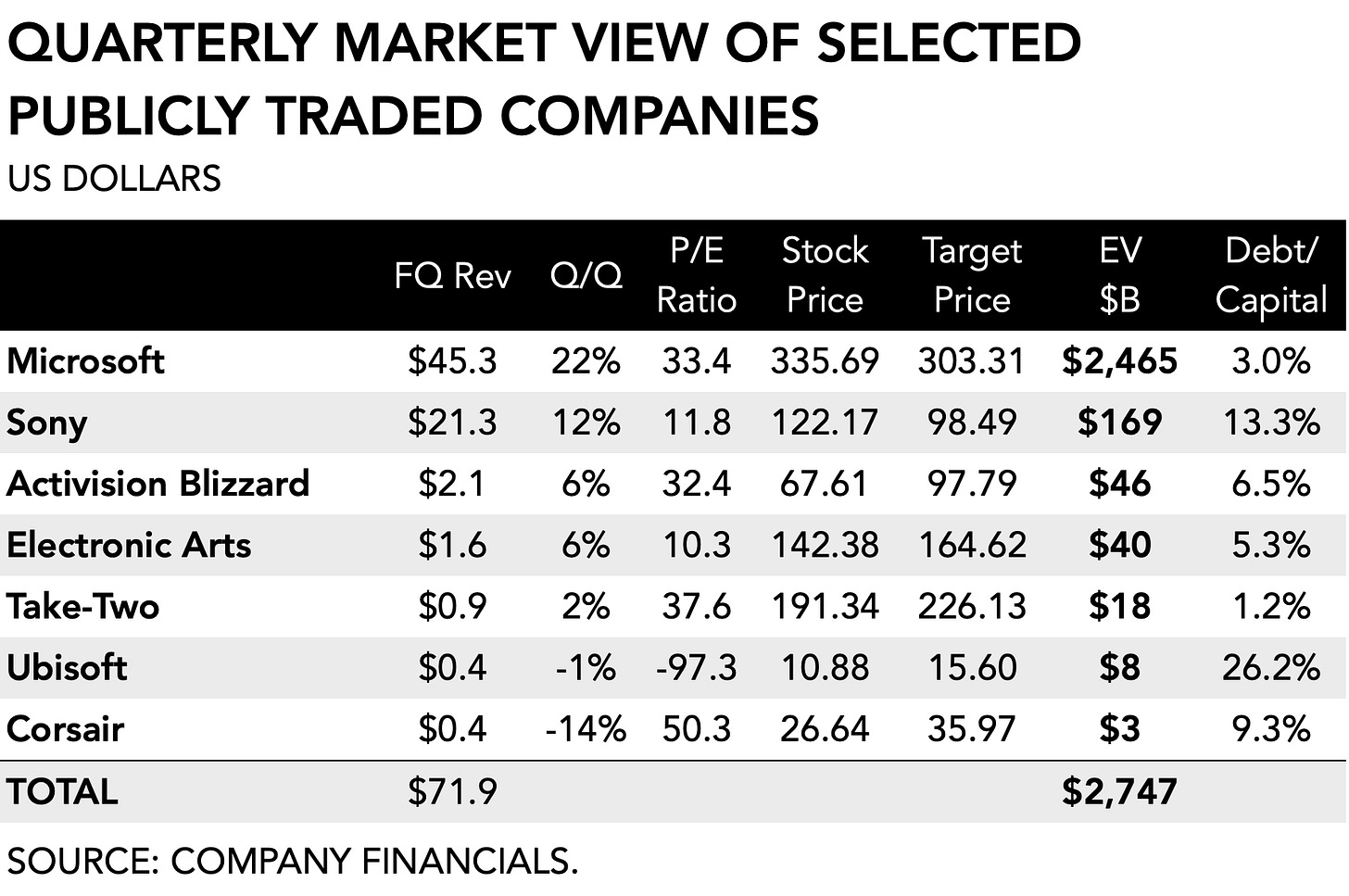

Ubisoft’s performance was down -5% with reported net bookings of €718 million for the first half of 2021 compared to €754.7 million y/y. Back-catalog sales drove the bulk of sales and were up +20% compared to the same quarter a year earlier. Top performers included Assassin’s Creed Valhalla, Rainbow Six Siege, The Crew 2, Watch Dogs Legion, and For Honor. Ubisoft explained the softer revenue figures by calling 2021 a “normalized” year compared to momentum it saw as a result of the pandemic. Compared to net bookings in 2019, numbers were up +9%. Link

Microsoft’s gaming revenue was up +16% y/y at $501 million as a result of a +166% increase in Xbox hardware sales. It also reported a +2% increase in its content and service revenues. It disclosed that first-party titles, including Hellblade: Senua’s Sacrifice, Microsoft Flight Simulator, and The Elder Scrolls Online improved engagement for its Game Pass program. Microsoft also announced it is exploring a strategic alliance with SEGA to “optimize development processes.” Gotta go fast.

Sony’s Game & Network Services division reported $5.6 billion in revenues, led by Add-on content as the largest category with $1.71 billion in sales. Hardware sales jumped from 8% of total to 25% ($1.46 billion) due to the success of the PlayStation 5 which sold 3.3 million units in 21Q2 and reached 13.4 million in lifetime sales. Packaged software sales now represent a measly 4%, or $260 million in sales. As expected, the Japanese firm had expected to sell more PS5 units if it hadn’t been for the chip shortage, according to its chief financial officer, Hiroki Totoki. Link

Despite booking $1.9 billion, a +6% increase, and maintaining guidance of $8.7 billion for FY21, Activision Blizzard is having a rough week. Both Overwatch 2 and Diablo 4 are delayed because, according to management, they need additional development time and there’s been significant employee turnover at Blizzard. The cherry on top of the latter is the departure of Jen Oneal, one of the two leads put in place in response to the recent lawsuit against the firm’s toxic work environment two months ago. Oh, and BlizzCon 2022 is cancelled.

King Digital managed to side-step any impact from Apple IDFA antics, and generated $652 million (+22% compared to same quarter last year). Blizzard came in at $493 million for the quarter (+20%), and Activision was down -17% with $641 million in revenues. The company has $10 billion on its balance sheets, which ameliorated some investor sentiment who are hoping for the chance of up to $4 billion in authorized buybacks. What seemingly got lost was the first acquisition in years, with the purchase of Digital Legends which is expected to further the success of Call of Duty Mobile. Wall Street wasn’t super impressed and ATVI’s share price dropped to $67, down from a high of $103 in February.

As previously announced, Corsair reported disappointing revenues at $391 million, which means a -14% decline y/y and -17% q/q. Its Gamer & Creator Peripheral division declined to $139 million (-14%) and now represents 36% of total earnings. The firm’s leadership suggested that it suffered a $100 million loss in 2021 sales due to the shortage in semiconductors and didn’t offer a clear plan on how to make up for it. Because of the delay in supply and growing demand, prices for GPUs have increased to the point where consumers are waiting for the market to cool off. Consistent with anticipated supply chain issues, Corsair’s shipping times have doubled and it suffered a decline in margins due to higher freight costs. Investors were comforted by Corsair’s continued output of new product, including its gaming monitors, which is estimated to present a $140 billion addressable market, and its webcams ($1 billion TAM).

EA delivered its strongest quarter ever with $1.851 billion in bookings, outperforming both guidance ($1.725 billion) and consensus ($1.754 billion). The +103% y/y growth was the result of Apex Legends and FIFA Ultimate Team. The October 1st release of FIFA 22 had resulted in higher engagement among existing players (+16% y/y) and new players (+50% y/y). The firm is at risk of losing the rights to the FIFA brand as negotiations have stalled. Management has been defiant, effectively arguing that it no longer needs it. According to the NY Times, the publisher recently registered the more generic "EA Sports F.C.".

To drive the success of its Apex franchise, EA has been working on localization (e.g., language, cosmetics) to capture a larger piece of the global market, which, according to management, paid off well in Japan. So far Apex Legends has generated lifetime earnings of $1.6 billion and slated for a mobile release in 2022. Following the acquisition of Playdemic earlier in Q2, EA is looking to expand its presence in mobile gaming. Link

Take-Two Interactive beats expectations with $985 million in revenue for the quarter, compared to a consensus of $867 million and guidance of $865 million. NBA 2K22 was the biggest contributor to its performance, having sold 5 million units to-date and yielding a +58% y/y increase in new user spending. The GTA franchise continues to print money, too, with 155 million units sold and the second strongest quarter ever for recurrent revenue (+33% y/y) and an +11% increase in its active player base. Its July 20 release of the Los Santos Tuner update helped drive momentum, according to management.

TTWO’s mobile division, which accounts for about 10% of total revenues, is gaining in strength as Two Dots reached its highest bookings quarter ever since its acquisition and WWE Supercard continues to perform well. So far, the firm claims to have found little interference from Apple’s recent changes to its IDFA program. TTWO also cancelled a $53 million project that had been in development, stating that the project had become “commercially unviable.” Finally, digitally earnings grew +9% and now account for 89% of total bookings. The firm reported that 65% of console game sales are delivered digitally (+57% y/y).

[Updated: Minor table fixes 11/04/21.]

PLAY/PASS

Play. Renegotiating personal space will never be the same and is outright awkward in a world of introverts. Higher ed provides some helpful tips.

Play. The Skyrim boardgame. Try me and see if I won’t cast Fus Ro Dah on this whole damn table.