The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

In two days I will board a flight to Los Angeles for a fireside with Unity CEO John Riccitiello at this year’s Gamesbeat Summit.

JR, as he is known, and I first connected over a decade ago. One thing that’s particularly helpful about the American capitalist system is the proximity to power. I, a nobody, was in year two of my bootstrapped startup, SuperData Research, and managed to get a 15-minute phone call with the CEO of Electronic Arts. We discussed the games industry’s transition to digital distribution.

Needless to say, I had been quietly in awe of the man. Around the time of our first interaction, EA generated $4 billion in annual revenues, which made it the third-largest game publisher in the world after the recently merged Activision Blizzard and Sony. He had been the one who threw down the gauntlet and signed a five-year exclusive agreement with the NFL in the early 2000s to cement Electronic Arts as the premiere sports video games publisher. He had been doing Big Things while I was merely reading the case studies it produced.

That phone call proved instrumental for two reasons. First, hearing him ask me questions about how to measure digital games was encouraging. Year two in any startup is arguably the worst year. After the initial honeymoon phase of “going out on our own” had well worn off, our tiny business was broken and scattered. Having a big-time CEO share his curiosity meant we weren’t the only ones seeing the potential.

Second, he proved much sharper than I expected. I had always imagined senior decision-makers to be mostly alienated from the actual machinations of whatever business they led. Not JR. Despite his encouragement, he still managed to grill me on the specifics of our data model (we didn’t cover mobile gaming as well as he felt we should) and left me with several years of homework.

In spite of this appreciation, when we take the stage on Monday, I don’t plan on letting him off easy. His current company, Unity, is having a rough time. Recently it announced another 600 layoffs, after lowering its financial guidance not once, but twice last year. It currently trades at $30 a share, down from a peak of $200 in 2021 and $53 last year when AppLovin offered to buy it. Yes, Unity’s enterprise value has dropped from $15 billion to about $13 billion, but the aspiring acquirer AppLovin has come down even more so, from $17 billion to $11 billion. Wall Street seems really excited about the firm’s acquisition of IronSource and the mobile ad market bottoming out. In hindsight, rejecting AppLovin’s $20 billion deal was the right move.

Being able to discern what trends and technologies matter, and which don’t, is a key survival skill. It is the type of foresight that is earned through experience, not by financial modeling in an air-conditioned cubicle. In our prep call earlier this week, JR mentioned that during an hour of analysts’ questions following the firm’s most recent earnings, “56 minutes” were spent on artificial intelligence and not much else. That is entirely unsurprising because AI is the future now. But we have seen such cycles before, leaving me deeply skeptical that AI can build businesses the way hard-earned organic intelligence can.

Let’s find out in LA.

On to this week’s update.

EU watchdog approves ATVI/MSFT deal

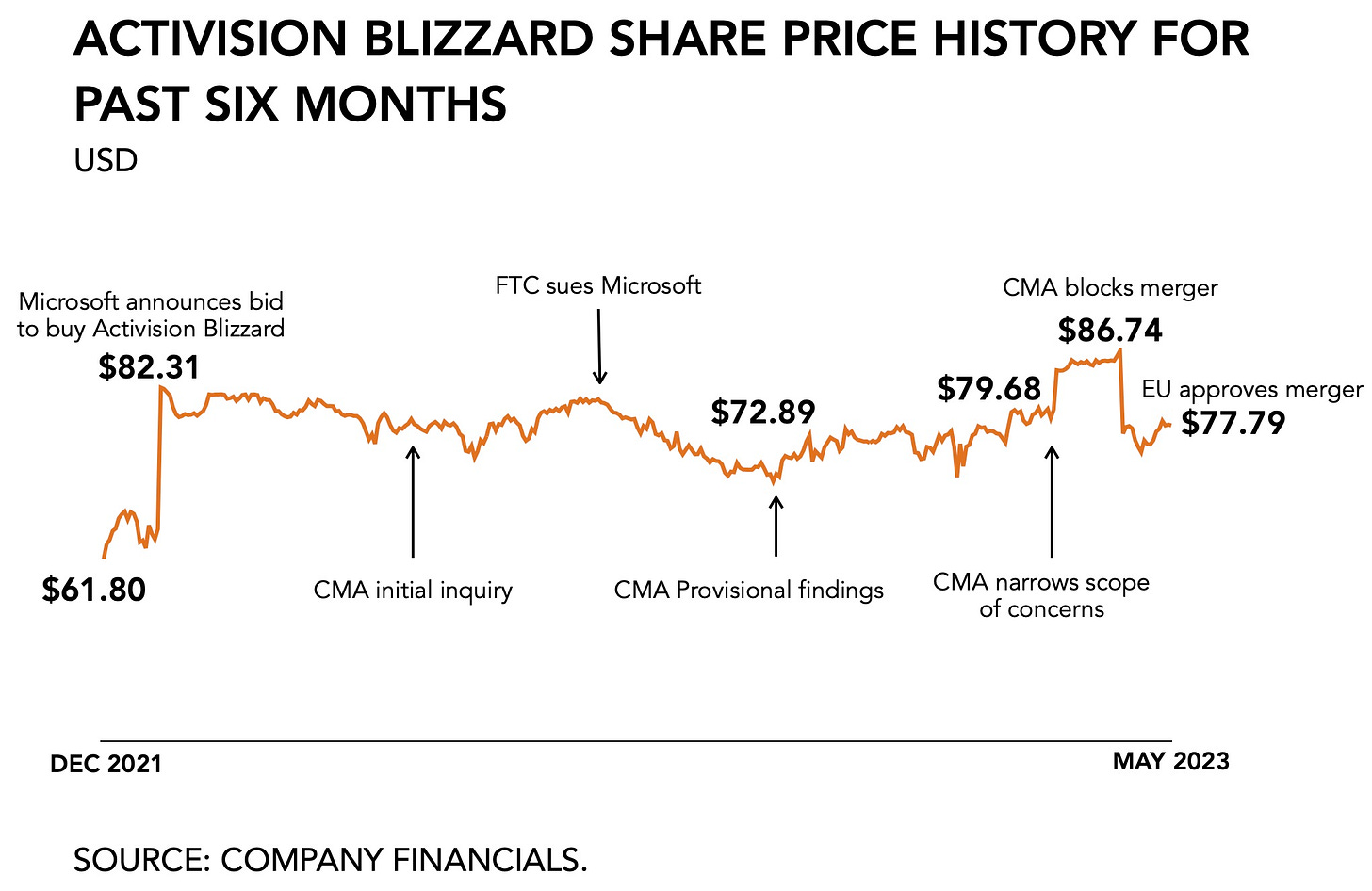

Well, this is awkward. After the UK’s Competition and Markets Authority, the CMA, blocked the proposed acquisition of Activision Blizzard by Microsoft in April, this week the European Union’s antitrust watchdog gave it the go-ahead.

The EU’s competition chief, Margrethe Vestager, said the EU was content with Microsoft’s concessions to alleviate its concerns. The CMA promptly took to Twitter to reaffirm its own decision and all but outright say that the EU is wrong. It didn’t save the CMA’s two figureheads, Marcus Bokkerink and Sarah Cardell, from a veritable grilling on whether or not the UK was, indeed, still open for business.

So, which one is it? Which one of these well-informed agencies is correct? It seems odd that two different watchdogs, each following their own diligent and sincere process would arrive at such opposite conclusions. Despite the emphasis on “many, many similarities in terms of the underlying concerns,” as CMA’s Sarah Cardell states, but insists that the UK’s model affords “a more targeted and a more bespoke firm-by-firm approach” where the EU uses “a little bit more of a blanket approach.”

It forces the question of whether in the case of MSFT/ATVI, antitrust policy is politically motivated, or just informed by a general ignorance around a growing culture industry. After suffering through a week of coronation news and the ghastly return of US Senator Diane Feinstein, I’m no longer sure if we’re all working to benefit the future or to celebrate a history that never was. It seems entirely possible that the regulatory split comes as part of a final hurrah of broader post-colonial politics emerging from a self-isolating island off the coast of Europe.

Anyway, the remainder of this deal is now rather predictable. The last holdout, the FTC, has already submitted its lawsuit, which, provided Microsoft commits to a consent decree to neutralize the regulator’s concerns, will likely be dismissed by the administrative judge. The impact on the games industry at large will be one of continued consolidation and the massive sell-off (and sell-out) of interactive entertainment assets.

Even so, investors remain wary. Activision Blizzard’s share price did not materially change based on the news as analysts and shareholders are likely to wait and see what the end result of the FTC’s lawsuit will bring.

🎙 Worth a listen

I’m grateful to the following podcast hosts for inviting me over the past few weeks. In chronological order.

Ahmad and I had a timely conversation about why Nintendo continues to be undervalued even before the Super Mario Movie and the new Zelda dropped.

Together with Angela Dalton (Sigma Capital) and Nicholas Grous (ARK Invest), I discussed Investing in the Growth of Gaming.

I got a rare chance to discuss the SuperData story on The Gaming Founders Podcast with Eden Chen and Kevan Zhang.

And finally, on This Week in XR, I found myself in the company industry luminaries like Charlie Fink, Rony Abovitz, and Ted Schilowitz, l to discuss AI in games, consolidation, and the future of VR games.

MONEY, MONEY, NUMBERS

Legacy publishers are finding warmth in relying on their most successful franchises as demand has cooled. Having made the most of cheap capital and high demand during the pandemic, the reliance on proven franchises plays a critical role, especially as we enter the second half of the console cycle which tends to attract consumers less willing to try novel intellectual property.

Nintendo announced that The Legend of Zelda: Tears of the Kingdom has sold over 10 million units worldwide within its first three days. That makes it the fastest-selling game in the series despite its $70 price point. It tells you that gamers are largely indifferent to price increases for their favorite franchises. The console maker also noted that the title was the fastest-selling Nintendo Switch game and the fastest-selling Nintendo game for any system in the Americas specifically, with sales of over 4 million units. By comparison, Mario Kart 8 Deluxe has sold 54 million units over its lifetime, and Animal Crossing: New Horizons sits 42 million units. Considering the Switch’s install base of 125 million worldwide (as of March this year), an attach rate of around 40 percent means the new Zelda game will sell approximately 50 million copies.

Take-Two Interactive reported better-than-expected earnings but that wasn’t the big news. It provided full-year guidance for 2025 that showed a $2.5 billion year-over-year increase which told analysts that Grand Theft Auto 6 is going to launch soon. Take-Two discussed its updated development pipeline with a total of 36 titles for 2025-2026, but all everyone heard was an imminent GTA6 release. According to one analyst, GTA6 is “the only game capable of contributing to a $2.5 billion increase to net bookings.” Later this year it will have been exactly a decade since GTA5 came out. Assuming a 2025 launch window, which is optimistic given the publisher’s propensity for delays, early estimates expect the new title to sell 25 million units. Net bookings for Q4 were $1,394 million compared to a consensus of $1,339 million and guidance of $1,310 to $1,360 million. Shares for Take-Two jumped +12 percent to $140.

For the remainder of the year, I anticipate further consolidation at all levels of the industry, including a few acquisitions by large platform holders as they seek to take advantage of low valuations for, especially, European game makers.

PLAY/PASS

Play. Good news, mate. The video games business in New Zealand has officially outgrown its wool sector.

Pass. The Wall Street Journal ran an article describing the run on government secrets by gamers. Fearmongering is alive and well.