Going in, I knew I needed an emotional warm-up.

Having played the game, I had a good sense of what awaited me in the first episode. You know, that scene. The same one that made me put down the controller during my first play-through and rethink whether I was really able to carry on.

I find it easier to indulge in analysis and spin some abstract yarn than to sit with such a big emotion.

What has always excited me about video games is their ability to tell a different type of story. Not just in the way that stories are seemingly more interactive, but the willingness of creative studios to explore narratives that seldom appear anywhere else.

Like cartoons and comic books, where you can drop a character on their head and watch them simply walk it off, video games offer a kind of elasticity that allows us to explore different ideas or take new approaches to existing ones.

For example, Disney has published a wide range of contemporary interpretations of age-old folktales and will have us believe that fish can sing and dogs can talk. More so, Pixar has opened our minds to more grown-up themes, like the passing of a loved one in Up, to set off a whole movie about pursuing our dreams. And the Japanese manga and anime industries produce an even broader array of narratives, including, for example, the early 2000 Battle Royale manga series, known for its violence and gore, which ultimately inspired The Hunger Games novel trilogy, including a movie adaptation, and, of course, games like PUBG and Fortnite. Innovation isn’t the exclusive accomplishment of technology or business savvy.

HBO’s new series The Last of Us open with a scene that jolts our attention. As the first episode’s chaos ensues, we’re forced to confront the worst manifestation of any parent’s greatest fear. And one that is borne from a slowly developing, overwhelming, and, demonstrably, preventable catastrophe. It knocks our little rollercoaster cart off the tracks and in the unknown. It’s about death, of course, but unlike Game of Thrones, we don’t get to suspend our anxiety because TLoU is set in present day.

Now that the franchise has been adapted for streaming television, I still have that sense of deep dread. But there’s an optimism, too. Despite my insistence that the games industry does not need any validation from Hollywood or any other existing entertainment category, I’m excited to see stories that originate in gaming garner such success elsewhere. I’ll even consider the pedantic mansplaining at the start of episode one as a return volley for the New York Times’ observation this week that "until fairly recently, games were considered a niche hobby, typically associated with children." The adaptation sets a new standard and opens the door to more and better interpretations of intellectual property from interactive entertainment and the richness of their narrative economies.

Call it the first of us.

On to this week’s update.

📆 Event Calendar

I’m co-hosting a mixer on March 20 in San Francisco for GDC. Email me if you’d like to be added to the guest list.

On April 7 I will be moderating a fire-side chat with Xbox CFO Tim Stuart at The MIT Gaming Conference.

Let’s catch up!

BIG READ: Inside Playtika’s $800 million Rovio bid

On Friday the Israeli-based mobile gaming company, Playtika, submitted a revised proposal to Rovio’s board of directors in an offer to purchase the Angry Birds firm for about $800 million (€9.05/$9.82 per share, a 60% premium over trading). It came, ICYMI, mere hours after I predicted it would.

In November, Playtika had submitted an earlier, non-binding offer of €8.50/$9.23, suggesting that the Rovio advisory board rejected the initial proposal. According to one Wall Street analyst, the bid was “adequate” but expected it to go higher, up to €10/$11.87, given Rovio’s strategic value based on its well-known intellectual property. The firm’s board stated it was not in negotiations with Playtika but rather considering “whether and how” to proceed.

The deal makes sense for the acquirer. Playtika’s casual portfolio represents 55 percent of its 22Q3 revenue and the Rovio acquisition would add 42 million monthly active users and 6 million daily active users, assuming there is no pre-existing overlap. The question is whether a take-over bid makes sense for Rovio.

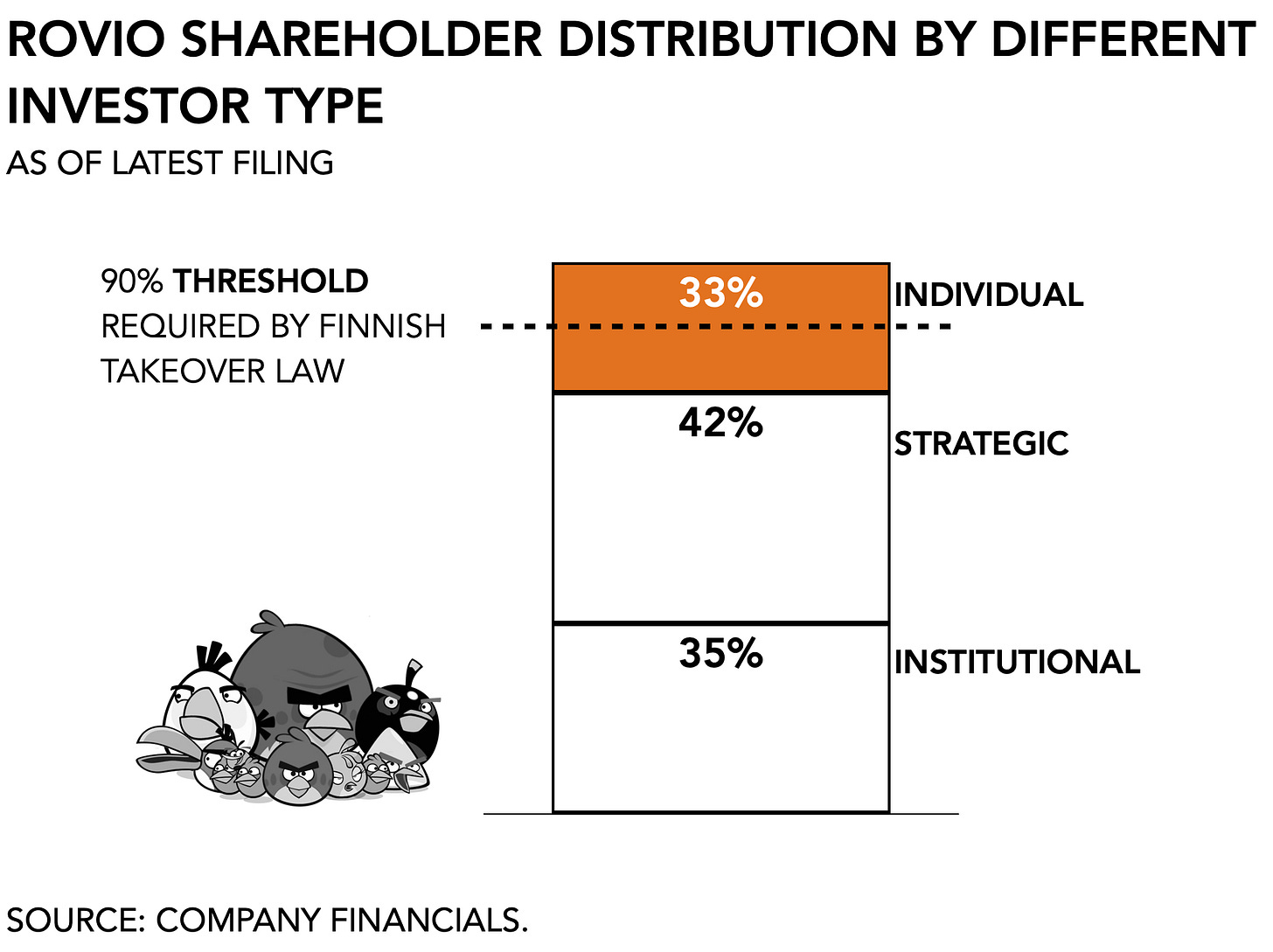

First, Playtika will need to reach a 90 percent threshold of shareholders to close the deal in accordance with Finnish take-over law. According to its most recent filings, Rovio’s ownership structure breaks down as follows.

Beyond the 77 percent it can buy from institutional shareholders (e.g., mutual funds, endowment funds) and strategics (who invest to gain a strategic advantage, for instance), Playtika will still have to buy out at least another 14 percent of individual retail shareholders. That presents a risk as, while they rifle through stock certificates to find enough of these individual investors, hedge funds may do the same to get their hands on shares and force Playtika to pay a premium to reach the necessary threshold.

Second, Playtika isn’t a spring chicken itself. In February 2022, the firm announced that it was “exploring strategic alternatives” which is finance speak for “we’re trying to sell ourselves.” Now, a year later, that hasn’t happened, which suggests that strategic investors and more traditional financial sponsors have looked at their books and passed on the opportunity.

Moreover, Playtika has a complex ownership dynamic. A single firm, AlphaFrontier owns 60 percent of its shares. Next, Ms. On Chau, who is an individual investor, owns another 23 percent, or about 81 million shares of common stock, through several holdings companies. This gives two shareholders an intense amount of decision-making power and may jeopardize Rovio’s creative independence post-acquisition.

And third, the mobile market for casual games isn’t what it was. With $1.3 billion on its balance sheet, Playtika has enough cash to close the deal but it also has a substantial debt load with a 40 percent debt/capital ratio. That may limit what it is able to accomplish in the period ahead, with consumer spending softening, app store mechanics worsening, and marketing costs increasing.

In effect, Rovio has been through the entire cycle of the mobile games industry. After being the posterchild for the early years of the smartphone, when it had the ambition of becoming bigger than Disney, it fell to the wayside even if it still managed to eke out an IPO based on the success of its box office movie release, only to report a 96 percent drop in y/y profits due to the costly investment in developing a 5G platform Hatch, and, finally, finding itself stuck between its reliance on the evergreen success of the Angry Birds franchise and an inability to produce another hit. Despite modest growth, Rovio acquired Ruby Games, a Turkish studio developing hyper-casual games, in pursuit of this emerging market. It means an acquisition is increasingly likely.

The deal is emblematic of the broader economics of mobile gaming. The popularity of mobile gaming has proven a double-edged sword for many mid-tier game makers. Despite strong demand, competition has gotten a lot more fierce and Apple’s push for greater control over its ecosystem has further exacerbated circumstances and rising marketing expenses. Well before the pandemic, the Finnish game maker was already having a rough time. Despite its well-known intellectual property, the rising costs of user acquisition depressed Rovio’s finances: in 2Q18 the firm acquired 35 million users at a cost of $26 million, or roughly 90% of revenues. In 3Q18 it spent $20 million, adding only 28 million users at about 70% of revenues.

It leaves Rovio with a tough decision: take the deal or hope for a stroke of luck that will catapult it back to the top of the ecosystem.

NEWS

Microsoft calls Sony’s bluff

After hearing the Japanese console manufacturer incessantly make the case that the ATVI/MSFT deal would be bad for everyone and that the loss of the Call of Duty would be “irreplaceable”, Microsoft seemingly got tired. If it’s such a big deal, it must have reasoned, Sony won’t mind sharing a bit of information about their business as evidence that would warrant so much clamoring coming from a non-party in the FTC’s lawsuit against Microsoft. It had already issued the subpoena last month but had not publicly mentioned the name of the recipient. With the extension request, we’ve now learned it was its Japanese rival.

Apple postpones its AR glasses

Staying with this edition’s avian metaphors, the Dutch expression “to delight someone with a dead sparrow” is applicable to Apple this week. After first hearing rumors suggesting Apple was about to release a cool set of glasses, Bloomberg now tells us that plan got moved back. But, we’re still getting a mixed-reality headset.

Professionally I’ve been talking about the advent of fancy goggles to overlay technology on top of the real world for a decade and it’s always “not yet.” The great hope here is, of course, that Apple will push the category forward and earn more than a participation award like Meta.

As a parent, I have no interest in strapping a $3,000 headset to my 9-year-old’s forehead. It all seems pedagogically unsound. Also, he’s managed to disassemble everything else I’ve handed him thus far, so I will 100% expect to find such a pair of goggles strewn around the house just like the $200 lego set we bought him for his last birthday.

As usual, Matt Ball managed to pen a thoughtful assessment of the status and future AR/VR/MR/XR that is worth a read.

Riot Games gets hacked

A week ago, the maker of League of Legends found itself compromised through a social engineering hack and confirmed that its source for League, TFT, and a legacy anti-cheat platform had been obtained. However, user data remained safe. Phew.

PLAY/PASS

Pass. The Washington Post axed its gaming division, Launcher. A wholly undeserved and real loss.

Play. If you thought 8-bit characters lacked depth, check out this study into Mario’s Italian-American identity.