Amusing ourselves to death

FaZe's public listing and esports' next era

On account of Halloween this week, I figured I’d pick a macabre title.

In a place like New York where people generally ice each other out with steely stares and overpriced headphones, getting to dress up and jovially misbehave easily makes Halloween the most important holiday.

The title, Amusing Ourselves to Death, is from a book by Neil Postman, whose ghost continues to haunt political science faculties and popular entertainment makers everywhere. He argued that discourse was dying because people preferred the ease of amusement over the difficulty of doing the work. It offers a preview of what was to come years before social media was even a thing.

It’s frightening what close cousins entertainment and death are.

In Squid Game, the billionaire audience is depicted as vile and lacking the moral framework needed to be decent humans. We’re told, they have all become so bored as to have no other form of amusement.

A terrifying term like gamification, however, seems equally apt when discussing the high stakes game that a growing number of people are playing today. The retail investor class, regular folk using an app or interface to buy and sell shares in equity markets, has bloomed. To play a game of financial David versus Goliath, thousands of small budget investors (think $50) put their money in meme stocks, NFTs, or crypto in the hopes of paying off student loans and mortgages. Brrr.

Even the SEC thinks that’s too scary. It issued a report a few weeks ago discussing what happened with the unprecedented influx of retail investor capital that led to massive losses among funds that had shorted the stock. In its conclusion it argues that

“game-like features and celebratory animations that are likely intended to create positive feedback from trading lead investors to trade more than they would otherwise.”

I can absolutely see the irony as I’m frantically refreshing my Coinbase app to see how high the price of Shiba Inu can go. Financial markets are seemingly losing touch with reality and the economic underpinning of how businesses operate.

That’s too spooky for me.

On to this week’s update.

BIG READ: The next era in esports

The announcement of FaZe’s upcoming public listing at a $1 billion valuation signals the start of a new era in live-streaming and gaming celebrity. It also raises questions about how these esports-gone-franchise enterprises are planning to innovate next.

In a world of hype-men and online bravado, there’s no shortage of enthusiasm for the news. Following a reserved merger transaction of B. Riley Principal 150 Merger Corp, a special purpose acquisition company, or SPAC, the combined firm’s common stock is expected to be listed on NASDAQ under the new ticker symbol “FAZE.” According to the associated 8-K, we’re looking at “a pivotal moment in the ever-evolving media landscape.”

Those are some big words. Let’s take a look.

First, the good news. FaZe’s success tells a story of how a relatively unknown phenomenon of competitive gaming has managed to become a financially sustainable enterprise in spite of many naysayers. As a category that’s been mocked and relegated to the sidelines for years (“Why would anyone want to watch anyone play video games?”), the last decade has been an uphill battle.

The abbreviated history of esports goes something like this.

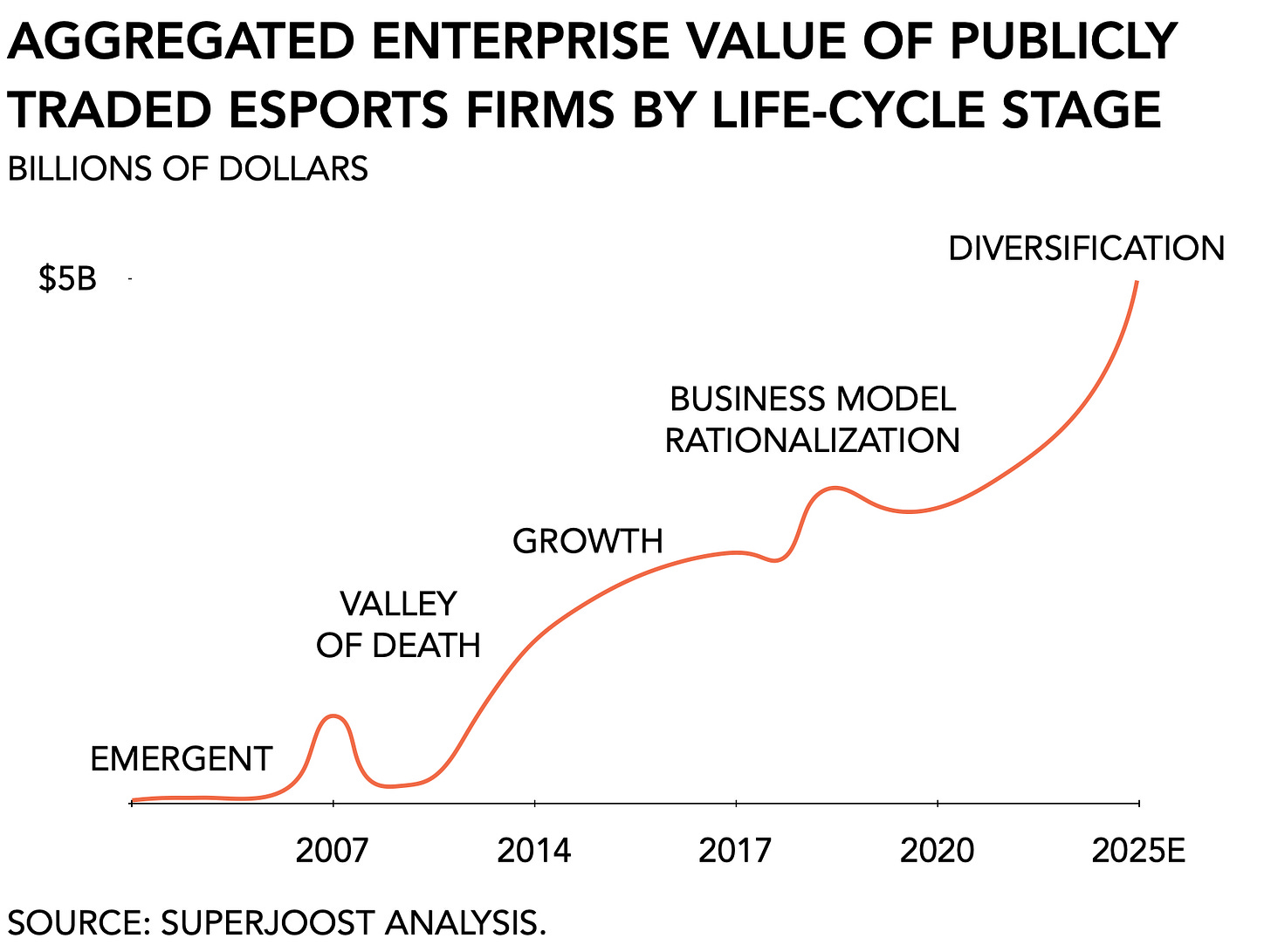

In its early years, South Korea was the gravitational center of competitive gaming. Its government orchestrated a massive push into information technology as a cornerstone to its economy, which resulted in the ascension of several major game publishers and not one but three dedicated television networks. This was the emergent phase because That was all well and good until the introduction of the smartphone triggered a massive shift away from PCs. Esports collapsed and incorrectly proved to many that it had been a fad and something specific to South Korean culture.

During the valley of death that followed several entrepreneurially minded individuals started leagues in western markets, such as ESL in Europe and MLG in North America. This stumbled forward for several years until free-to-play gaming had taken root globally and digitally-native publishers like Riot Games started to leverage competitive gaming as a way to attract and retain audiences. As free-to-play gaming grew, so, too, did esports.

During the period that followed, venture capital and the marketing departments of major publishers fueled growth by developing bigger production, aiming to reach bigger audiences, and prompting headlines on bigger purses. But even as players proved interested, conventional brands and sponsors were as yet unwilling to take big bets on such a seeming novelty. Worse, publishers preferred to retain a tight grip on their intellectual property and started to require high upfront investments from teams. Despite the foresight of many young executives, their more senior peers proved too risk-averse to jump in with both feet. What grew, in effect, alongside esports’ popularity was the number of naysayers.

Not long after, venture capital and publisher subsidies started to dry up, creatives and competitive players started to consolidate, often huddling together in multi-channel strategies in pursuit of economies of scale, and establishing a diversified array of revenue streams. This period relative austerity triggered business model rationalization that resulted to a shake-out and streamlining of the industry. To boot, right as esports had started to claim its place among adjacent live events productions, despite sometimes missing the mark, the pandemic hit and set things back.

With FaZe’s public listing we’ve finally reached the next phase of diversification. It marks the end of a period of relative uncertainty and brings more clearly defined business models, partnerships, and an more honest ecosystem. The novelty has worn off. No longer restricted to just competitive gaming income, and having survived the worst of it over the last few years, many esports organizations have evolved into broader entertainment companies.

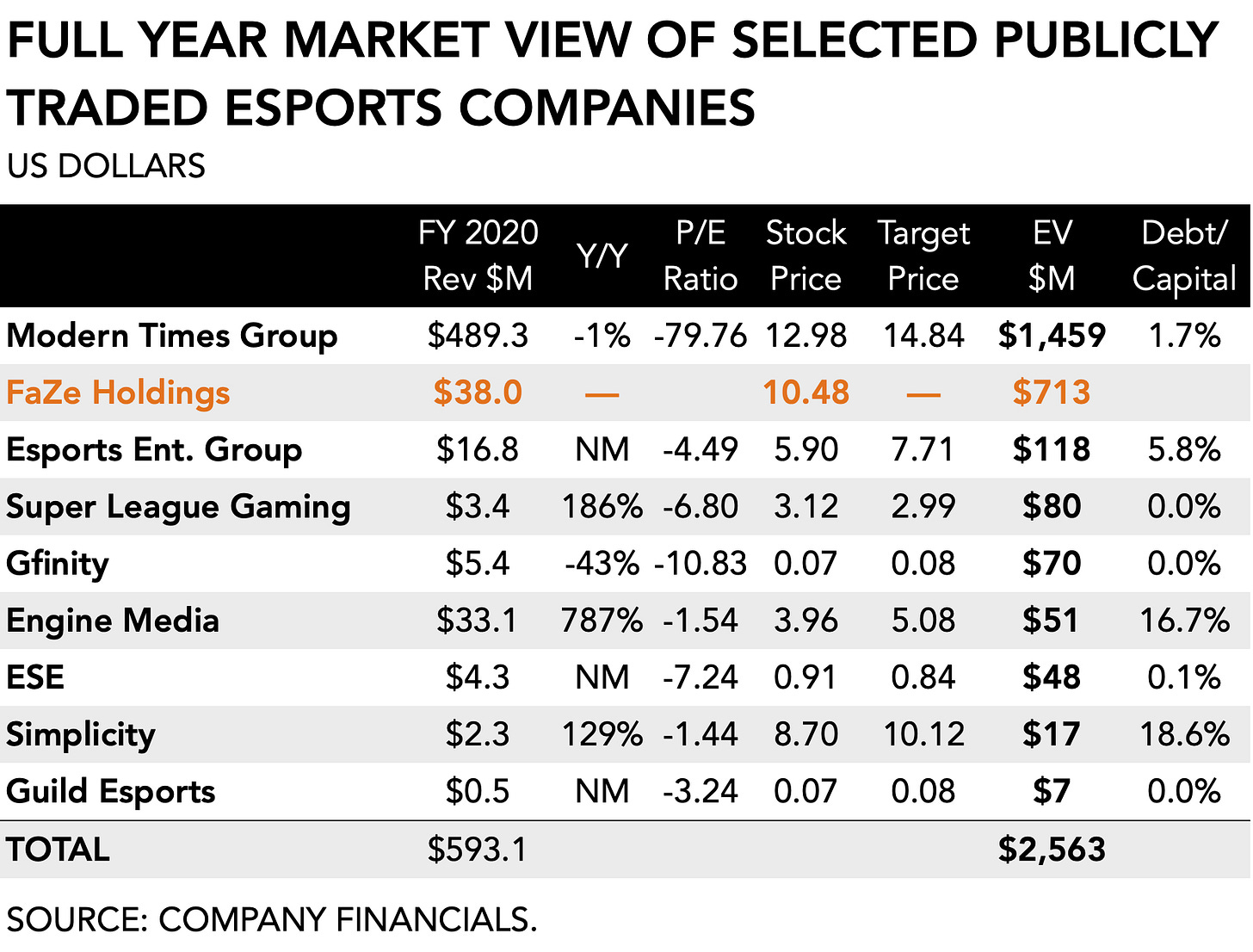

A casual observer will find the esports category somewhat lackluster. And to a degree it is. Earnings across the publicly-traded esports space are meager.

Danish competitor Astralis reported $6.1 million in revenues for 21H1, up +92% y/y from $3.1 million. It relies largely on sponsorship money for its income: in 2020 it reported 66% of earnings from sponsors followed by 27% in winnings and league earnings.

Guild Esports, the venture backed by David Beckham, generated a paltry $508,226 in the first half of the year. Of that, $390,743, or roughly 77% of total, came from winnings. The group emphasizes that it expects the second half of this year to be more plump when four partnerships go live.

The Modern Times Group, one of the largest firms in esports and owner of the ELS League, suffered a -3% loss in 21H1, based on $73.3 million in revenues compared to $75.6 million a year earlier.

With negative P/E ratios across the board, it’s not pretty. For all the hubbub and headlines on esports over the years, we have yet to see substantial returns. The proposed listing of FaZe would value it at roughly half of the MTG, a leading firm in esports that has been acquiring game studios like InnoGames, Kongregate, and most recently, PlaySimple.

Explain to me a billion dollar valuation

Judging these firms on their tournament winnings alone is to miss entirely the broader potential of an entertainment category. Esports is, and always has been, an entry point into the broader array of practices around live-streaming, online gaming, celebrity (an important element that has historically been notably absent from gaming when compared to music and film), and fan culture.

From a revenue perspective that has several implications. First, esports-only clearly isn’t enough. Winnings seem impressive, sure, but it’s way too lumpy and volatile to build a business. If your team has a bad season you may be out of business. And what matters most is the number of people that you reach. That means the gravity point of any successful esports team lies beyond just competitive play and, more importantly, beyond the reach of the iron-fisted publishers that seek to own the vertical for themselves.

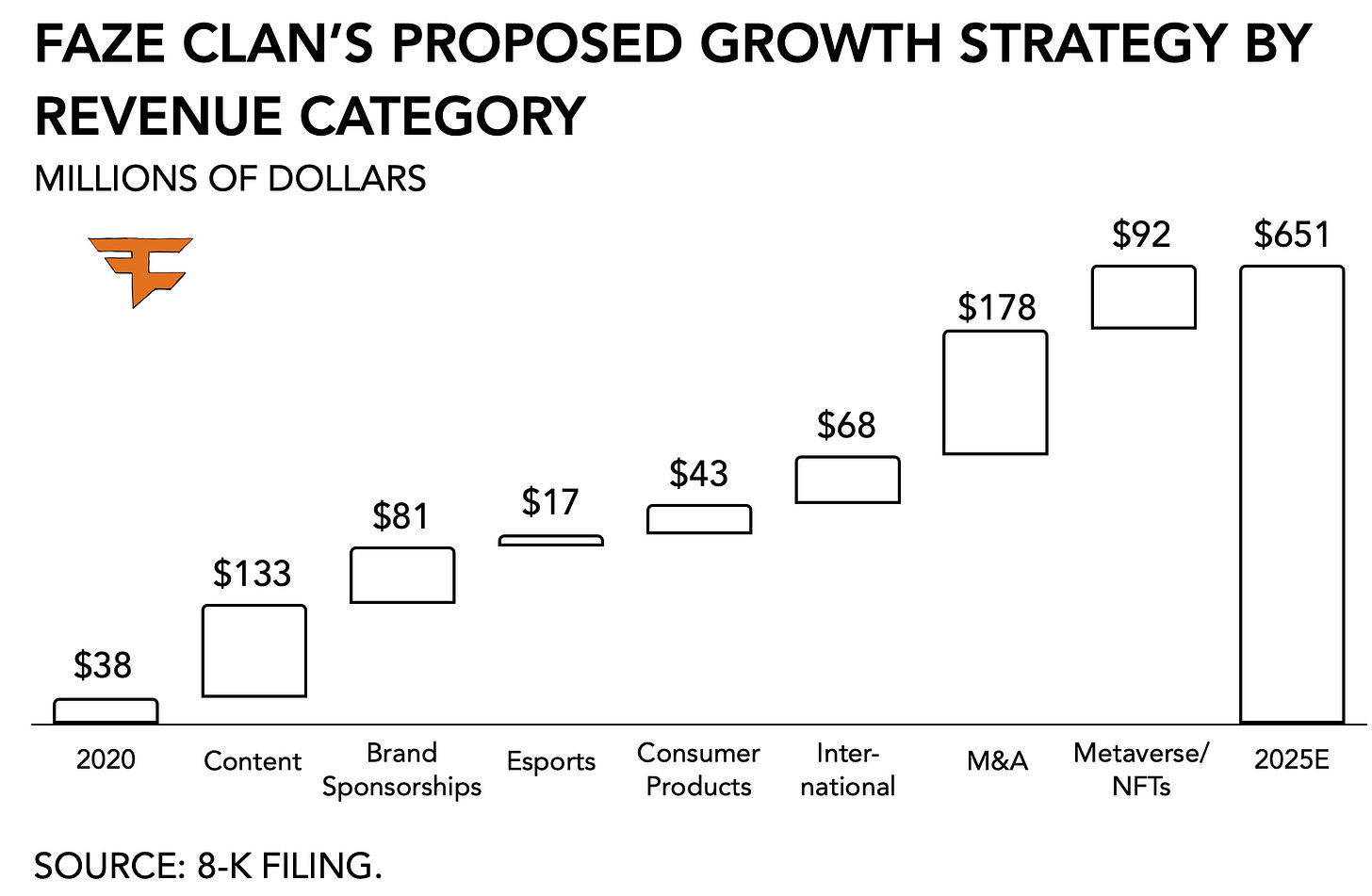

Despite stating in its filing that “esports is key,” revenue from competitions amounted to just $3 million (8%) in 2020 out of a total of $38 million. It’s a “minimal part of our business,” its CEO told The Washington Post. By far its largest source of income were brand sponsorships with $17 million. In a few years, esports will represent just about 3% of FaZe’s annual income.

Second, the pandemic didn’t deliver quite the deathblow many thought it would. Over the past two years the top-tiered esports organizations have been growing and building out their fan base rather than watching it decline. The reason: esports was always online.

Perhaps one of the positive outcomes from the pandemic for esports is that it put a lot of half-hearted initiatives out of business. Competitive gaming is about being part of a community. It has been one of the few remaining ways to come together online and share things game audiences enjoy. People naturally compete. Being able to do so with others online proved a potent antidote to the social disruption the pandemic posed in real life. FaZe emerged from all that with an increase in both reach (+63% across all social media channels) and revenue (+32% y/y).

Third, FaZe’s evolution from a band of competitive players to a billion dollar franchise is a masterclass in business model design. The combination of brand sponsorships ($17 million), content production ($12 million), merch ($7 million), and, finally, esports winnings ($3 million) earned the company $38 million in 2020. It is on track to earn an anticipated $50 million in revenues this year.

Where elsewhere in entertainment we observe a disproportionate reliance on the success of a single business asset, FaZe built a portfolio that offers plenty of diversity and insulation from volatility.

Where to next

This is also where we should ask some tough questions. Congrats on the success. But where do we go from here?

According to its filing, FaZe currently generates $0.42 per head per year of its 120 million audience and expects to more closely match established sports leagues, traditional, and digital media. It expects to grow this to $3.52 per fan by 2025E when its base reaches 180 million uniques and revenues total $651 million.

That’s quite ambitious.

FaZe’s answer is that it manages to reach a young demographic. It brags about its audience largely being made up of consumers aged 34 and younger. That is indeed a desirable demographic that is proving hard to reach via traditional channels. And so I’m totally onboard with the idea of a cool collective of gamer bros making a connection with a largely young, male audience. That makes sense. But it raises at least two concerns.

First, the 13 to 34 year olds that make up 80% of its audience don’t quite spend the same way on as baseball fans and AMC subscribers do. Such direct monetization tactics work well for audiences that have a strong emotional connection to a team and a sport they were spoon-fed growing up. Consumers for television entertainment simplify their lives by purchasing access to their favorite shows and streaming platforms.

But it’s unclear how that would work with young esports fans. It assumes franchise loyalty in a digital age, which is arguably much more fickle than having your dad take you to a stick-and-ball game every weekend. Direct monetization will be harder to accomplish. It makes more sense then to focus on indirect revenue strategies such as advertising and sponsorships.

Second, now that the cat’s out of the bag, there are many, many more competitors vying for the same attention. Esports has, for better or worse, been able to grow up in relative isolation because no one took it seriously. But as we learned from the Twitch data leak, live-streaming is a cutthroat business in which everyone fights for viewers. Even the best-paid female twitch streamer, Pokimane, is actively expanding her range of activities.

FaZe further seeks to grow revenue by expanding into novel categories. In its future, the organization sees subscriptions, gambling, virtual dining concepts (huh?), metaverse (oh no), and NFTs (woo boy). In 2020 FaZe generated $38 million, which it expects will reach $50 million this year (+32% y/y) and $91 million in 2022E (+82% y/y). By 2025E revenue could reach $651 million, it says, an increase of 1,200% from today.

It is here that the proposition is weakest and crawling with buzzwords.

What does the metaverse even mean for FaZe, for example? Is its most popular streamer, NICKMERCS, going to sing? God help us. And yet, says the CEO:

“I cannot overstate the importance of the metaverse and NFTs when you think about Faze Clan’s future. As we all have heard from the largest media companies in recent months, the metaverse is at the forefront of next-generation media. With our platform and our unique reach into Gen Z, we believe FaZe Clan is exceptionally well positioned to benefit from this phenomenon.”

It expects to make $92 million of such “emerging monetization areas” by 2025.

Maybe.

The success of Dapper Labs taught us that there is money in NFTs, because fans will want to collect key sports moments. But you’re going to need to be playing competitively to generate those, though. The core strength of an esports franchise, ostensibly should be its esports activity, no? If you’re in the frozen yoghurt business and doing well, it’s totally fine to sell a few hoodies. But you still have to make frozen yoghurt.

What FaZe really proposes is that it can get enough lift and leave esports behind altogether. But such a strategy arguably dilutes the foundation and proposes a Kardassian replicator: expanding celebrity in spite of the absence of a demonstrable creative talent. It is possible to be famous purely for being famous. By overwhelming airways with a set of familiar faces, eventually whatever they do becomes newsworthy even when it isn’t. Paris Hilton, we’re told, has already beaten us to the metaverse. In conventional sports you at least see Messi or Ronaldo score a goal here and there in between domestic drama and other non-sportsy fluff. Musicians are first and foremost artists: Ariane Grande’s ability to entertain audiences in Fortnite hinges on her talent as a singer and performer.

It leaves the door open to broad speculation. Is FaZe, despite its clever commercial thinking, truly capable of growing revenues 13x over the next five years? With $274 million in cash to fund its future, FaZe has bought itself enough runway for the foreseeable period.

In the meantime, the listing of FaZe Holdings, as the new entity will called, presents the start of a new chapter for the rest of us. Even if its strategic plans are still vague, it made it this far. Its success shows the resilience of a category that has been undervalued and in disarray for years. Perhaps now that esports and gaming celebrities are gaining legitimacy, more revenue models will open up. So far, the initial response among investors has been positive. After the announcement, shares in B. Riley Principal 150 rose +15% compared to closing on Friday.

Time to make a play.

NEWS

Kotick takes a pay cut, steps in the right direction

Ahead of earnings, Activision Blizzard’s CEO, Bobby Kotick, requested he’d only be paid minimum wage and forfeited equity and bonus payout until the firm’s board determines it has achieved its “transformational gender-related goals.” It’s both a symbolic offer to have the CEO of one the largest publishers to take responsibility for the mess in his house, and substantial financial sacrifice to help fund reform. One could argue, of course, that the frat boy work culture that haunts ATVI is exactly the type of thing that should unseat an entire C-suite. Nevertheless, it is an appropriate response that now needs validation with actual, demonstrable change.

Stadia announcement foreshadows shutdown

The clock is officially ticking on when Stadia is going to call it quits. Following a week of no news, this week’s news was that there’ll be less news. Contrary to the journalism adage, here no news is bad news. In the absence of any official announcement, my guess is as good as yours. But it’s not a good sign. At all.

Card game maker Parallel raises $50 million

Perhaps I’m biased but every time there’s a disruptive technology wreaking havoc on the existing ecosystem, classic game mechanics like collectible card games lead the way. When trying to explain virtual items and digital goods to legacy publishers a decade ago I relied on the fundamentals of trading card games. There’s something uniquely difficult and evergreen about building a deck and devising clever tactics.

It is no surprise then that collectible card games are, again, receiving plump valuations. This week saw a $50 million raise by Parallel at a $500 million valuation to build its sci-fi card game based on the Ethereum blockchain. Utility informs the value of its individual components and makes it well-suited to benefit from the surge in NFT adoption among collectors and players. According to Cryptoslam, a data provider, Parallel saw a spike in NFT trading in August and recorded $105 million in aggregate transactions. One of its showstoppers, a Masterpiece card, sold a for $1.1 million. That’s pretty good for a game that isn’t out yet.

New gaming VC Patron raising $90 million

The success in gaming is leading to two-fold disintermediation. On the one hand there is creative talent that after a few years at a well-known publisher goes out and raise a bunch of money to build their vision in the wild. No need to make someone else rich, either.

On the other hand, a growing number of business folk is graduating into venture capital. This week comes with the announcement of Patron, a brand new $90 million fund focused on seed-stage rounds, co-founded by former Riot global head of business and corp dev and ex-a16z. It plans to invest in what it calls the Spectrum of Play (“convergence of games, consumer, and Web 3”) using the money gathered from industry bigwigs like Unity CEO John Riccitiello, Twitch co-founder Kevin Lin, Riot Games co-founder Marc Merrill, and few partners from a16z.

It suggests a new breed of gaming-focused entrepreneurs and like-minded investors. I like it. Now let’s see some games, people!

Hasbro reports strong earnings despite supply chain issues

Total sales came in at $1,970 million, an +11% increase from the same quarter last year. It Consumer Products group was down -3% with $1,283 million in sales because supply chain disruptions pushed approximately $100 million of orders in the next quarter (I expect to see more of these the coming weeks). But, no matter, Wizards and Digital Gaming was up +30% generating $360 million versus an expected $300 million among Wall Street analysts. Sales for the segment are expected to double this year compared to 2018, a strategy the firm set out to accomplish by 2023 and putting it two years ahead of schedule. Finally its Entertainment group came in at $327 million, a +70% y/y increase. Link

PLAY/PASS

Pass. Gamer-focused skincare products. I like my ghoulishly white skin tone thankyouverymuch.

Play. Don’t be a boring grownup. Go get a costume and hand out some candy.

🎃👻🧙💀