Apple finds friend in VR

Will a Sony partnership lead to something real?

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Watching the re-opening of the Notre Dame this week, I tried to recall when I had visited it last.

There was one rainy afternoon with my family when I was a kid. But that memory is a jumble—my little brother clamoring for ice cream, my parents growing frustrated at their failed attempts to cultivate us. I realized, though, that the last time I truly explored Notre Dame was when I played Assassin’s Creed.

Seeing political figureheads shuffle through the modernized cathedral, I recognized its interior. I’d climbed those archways and reached the top during a mission, getting a real sense of the artistry and majesty of the place. How many of the 15 million annual visitors will get to see it as it was nearly 900 years ago, under construction?

Understandably, when Notre Dame burned down in April 2019, France didn’t just lose a religious building—it lost a national symbol. In the fire’s wake, Ubisoft made an unexpected contribution to cultural preservation, giving away Assassin's Creed: Unity for free.

Video games, with their ability to create realistic renderings of real-world spaces, are emerging as tools for preserving cultural heritage. And it’s not just the French. Take-Two’s Red Dead Redemption 2 offers a glimpse into life at the turn of the last century. And Black Myth: Wukong, nominated for Game of the Year later today, is a contemporary retelling of Chinese mythology. For all the flak games get for being frivolous or feckless, their power to simulate places and periods—and let us explore them—is unparalleled.

But it raises questions: who gets to manage and curate these cultural artifacts and simulations? With Ubisoft facing imminent privatization and the Guillemot brothers bickering over ownership, the prospect of private equity incinerating assets looms. If that happens, we risk losing Notre Dame all over again.

On to this week’s update.

BIG READ: Apple finds friend in VR

According to Bloomberg’s Mark Gurman, Apple and Sony are reportedly collaborating to bring PSVR 2 controller support to the Vision Pro headset. As part of the arrangement, Apple is to begin selling Sony's controllers independently, potentially expanding the Vision Pro's gaming capabilities and offering more precise controls for professional applications like Final Cut Pro and Adobe Photoshop. Originally the partnership was scheduled to be announced weeks ago, but the rollout was delayed.

It nevertheless raises a few noteworthy observations.

For one, it seems like an odd decision for Apple, which jealously controls its hardware ecosystem. In 2020 it announced plans to design its own processing chips for better balancing between power efficiency and performance. By rolling out a tailored chipset, Apple continued Steve Jobs’ legacy of obsessive control over the user experience. So why turn to Sony’s controllers for, arguably, the most intimate, physical part of the Vision Pro experience?

Rather than developing its own controllers for the emerging category of “spatial computing,” relying on Sony suggests that the Japanese consumer electronic manufacturer offers a superior device (possibly) or owns the necessary patents (probably) that would either force Apple to pay a considerable royalty or invest heavily in R&D to develop an equivalent. Regardless, it speaks to Sony’s ingenuity.

The PS VR2 Sense controller, as it is formally called, was originally developed as part of Sony’s entry into virtual reality and a way to differentiate its console offering. A second implication from the partnership is that Apple may finally be making a bigger push into gaming beyond mobile. Over the past few years, Apple’s product announcements have regularly featured video game royalty like Hideo Kojima, suggesting that the firm plans to play a bigger part outside of being a platform overlord.

Next, initial sales for the Vision Pro have failed to make a big impression. Its prohibitive price point, starting at $3,500, indicates that the device is only at the beginning of a very slow adoption curve. Initially targeting affluent consumers, developers have been slow to jump in, too. The ever-studious Matthew Ball observed in August that there were only 2,500 available apps for the Vision Pro, compared to 2 million for the rest of its ecosystem as firms like Netflix have yet to release native applications.

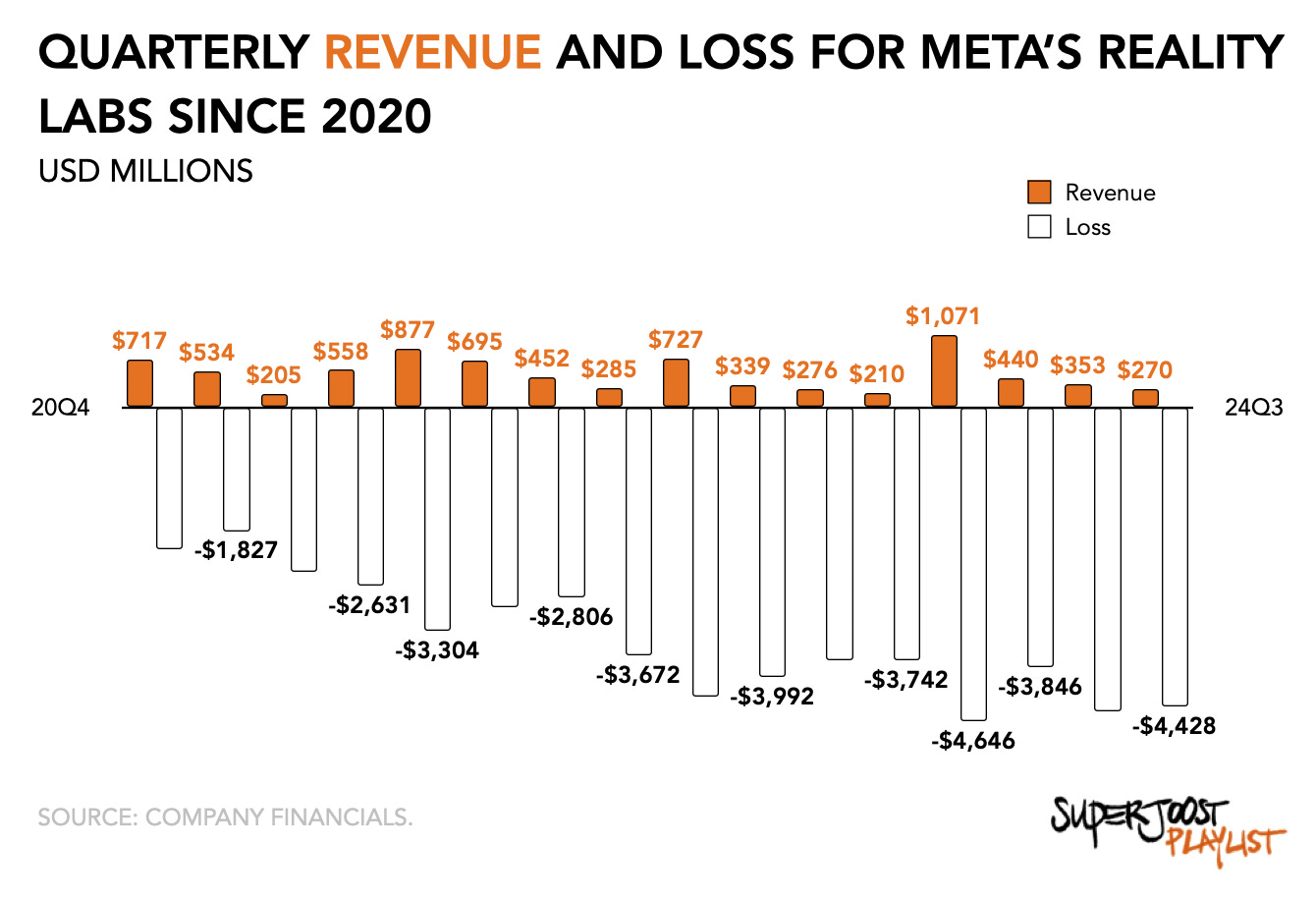

Especially during the early stages, new platforms need a rapid influx of content creators and consumers. It amounts to a slow adoption on both the demand and supply side of what is earmarked as Tim Cook’s legacy product. Meanwhile, the dominant firm in virtual reality, Meta, continues to spend literal billions. Its subsidiary, Reality Labs, has spent a cumulative $55 billion compared to $8 billion in revenues.

One problem unique to Apple is that people have become accustomed to disruptive innovation. As its smartphones continue to underwhelm, the Vision Pro is soon going to reach a point where a lack of widespread adoption will work against it. In terms of market share, Apple is currently third—after Meta and Sony. It is not a position it can afford to occupy forever. Striking an alliance, or at least a deal that carries the promise of a more collaborative partnership down the road, will allow Apple to catch up to the billions that Zuckerberg is spending.

Marc Zuckerberg continues to advocate for the investment after previously having his business fall victim to Apple’s ecosystem policy changes hindering then Facebook’s ability to target audiences. In an interview, Reality Labs’ CTO, Andrew Bosworth, illustrated how existential the quest to dominate a new hardware category is for Meta, stating:

“How much would you pay to be in a position to control your destiny?”

It has earned Meta a dominant market position in the mixed reality market, claiming 61 percent in the first half of this year. Sony, by comparison, is second-runner up with just over 10 percent, followed by Apple in third position with 9 percent.

Allying itself with another consumer electronics firm, a partnership around the PSVR controllers makes strategic sense for Apple. Sony, on the other hand, gains a valuable partner’s support in growing demand for its hardware. Beyond selling more units, it is not hard to imagine additional ways for the firms to collaborate. Sony is transitioning to become a media firm and Apple would make a great partner to help bring its IP to market.

But there are limits to cooperation.

At first, the idea of Apple acquiring Sony at its current valuation of $136 billion might seem like a logical outcome. Valued at $3.8 trillion—the same as Germany’s GDP—Apple certainly has the cash. What it lacks is time. And expanding the Vision Pro’s functionality by establishing a broader array of interactive experiences that go beyond watching sports on the couch, would go a long way toward competing with Meta.

However, such an acquisition faces multiple insurmountable obstacles. First, Apple's acquisition strategy historically focuses on much smaller deals, typically around $200 million, rather than mega-mergers. More importantly, regulatory hurdles would be enormous—even though Apple has minimal presence in gaming consoles and PC gaming, antitrust scrutiny would be intense given both companies' dominant positions in consumer electronics. Moreover, the Japanese government would likely oppose selling such an iconic national company. Additionally, Sony's complex web of strategic positions, including its $2 billion stake in Epic Games, would further complicate any deal. A more focused collaboration around virtual reality spatial computing makes far more strategic sense for both companies.

My prediction is that the next growth phase in Big Tech will rely on alliances. Rather than spending endless amounts of money to develop better mousetraps, the softening of their existing business models and increased scrutiny from regulators make an amicable circle of friends a better strategic option.

Ultimately, the Apple-Sony partnership around PSVR controllers reflects the current state of the market, which is one of cautious experimentation rather than a bold revolution. While Meta continues to pour billions into its vision of the metaverse with mixed results, Apple is taking a more measured approach, focusing on high-end hardware while being willing to partner for specific components. With Vision Pro sales still modest and Sony having recently halted PSVR 2 production due to slowing demand, both companies seem to recognize that mass VR adoption remains years away. In the meantime, selective collaboration allows them to share risks while exploring use cases that could eventually lead to mainstream success. The path toward the next product category may be less about dramatic disruption and more about patient iteration and strategic partnerships.

NEWS

GameStop reports $861M in earnings, but no plan

Missing the consensus among financial analysts of $888 million, GameStop is building its cash reserves but offers no plan on how to emerge on the other end of the current shift toward digitalization. At its current trajectory, GameStop is well on its way to becoming a private equity fund that sells used games on the side.

With a total cash position of $4.6 billion, the specialty retailer is showing declining revenues across all business units: hardware and accessories revenue contracted by precisely 28.0% (compared to -24% q/q), software revenue declined 15% (an improvement from -48% q/q), and collectibles revenue decreased by 4% (up from -18% q/q). Its core business continues to face headwinds, with $33 million in operating losses. It nevertheless reported a net income of $17.4 million as a result of $54 million in interest income (!) during the quarter from its cash position. GameStop generates approximately 4% annual returns on its cash holdings.

The retailer is planning to exit from the German and Italian markets to reduce overhead. After its unsuccessful venture into NFTs and omnichannel retail, the retailer is now pivoting into the trading card business.

Management did not host an earnings call for questions.

PLAY/PASS

Pass. In the wake of the United Healthcare CEO’s murder, NBC reported that the alleged perpetrator “once belonged to a group of Ivy League gamers who played assassins.” They’re talking about Among Us and omg.

Play. Games Workshop announced they agreed on “creative guidelines and reached a final agreement with Amazon” for adaptation of its Warhammer 40,000 universe into films and television series. Squeeee.

UP NEXT

I’m staring down a stack of student papers. Provided I survive its onslaught, I will share what’s on my students’ minds in terms of the most researched game companies and strategic suggestions. Let me get my red pen.

In regard to the future of certain interests' , you offer priceless insight 'Video games, with their ability to create realistic renderings of real-world spaces, are emerging as tools for preserving cultural heritage. And it’s not just the French.'