Platform power, by the numbers

Rapid consolidation is fundamentally shifting the games industry's power structure. Here's what it means for creatives

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Greetings from Las Vegas.

My conference cycle has started anew. The busy period begins roughly after Labor Day and runs rough GDC in March. It is also why this week’s write-up is a day late.

On Wednesday, I found myself at a summit hosted by Galaxy Interactive. For all the grief I’ve given venture capitalists over the years, there’s one thing they do bring to the games industry that it has historically lacked: transparency.

Hearing from a broad variety of existing and aspiring portfolio companies about how they’re tackling strategic issues around how to build better games, these types of gatherings offer an opportunity to learn more in an afternoon than you’d do in a year.

It makes sense for venture funds to host.

As a result of the vast amounts of money that have been sloshing around the games industry over the past years, venture funds have begun to reinvent themselves by offering more than just a check. They’re looking to play a more involved role in creating a portfolio ecosystem and like to dip into thought leadership. It encourages so-called ‘synergies in the portfolio.’ Firms can learn from each other and identify potential ways to collaborate. And the increased visibility means they attract more startups to evaluate as potential investments.

But the real value comes from comparing notes on specific conversations with publishers and platforms. In an industry characterized by information asymmetry, your peers are your best source of information.

Does it make sense, for example, to spend $600,000 with Geoff Keighley to promote your new game at the Video Games Awards in a 2-minute clip that is one among dozens of others? Perhaps it makes more sense to recruit a small army of influencers instead to live-stream your game for weeks. And before committing to a celebrity streamer, what were the results of someone else’s campaigns? How is TikTok better as a marketing channel than other social channels?

Openness to questions about the cost of development, distribution, marketing, and monetization is key to appropriately managing your project’s risk profile. More broadly it leads to a healthier industry environment. Against a background where small and medium-sized devs tend to exist at the mercy of their engine providers and platform landlords, sharing insight and experiences is one of the most effective countermeasures.

Of course, I’m aware of the irony of rubbing elbows with venture investors in the midst of a Vegas casino floor littered with people feeding money into slot machines. Both place seemingly irrational bets. Collaborating to improve the odds, however, should tilt the outcome.

On to this week’s update.

BIG READ: Platform power, by the numbers

[Update: Several observant readers pointed out a few data errors, which have been corrected. Thank you.]

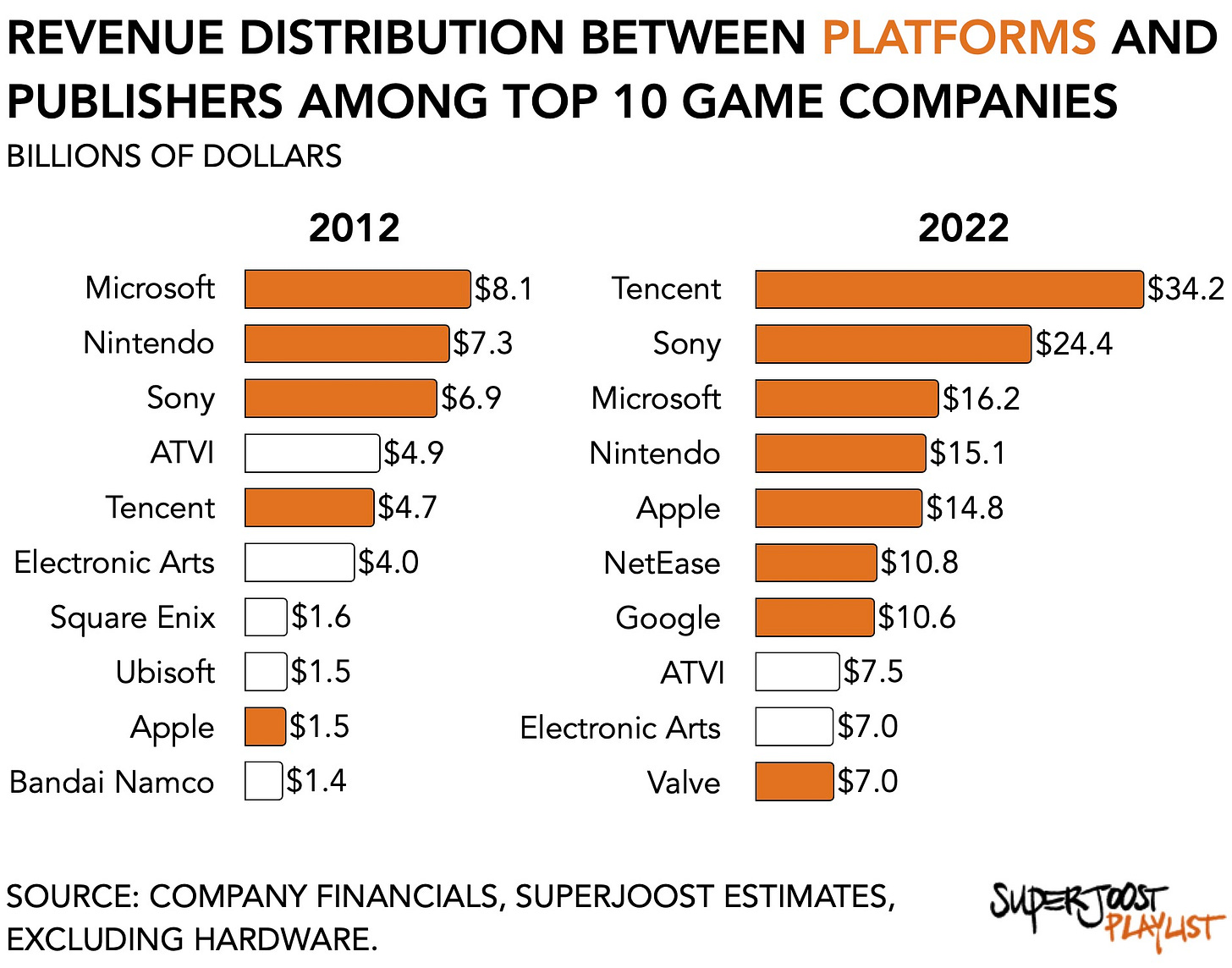

As we approach the consummation of Microsoft’s acquisition of Activision Blizzard, I decided to review the changing power structure in the games industry. Specifically, what is the ratio of publishers and platform holders among the top 10 game companies, and how has it changed over the last decade?

Disclaimer: Using publicly available financial information from earnings reports, combined with some estimates, I was able to tease out the games revenue for major companies. I’ve been tracking the industry for a long time now, and have received a host of feedback on previously shared numbers. This is as good as I’m able to get it today. Take from the following what you want.

There’s also the question of what makes a company a platform. Don’t firms like Sony, Microsoft, and Apple all host third-party content? Yes, but my definition is that platforms are those firms that make most of their money in gaming from third-party content providers. As we saw a few weeks ago, Microsoft’s Game Pass generates substantially less from its own titles than it does from third-party content: $0.18 versus $0.25 of revenue per hour, respectively, over the 12-month period ending in April 2022.

Yes, the Epic Game Store is, in principle, a digital distributor similar to, say, Valve. But Epic only makes a small amount of money from this role compared to its blockbuster title Fortnite. That makes Epic Games a publisher and not a platform.

As always, I welcome comments and corrections. Here’s what it looks like.

A few observations. First, platforms have come to dominate the top of the games industry. In 2022 they account for 8 out of the 10 largest firms in gaming worldwide, compared to a more even 5 out of 10 a decade earlier. The rapid growth of mobile gaming in particular has contributed to Apple, Google, Tencent, and NetEase taking up market share.

Next, platforms have grown much faster. The top 10 firms generated a combined $148 billion in 2022, up from $42 billion a decade earlier. The growth, however, is unequally distributed. Over this period, the combined revenue for platforms grew from $28 billion to $133 billion, at a compound average growth rate, CAGR, of 17 percent. For publishers, that number is only 2 percent, as their combined total stayed largely from $13 billion at the start of the period to $14 billion at the end.

The largest platforms have grown at a spectacular rate. Tencent has increased from $5 billion annually in 2012 to $34 billion in 2022. Similarly, Apple now generates ten times more money from games than a decade ago. Legacy platforms have grown, too. Nintendo and Microsoft each roughly doubled, and Sony tripled in size.

Beyond the top 10, the two largest platforms together earn more than the 15 largest publishers combined in 2022. A decade ago the top two platforms only earned the same as the five largest game makers. That gives them immense leverage in negotiating deals and makes it harder for new projects to get marketing support. Instead, platforms push franchises they know will work and it’s the reason why Sony and Microsoft have been acquiring studios that create proven content.

Consumers stand to benefit in the short term. These megalodon-sized platform holders will both look to expand their audience and increase their revenue per user. But first, they’ll subsidize your entry and offer competitive prices.

After Microsoft started to make waves with its Game Pass offering, Sony was quick to follow with a rebrand and new, tiered subscription structure. Tencent, unable to expand due to regulatory constraints in both its domestic market and internationally, has planted some flags (e.g., by expanding its position in Ubisoft) and is building not one but three console game studios in North America. All of them are investing billions in content development which they will likely offer up at a discount to attract users to their ecosystems.

Life for independent publishers and developers, however, has become notably more difficult. Increasingly reliant on platforms to provide access to audiences, an average studio’s marketing effort is increasingly expensive and complex. It also forces them to develop across different platforms and facilitate cross-play, which further encumbers development. Meanwhile, established franchises are likely to capture a disproportionate amount of attention and revenue in an increasingly cacophonic environment. Platforms have grown bigger, but they have also started to settle and mature. And despite Zuckerberg’s $21 billion investment in virtual reality is still only worth $2 billion, which means it is not quite yet the new blue ocean needed to rack up cheap users for your game.

I predict that successful studios will look for ways to bypass platforms, establish a community on their own, and monetize where the margins are best. Rather than relying on an algorithmic marketing mechanism that will gladly eat your $10,000 budget every day and pay a 30% tax, studios will come to rely on cultivating an active and engaged following.

Going against the grain, the recent success of Baldur’s Gate III by Larian Studios is broadly attributed to the studio’s insistence to abhor micro-transactions, a revenue model favored by platform holders. Its community had been clear about how it wanted to be monetized. Similarly, establishing a meaningful connection with influencers who really care about a franchise will go further in getting the word out.

Successful game makers build communities. In the years to come, success will be determined by the strength of their support network and fanbase.

That’s a different design altogether.

NEWS

Epic layoffs suggest strain at Fortnite maker

Despite its wildly popular Fortnite, Epic Games still needed to shed more than 800 people. The game, we’re told, is “starting to grow again.” And with most of the layoffs falling outside of the core development team, everything remains largely on schedule.

What, then, is the cause of these layoffs?

One hint is that the firm has been growing really quickly. Its headcount ballooned from a few hundred people in 2016 to about 8,000 employees by 2022. Such rapid growth never bodes well historically. One such precursor I discussed in my class recently was Atari’s growth during its heyday in the 1980s. According to the NY Times at the time,

“Atari has grown from less than $200 million in revenues in 1978, just before Mr. Kassar took over, to roughly ten times that in 1982. Its staff has mushroomed to 10,000 people, with 4,000 added in this year alone. They are spread among more than 50 buildings in California's Silicon Valley, south of San Francisco.”

Expansion at that rate goes at the expense of quality control. With Atari, we know what happened next.

Epic is smarter, of course, and keeping its eye on the Fortnite ball.

Another clue we find at the bottom of Tim Sweeney’s letter where it reads:

“What about Project Liberty?

We've been taking steps to reduce our legal expenses, but are continuing the fight against Apple and Google distribution monopolies and taxes, so the metaverse can thrive and bring opportunity to Epic and all other developers.”

Let me emphasize: aaaaallll the way at the bottom.

It suggests to me that in his battle against several Goliaths, David is spending a lot on rocks to supply his slingshot. Epic has taken on Apple, Valve, Unity, and Roblox all at once, which is a quick way to spread yourself too thin. Team Sweeney had to re-focus. The Unreal engine engineering team only saw 3 percent layoffs compared to the business, sales, and marketing teams which “suffered 30 percent layoffs.”

Finally, Epic Games is also transitioning toward a new model that relies more heavily on content created by its player base. I, too, believe that the future is user-generated. According to Sweeney: “Success with the creator ecosystem is a great achievement, but it means a major structural change to our economics.”

It means that in the short term, Epic has to contend with lower margins and therefore increased financial vulnerability and reduced efficiency. It is generally better to fire off all the hard decisions in a single shot.

PLAY/PASS

Pass. After a year-long investigation, five former Ubisoft execs have been arrested in relation to a sexual harassment investigation. Mon Dieu.

Play. Google accidentally leaked the release date of Silent Hill: Ascension, an immersive experience that millions of people can play together. Its maker, Genvid, promptly showed one of the scenes and now I’m excited.