The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

It is a week of walk-backs, apparently.

After Unity kicked off its mea culpa campaign, which, I expect, will result in a full negation of their earlier plans, France’s leader, Emmanuel Macron, issued a statement of his own.

After first describing gamers as disconnected from reality and “living out, on the streets, the video games that have intoxicated them” back in June, this week the French President capitulated and walked it all back. Mon Dieu.

At the time, France was roiled in widespread rioting in response to the death of a 17-year-old delivery driver of North African descent during a traffic stop. Many were understandably upset. Blaming social media for polarizing social discourse and alienating people from reality, Macron also added video games to the list of bad influences that led to the chaos.

But now he’s sorry and says he feels instead that interactive entertainment is “a culture, an entertainment, a spectacle!”

For Macron that would mean putting in more of an effort than sending out a tweet, which arguably is a quick way for him to reach the target audience, but does not do much else. For a country where a portion of movie ticket sales of major blockbusters goes to independent filmmakers, Macron should put his monnaie where his mouth is.

And then there was Microsoft’s accidental leaking of a bunch of internal documents disclosing its plans for 2030 (full PDF below). It presented some notable inconsistencies with what we’ve heard from the firm over the past year, especially in its defense against accusations from the FTC and the CMA.

Of course, the leaked documents have since been removed along with, I suspect, whoever was responsible for uploading the unredacted version of it. Given how much everyone else involved in the ABK/MSFT saga—Sony, the FTC—suffered exposure of confidential documents, I think it’s only fair that Microsoft’s carefully laid out plans catch unwanted attention, too.

Between all three of these incidents, I’m reminded of Cunningham's Law. It states:

"The best way to get the right answer on the internet is not to ask a question; it's to post the wrong answer.”

Let me get my red pen.

On to this week’s update.

BIG READ: Deep dive on Xbox leak

In its exchange with the Federal Trade Commission around the proposed acquisition of Activision Blizzard, Microsoft accidentally released a host of confidential documents. It includes the firm’s “Roadmap to 2030”, detailed hardware specs on its next Xbox console, and unredacted internal communication from key decision-makers.

Before I dive in let me state that none of this information, or my shoddy analysis, should be trusted. What follows is merely an exercise in trying to make sense of how Microsoft sees itself and its competitive advantages. The company has already stated that much of what is available in these documents is over a year old. And the market conditions in which much of it was written have changed. In that understanding, I do believe it has educational value.

Among the juicer bits is Microsoft’s full plans to refresh its Xbox Series X console in 2024, codenamed “Brooklin”, a cylindrical, disc-less update of its existing device in combination with a new controller. The firm imagines a future of “hybrid gaming” that includes console, PC, mobile, and cloud gaming.

There was also ample correspondence about potential acquisition targets, including Nintendo and Valve, to help bolster Microsoft’s gaming business. In the lead-up to its purchase of ZeniMax Media, owner of Bethesda whose game Starfield everyone is currently playing, Xbox CEO Phil Spencer also reflected on buying Warner Bros. Although the firm was “for sale,” Microsoft would not gain control over any of its intellectual property. As for Zenimax, its owners had a different valuation in mind (I heard it at the time to be $10 billion), but it seems they eventually relented and agreed to sell for $7.5 billion.

Beyond the excitement of accessing confidential documents and emails, what excites me most is the apparent dialogue even high-level execs have around major business decisions. While there are specific protocols in place to get approval for a multi-billion dollar acquisition, a notable part of the decision-making still occurs in email exchanges. (Side note: clearly these execs have lots of time to sit around and compose lengthy emails.)

What excites, or worries, me personally, however, are the numbers.

According to the document, Microsoft has set itself a goal of generating $35.4 billion in revenue across its entire gaming division, including all those Game Pass subscribers. Assuming the ABK/MSFT proceeds as planned, Microsoft will generate around $25 billion annually next year. It is expecting to grow its games business by 41 percent by the start of the next decade.

(I took the liberty of re-creating some of the charts because they were barely legible. Next time Microsoft leaks confidential documents, it should consider using a larger, easier-to-read font.)

It raises a few questions.

First, the date on the email containing its 2030 roadmap reflects Microsoft’s thinking in May 2022. That puts it in the middle of the regulatory investigations by the UK and United States relating to the ABK/MSFT acquisition. As part of its argumentation, Microsoft has insisted that mobile, and specifically ownership of the Candy Crush franchise would finally provide it with a significant presence in mobile gaming. A revenue target of $2.6 billion in mobile gaming revenue by 2030 is inconsistent with such ambitions, as Activision Blizzard’s King Digital division already generated that amount in 2021. Even a mediocre forecast should at least double that figure.

Second, the $1.4 billion Advertising category is a mystery, too. Outside of its mention on page 3, it doesn’t appear anywhere else. That makes sense since this is a hardware roadmap. However, fairly recently Microsoft announced it had generated over $10 billion in ad revenue in 2021. And it had made a few acquisitions to further beef up the effort. Aiming for a rather paltry $1.4 billion from its Xbox ecosystem suggests that it does not see an immediate path to monetize using advertising. Seemingly, team Xbox currently has no plans to offer a tiered Game Pass offering that includes ads as other content streaming providers like Netflix and Disney have recently started.

But perhaps my biggest issue centers on the math around its Game Pass service. Generating $7.8 billion annually across 100 million subscribers puts the average monthly revenue at $6.50. That differs substantially from the $9.26 it earned in April 2022 (see below). In June this year, Microsoft already announced it would increase the price of its services from $9.99 to $14.99. At that price point, a base of 100 million subscribers totals $18 billion, or more than double its 2022 internal target.

One explanation for the difference is that the leaked document accounts for changes made since then. Another is that Game Pass is going to be ubiquitously bundled with Xbox hardware, which is a practice that has historically worked well with physical products.

But neither of those can account for the massive increase in subscribers, which leads me to believe there’ll be a heavily discounted or much cheaper version of Game Pass somewhere in the plans. For instance, Microsoft may release a mobile-only version, let’s call it Game Pass Mobile, at a $5 price point. That would give it a large enough addressable market to reach its target. It would also minimize its financial obligations to Apple and Google, who are unlikely to give Microsoft the same deal as they do with Netflix. And, it would explain how its Game Pass service would generate only $6.50 per user per month.

In its chart titled “Path to Leadership” Microsoft shows an apparent accounting of approximately 42 million Game Pass subscriber numbers by platform. Based on the chart, console gaming represents the biggest share, with 36 million (21.9 million on console only in April 2022 according to another document), followed by PC-first gamers (5 million), and Cloud-first (e.g., smart TV integrations) with 1 million. It has apparently hoped to have that many subscribers which hasn’t materialized.

Microsoft further forecasts this total to grow to more than 100 million by 2030, with console, PC, and cloud accounting for 60 million, 20 million, and 25 million, respectively. (N.B. All numbers are eyeballed from a chart so take from this what you will.)

Microsoft here includes mobile gaming in the ‘cloud’ category, which it expects to grow from less than a million in 2023 to 30 million by 2030. It’s unclear what it means by the “multi-device gamers” and “limited Mobile-only” categories. However, the totals tell you that it anticipates a compound annual growth rate of 12.8 percent (more-or-less) on a rather steady path.

To make this all work, Xbox needs a solid content portfolio.

Here, too, we find some useful numbers. (h/t to Derek Strickland) It provides some important context to the firm’s recent market moves and announcements.

For starters, on console, the firm reported 51 million monthly active users in April 2022 showing an increase of +3 percent y/y. About 4 out of 5 console players (78 percent) spend money.

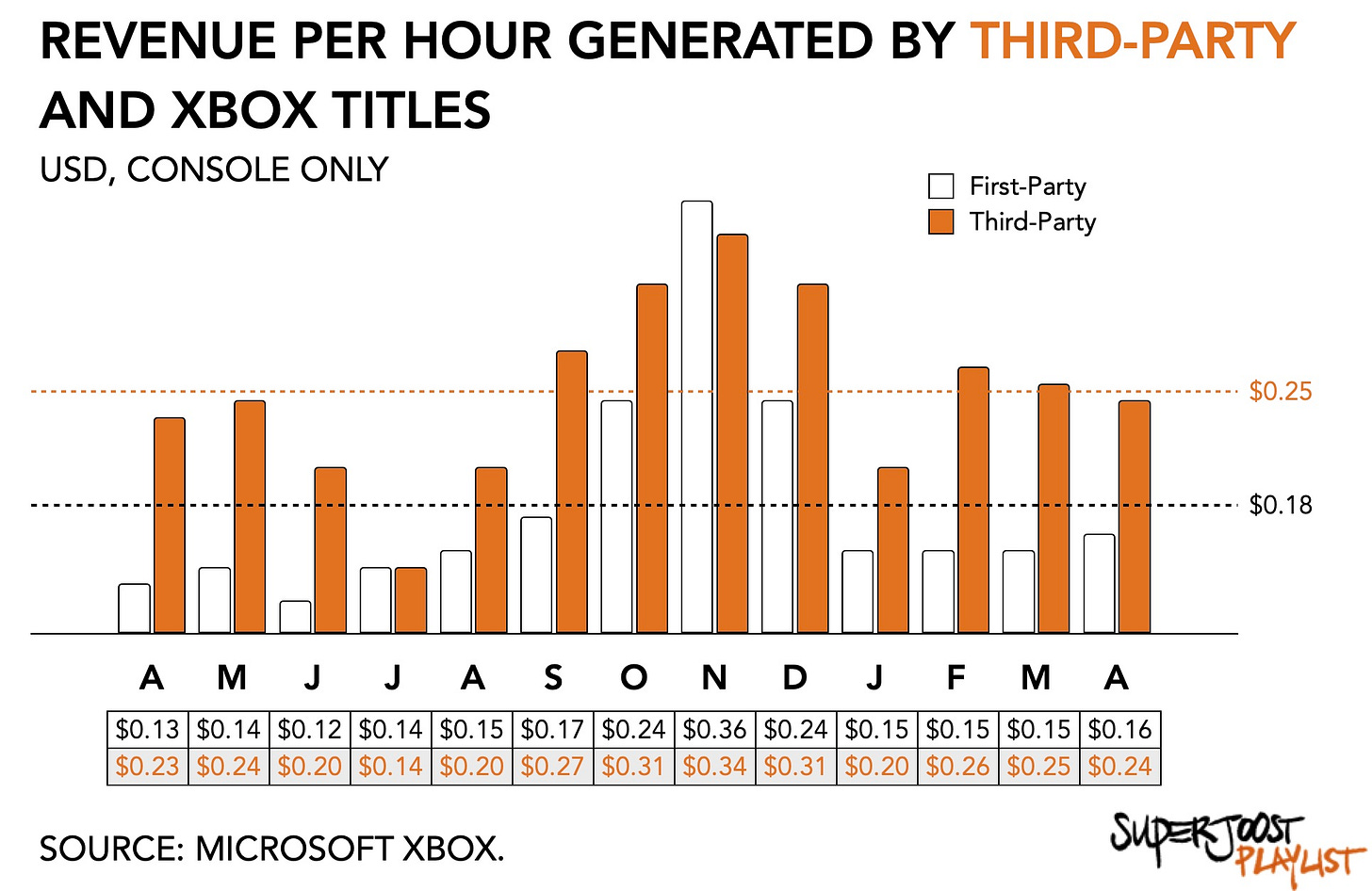

Last week, it was happy to claim that 10 million people were playing Starfield. But it is clearly trying to close the gap between its own and other publishers’ content. Specifically, third-party content generates more revenue than Microsoft’s own titles.

In terms of time, 3rd party content gets most of the attention and accounts for 39 out of the total 44 hours of console gaming hours played per monthly active user in April 2022, or 87 percent.

Third-party games generate, on average, $0.25 in revenue per hour compared to $0.18 for Microsoft’s own titles. While the former increased only slightly, +3 percent y/y, Xbox did see some success with Minecraft and Forza Horizon 5, which it claims contributed to an increase of +22 percent in revenue per hour.

Perhaps the most important observation here is the absence of profitability. None of it covers Xbox’s costs. While it has never disclosed its operational overhead, I estimate the cost of facilitating game streaming on a per-hour basis is around $0.45. (In April I quizzed Xbox CFO, Tim Stuart, on Xbox’s plans at MIT’s 2023 Gaming Industry Conference. You can watch the full fireside here.)

It means that Microsoft is about halfway to reaching profitability on its console-based game streaming infrastructure. That type of strategy is common among large tech firms who like to subsidize a service to capture market share and then turn to monetization (see: Unity). Based on these figures, that won’t happen just yet and, instead, we can expect Microsoft’s continued investment and subsidies until it gets closer to breaking even.

What isn’t news, however, is that Microsoft is always considering who to acquire next. It should. Large corporations can grow in two major ways. The first, innovation, requires a lot of patience and operational expenditure as it spends years slowly developing and tinkering with novel product offerings and better ways of doing things. Short-term focused shareholders tend to dislike this approach because it can strain profitability.

The second, acquisition, is a lot flashier, faster, and can drive up share prices instantly. More so, acquisitions tend to be capital expenditures, giving them the additional benefit of reducing tax liabilities. In Microsoft’s case, much of the $2.5 billion it spent on buying Minecraft-maker Mojang was paid using capital that would have otherwise been taxable.

I’d warn against taking all this too literally. More than a year has passed since these first circulated internally and much of this information has changed already. But judging on these numbers, Microsoft has its work cut out, even after it lands Activision Blizzard.

PLAY/PASS

Play. The New York Times had a moment of introspection and realized it’s been sleeping on video games.

Play. Did you see this Pokémon drone show? Supercool! (h/t Daniel Ahmad from team Niko Partners)

great analysis Joost and much appreciated!

Thank you for this. The Polygons and IGNs of the world are so laden with clickbait that their analysis on the leak made no sense to me. Yours is reasonable and well considered. You’re the best.