Sony and Microsoft's agreement on Call of Duty

Everyone gets what they want, including regulators

This year’s Super Bowl was the third-most viewed in its history.

The symbolic overtones of this sports event never cease to amaze me. There’s the persistent ubiquitous presence of the military. The deeply held beliefs and values emanate from the game’s ruleset. A pregnant Rihanna offered a well-choreographed performance balanced on several floating platforms during the halftime show. And, of course, what to make of the skybox filled with collegial billionaires enjoying a hotdog. As an immigrant, I’ve learned more about the American psyche from watching this singular event than from a thousand hours of naturalization studies.

Notably absent this year was the slew of crypto companies running ads promoting their various NFTs and crypto-currencies. For good reason, of course. “Fortune favors the brave,” Matt Damon told us last year, only to see everyone’s digital fortunes decimated shortly thereafter.

One firm, Limit Break, seems unperturbed. During its 30-second halftime show commercial, it encouraged people to come to its site and create a wallet. Specifically, it offers a free Ethereum NFT mint for its anime-styled game, DigiDaigaku. The firm, which recently raised $200 million, isn’t just some newbie. It is the next empire dreamt up by the same CEO who built Machine Zone, which was among the top-performing mobile game companies for years until AppLovin (see below) acquired it for $500 million. Its best-known games--Game of War and Mobile Strike--were not my cup of tea, to say the least. But they managed to perform exceptionally well because the firm identified early on the perpetual need for a live services game to always be recruiting new players.

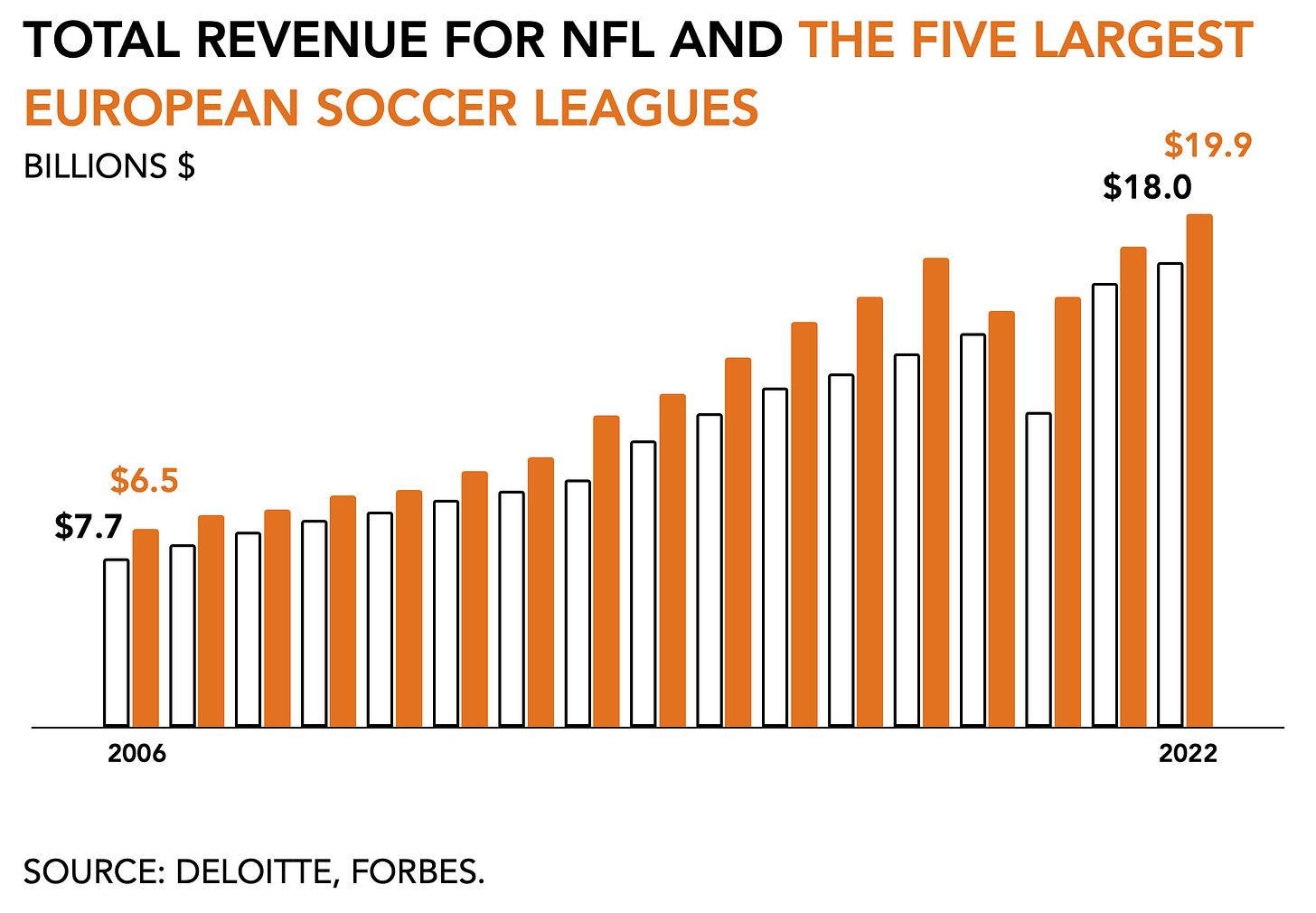

Like the Super Bowl, the penultimate event for a sport that continues to baffle me twenty years on, the marketing machine that makes it all work is more important than the game itself. Sports video games, for one, continue to generate massive amounts of revenue. In the wake of its rather disappointing earnings report, Sky Sports reported this week that Electronic Arts is close to signing a 6-year agreement with the Premier League valued at $600 million (£488M). The publisher is looking to maintain its name for being the de facto sports video game maker after losing the FIFA license. Simultaneously, the deal is a boon for the soccer League, which is the most financially robust league in the world of football.

The Super Bowl insight here is that somewhat counterintuitively, commercially successful games aren’t always the most sophisticated or the most beautiful. Such is our bread and games.

On to this week’s update.

BIG READ: Sony and Microsoft's agreement on Call of Duty

Following the release of the UK’s Competition & Markets Authority’s (CMA) provisional findings last week, I’ve been privy to a few behind-the-scenes aspects. I believe these deserve to be shared because the potential acquisition of Activision Blizzard by Microsoft is a landmark case that is taking place in real-time and is producing unprecedented insight into the industry’s workings and its anticipated future.

For my personal perspective on the case, you can read my 20-page submission to both the FTC and CMA here. Keep in mind, please, that I have no horse this race, nor do I own shares in any of the companies involved, and I am not compensated. Also, none of this information was shared with me in confidence.

The first observation is that since Microsoft made clear in December its willingness to offer parity on the Call of Duty franchise, Sony hasn’t said anything negative. After Sony publicly stated in the Financial Times this week that it was in contact with Microsoft but refused to comment on “private negotiations” it suggested to some observers that negotiations are taking place.

Second, one source tells me that Sony’s corporate jet made a visit to Seattle last week for the first time in 18 months. It suggests that the two firms are meeting to come to a resolution. In early September last year, Microsoft had flown out to Japan to offer a license extension for Call of Duty for five years. Sony, I’m told, didn’t even take the meeting and thereby rejected this initial offer. It instead asked for a license ‘in perpetuity’. With this alleged recent visit, however, the publicly cold relationship appears to be thawing.

Third, there was a notable difference in tone between the provisional findings released by the CMA and the press release issued last week. That may just be the result of how it chose to make the announcement, or, as some would have it, an indication of inconsistencies which could even indicate a potential split in the panel looking at the case. Either way, as the case progresses, regulators are much closer to finding a reasonable compromise than when they first voiced their concerns.

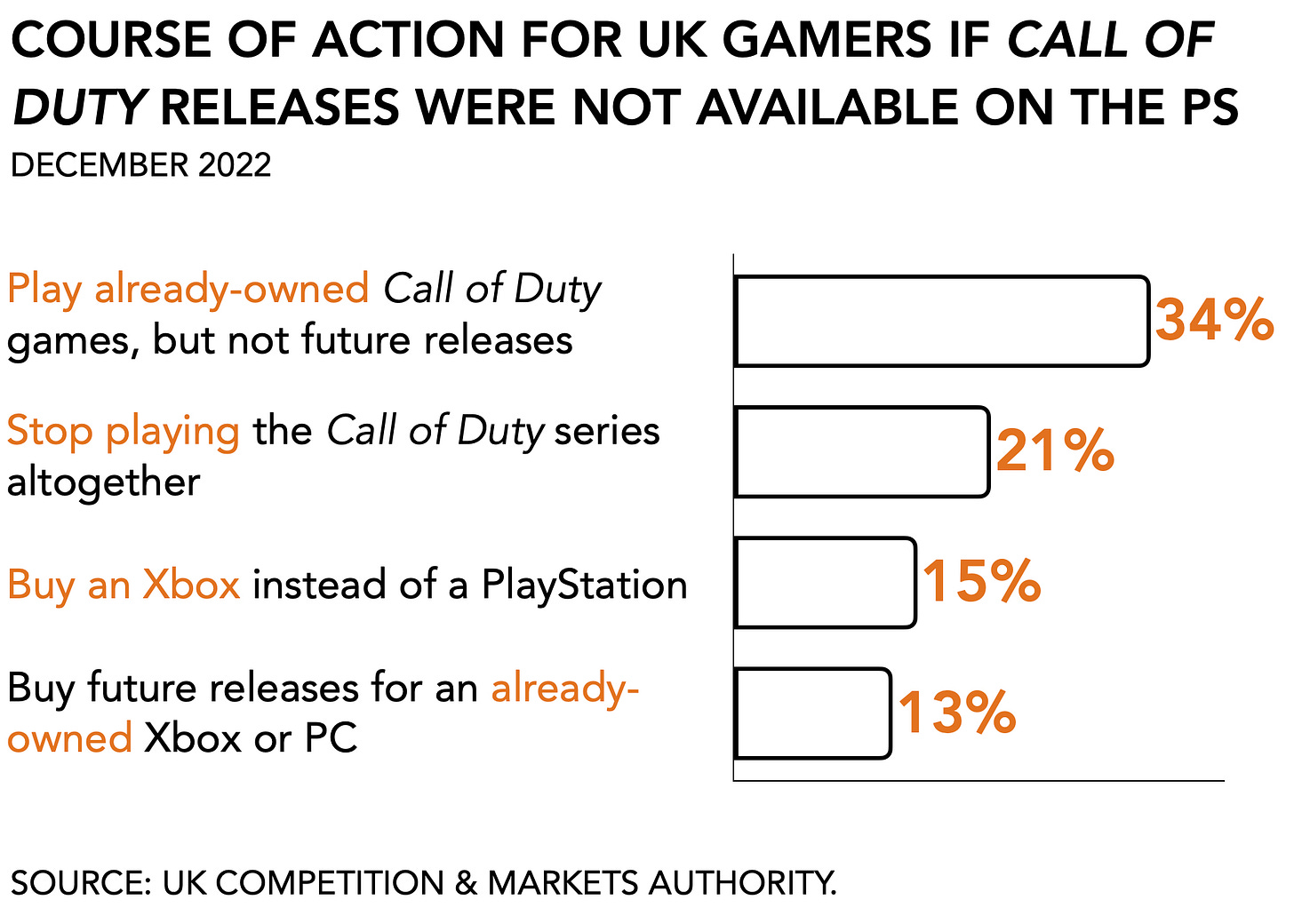

The CMA also released its commissioned survey report among UK-based gamers that provided some notable details on players’ willingness to switch devices post-merger. Specifically, 21 percent of respondents stated they’d stop playing Call of Duty if it were no longer available on the PlayStation, and 15 percent would move to buy an Xbox instead.

Furthermore, the European Commission (EC) sent Microsoft its Statement of Objections (in private). The two have been running experiments on behavioral remedies for the European market, including an assessment of customer loyalty and players’ willingness to switch devices on account of licenses like Call of Duty. I expect the findings to be similar to those from the CMA’s study and indicate a low potential conversion rate.

And, finally, the FTC’s complaint effectively provided a roadmap that will allow Microsoft to address line-by-line the different concerns by way of a consent decree. Once it does, an administrative judge presiding over the case will consider it moot and move to dismiss. The FTC, by the way, was having a bad week, because its only Republican commissioner, Christine Wilson, resigned this week with what she described as a necessarily “noisy exit” to make the point that Republicans fundamentally disagree with several of chair Kahn’s decisions. With the announcement two weeks ago from the Australian Competition & Consumer Commission to suspend their timeline to engage with “overseas regulators”, it is clear all eyes are on the CMA, FTC, and EC, while regulators elsewhere wait and see.

For these three it is critical that Sony and Microsoft come to an agreement on the Call of Duty license. They will block the deal without it. However, after initially fighting tooth and nail to defend its walled garden business model, Sony has softened its tone or at least stopped slinging mud. It will also be in the Japanese console maker’s interest to strike a deal. Following several proposed divestiture scenarios from the CMA, Sony potentially faces a stand-alone entity controlling the precious franchise. Keeping in mind that the existing license is set to expire in 2024, it is unlikely, however, that this spin-off company will offer Sony a better deal than Microsoft.

Everyone involved in this deal is starting to feel the burn and it is pushing all of them to arrive at a resolution.

What’s next

One scenario that may allow the deal to go through and satisfy everyone is a combination of two elements:

an agreement between Sony and Microsoft around the Call of Duty license, as a behavioral remedy, and

the divestiture of Blizzard to satisfy regulators as a structural remedy.

This is a different approach than suggested by the CMA. Spinning off Blizzard would directly speak to reasonably diminishing Microsoft’s ability to leverage content to build its cloud ecosystem, especially because its biggest money-maker, World of Warcraft, is exclusively on PC. It will also allow Microsoft to push into mobile where, as I’ve argued previously, it will bring some much-needed competition.

Moreover, Blizzard is the smallest component of the existing entity with $1.8 billion in revenues in 2021 and the lowest profit margin (38%) compared to Activision ($3.5 billion, 48%) and King Digital ($2.6 billion, 44%). Microsoft will also need to strike a deal with Amazon and NVIDIA for their respective cloud services, even if they have substantially smaller market shares currently, to clear the road and allow for everyone to compete on more-or-less similar terms from here on.

Given the softer tone and apparent on-site visit, it’s starting to look like the two rivals are much closer to an agreement than they were a year ago. With the deadline to close the deal now months away, it’ll be in everyone’s interest to wrap this up.

As always, comments are welcome.

MONEY, MONEY, NUMBERS

Roblox’s 22FY revenues reached $2.2 billion, up +16 percent y/y. Its audience continues to grow with the number of average daily active users up +19 percent to 58.8 million, although average spending per daily active was slightly down -2 percent y/y at $15.29. According to its CFO, growth was particularly strong among users (+39 percent) between 17 and 24 years old, suggesting a break in its reliance on younger players. In January, Roblox recorded a new high of 65 million daily active users and leadership pointed at a “very, very healthy” payer conversion rate, despite posting a $290 million loss for 22Q4. Despite all this upbeat information, Roblox still runs at a loss. The largest costs on its balance sheet are its R&D costs, which were up +64 percent at $873 million, Infrastructure costs (up +51% at $698 million), and Developer Exchange fees (+16% at $624 million) for 22FY. The increase of its EBITDA margin of 20 percent, versus a Wall Street anticipated average of 11 percent, surprised investors. The firm previously announced its discontinuation of providing monthly performance metrics. The metric ‘total bookings per hour engaged’ shows a slow decline, from $0.065/hour in January 2021 to $0.052 in January 2023, which will have to improve to reach profitability. Roblox’s shares are trading at $45 a share, up from the $36 pre-earnings report.

AppLovin reported $702 million in revenues for 22Q4, down -12 percent y/y from $793 million. This was largely the result of declining consumer spending in its own games portfolio, “comprised of 11 studios plus several publishing relationships,” which dwindled from $547 million to $396 million over the same period. Revenue derived from its Software Platform, which focuses on connecting consumers with content through a variety of different channels and includes AppDiscovery, MAX, AppLovin Exchange (ALX), Adjust, Wurl, and Array, was still up +24 percent y/y from $247 million to $306 million. However, q/q earnings were flat and recent figures suggest an imminent decline based on a drop in enterprise clients from 566 to 380, accompanied by -14 percent lower average spending. AppLovin further announced a bunch of updates to its key metrics. Uh oh. My guess is that the firm is currently evaluating whether to sell off its games portfolio in part or wholly in the coming year.

Nexon had a solid fourth quarter earning $618 million (+50% y/y) and $2.7 billion for 22FY (+29%). It attributed the growth to the strength of its virtual worlds, especially MapleStory and Dungeon Fighter, and the higher-than-expected traction of FIFA ONLINE 4 attributed to “World Cup-related events and sales promotions.” Its mobile business, however, came in lower than expected at $200 million for 22Q4 versus an outlook of $243 million, resulting in a slight loss for the quarter. Korea continues to be its primary market with 60 percent of total revenues, followed by China (24%), North America and Europe (6%), and Japan (3%). Two-thirds of earnings (69%) come from its PC games versus 31% for mobile.

PLAY/PASS

Play. Supercell’s CEO posted his annual thoughts which this year cover the conundrum of where to go next when you’ve accomplished everything. Worth a read.

Pass. During a conference, China’s Audio-Video and Digital Publishing Association called for further restrictions on the existing three-hours-a-week game time allowance for minors. It has the same energy as the UK school that eliminated bullying by banning outdoor recess.

Sony have no incentive to strike a deal with MS. They have said multiple times they want the deal dead, and with the FTC block, the CMA largely talking the same as the FTC, its almost irrelevant what the EU does if the CMA blocks or asks for divestiture.

A CMA block is game over for this deal. There is no recourse, and Sony are very close to getting it.

I find it incredibly likely ATVI/MSFT want divestiture, even if they did, there are a handful of companies interested that could buy Activision or Activision+Blizzard, many of whom might run into similar anti-trust problems (Facebook, Amazon, Tencent, Sony).

A couple of further observations:

(i) I agree with your assessment that this deal is dead without a Call of Duty deal. That gives Sony enormous negotiating power in that particular discussion. I expect something close to perpetuity

(ii) Having achieved second stage investigations from the three key regulators, Sony has no need to mount a public campaign to object to the deal. I would not read much into their new found reticence

(iii) It’s unclear to me that a disposal of Blizzard will be a sufficient structural remedy