Unity divides

New fee structure sparks controversy

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

With school back in session I anticipate a seasonal drop in Roblox activity.

Over the summer, it’s been a bit of a free-for-all because it allowed my ten-year-old to connect with his friends as they found themselves scattered across the East Coast on vacations and trips. Of all the apps and games that relentlessly target my child, few have proven to retain him as effectively. It fills me both with worry and wonder.

For that reason, too, I like to keep an eye on the company. Last week Friday, Roblox hosted its ninth annual Roblox Developer Conference. With 65.5 million daily active users that play an average of 2.3 hours a day, Roblox is in a position to shape what it means to play and interact with others online. After sitting through its 4-hour-long keynote, here are a few observations.

First, its CEO, Baszucki, positioned Roblox as a platform for “communication and connection,” arguing that its shared experience has the potential to combat the negative effects seen on other platforms. Baszucki has always been an idealist, so while this warm fuzzy creed has received a stamp of approval from the PR department, I believe his optimism. This is despite the class action lawsuit filed last month by two parents alleging that Roblox facilitates “child gambling.” Laine and I discuss it in more detail on this week’s episode if you’re interested, but succinctly stated, I see no evidence that Roblox is in any way slacking on its responsibility to keep children safe. It’s not perfect by any means, but you do get the impression that, unlike other social networks, it is at least trying, whereas Twitter X and TikTok are not so much.

Next, Roblox is set to launch soon on the PlayStation and Meta Quest. In a world where cross-platform gameplay and network effects are key to success, it makes sense for Roblox to make itself ubiquitously available. However, according to its filings, mobile and desktop remain its largest platforms with 78 percent and 20 percent, respectively. Traction on the Xbox and Oculus has amounted to very little, so it’s unlikely that two additional dedicated devices are going to make a big difference.

A much more promising effort comes from its integration of generative AI. Allowing users to create custom avatars and virtual landscapes using text prompts will provide a richer experience and, subsequently, improved engagement and retention. Wall Street won’t like it in the short term because it will inevitably depress profitability. But users will. Moreover, its vision to create a marketplace centered on user-generated content promises to become a key aspect of its future. According to management, the roll-out of so-called ‘Limiteds" (e.g., in-game items sold in artificially limited quantities) is proving quite popular as 80 percent currently trade at a premium on its secondary market.

The firm’s focus on improving and expanding the user experience is, I believe, critical to its long-term success, especially against a background of corporations catering to shareholders over users. Roblox currently trades at $29 a share, down from $44 a year ago.

When I picked my kid up from sleepover camp, I naively asked him if he had gotten the phone numbers of his new buddies so that they could stay in touch.

“Of course not, Dad. I have their Roblox user names.”

On to this week’s update.

BIG READ: Unity divides

Even as creatives in other entertainment industries continue to fight to make fair wages, a new front has opened in gaming as developers figure out what to do about Unity’s new fee structure.

Starting in January 2024, Unity, a popular game engine, will introduce what it calls a "Runtime Fee." Based on the number of users installing a game, the platform will trigger a fee depending on specific revenue and installation thresholds. Marc Whitten, president of Unity’s Create division, defended the decision arguing the continued updates necessary to evolve its technology are costly.

Game developers are not pleased.

Because the fee is based on the number of installs—not monetization like Unreal Engine—developing free-to-play titles is at risk of suddenly becoming much more costly. Digitalization has resulted in a glut in gaming content and increased marketing expenses. By charging for installs, Unity is imposing on the cost structure of, especially, smaller devs.

But what got one studio head to call it “an astonishing scumbag move" is that the policy allows Unity to apply the new charges to "eligible games currently in market." For instance, a small developer keeping a free-to-play title alive that generated over $200,000 in aggregate over twelve months, would end up owing Unity money retroactively.

Unity’s game engine is a popular developer tool and, by comparison, easier to master than Epic Games’ Unreal Engine. But to smaller studios, the updated fee structure is a financial threat. Mobile game makers and indies can get mired in a host of different costs and expenses as component licensing arrangements—by relying on different service providers for specific technologies (e.g., cloud infrastructure, localization, customer support)—often lead to revenue fragmentation. And larger publishers already locked into the platform now face increased costs to their titles.

Unity’s decision to raise its prices, however, should not come as a surprise.

Large platform companies often initially subsidize third-party content creators to ensure widespread adoption of their technical standards. Once critical mass has been achieved, platform holders tend to gradually alter their policies, including fee structures.

Unity is in a tight spot and has been trading down since its peak of $197 per share in late 2021. A few months later, the firm discovered its advertising algorithms had been based on “bad data” leading to a $110 million revenue write-off to fix the problem. Further exacerbated by softening demand for games, Unity’s share price lost about three-quarters of its value despite doubling revenues since 2020 to $1.4 billion last year. Wall Street analysts now forecast Unity will double its revenue again over the next two years to over $3 billion, based on its increasingly aggressive commercialization effort.

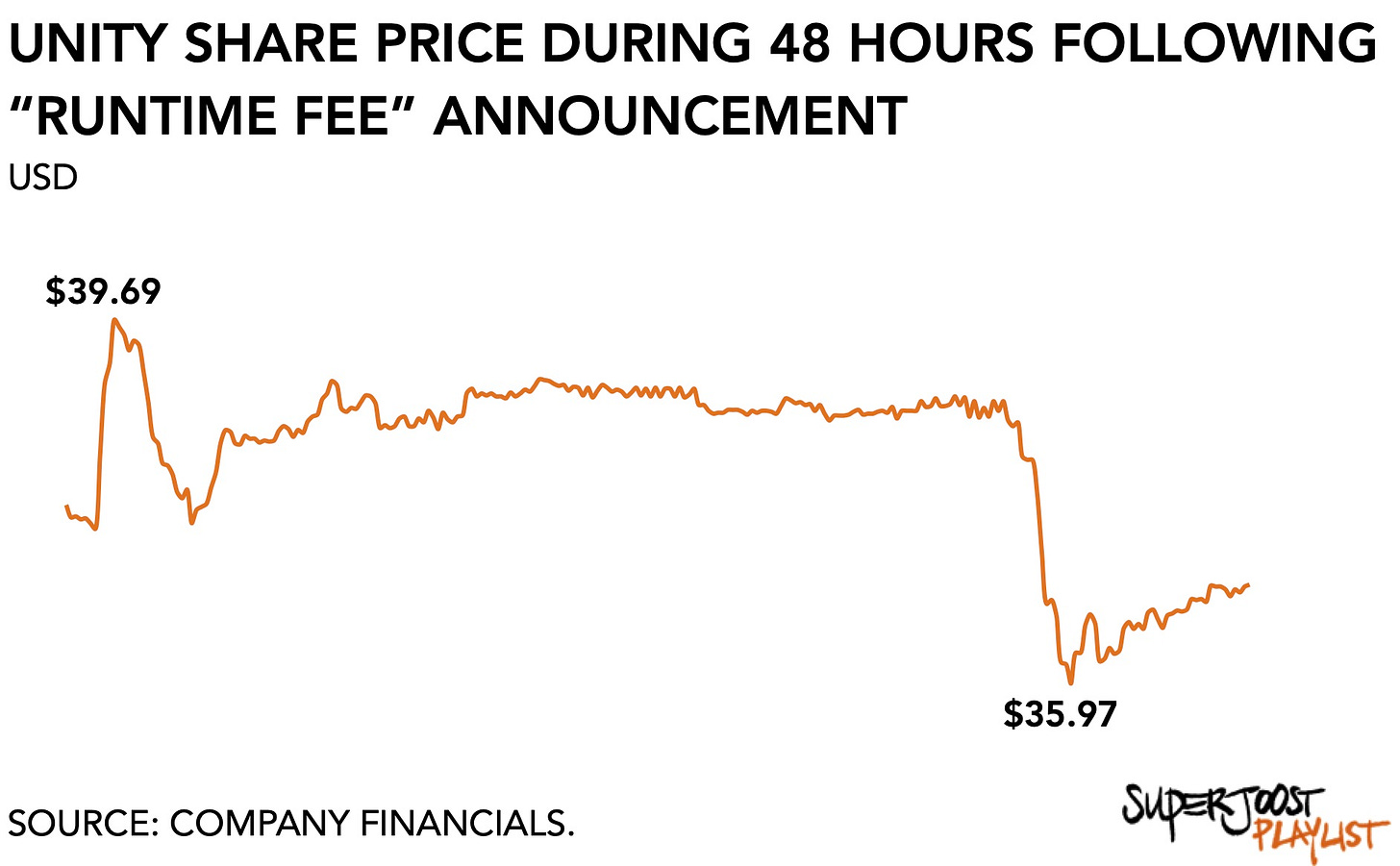

Investors initially responded positively and Unity's share price increased 5 percent on the news to almost $40 a share. According to some estimates, the updated fee structure would bring in an additional $140 million in revenue in 2025 even after one in five developers abandon the platform.

There are market conditions to consider, however.

Aggressive rent-seeking behavior is a tough sell and will likely bolster the position of the other game engine provider, Epic Games. Despite targeting different market segments—Unity is more popular among mobile game developers whereas Epic’s Unreal Engine is favored for high-end productions—Unity’s decision set a clear tone for what’s to come, even if it increases its revenue prospects in the near term. It makes other game engines more attractive. While Unreal Engine charges 5 percent for games that generate over $1 million in revenues, other engines like GameMaker ($50 annual license without additional fees) and RPG Maker ($25 one-time fee, no additional fees) become more reasonable alternatives. Beyond Epic, there are also Godot, GameMaker, and RPG Maker to name a few. It is naive to expect these to become existential threats to Unity overnight, but their collective popularity is likely to increase which will blow back on Unity.

Moreover, game production is changing rapidly. Specifically, I expect the dream of becoming a game developer to shift away from the ultra-competitive mobile ecosystems to the much more friendly pastures of popular multiplayer universes. The push into user-generated content and the emergence of small, professional outfits creating experiences inside large online worlds means that game engine providers now also compete with the likes of Roblox, Minecraft, and Fortnite. As publishers and franchise holders move to engage their audiences in novel ways, including by encouraging them to create content inside a game world, these aspiring amateur developers will rely on whatever editor a publisher provides.

Beyond the bad press, Unity’s changes make life substantially more costly for small and medium-sized studios. The corporate logic rhymes with shareholder interests. But for creatives, the creeping monetization practices that exist in other platform-based businesses, mean overall returns will diminish.

After initially experiencing a spike in its share price, Unity has since traded down to a low of under $36 a share. Rolling out a monetization strategy that many perceive to be too aggressive may hurt Unity in the long run as creatives adjust the risk profile associated with soul-binding themselves to a single engine provider. And for tiny devs, it may be time to untie themselves from Unity altogether.

NEWS

Apple steps up high-end gaming on new line of iPhones

While most of the annual event presents an exercise in diminished returns on innovation, Apple has been increasingly leaning into gaming to upsell and showcase the capabilities of its hardware and proprietary chipsets. With this week’s announcement of its upcoming line of smartphones, the iPhone 15, several established franchises that were previously only available on PC and console are now coming to mobile. The line-up includes Resident Evil 4 Remake, Resident Evil Village, Death Stranding, and Assassin's Creed Mirage. [Segment begins around 1:06:45]

As you’d expect from a consumer electronics manufacturer, Apple prefers that you run your games locally. Instead of relying on cloud infrastructure, where it coincidentally does not have any dominant market power, it has developed its latest line of processors to optimize for increased frame rates and graphics. In 2024, the console version of the latest edition of Assassin’s Creed will be “natively available” on a smartphone.

It’s promising, certainly. As per tradition with the release of any new platform or innovation, Ubisoft got itself a front-row seat. But Apple fortunately also roped in Capcom and MiHoYo, which will fortify its position in Asia. And by opening up high-end mobile gaming, Apple has effectively run out ahead of Samsung which has long wanted to but has remained unsuccessful (h/t Rob).

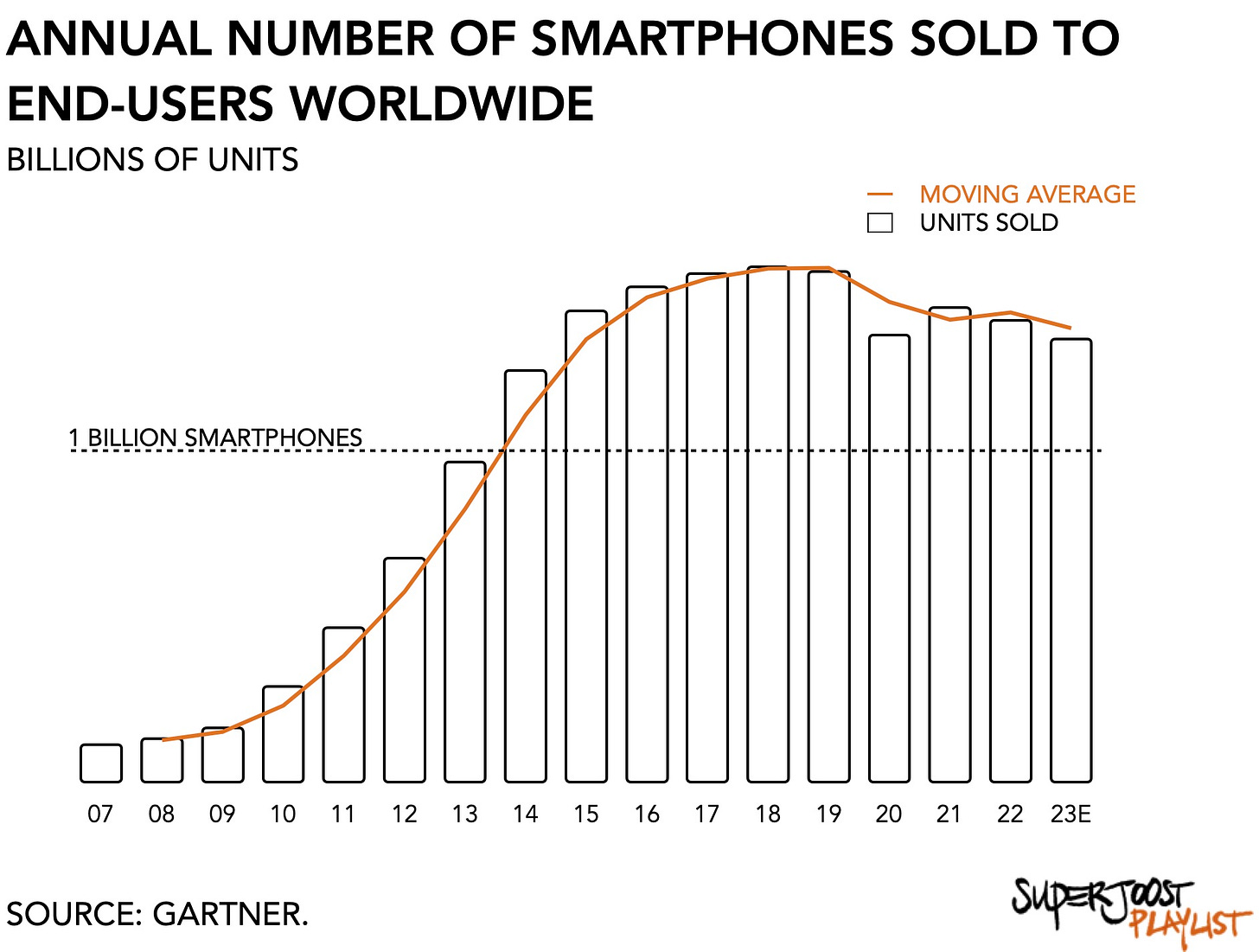

Since the annual sale of smartphones has reached a plateau, manufacturers are understandably looking to accommodate more high-value users who are willing to shell out extra cash for higher-end experiences and hardware. Worldwide, the sale of smartphones peaked in 2018 at 1.56 billion units and has since gradually settled around 1.4 billion annually.

I do have questions about the demographic overlap between mobile gamers, which tend to skew more casual historically, and high-end productions that are popular among dedicated players. More so, despite the increased framerate, is playing a high-definition action game going to be feasible and fun even on a large phone, compared to a more traditional setup? And, there was no mention of Electronics Arts, Take-Two Interactive, or Activision Blizzard. Releasing high-end remakes is cool, but not quite as cool as, let’s say, being one of the platforms where Grand Theft Auto VI will drop when it comes out.

PLAY/PASS

Play. After we did a recent episode of Unboxing discussing the dire state of game preservation because only a fraction of video games remain available today, there’s something to be said for people making WipeOut for the PSX available to play on a browser.

Pass. Esports is in the midst of another winter and even a major brand like FaZe is shivering out in the cold. Here’s a great write-up about an enormous mess.

This is nuts. I go through a lot of demos for my newsletter, and the vast majority use Unity. I'll watch to see if more of the other engines start popping up.

I often wonder what made Unity so overwhelmingly popular among indie developers over the alternatives. Is it cheaper, easier, more versatile? It still blows my mind how wide the Unity catalogue is today, from very basic games to hundreds of players online in a Battlebit map, and across most genres.

I have no doubt this will hurt indie games, particularly at the higher quality tiers where the breakthrough titles emerge from.