In between the spotty internet and this pesky bear that keeps knocking over the trash can at the place we’re staying in upstate New York, I’m a bit strapped for writing time.

But I couldn’t ignore a few key topics this week. First there’s AppLovin’s hasty proposition to Unity in an attempt to find love in the cold, hard world of in-game advertising. Spoiler alert: hello friendzone!

Next are the parallels between the early days of social poker games and the next iteration of crypto game companies. A steady stream of income from an evergreen game type affords creative firms to keep reinventing themselves until they achieve commercial success. Game makers, like many of us, hold jobs they don’t like to pay for building things that they’d rather do. Transformation is costly.

And finally I put a few thoughts together on video game accessories and how this mostly ignored category serves as a viable proxy for the state of gaming. Like movie buffs and vinyl collectors, the upper echelon of video game enthusiasts like buying the best and most expensive equipment available. Is there are a luxury category in gaming?

On to this week’s update.

NEWS

AppLovin’s unrequited love for Unity

When Unity offered to merge with its ad competitor IronSource a few weeks ago, the team at AppLovin must have felt left out. It promptly threw together an $18 billion bid to win Unity’s affections. It’s the love language of an incel.

At face value a merger makes sense. Unity’s game creation engine and advertising tools make it a suitable expansion to AppLovin’s mobile ad network.

Too bad all of this heavy petting will fall short of consummation for four distinct reasons. First, to accept AppLovin’s advances, Unity will have to walk away from the deal with IronSource. However, the termination fee is $150 million, which makes up about 13% of Unity’s cash and equivalents, based on its March filing.

Second, the AppLovin deal values Unity too low. Sure enough, it has fallen from a high of $200 a share in November last year to about a quarter of that at $53 today. But the AppLovin offer to merge puts Unity’s share value at around $50 when Unity itself valued its shares at about $80 for the IronSource deal. There’s always a slight chance that Unity boss Riccitiello is seduced by taking the CEO position at the merged entity, but he already has a private jet, I’m sure.

It would thirdly be a wholesale deviation from the path Unity has been on for the past few years. The firm has switched its focus to non-gaming and non-mobile gaming plans, in the form of several acquisitions including Metaverse Technologies, Vivox, their investment in real-time 3D, and their partnerships with Adobe. An important part of Unity’s pitch has been its focus on bringing its gaming experience to non-gaming categories like automotive, architecture, film, and entertainment. A marriage with AppLovin would be a full-scale reversal of Unity’s self-actualization.

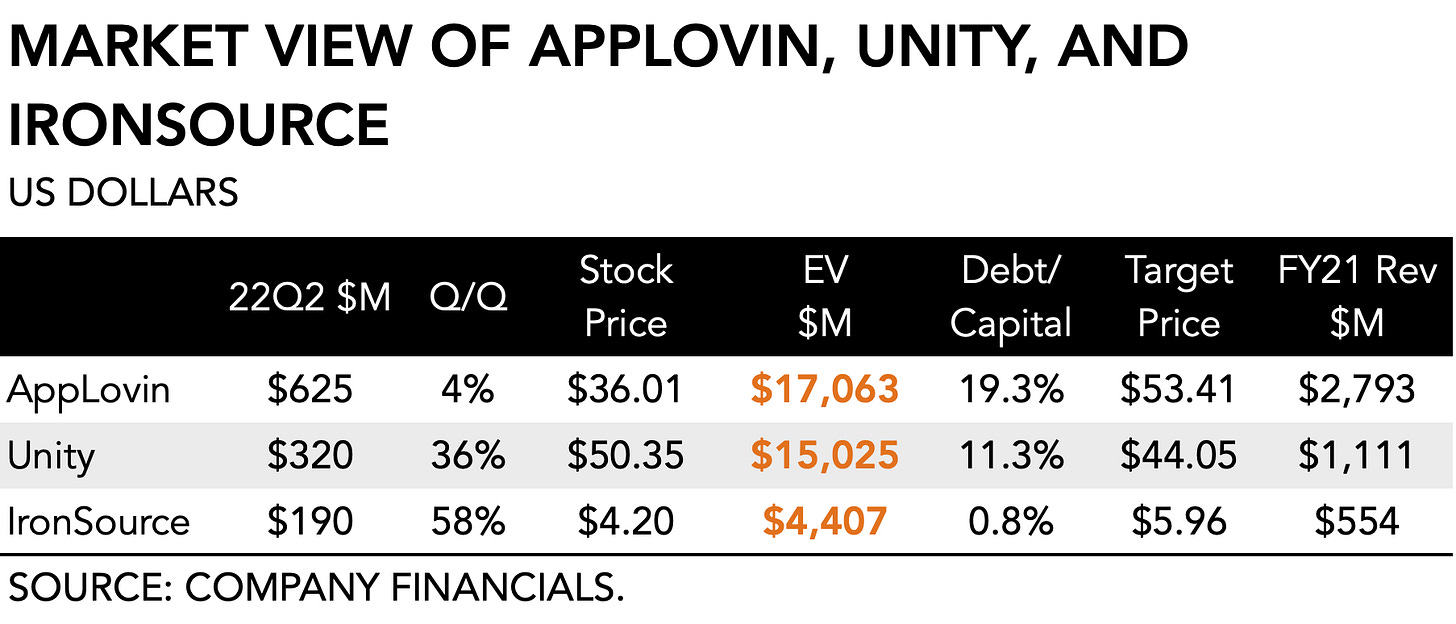

But fourth and critically, the combined entity of Unity and IronSource is worth more than AppLovin. The category leader, valued at $17.1 billion has at once the lowest quarterly growth and the highest debt-to-capital ratio. The Unity/IronSource entiry would be worth more, have less debt, and more upsight potential. Combined with the repeated comments during its earnings call that it had only “observed Unity from a distance” and that it’s currently “only a high-level discussion” means that it is trying to not get left standing when the music stops.

The popularization of games before and over the pandemic has enabled a broader array of monetization strategies and advertisers, in particular, have been looking to expand their role in gaming. Baking advertising right into the source code and relentlessly driving user acquisition is proving critical to mobile and other digital formats that no longer exclusively cater to consumers willing to pay a premium.

But a marriage borne from a sence of scarcity is unlikely to be compelling to anyone. A year or two from now the Unity/IronSource entity may even be in a position to buy AppLovin instead. Until then, I hope it enjoys its time in the friendzone.

Crypto poker recurrence

Now that most crypto gaming nay-sayers have gotten their pound of flesh it may be a good time to take stock. Did the crypto crash wipe out everyone’s hopes and dreams, or does an ember remain that could relight excitement?

To many, the final nail in the crypto coffin came when Minecraft officially and in no uncertain terms declared that it would never ever never allow NFTs ever. The game has been adapted to facilitate literally every other innovation in gaming (e.g., cross-play, micro-transactions) but digital ownership was a bridge too far.

I’ve previously written about the lack of nuance in the industry-wide debate on whether blockchain technology would, could, and should serve as a new innovation. Most creatives have dismissed the technology outright on grounds of it being predatory, facilitating Ponzi schemes, having a bad impact on the environment, the impossibility of applying item characteristics across different franchises, and the emphasis on the marbles and not the game.

They’re right, of course. With the crash, many would-be crypto games saw themselves flushed along with their crappy currency schemes. Even the king of the crypto hill, Axie Infinity, was brought to its knees.

But I remain a firm believer in long-term digital ownership.

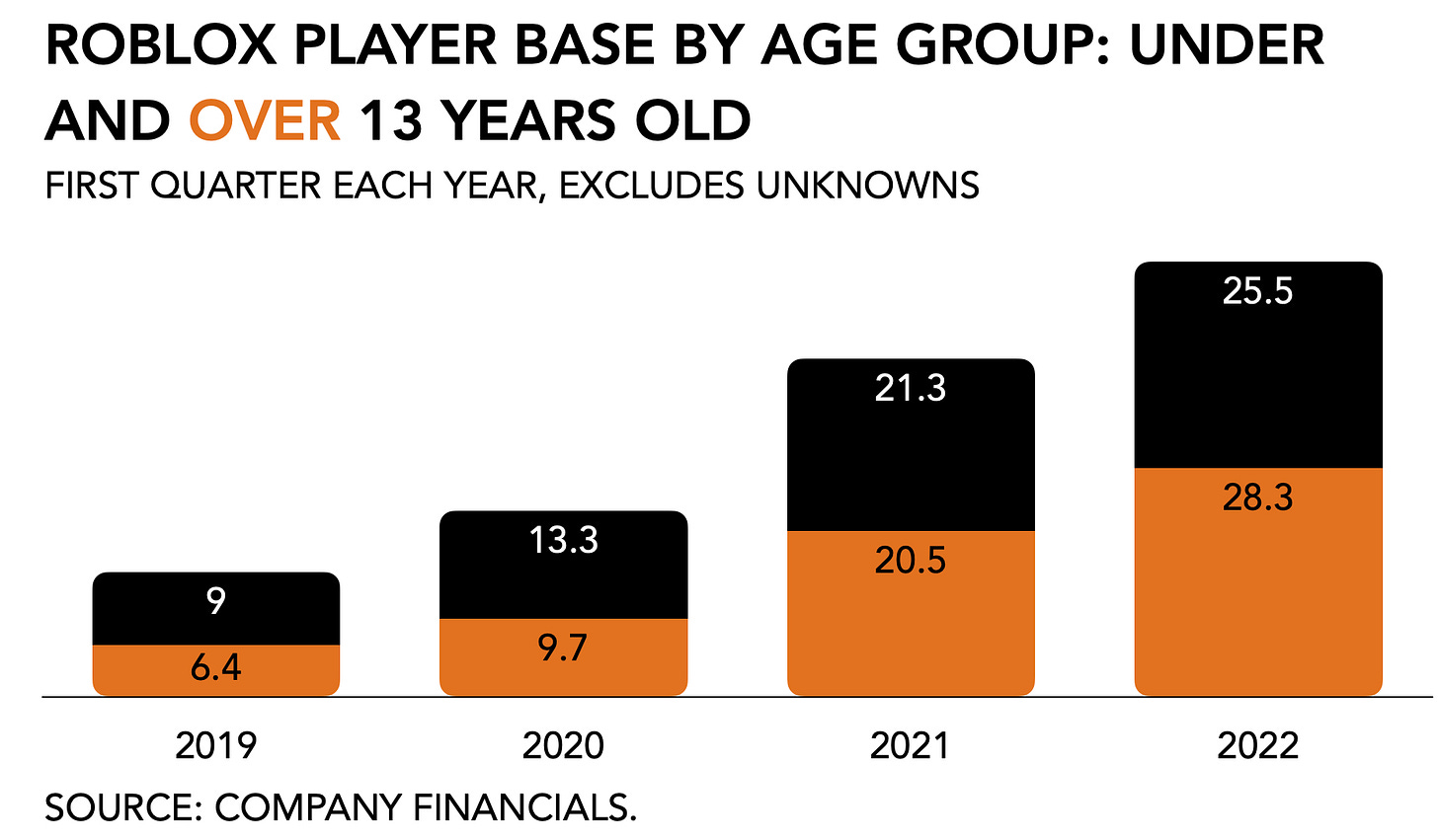

Customization and creative control over our online experience are increasingly prevalent and common among even the most average players. Sure enough, a decade or so ago it used to be the die-hard collectible card players and RPG fanatics that just had to grind their way to obtain a fancy item or mount. But since then online play, and by extension, the scale and complexity of life online, has grown exponentially. Not just existing audiences have started to spend more time online; younger players are increasingly growing up in virtual environments. Titles like Minecraft and Roblox, which originally targeted a younger player base, are watching their audience age up.

To them, digital assets today are similar to what Pokémon cards were a generation ago. Your deck or avatar serves as a token to participate, shows that you understand the social conventions of your peers, facilitates the expression of identity, encourages agency and decision-making, and carries a deeply emotional connection.

Second, seldomly do game makers achieve the type of lasting success that attracts mainstream audiences when they first seek to exploit a novel market or technology. What characterizes successful game companies is the ability to adapt to new market conditions and transform their business models.

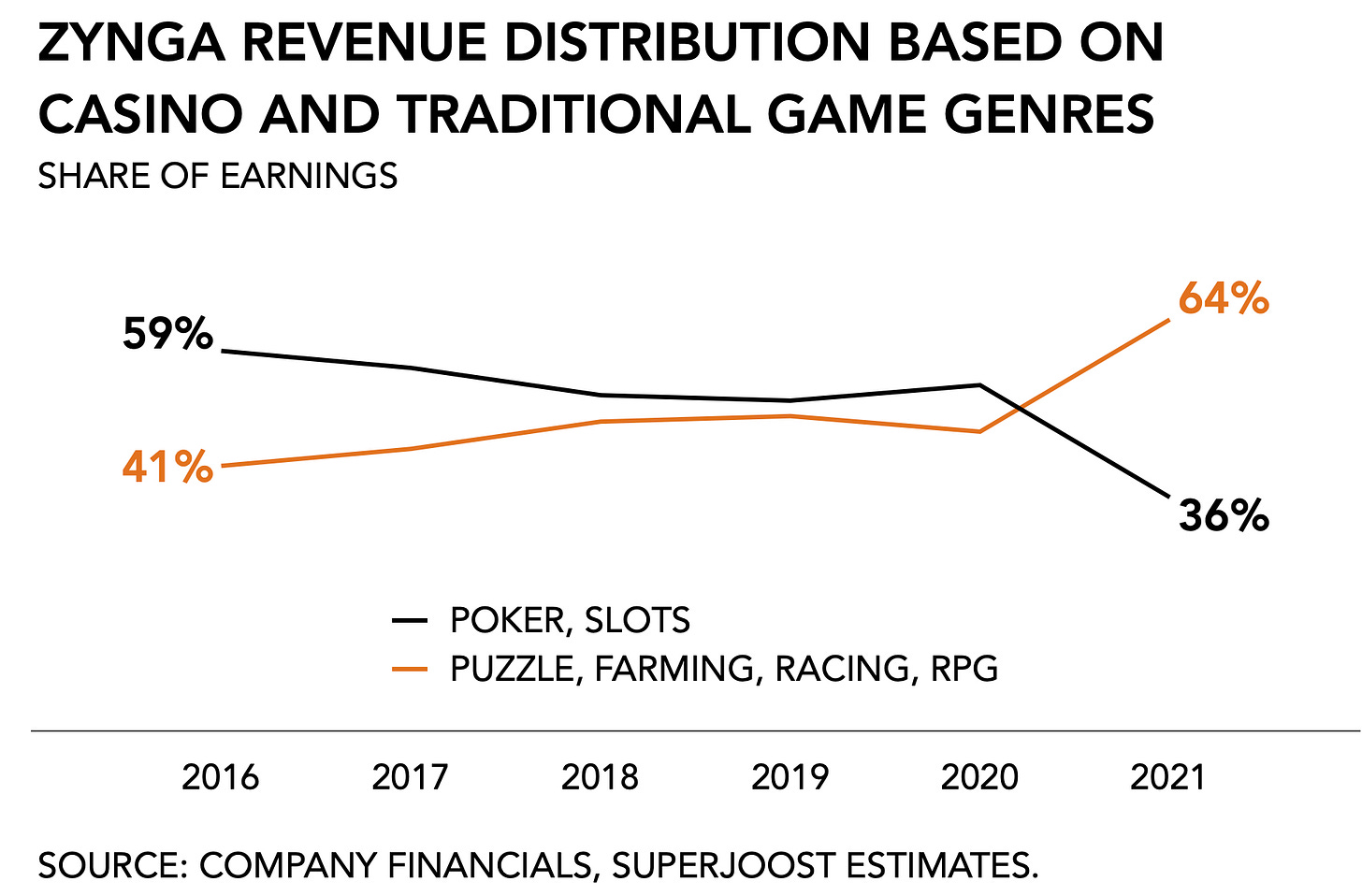

Before social gaming reached widespread popularity, casual online games lived freely in the wild. Zynga, now a subsidiary of Take-Two Interactive, built its initial success on its own with its poker game. Generating about $30 million a year before the publisher became Facebook’s sweetheart and became the de facto social game maker, Zynga relied entirely on poker for its income. It moved on to farm-type gameplay, of course, but has since made a full swing back into casino-style titles. Prior to its acquisition, the firm reported 37 million daily active players on mobile and $727 million in annual revenues, up +4% y/y as it benefitted from an increase of ad revenue in the wake of Apple’s IDFA changes.

Few people took Zynga seriously during its early days.

Its heavy reliance on analytics meant many regarded the firm more as an invasive species that encouraged people to clutter each other’s timeline than a game publisher. After Marc Pincus handed over control to a set of more traditional game industry executives under the leadership of Frank Gibeau, a former VP at Electronic Arts with decades of experience.

Zynga’s transformation from an innovative online poker startup to a billion-dollar incumbent serves as a possible precursor to the current state in crypto-gaming.

In effect, we’re witnessing somewhat of a recurrence.

Caught between the crypto downturn and the metaverse hype cycle sits Decentral Games, a game operator within the 3D browser-based world of Decentraland. Its most popular game is a version of Texas hold ‘em.

The firm, which uses Polygon for its scaling, has suffered under the crash like the rest of the ecosystem. Its daily active user count has dropped by about half, from 11,976 DAUs at its peak on April 11 to 5,435 by the end of June, according to research firm Messari.

Like Zynga, Decentral Games is building its foundation on a well-known game type and adapting it to a novel technological environment. Where Zynga initially built for browsers in general, then for Facebook, and eventually for mobile, so, too, should we expect crypto-game makers to develop around an existing category, and then innovate from there.

The key word here is transformation. Innovative newcomers often start with moderate success in a relatively new category, characterized by novel distribution models or monetization strategies, before breaking through to a much larger market.

Evergreen play genres can generate steady capital that enables a publisher to continue pushing its creative boundaries or acquire innovative startups.

Headphone and keyboard makers add to glum outlook

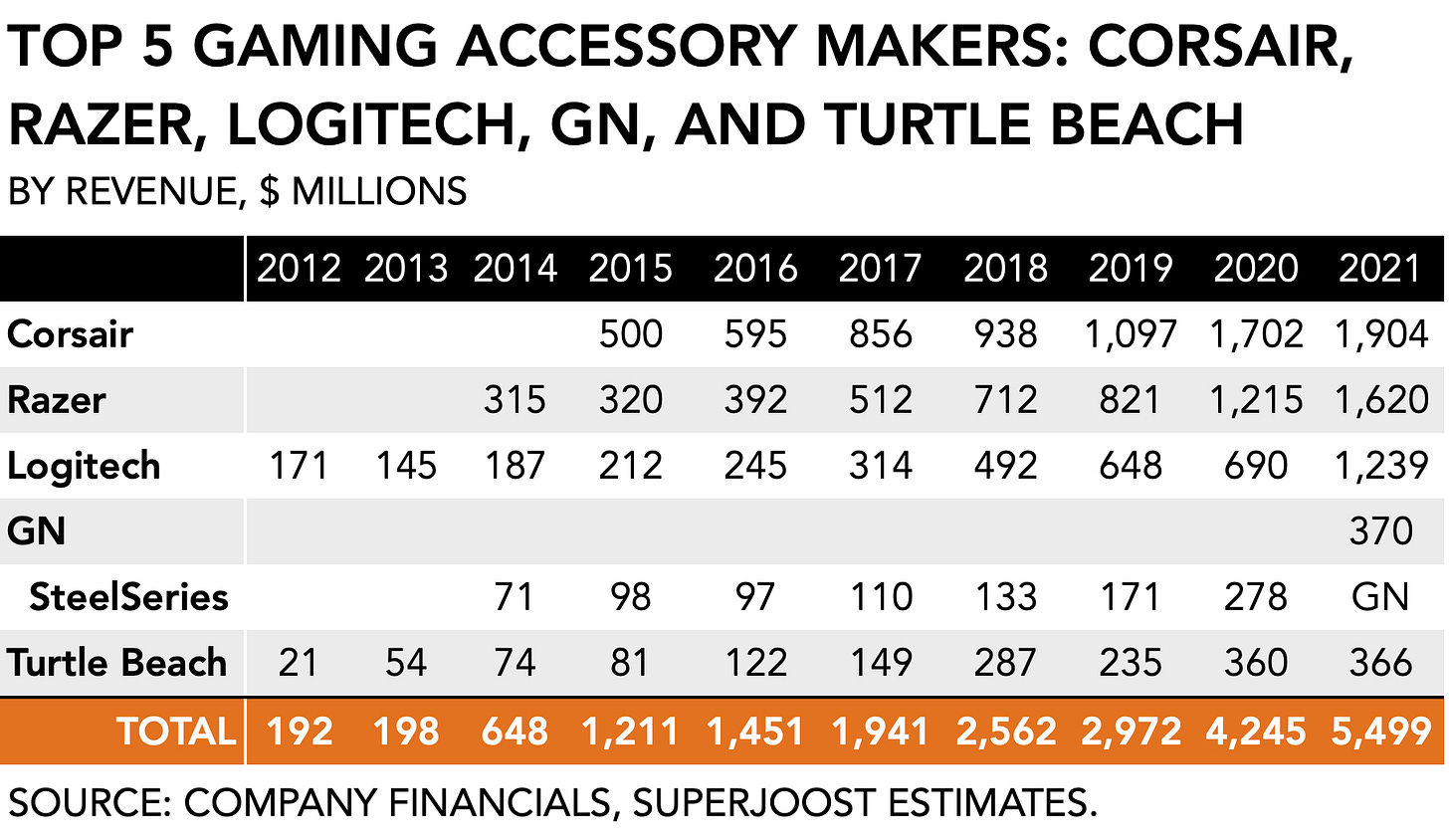

Pandemic-induced consumer spending has subsided and gaming accessory manufacturers are feeling the burn as they reported lower than expected earnings. Up until recently, accessories enjoyed a boost in demand. Over the past few years, combined revenues for the five largest manufacturers grew from $2 billion to $5.5 billion. Over the first two years of the pandemic, their earnings grew +29 percent.

But now the tides have turned. Corsair, the leader in the category, saw its second-quarter decline -40% y/y, due to inflation, supply chain issues, war, and the current demand for out-of-home activities. At the start of 2022, the firm forecasted $2.1 billion in revenues for the year on the high, which it has since first lowered to $1.8 billion, and now to $1.45 billion, compared to $1.9 billion in 2021 revenues. Lowering revenue expectations by -31% is a sobering moment.

Similarly, Turtle Beach reported $41.3 million in revenues which was a -47% decline y/y, and well below a Wall Street estimate of $49.1 million. The narrative was the same as Corsair’s, of course. Notable here, however, was Turtle Beach’s announcement that it was no longer pursuing its “banker-led” exploration of acquisition opportunities. Apparently, more than 100 firms have looked at the firm and declined.

The category’s ownership has changed, too. Danish audio technology firm, GN, acquired Steel Series for $1.2 billion, a 4.3x multiple on 2020 revenues. At Razer, a gaming lifestyle company that makes snazzy laptops, keyboards, and gaming chairs, leadership voted and took the firm private in May. Its revenues had roughly doubled from 648 million in 2019 to 1,239 in 2021. And now that Turtle Beach has abandoned its acquisition exploration, chances are that Corsair will scoop it up and capitalize on logistical efficiencies and economies of scale as much as possible.

The slowing in consumer spending on gaming accessories and a subsequent shuffling of the category’s makeup depress its outlook, especially as firms struggle with excess inventory in the retail channel and continuing headwinds from supply chain constraints.

MONEY, MONEY, NUMBERS

Roblox’s earnings came in low, too, with $640 million in bookings (-4% y/y, +1 q/q) which was in line with Wall Street’s expectations. Its leadership pointed to its audience “aging up” among 17 to 24-year-old males, as a sign of optimism which it expects to be an important growth driver in the years to come.

Take-Two Interactive reported $1,003 million of net bookings, split between Take-Two contributing $731 million and Zynga $272 million. The biggest drivers of success were NBA 2K22 and WWE 2K22. To address the softening market, which management believes will mostly impact the free-to-play business, it is scheduled to release Rollerdome and NBA 2K23 in the second quarter of 2023, Kerbal Space Program 2 from its Private Division label at the end of next year, and a new Tales from the Borderlands game. According to the publisher the next installment in the GTA franchise is “well underway.” Yasss.

PLAY/PASS

Play. A clear headline of the week: “BioWare activates its thirst trap card with a ‘romance bundle’ for a beloved Dragon Age character.” h/t Maria

Pass. Sony paying developers to block them from adding their content to Game Pass. How do you say, we’re losing the subscription wars in Portuguese?