Embrace Another Fall

The Swedish gaming empire hits a wall. What's next for Europe.

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

After its rapid rise to become Europe’s largest and most valuable game publisher, Embracer suffered a $2 billion loss on the eve of its most recent earnings and woke up this week to a company-wide restructuring plan.

If only someone could have seen this coming.

I did, in fact, back in November, when I wrote,

The European ‘get-big-quick’ gaming empire has reached the natural conclusion to its acquisitive strategy. After a four-year buying spree, management now blames the economy for turning “darker in recent months” and is launching a special review. You can’t make this up. Embracer has racked up a total of 22 deals since the start of the year for a total value of $4.6 billion, according to InvestGame’s recent report. That’s twice the amount of dealmaking reported for Tencent, which has announced 14 deals at a combined value of $2 billion over the same period.

It’s an insane notion that you could have so many people doing due diligence simultaneously on dozens of deals, and yet fail to look out the window.

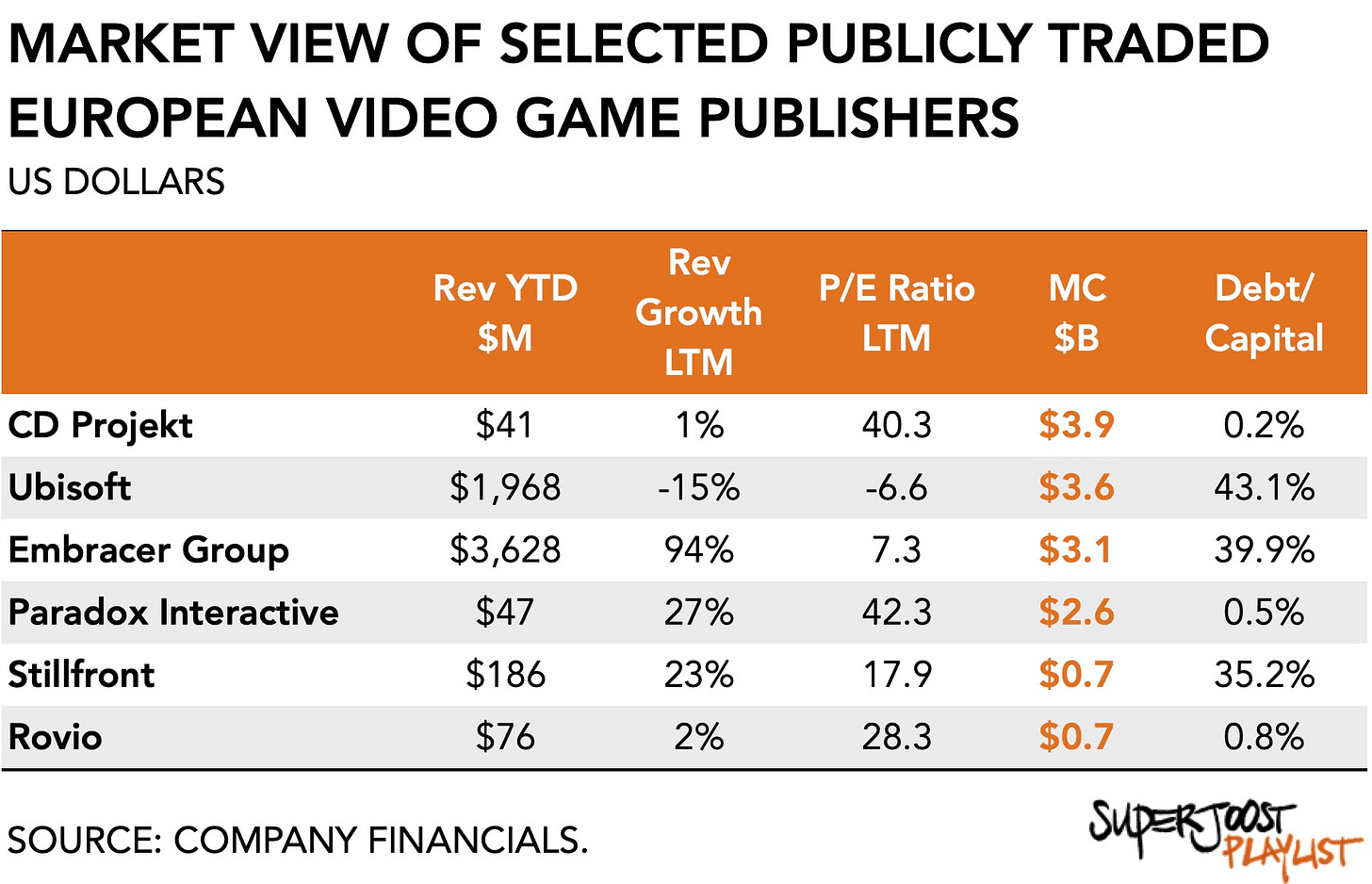

We’re treated to an incredible exercise in the destruction of value. Today, Embracer in its entirety is worth $3 billion, roughly the same as what it paid for Asmodee in December 2021. The plan had been to become an IP portfolio company and combine it with a slew of channels (e.g., mobile, boardgames, film) to maximize value capture. But it reeks of financial decision-makers managing for margins, rather than pursuing a clear creative vision. This is the business of entertainment after all, and it is blockbusters that make it tick.

The fallout brings me to two observations.

First, this is late-stage capitalism destroying creativity at its finest. In its run-up to becoming the powerhouse it isn’t, Embracer spent a lot of money and implemented a laisse-faire managerial style to quickly grow in size. But given how common earnouts are (ie. results-based payouts following an acquisition), a lot of people who sold their studios are likely to receive less. For example, the purchase of Saber Interactive, one of Embracer’s 2020 acquisitions for a total of $525 million, consisted mostly of shares in the parent company and only on condition of completing several projects. Since Embracer’s value has dropped by about 50 percent since the acquisition, many of Saber’s employees are going to be disappointed. Worse, the announced restructuring (read: layoffs) means an unfortunate share of Embracer’s 16,601-strong workforce will now have to look for new jobs.

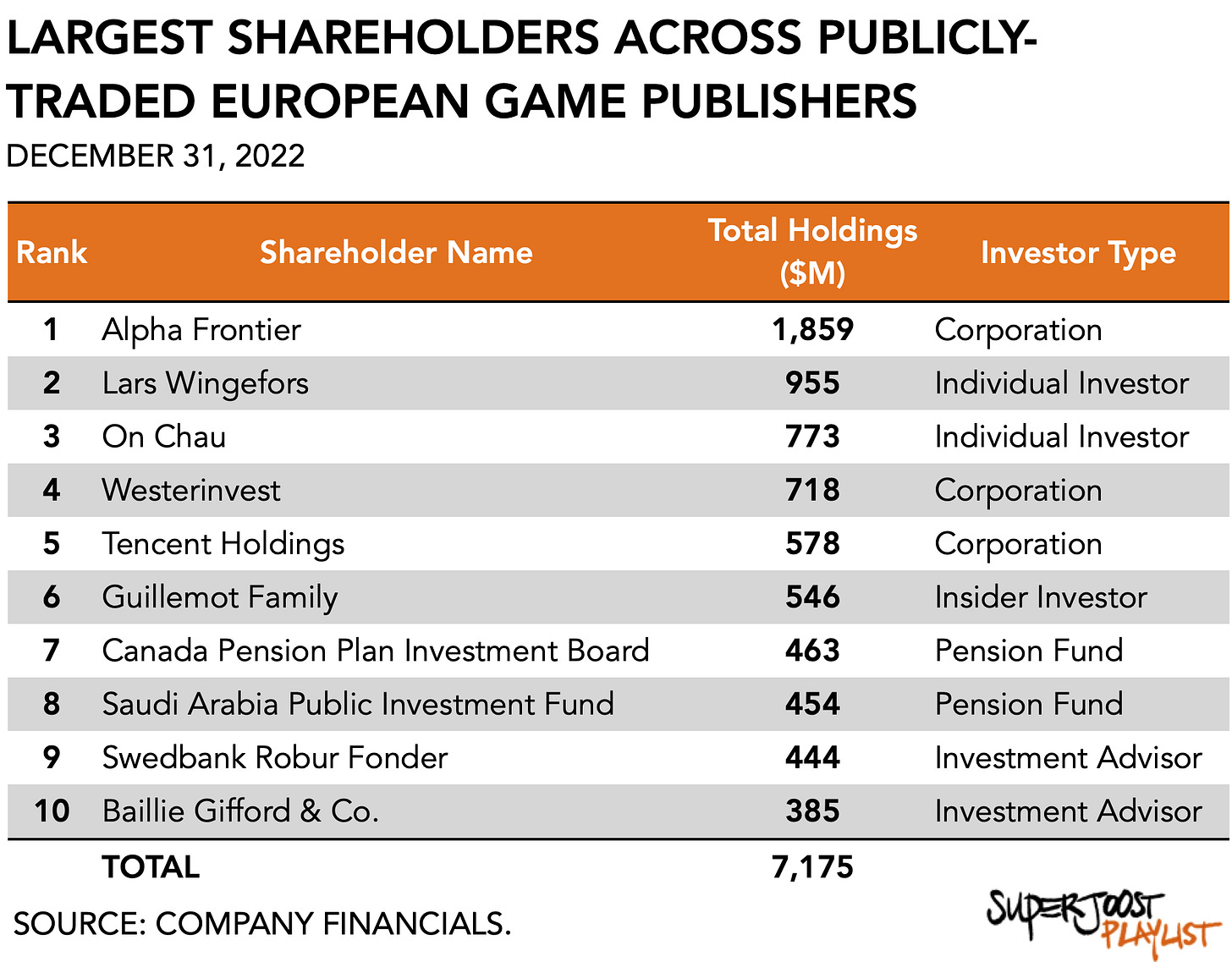

Not Embracer’s CEO, Lars Wingefors, however. He is the second-largest shareholder across all publicly traded game companies in Europe after Alpha Frontier, which owns 60 percent of Playtika whose offer Rovio shot down a few months ago. Lars holds more value even than Tencent and the Guillemot family, owners of Ubisoft. It is perhaps possible then that management has gotten somewhat disconnected from reality. Moguls, after all, are cursed.

Second, the fall of one of Europe’s largest and most prominent publishers further exacerbates Europe’s straining games industry. Certainly, Embracer isn’t the only one suffering here. There’s also the gradual decline of Europe’s former lead publisher, Ubisoft, the $776 million sell-off of Rovio which couldn’t find lift beyond its Angry Birds franchise, and the prolonged wait for CD Projekt Red’s turnaround which has pegged its future on the Phantom Liberty expansion for Cyberpunk 2077 and a push into online multiplayer gameplay. At the highest level, European game publishing isn’t doing so hot.

The rapid rise to prominence, boastful push into acquisitions and consolidation, and, now, a sobering restructuring make Europe a much less attractive investment target. It means access to capital, necessary to fund innovation, is pushed further out of reach. Currently, the world’s largest shareholders in publicly-traded game companies hold only a combined $15.4 billion in shares in European firms. By comparison, they hold $122 billion in American entities and $123 billion in Asian firms. In effect, Embracer has successfully consolidated most of the IP value and creative talent in Europe under a single umbrella only to now have to sell it off at a painful discount to other, much larger and more successful expansionist conglomerates.

Embracer’s inevitable decline is likely to drag the rest of Europe down with it.

NEWS

Diablo IV sells 10 million copies

Activision Blizzard disclosed that its latest release, Diablo IV, generated $666 million (sigh) in sell-through revenue within its first days, making it the best-selling opening in the franchise’s history. It suggests total sales of well over 10 million units worldwide to date. By comparison, Diablo III (2012) sold 3.5 million units within its first 24 hours and 6.3 million in its first week. The new title mounted an impressive immersive marketing campaign that blanketed all of New York in an ominous smoke for several days. Diablo IV is available on console and PC, but not on Mac OS, which angered Whoopie Goldberg.

Influencers aspire to become game publishers

This week Bloomberg had a worthwhile write-up about popular live-streamers not just talking about and playing games, but making them, too. A growing number of well-known tastemakers on Twitch and YouTube have set their sights on becoming game publishers and releasing their own titles in an effort to diversify their revenue sources and offset their reliance on ad revenue and sponsorships.

The math here is simple: with their ability to drive millions of viewers to specific games, why take a check from someone else, when you can promote a game that you develop and publish instead?

The article mentions several current initiatives, including OTK’s collaboration with a former Square Enix executive, a venture between Splash Damage and two popular streamers, Michael “Shroud” Grzesiek and Chris “Sacriel” Ball called Project Astrid, and DrDisrespect’s effort behind a “vertical extraction shooter set in a dark and violent future where the 80s never ended,” called Deaddrop. And last September, another popular YouTuber, Videogamedunkey, announced the launch of his publishing outfit, Bigmode. According to his announcement video,

“For years and years and years, I have always sought out the very best Indie games out there and have tried to do them justice, putting millions of eyes on the games that actually deserve attention.”

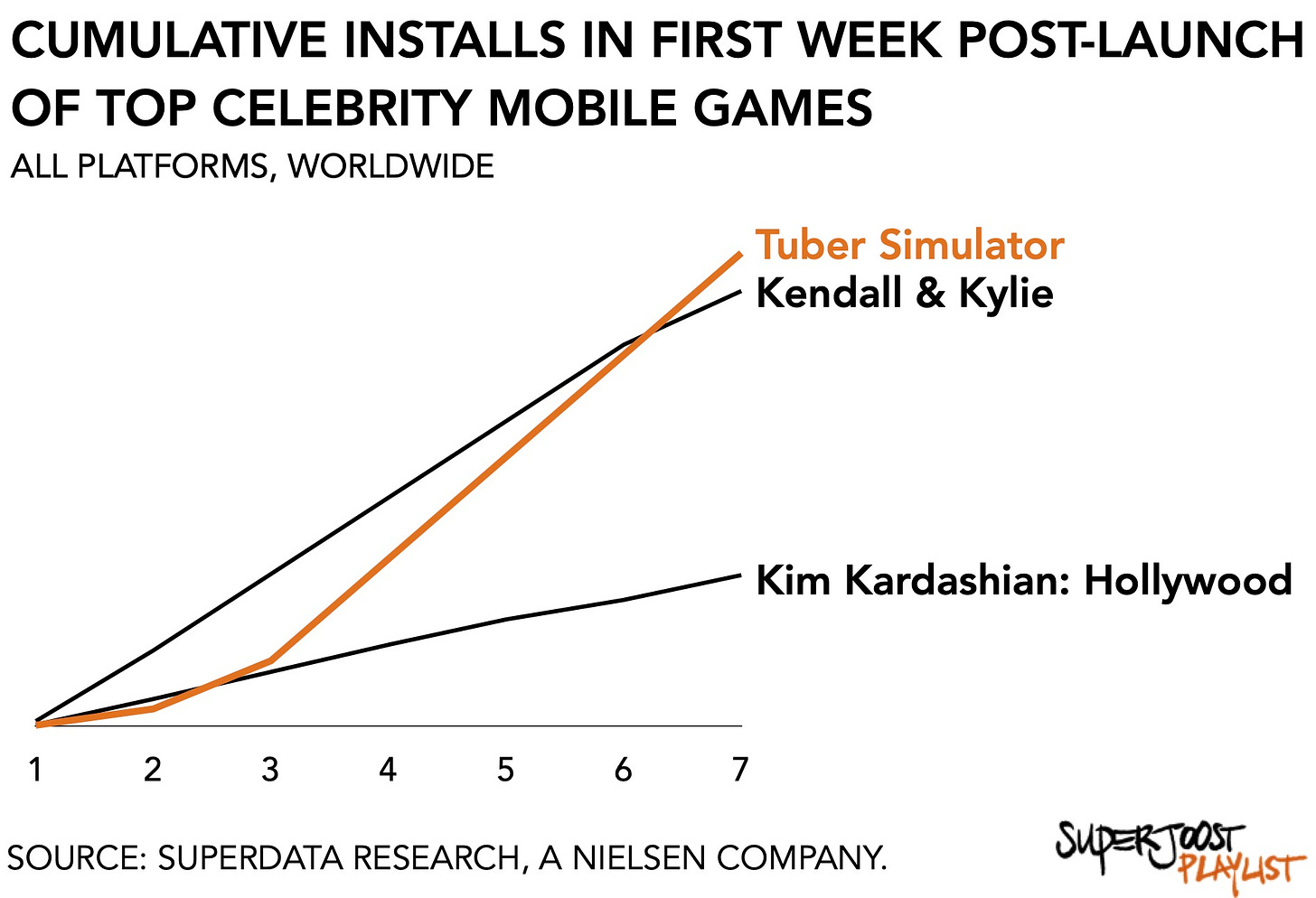

The skeptic in me says they should stay in their lane. For one, historically the cross-pollination of video jockeying and game development hasn’t worked. When Pewdiepie launched his Tuber Simulator in 2016 it did outperform all other celebrity-based mobile titles at the time. But it amounted to nothing more than a complicated form of merch.

Pewdiepie’s title did manage to keep up with, and even do better than, the Kardashians, and pushed 1.8 million initial installs within the first week after launch, compared to Kendall & Kylie’s 1.6 million. But live streamers lack the A-list status and create a lot of risk by committing themselves to play and foreground a self-published game if it lacks appeal. Similarly, YouTuber Casey Neistat previously ventured into gaming (in fact, I met him at a press event for the Nintendo Switch in New York a few years ago). He was at the peak of his popularity and looking to diversify by leaning into gaming by showcasing the device in his videos and setting up an EA-sponsored competitive gaming room in his studio basement. But Casey, too, proved unable to break through category boundaries. While it may be tempting to do so, crossing over into game-making is hardly a full-proof strategy.

There’s also a distinct difference between creating interactive entertainment and producing 8 to 10 hours of live-streaming content daily. Both are hard and time-consuming, yes, but the respective skill sets vary greatly. Most of the development is outsourced to pre-existing studios, while the live-streamer figurehead focuses on marketing. It seems unlikely that the next blockbuster game will emerge from a live-streamer production studio purely because you reach a lot of people any more than it will come from a film studio, television production company, or music label.

More broadly, I wonder whether the games industry needs more white male game developers. Based on the utter absence of women during last week’s Summer Game Fest, we don’t. You may also recall that among the top 100 streamers on Twitch, there were only three women. Given how difficult it has been to reach consumers in this homogeneous cacophony of digital releases, content drops, and season passes, streamers may have gained enough leverage to formulate vertical integrations. But it raises the question of whether these tastemakers and gatekeepers are, in fact, the right people to make games.

FTC files restraining order on ATVI/MSFT deal

The Federal Trade Commission filed a “temporary restraining order” and a preliminary injunction to prevent Microsoft from consummating its proposed acquisition of Activision Blizzard. The FTC fears that the deal will go through at any time after June 15th based on public statements by both firms involved. It reiterated its standpoint that post-acquisition Microsoft would have “the ability and increased incentive to withhold or degrade Activision’s content in ways that substantially lessen competition.”

Two observations. First, it’s odd that the FTC worries about the deal closing early based on public statements, but manages to ignore the other public statements by Microsoft that it wouldn’t withhold or degrade Activision’s content.

Second, as we’re coming to a close (finally) on this saga, a new landscape of regulatory authority is starting to emerge. What to make, for instance, of the wholesale absence of other major gaming markets in this conversation?

Late last month, the Korean Fair Trade Commission, KFTC, approved the merger on the basis that console gaming is a minor component of the gaming market there. Moreover, PlayStation has a massive market share, between 70 to 80 percent according to the filing, compared to Nintendo’s 10 to 20 percent and Xbox’s measly single-digit share. Subsequently, it concluded that post-merger the South Korean console market would become more competitive.

Post-Brexit, the FTC now has to contend with UK’s decision to block the deal, which differed from the European Commission’s approval, in deciding whether one American company may acquire another American company. Does the UK, whose government has proven royally ineffectual over the past few years while its economy is in the loo, get to determine international policy and economic reform? I thought they wanted to be left alone. Seems to me, the FTC needs to make sure they are still driving the bus.

PLAY/PASS

Pass. GameStop came up short on earnings. No surprise there. But firing its CEO without even mentioning their name lacks leadership.

Play. Capcom turned 40 years old this week and treated itself to a big spread in the Financial Times. Odd. But hey, it’s your party. Congrats!

Thanks for sharing, great perspective. Embracer situation really looks very interesting and the main question for me is more about if this situation will create some opportunity, if other players start taking over some of its IPs or spin-offs emerge. It might not be a big fallout after all.

Also like how you challenging FTC... the more I think about the deal, it looks like MSFT will make it pass somehow. Still, the unknown is at what pain/tradeoff will that be in order not to disturb overall plan...

Incredible analysis as usual. Was hoping you’d cover the fallout in Europe, so this made my morning. Thank you’