The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Here’s my Barbie experience.

At age 4, I owned a naked Barbie called “Grietje.”

I remember it as my absolute favorite thing to carry her around in my inside coat pocket. My younger brother had just been born and took up most of my parents’ attention. Somehow having a Grietje to care for provided a deep sense of purpose.

Seeing my own 2-year-old fuss over her own plastic doll, which she superfluously calls “Baby-baby”, I recognize the instinct to emulate the world around her to gain a sense of agency. She changes her doll’s velcro diaper with the same ado as we change hers.

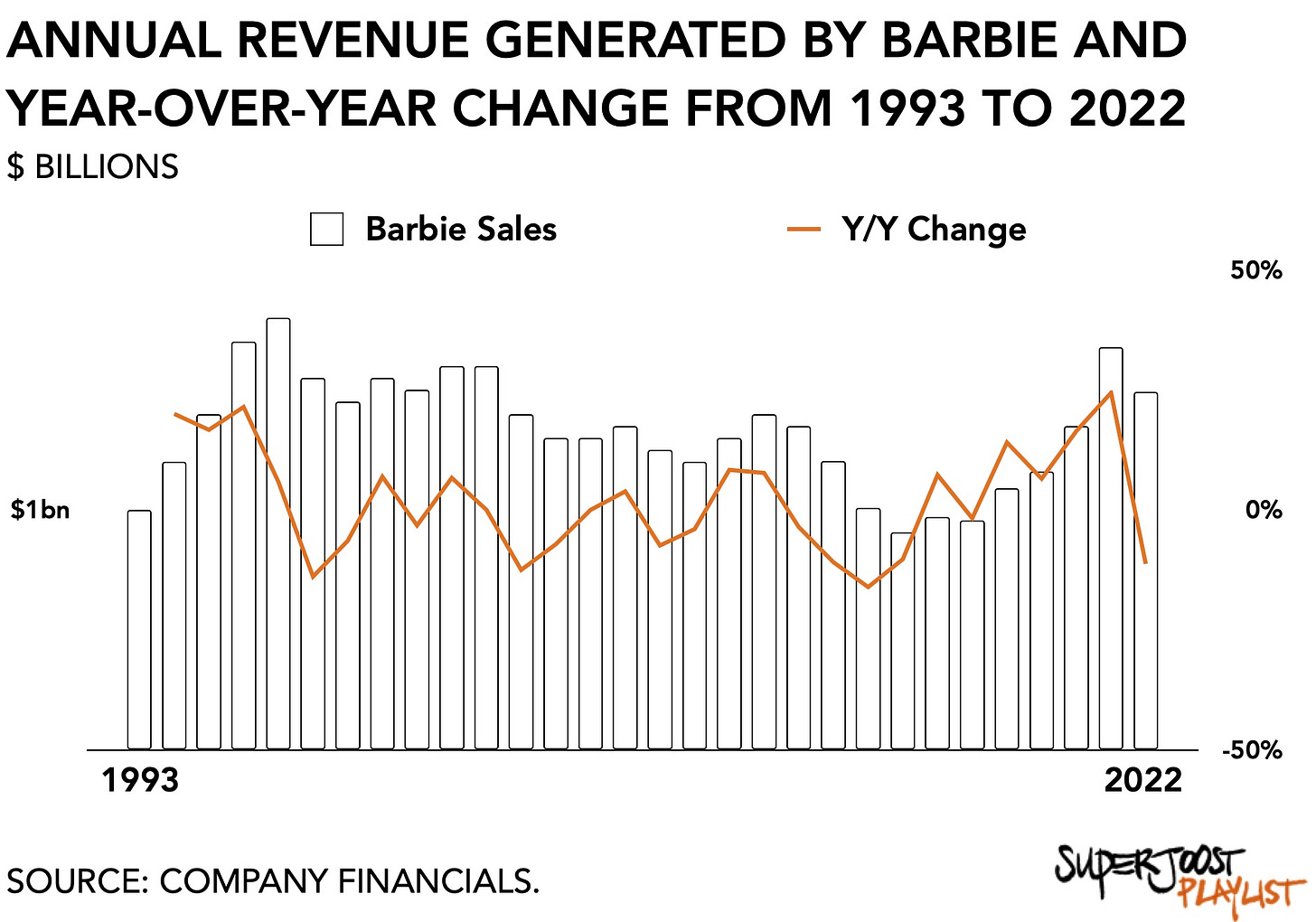

My amateur psycho-analytical take is this: a popular doll manages to find consistent market demand as new generations need ways to enact their own emotional maturing. Part of what makes Barbie so time-enduring is the doll’s versatility and evolution. It certainly has been a boon for Mattel. Sales are surprisingly consistent despite fluctuating between a high of $1.8 billion and $900 million over the past three decades.

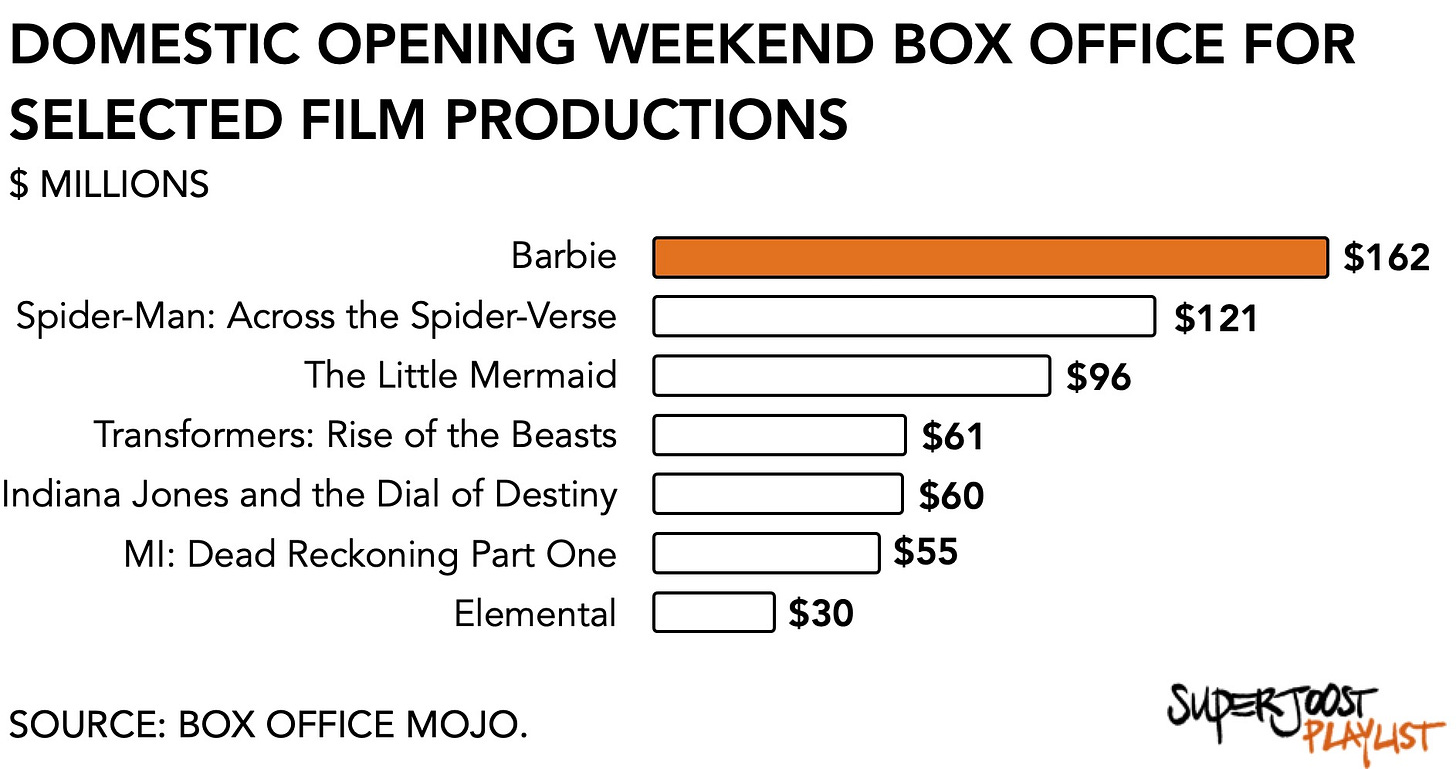

Despite reports in 2016 of Barbie losing luster, arguing she was, ho hum, “showing her age,” an ongoing reinvention and adaptation of the doll to changes in consumer preferences and behaviors have served her well. The $155 million opening weekend sales of the Barbie movie certainly proved to be a much bigger success than expected. It crushed Wall Street expectations which put that number at a third last March. It suggests that global box office sales will reach a cool $1 billion. The hilarious “Barbenheimer” chitchat that erupted this weekend is also a misnomer in that it Cillian Murphy’s flick has little to offer in terms of licensing expansions. A better comparison, perhaps, is to put Barbie in the context of other recent productions.

Franchising reigns supreme since the zeal translates to real-world fashion sales, too. Zara sells a $56 lookalike of Barbie’s pink gingham dress and Impala offers the movie’s neon-yellow rollerblades for $213.

As was to be expected, Barbie was the star of the show at Mattel’s earnings this week. And not one moment too soon as Mattel’s quarterly earnings were down from $1.3 billion a year ago to $1.1 billion (-12%). The film’s breakout success is a much-needed boost for the toymaker, whose toys categories have been declining. Its so-called Power Brands, which accounted for 62% of total revenues in its most recent quarter, are showing a general decline. Barbie sales declined from $301 million to $283 million (-6%). Mattel promptly announced it plans 14 more movies based on its properties.

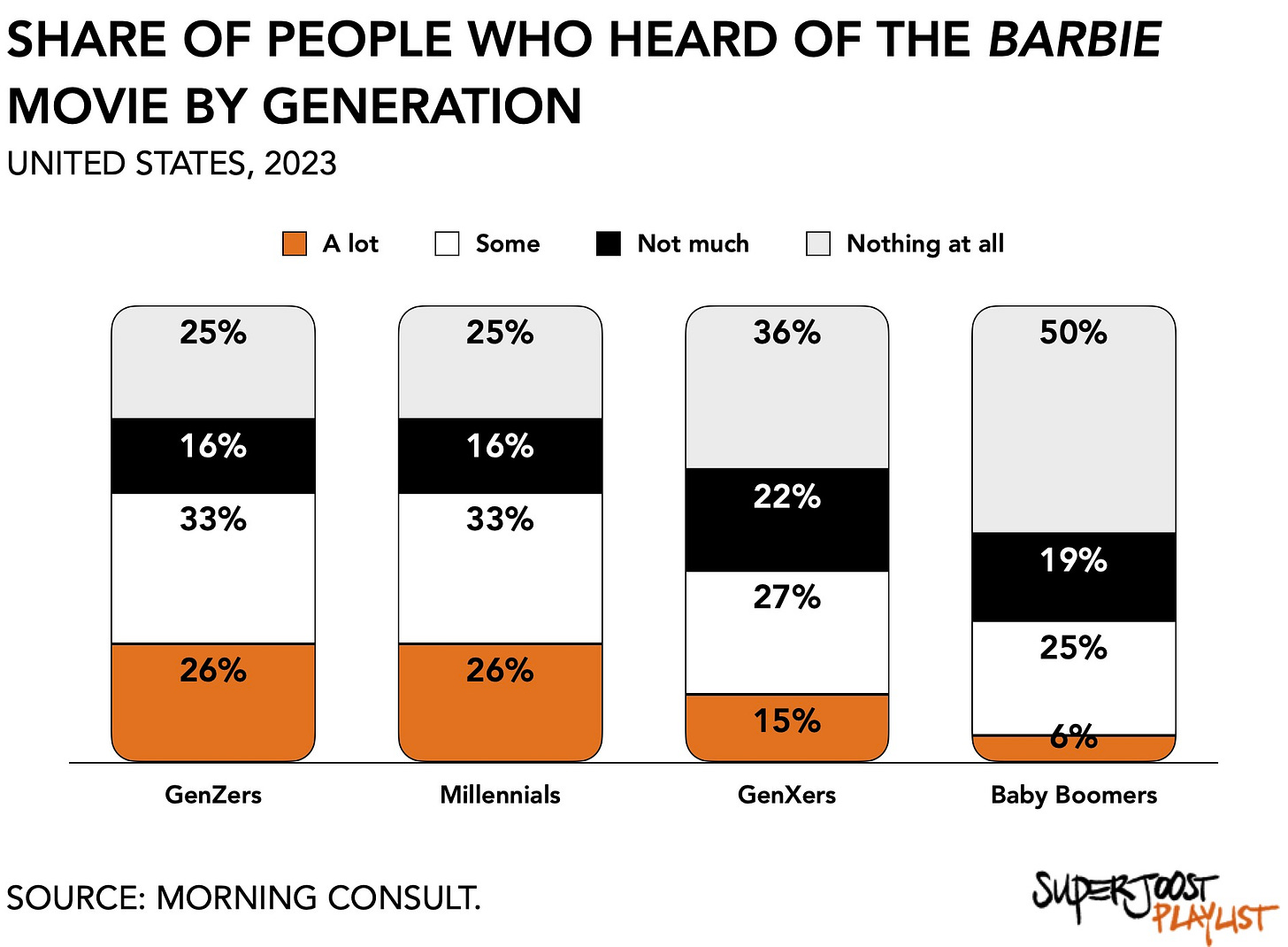

Once an icon of the good old days, it is not Barbie who managed to reinvent herself (she’s an inanimate doll, you see). People project their deepest needs and desires onto objects. One explanation is how well it resonates with younger audiences. Anecdotally, it is mostly younger people I see wearing all pink in public. Despite its glossy veneer, it carries a streak of rebellion. Boomers don’t care as much: only 6 percent had even heard about the movie last April, compared to 26 percent among GenZ and Millennials.

There’s more going on here than a well-executed blockbuster release with an alleged $150 million marketing budget. The self-congratulatory praise from Mattel’s CEO is equally unexpected and not their own doing. The degree to which people have quite literally taken to the streets decked out in hot pink suggests something deeper. If I had to guess, the current craze isn’t about a love for the franchise. On the low end, it reads like a temporary hype cycle in which we like to participate and share. On the high end, the Barbie craze has an undertone of defiance.

Or maybe I’m just projecting.

On to this week’s update.

BIG READ: Essential facts about the ESA's finances

In preparation for this week’s podcast, where Laine and I took a run at the Entertainment Software Association’s (ESA) annual release of its Essential Facts for 2023, I found myself deeply disappointed by the quality of the report. Succinctly, this often-quoted piece of free research is, as is custom, marketing fodder generated by Circana (formerly known as NPD). Free shouldn’t mean terrible. Being one of the world’s most prominent advocates in interactive entertainment obligates you to provide a show of force. Given the visibility that this publication generally receives, I’m deeply underwhelmed by at least three things.

First, enough already with the infographics. We live in a late-stage capitalist society and there are newer ways of communicating to the world that do not make one feel like a child. I get that it’s a freebie. But that apparently also means we have to keep reporting the same bits of information for the rest of our lives. REALLY?! Do women play games? Wow. BIG FACTS. Sure enough, inclusion and diversity are important topics. And so perhaps we could e-x-p-a-n-d the scope and depth of topics for the grownups in the room.

Another vexing aspect is that the report offers no context. Since the ESA publishes it annually, it would perhaps make sense to compare this year’s numbers to previous editions. Other entertainment categories like music and film, which are often mentioned in relation to gaming because the latter is *so much bigger*, how about drawing some comparisons instead of reporting a bunch of loose facts in a vacuum.

Third, doing an online survey with 4,000 respondents in the US costs about three cents. While I’m grateful for Circana’s contribution, this research report really is the cheapest of the cheap in terms of production materials. Terrified to disclose any competitive information, I’m guessing Circana isn’t dipping into its own data pool. However, this is a firm that was recently acquired and made its founder a billionaire. You can’t tell me that they lack the resources to give this more oomph. My estimated cost of this report is (a) $3 per respondent = $12,000 plus another $3,000 in analyst hours and design. If that.

All of it leads me down a road to verify, perhaps, if the ESA is totally broke. Not hosting E3 could be one explanation for their unwillingness or inability to spend any money on a freebie report. Fortunately, the ESA reports its taxes, allowing for a useful look into its finances.

The ‘S’ is for self-enrichment

For convenience’s sake, I’ve organized a few notable line items from the different filings into a single spreadsheet, allowing for some really basic calculations. It’s important to note that I’m not an accountant or tax filings specialist. Everything is publicly available information and pulled from the ESA’s tax filings between 2004 to 2021. Feel free to correct me. I will be happy to apologize for any mistakes.

[N.B. Income distribution shown excludes minor revenue sources and totals may not add up to 100%.]

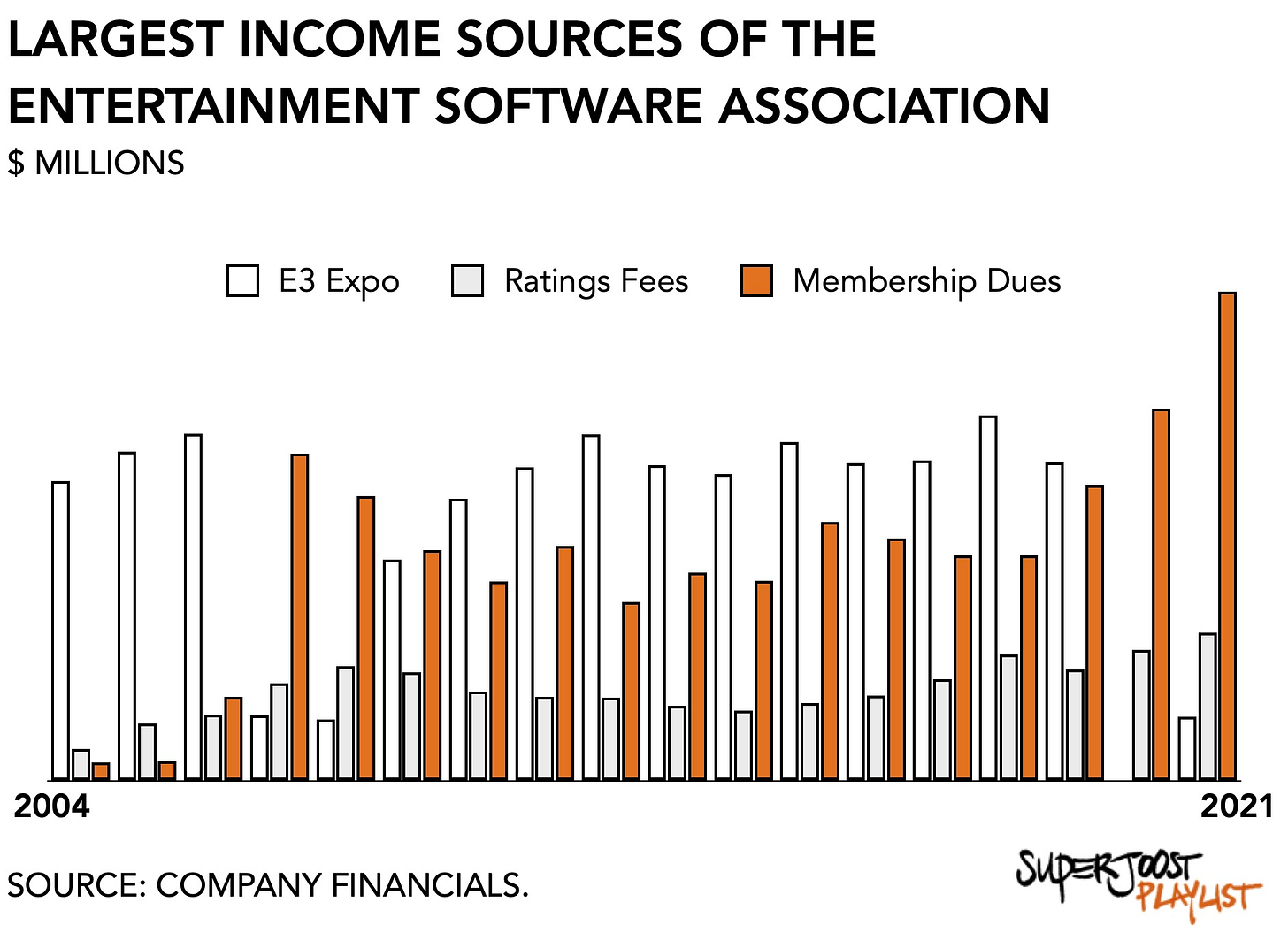

Over the entire period, the organization saw its annual revenues increase from $19.8 million to $39.9 million, effectively doubling (+102%). Expenses kept pace and increased from $18.1 million to $37.8 million.

Income from the E3 Expo has consistently been between $16 million and $19 million throughout the period, except for the two years when the ESA tried to kill it. First by scattering it across Santa Monica forcing everyone to bus around to different hotels, and, second, by excluding consumers, which reduced the number of attendees from 60,000 to 5,000. Income from the event for 2007 and 2008 dropped to $3.5 million and $3.2 million, respectively.

It is notable that senior management’s compensation outpaces revenue growth. Between 2007 and 2019, which is roughly the period during which Michael Gallagher took the helm, the ESA’s revenue grows 44 percent. Executive compensation (salaries plus incentives) increases by 102 percent.

During the Gallagher Years, spending on other salaries increases, too, by 63 percent but that does not account for the increase in headcount, whereas the C-suite initially adds two additional members and then stays at a total of eight executives who enjoy pay increases and bonuses each year.

One of the major changes that the tax filings demonstrate is the introduction of bonus payouts. It makes sense, of course, for an industry association to recognize the accomplishments of its leadership by awarding the success of recruiting new members and offering some sort of incentive structure. Gallagher, however, institutionalizes bonus payouts as a major part of their compensation packages anywhere between 34 percent at its lowest to 56 percent at most.

On a personal note, I got in trouble with the ESA in 2016 when I submitted an op-ed piece claiming that the ESA had to adapt or die. The phrasing of that title was perhaps a bit unfortunate. And that’s probably why it drew the attention of the ESA, which promptly issued a reply. It is an honor, really, to draw the ire of a $ 500,000-a-year head of communications.

The future of E3

The structure and shifting degrees of importance between the ESA’s income sources paint a distinct picture of the future of E3.

From 2009 onward, the ESA started to crawl back into the black and makes a consistent profit. More so, the share of income generated by E3 has notably declined. In 2004 the event accounts for 83 percent of its revenue. By 2019, just before the pandemic, E3 represents 43 percent of total income.

The major new source of income is memberships, which grows from 5 percent in 2004 to 39 percent in 2019. In the absence of E3 in the following two years, its share increases to 65 percent of the ESA’s total income. It suggests to me that the ESA is going to dismantle the E3 conference or, at the very least, greatly reduce its effort. With other revenue sources effectively replacing its conference income, it will just be easier to focus on its ratings fees and membership dues.

Regardless, the ESA is a $40 million-a-year organization that generates an average annual profit of $1.1 million and spends $1.5 million on its CEO alone. So here’s an essential fact from me to the ESA: you need to spend more money on your research reports.

MONEY, MONEY, NUMBERS

Activision Blizzard reports $2.5 billion in 23Q2 net bookings

Organized by its three divisions, a strong launch for Diablo IV propelled Blizzard to a record quarter with $1.058 billion, up +160 percent y/y and over 10 million players logged for the game in June alone. Even so, Blizzard has potential trouble brewing as Overwatch League teams will soon vote on whether to continue operating at the conclusion of the current season. (You can find a more in-depth discussion here.) Activision Publishing generated $574 million, up +17 percent y/y, and continues to ride the success of Call of Duty: Modern Warfare II. And King Digital, delivered $829 million, up +9 percent y/y across the entire division, with the evergreen Candy Crush franchise coming in with a +10 percent y/y increase in in-game spending. Organized by platform, mobile generated $943 million in 23Q2, compared to $594 million for PC and $556 million for console. Yes, after all that regulatory “scrutiny”, and console is Activision Blizzard’s smallest platform. It’s literally right here, in its quarterly earnings report. Read, people.

Wall Street is pretty happy with Bobby Kotick right now because shareholders can’t lose. Even if Microsoft manages to lose the deal at this stage, the recent extension to October 18th included an increase of the termination fee—from $3.0 billion to $3.5 billion after August 29th, and to $4.5 billion after September 15th. The U.K.'s Competition and Markets Authority set August 29th as the deadline for its final ruling. Analysts expect the deal to close soon after. Activision Blizzard has over $13 billion in cash & equivalents, and announced a $0.99 per share dividend for August 17th, for a total payout of $800 million.

Notable releases include Season of the Malignant for Diablo IV, which dropped July 20th, the August 10 release of Overwatch 2’s next season, Invasion, both a premium Call of Duty title and Call of Duty: Warzone Mobile by EOY23, and Warcraft: Arclight Rumble, a mobile action strategy game set within the Warcraft universe that includes collectible Minis which is currently in pre-registration.

Ubisoft congratulated itself on $298 million in quarterly earnings

The publisher’s performance was well above its guidance of $267 million, but still below the same period last year of $326.3 million. Digital sales, which accounts for 90 percent of the total, fell -8 percent, as did its so-called Player Recurring Investment (e.g., sales of digital items, DLC, season passes, subscriptions, and advertising) by -17 percent.

In June, Ubisoft hosted its Forward where it announced Assassin's Creed Mirage (October 12), Just Dance 2024 Edition (October 24), The Crew Motorfest (September 14), the previously delayed titles Avatar: Frontiers of Pandora (December 7), and Prince of Persia: The Lost Crown (January 18). Ubisoft has not yet provided any release dates for Skull and Bones, its free-to-play title called XDefiant, a mobile adaptation of Tom Clancy's Rainbow Six Mobile, and "another large game." Given the market’s current preference for established franchises, I expect especially this mystery title to get kicked further out.

In comparison to the above graph for Activision Blizzard, Ubisoft relies for 50% of revenues on console, 31% on PC, and 10% on mobile, respectively. According to CEO Guillemot, its publishing partnership with Tencent will enhance its “medium-term mobile footprint while delivering significant financial value to the benefit of Ubisoft and its shareholders.” In 2022, the two largest shareholders in Ubisoft were the Guillemot family, which held a total value of $546 million, and Tencent with $343 million.

In my experience, whenever a company makes less money year over year but manages to outperform some self-imposed target and calls it a success we are listening to corporate waffling. Wall Street loves that, though, and a string of investment banks promptly increased its price targets.

Games Workshop earns $575 million in 2023 revenue

A personal favorite of mine, the tabletop game maker reported income up +15 percent from a year earlier. Games Workshop features a sophisticated retail network and a deeply loyal fanbase. It caters to 427,000 active users (defined as “engaged online in the last six months”) through its “My Warhammer” account system, and its Warhammer+ subscription service is in its second year and accounts for 136,000 subscribers, up from 105,000 in 2022.

What continues to puzzle me is its white-knuckle grip on its intellectual property. For instance, two years ago, it released a statement saying “ [i]ndividuals must not create fan films or animations based on our settings and characters. These are only to be created under license from Games Workshop.” At the same time, its licensing business remains notably small due to an insistence on ensuring “representation continues to be respectfully maintained, “ and transferring responsibility over internal approvals and managing its IP to Warhammer studios. In 2022 it announced an agreement with Amazon Studios to produce a Warhammer-based TV series involving Henry Cavill but stated that contract negotiations continue.

Royalty income was down slightly for the period at $33 million, down from $36 million in 2022 due to “a high level of guaranteed income on multi-year contracts signed in the previous period.” Organized by platform, 68 percent ($22 million) of this income comes from PC and console games and 6 percent ($2 million) from mobile.

That seems really low to me for such a strong IP.

PLAY/PASS

Play. In support of the mounting labor strikes across entertainment and other industries, US Representative Alexandria Ocasio-Cortez once again took to Twitch where she played Pico Park with a cadre of streaming celebs. A nation that plays together, stays together.

Pass. To celebrate the 40th anniversary of its reconstituted boneless chicken meat bites, the well-known fast food chain opened a virtual experience called McNuggets Land. Made of plastic, it’s fantastic.

After complaining about the ESA not offering perspective on numbers, it's interesting that you cherry-pick the one quarter of ABK's earnings showing console as the lowest contributing platform, ignoring the fact that is the largest on an annual basis.