Falling into grace

Found money in streaming rights and back-catalog sales

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

If you like fleece vests, Seattle is the place for you.

I’m on the road this week. The semester has ended, the grades are in, and my focus has returned to business. This last earnings cycle provided more color for the next 12 to 18 months (spoiler: delays). Top game makers are gearing up slowly for the start of a new hardware cycle and focus on the success of their biggest franchises.

It creates an opportunity for newcomers to impress. The release of Animal Well is a masterpiece in both creative gameplay and business acumen. For one, its single-person development shop, Billy Basso, delivered an impressive platformer that leans on classic Metroid-like mechanics and blends it with novel visuals, enthralling music, and innovative gameplay.

It is also the first release by BIGMODE, a publishing label erected by popular Youtuber videogamedunkey who has 7.5 million subscribers. In the clutter that characterizes digital storefronts (ie. Steam had almost 13,000 releases last year), developing a novel distribution strategy is equally important to making great content. Curating a set of titles that resonate with his audience means the streamer is a kingmaker.

In the run-up to 2025, when all things will be better I’m told, it means the big incumbents will have to work extra hard to prove their acquisitions and investments from the past years were worth it. They might find that audiences have moved onto new channels and have found new things to play.

On to this week’s update.

NEWS

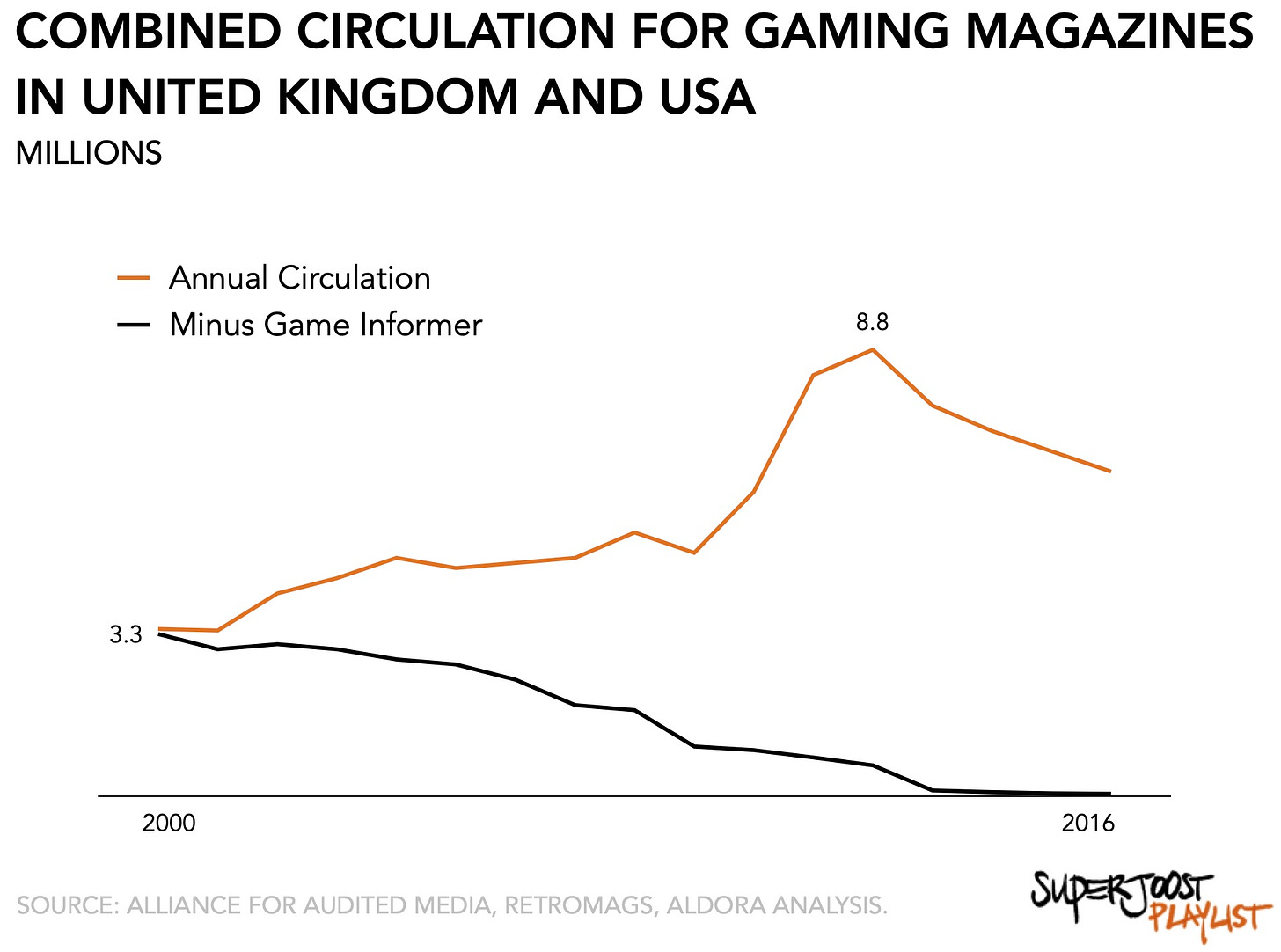

Games journalism consolidates and suffers more layoffs

Video game trade press became even more brittle this week with the acquisition, and subsequent shutdown, of part of the Gamer Network family by IGN Entertainment.

Despite being equally painful, it seems somehow easier to understand that mainstream press outlets had already reduced their coverage of video games. But now that even the trade press focused on interactive entertainment is proving unable to stay afloat, I wonder if we’re cutting to the bone.

The video game industry has experienced numerous acquisitions and layoffs. Halfway into the year, publishers have already laid off almost the same number of people (10,100) as they did in all of 2023 (10,500). The decline of video game magazines, once a staple of the industry, has left online publications as the primary source of information for consumers. However, the acquisition of Gamer Network by IGN Entertainment raises concerns about the future of independent games journalism and the impact on the industry overall.

Games journalists, reviewers, and other industry writers have the important task of helping filter through noteworthy and relevant releases. They set the agenda for conversation when it comes to upcoming title launches and bring visibility to key industry topics that would otherwise go unnoticed. The erosion of this critical role, as exemplified by the Gamer Network acquisition, represents a significant setback for the industry. Major companies often prioritize media outlets that provide favorable coverage of their latest offerings. Depending on marketing dollars and advertising for its revenue, it will be more difficult for a reduced number of outlets to safeguard the integrity of their writers. That in turn will inflate expectations and limit the critical review of corporate decision and indecision.

The acquisition by IGN Entertainment is part of a broader strategic push by its parent organization, Ziff Davis. In its recent earnings, the conglomerate appeared to be performing well. Its size and dominance affords it the attention of advertisers, and reported growth in the “mid-single digits,” according to CEO Vivek Shah. In the run-up to the anticipated release of the next console generation, Ziff Davis is well-positioned and, hopefully, willing to bolster its ranks. Early signs are promising as the firm is investing a three-day fan event in Los Angeles to fill the void left by the disappearance of E3.

However, judging from the language used by leadership, the current focus is squarely on large releases and their plumb marketing budgets. This focus persists even though the gaming industry has largely shifted towards digital distribution, with the majority of consumers opting for online play. This week’s acquisition puts the fate of an even greater number of games writers in the hands of a single, publicly-traded firm. Ziff Davis generated $1.36 billion in 2023 revenues, down from $1.39 billion the year before. Earnings for Q1 2024 were up slightly at $314 million, and guidance sits at $1,471 million on the high end for 2024. We’ll see, I guess. The firm competes against other large ad networks like Meta, Google, and Amazon, and its growth strategy depends heavily on continued successful acquisitions. One wonders what happens after the dust around releases for Grand Theft Auto 6 and the next PlayStation and Xbox settles.

The long view: The gradual disappearance of independent press increases the risk profile for game developers, investors, and players. Important supply-side developments, like workplace toxicity and greater transparency around unionization, will receive even less attention.

Large firms, such as Ziff Davis, the parent company of IGN Entertainment, have the financial resources to weather the challenges facing the industry. However, their focus on large releases and marketing budgets may come at the expense of covering smaller, more diverse titles and addressing important supply-side developments, such as workplace toxicity and unionization efforts.

It also makes it harder for investors to ‘read’ the market. As the industry’s momentum has slowed, publishers have become more risk-averse and centralized their efforts around a dwindling number of franchises. Earnings these past two weeks indicate the transition period until the release of a new generation of hardware and high-profile title launches may last longer than planned. Major publishers and platform manufacturers reduced their forecasts in an attempt to temper investor expectations. Much like the 90s and 00s, game execs are singling out what works and will be less willing to take risks on novel projects. Consequently, the industry has witnessed a surge in layoffs across the board.

It is the games journalists that help separate chaff from wheat among the tens of thousands of releases each year. Now that their numbers are declining, inflated expectations will be more common and, ultimately, we risk alienating players. This situation leaves consumer spending, in terms of both time and money, at the mercy of algorithms dictated by major platform owners.

A strong trade press is necessary for a healthy ecosystem.

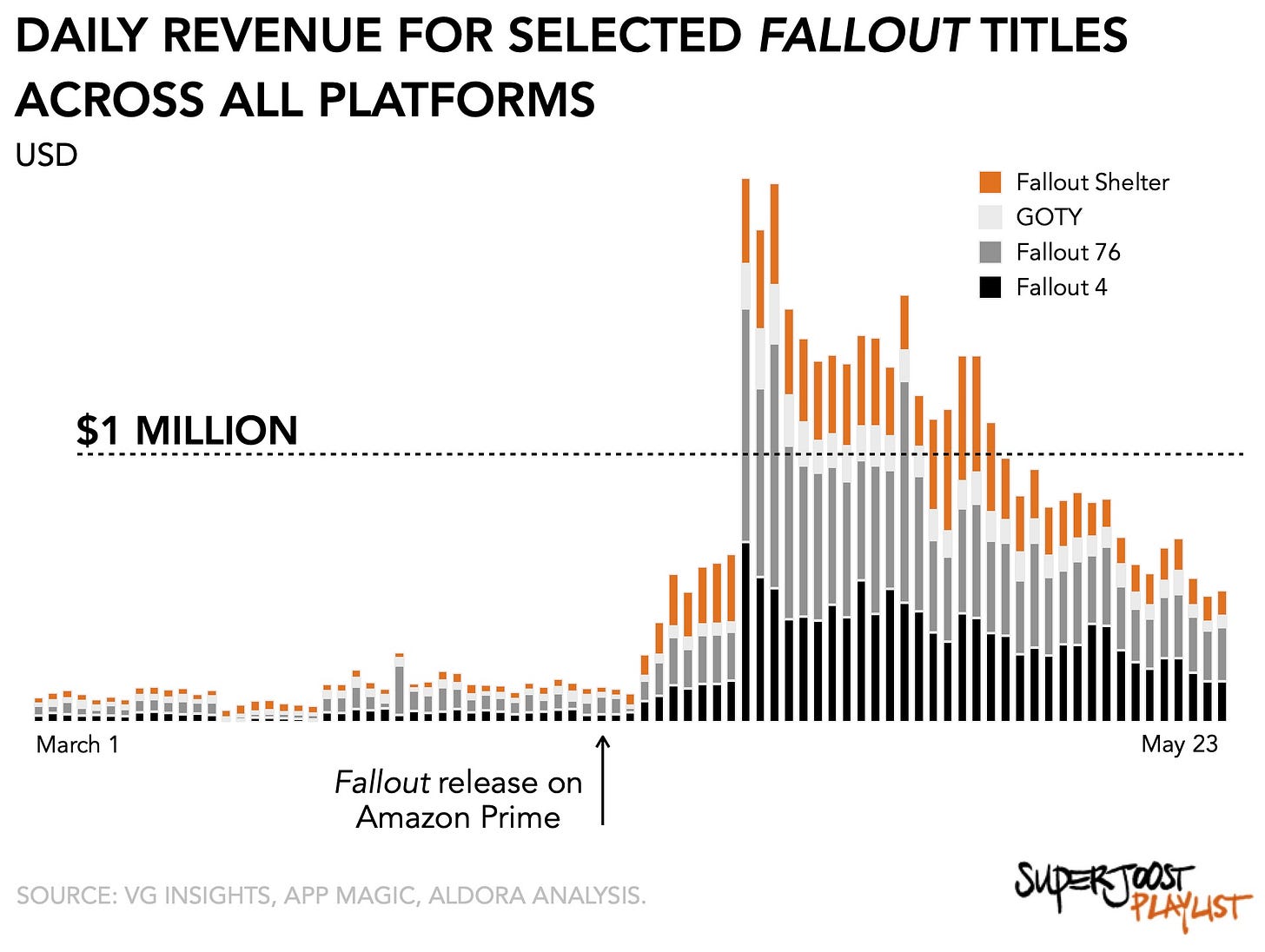

Fallout maker Bethesda falls into $84 million

An analysis by VG Insights argues that the recent release of the Fallout TV series on Amazon Prime, based on the popular video game franchise, is a successful example of “transmedia expansion.” The firm argues that it generated an estimated $80 million in revenue for Bethesda, the game's IP owner, from just one season.

The show, which attracted 65 million viewers in its first two weeks, primarily from the 18-34 age group and with 60% of the audience from outside the US, boosted sales of existing Fallout games by approximately 2 million units for Fallout 4 and 1-1.5 million units for Fallout 76, resulting in $35-40 million in post-platform fee revenues. Additionally, the show increased daily active users for Fallout 76 from 100-200k pre-show to a peak of 1 million during the launch window, leading to an estimated $10-15 million in incremental in-game revenues.

Missing from VG Insights’s analysis is the mobile component, but, have no fear, according to App Magic, Fallout Shelter also saw significant growth. Downloads increased from a monthly average of 236,198 in Q1 of 2024 to 2,048,542 in just the month of April, and revenues grew six-fold from an average of $554,110 per month to $3.6 million in April.

Combined, these extracurricular activities generated $84 million in consumer spending, suggesting we haven’t seen the last of it yet.

MONEY, MONEY, NUMBERS

Take-Two Interactive reported $1.4 billion in net bookings, exceeding its guidance range of $1.27-1.32 billion. Its full-year 2024 net bookings reached $5.33 billion, slightly above the revised guidance range of $5.25-5.30 billion. For 2025, Take-Two’s guidance sits at $5.55-5.65 billion, representing 5% year-over-year growth. Even as all eyes remain on the Grand Theft Auto 6 launch date, rumors suggest a 2025 release of Borderlands 4 as the closest match for management’s reference to “one of 2K’s most beloved franchises” scheduled for that timeframe.

Ubisoft’s earnings totaled $2.6 billion (€2.3 billion), up 33 percent year-over-year. The French publisher benefitted from several developments. Notably, back-catalog sales were up 49 percent at $1.65 billion. Especially Rainbow Six Siege increased in player engagement, and the Assassin's Creed franchise benefitted from the release of Mirage and the inclusion of Valhalla in Xbox Game Pass. According to CFO, Frederick Duguet,

"The year was marked by improved activity metrics across console and PC, with 138 million unique active users at plus 4% versus last year, and [monthly active users] at 37 million, also up year-on-year. Playtime progressed well, up 12% year-on-year, with higher [recurrent spending] per hour."

Last year Ubisoft obtained the streaming rights to Activision Blizzard’s catalogue as part of Microsoft’s concession to complete the ABK/MSFT acquisition. Its own subscription service, Ubisoft+, has presented its challenges, but greater reliance on premium franchises and brands has secured Ubisoft's continued momentum.

PLAY/PASS

Play. The US Department of Justice is suing Live Nation over its monopolistic practices after acquiring Ticketmaster 14 years ago. Maybe now those Taylor Swift tickets will become affordable for the rest of us.

Pass. OpenAI’s wunderkind Sam Altman requested, and was denied, the use of Scarlet Johansson’s voice. He used it anyway and now faces legal action. Eww.

🔥🔥🔥🔥

Transmedia seems like all the rage right now (among publishers who can afford it and have powerful IP that they could leverage, at least). At least it brings some interesting content 😅