Inactivision Blizzard

Bad to worse, backed by Bobby

I’ve just finished the first six episodes of Arcane, a spin-off series on Netflix based on League on Legends, and I have to admit that I’m rather enjoying it. Personally, I rolled out of the game as fast as I rolled into it because I KNOW MYSELF. Let’s not pretend I wouldn’t have dislocated my entire life to play all hours of the day; I one hundred percent would have. So I didn’t. But Arcane affords me a look where I cannot touch, right?

I’m not alone. As it turns out, Arcane is #1 on Netflix in 52 countries. It suggests that its viewership extends beyond the game’s player base. One of the biggest holes in LoL’s massive success has been the absence of cohesive and compelling lore. Sure enough, we love to dress up our champions and perfect individualized playing styles. But to retain audiences long-term, you’ll need some character motivation beyond “they’re all very upset with each other.”

In a parallel universe, the Angry Birds movies and Netflix series weren’t exactly high-brow theater. But the effort did manage to excite enough young players to warrant Rovio’s IPO at a $1 billion valuation. (Frankly, that amount seems small nowadays, considering the impact the firm had on the early days of mobile gaming.)

The core observation here is that on account of having become mainstream, gaming IP now no longer just lends itself as the basis for adjacent forms of entertainment. To deliver on its potential of becoming the globally encapsulating cultural phenomenon it could be, game companies are now obligated to actively explore those opportunities.

Another remarkable aspect is the gradual rollout of the different episodes. That’s not me saying: “Hey Riot, hurry it up already,” although they totally should. It is a noticeable deviation from the commonly held idea that audiences love to binge. Making me wait another week for the next batch of three episodes is unusually cruel and therefore most likely a test to see if there exists some effective cross-pollination of effort between the show and the game. The high productions values (hand-animated, not automated!) and the button-up sexed-down interpretation of some of Piltover’s lead characters tells you there is a lot more to come.

Hurry it up already.

On to this week’s update.

NEWS

Bobby Kotick is having a shitty week but will keep his job

Following an investigative report by the WSJ, it has become evident that Activision Blizzard’s CEO, Bobby Kotick, was aware of the inappropriate behavior and toxic work culture among the firm’s subsidiary studios. This comes after Mr. Kotick denied any knowledge of it, taking a pay cut (sort of), and publicly apologizing.

When it comes to Activision Blizzard, we really shouldn’t be surprised. When a competitive Hearthstone player publicly expressed his support of the Hong Kong protests during an interview, Blizzard cut the live feed and took away his winnings, and punished the streamers. It resulted in outrage by employees everywhere, who felt it did not, and should not, represent the company’s values. Absolutely nothing came of it. Rather, it taught us that legacy publishers struggle with having a clear and indisputable political position. As gaming became global, its major industry protagonists acquired the power to promote ideas and beliefs. We now know what those are for Activision Blizzard.

In response to the recent revelations, several hundred employees staged both a physical and digital walk-out. (One marvels at the idea of what impact it is expected to have when people start protesting things they believe are evil from the safety of their home office. Is there dissent in the metaverse? I digress.) They were joined by several smaller shareholders in calling for Kotick’s resignation.

That’s never going to happen, of course, for at least three reasons. Kotick built ATVI from the ground up. After raising $400,000 to buy the defunct asset, he led the firm through a series of growth spurts and landmark acquisitions to become the biggest North American game publisher. Today ATVI is valued at $44 billion and its share price has increased roughly 9-fold over the past decade.

Mr. Kotick is also the largest individual shareholder on the board, with almost 4 million shares, and additional voting rights through ASAC II, a financial vehicle he created during the Activision/Blizzard merger. It does not, like Mr. Zuckerberg, give him disproportionate voting rights. And historically he has managed to get buy-in from other board members and institutional investors.

Finally, financial investors don’t care, unfortunately. The group of ATVI shareholders with a combined total of 4.8 million shares calling for Kotick’s departure are but a drop in the 177 million O/S bucket. Their moral ledger has been balanced, perhaps. But their efficacy is limited. The abject anonymity of its three biggest institutional investors like the Vanguard Group (62 million shares), Blackrock Fund Advisors (38 million), and the SSgA Funds Management (35 million) tells you no one’s home. Anything short of Kotick himself being personally involved in Weinsteinian practices will likely result in a few more mea culpa press releases followed by a return to business as usual.

Is that a bleak outlook? You betcha. But that’s what things look like at the beginning of a much larger industry-wide transition for a group of creative firms that has long resided on the fringes. Reporting on the issues has been stellar by WSJ, WaPo, and the NY Times. The image that’s been circulating of Kotick as a frazzled off-screen exec in his sweatshirt carrying an enormous binder seemingly wondering what the hell next is journalism gold. However, it is going to take a concerted effort from reporters, employees, whistleblowers, and, perhaps one day, investors. I’m here for the long game.

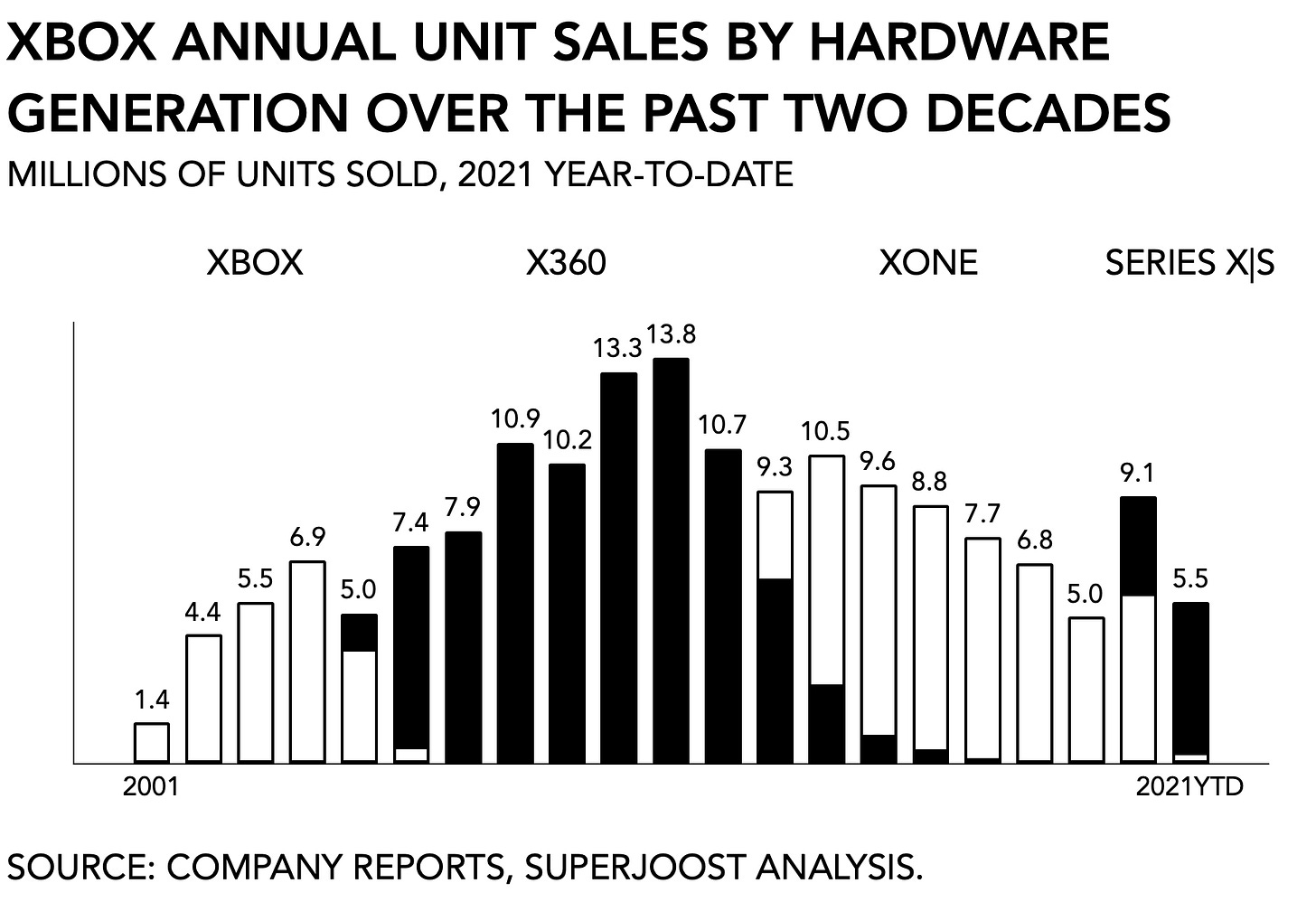

Xbox celebrates its 20th birthday

I recall the initial skepticism from analysts who argued there was no room in the market for a third console. But it is quite remarkable what can happen when a billion-dollar tech firm sets its mind to something.

Microsoft first launched its Xbox in November 2001, with a budget of $500 million for marketing and content agreements with over 150 game makers. Xbox did everything right from a platform penetration perspective. It had content, a technically superior device with a significantly faster microprocessor relative to the PlayStation 2 and GameCube at the time, and a sharp retail price of $299.

It nevertheless struggled to capture market share from Sony, or even to overtake Nintendo. It launched late in the year, leaving itself a short window to market the new device, and lacked support from many of the major Japanese game makers. By comparison, Sony’s initial success, and Nintendo’s before it in the 1980s, had come from convincing game makers like Square Enix, (pre-merger) to release their titles on PS1 and not the N64.

I tell you all this to impress you with my vast historical knowledge, of course, and to offer an antecedent for much of what continues to happen today. It’s easy to forego the broader context in which the Epic/Apple conflict is playing out. Facebook’s rebrand to Meta in honor of its pivot into the metaverse seems born from the same need for a large firm to lead the transition into a new technological era. The constant banter about blockchain, too, largely takes an ahistorical perspective, as if to say that none of this has ever happened before. That Bored Ape Yacht club party on a yacht in NYC was borderline Caligulan. Not sure that’s the vibe we should be going for.

Anyway, Xbox nevertheless managed to claim a 20% market share in the 128-bit console market by 2006. It drove sales by heavily subsidizing the devices. Microsoft matched Sony’s pricing at $199 in 2002 and further lowered it to $149 in the following year. By 2004 unit sales peaked at 7 million. In a later stage of the console cycle, Sony cut its price point to $129 (can you imagine?) but rather than racing to the bottom, Microsoft discontinued the Xbox and moved on to the Xbox 360. Big accomplishments often start small rather than big. Happy birthday!

OpTic and Envy announce merger

The market for competitive gaming is consolidating at a seemingly accelerating pace. After we learned about the SPAC-induced public listing of FaZe clan, now two of the biggest professional Call of Duty outfits are joining forces. Scale is everything, of course, because delivering more eyeballs means you attract bigger sponsorship deals and is far more valuable than living off of winnings.

Amazon’s in-game economy runs into a snag

If you wanted an example of what’s about to go sideways in blockchain gaming, you only need to look at New World. The game’s popularity inevitably, and unsurprisingly, resulted in players identifying weak points in its economy. Specifically, a glitch allowed players to duplicate items including furniture (meh) and trophies (yay!). The latter provide buffs and are rare and expensive. Duplicating an item like the subtly-named “Major Loot Luck Trophy” allowed players to make money. Amazon summarily turned off “all forms of wealth transfer between players.”It doesn't take an economist to see that it’s only a matter of time before something like this hits the budding NFT universe and upsets the economy of some aspiring killer app. Only with real-world implications.

NetEase music division reconsiders its IPO

After putting the plans on hold earlier this year, Cloud Village, as NetEase’s music group is known, refiled a preliminary prospectus to the Hong Kong stock exchange. It’s looking to raise $500 million, which is a big step down from the $1 billion number that Bloomberg reported in May. It is likely trying to offset the costs it incurred in competing with Tencent over agreements with labels for music rights. Outside of Asia, there aren’t any comparably vertically integrated firms like it (imagine something like Take-Two owning both Spotify and Twitch, I think?). Generally speaking, economists differ in their opinion on whether a vertically integrated firm makes sense as separate business units are more capable of capturing value and negotiating better terms.

RIGHT QUICK TIDBITS

Embracer reported $371 million in sales for the 21Q3, up +38% from $268 million. This was largely the result of its acquisitive efforts for its games business which increased $168 million to $319 million, up +89%. The firm is the poster child of an entertainment firm leveraging cheap capital to expand and diversify its portfolio. Sales were up largely due to the success in its recently acquired mobile business, DECA Games, which shot up from $3.7 million to $28 million, roughly 6.5x, “despite the changes in Apple IDFA.” Other parts of its business did not prove quite as strong, as THQ Nordic (-34%), Coffee Stain (-8%), and its Partner Publishing/Film business (-48%) all reported losses. Finally, Gearbox and Easybrain, both acquired in February 2021, added a combined $117 million to quarterly earnings. Today Embracer has 197 game projects in development and plans to “release 25 AAA (big-budget) games by April 2026.”

Take-Two’s Private Division announced the acquisitions of elite3d, a Spanish art studio that has created artwork for Diablo II, Hitman 3, Call of Duty, and PUBG, and Roll7, a London-based indie studio.

Zynga subsidiary Rollic acquired three Turkey-based mobile game studios, ByteTyper, Creasaur Entertainment, and ZeroSum, to expand the firm’s hyper-casual game effort.

CD Projekt Red acquired The Molasses Flood, best-known for its cooperative action village-building game, Drake Hollow, and promised it wouldn’t rob it of its identity.

NPD reported consumer spending for October at $4.4 billion (+16%). Hardware sales increased +82% to $472 million, the highest it has been in the month of October since 2008, with new-gen consoles accounting for 40% of total unit sales.

PLAY/PASS

Pass. The overuse of the M-word. I dare you to be more specific in your next earnings report and not use it. At all.

Play. The correct use of the M-word. Matt Ball’s OG essay sold for 100ETH and set a new astronomically high bar for business writers everywhere. Dang yo.