After spending last week in New Orleans, I have a clearer sense of the future.

For one, a tarot card reading revealed my own fortune. Evidently, I’ve come a long way, but am now in the middle of a reconciliation, and the road ahead is coming into focus. That is good to know. And, frankly, it is better guidance than I’ve gotten from any algorithm lately. New Orleans’ vibe has a way of reminding you of the cyclical nature of things. And beignets. Oh god. Beignets.

Another vision I gleaned there is the imminent manifestation of two distinct revenue models in gaming.

The first, direct-to-consumer monetization, has been gradually evolving as a necessary alternative to the iron grip platform holders have held over their ecosystems. The legal victories won by Epic Games’ Tim Sweeney against Apple and Google have cracked the walled gardens and started to oxygenate mobile gaming—a little, at least.

The court-ordered removal of ‘anti-steering’ clauses, which prevented publishers from guiding players off-platform for in-game purchases and offering them better value, initially resulted in a $4.1 billion windfall for mobile game makers. Since then, several firms have spun up alternatives. A newcomer like AppCharge raised $58 million in August to build the infrastructure game makers need to facilitate off-platform purchases. And we also heard from incumbent Unity last week, which launched a free payment product enabling ‘app-to-web payments’ together with Stripe. (N.B. Unity’s CEO is coming to my class in a few weeks, and, yes, the event is open to the public. Details below.)

The second, ad-based revenue, also seems ready for prime time. After years of trying to get in front of gamers, both publishers and advertisers appear poised to do so.

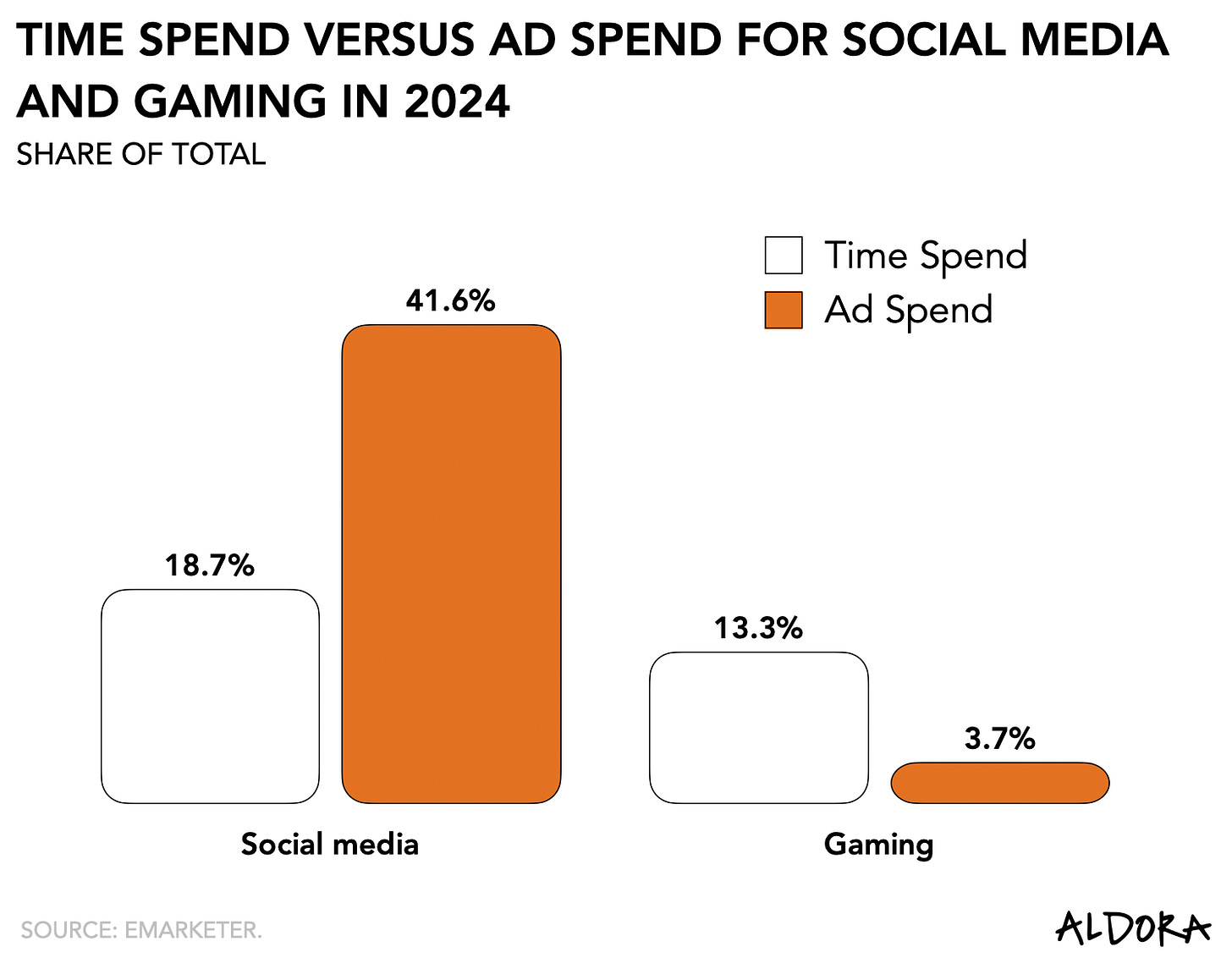

The latter, represented by a growing consortium of brand managers, is eager to, sigh, get in the game. The declining efficacy of increasingly toxic social media has turned their attention to more emotionally meaningful alternatives. In 2024, social media accounted for 19 percent of total time spent by consumers and 42 percent of total ad expenditure in the U.S., according to eMarketer. Gaming commands a comparable time share of 13 percent, but receives only 4 percent of total ad spending.

But more than merely stickering their logo all over, it is the newfound ambition to develop an integrated approach that leverages gaming as a growth driver. A few months ago, Julian Runge and I wrote a piece on that for Harvard Business Review. And then there’s Bastian Bergmann, who just published an entire book hammering the point home, titled: Press Play: Why Every Company Needs a Gaming Strategy. I strongly recommend it if you care about where culture and consumer attention are actually going.

Game publishers, on the other hand, find themselves in an obvious bind.

Hoping to offset the threat of additional regulatory speed bumps that could hinder their financial reliance on micro-transactions, they now lean more heavily into indirect revenue models. Firms like Zynga and Square Enix have recently expanded their commitment by partnering with Gadsme to offer in-game ads to mobile players. And on Friday, Xbox confirmed that its employees have access to an ad-supported version of Xbox’s Cloud Gaming service, according to Zachary Small from the New York Times. (You can find my prediction from July 2024 here.)

It’s all part of the broader push toward distribution innovation. To offset rising development and marketing costs, publishers are developing new strategies to generate income. Revenue models, however, are not business models. And so while novel ways to make money will help offset the suffocating dominance of Big Tech, creative firms will also have to overhaul the rest of their operations.

Maybe I’ll go back to New Orleans for another reading.

On to this week’s update.

BIG READ: Game Pass, or fail

“We are now the largest publisher after the Activision [deal] so therefore we want to be a fantastic publisher, similar to the approach of what we did with Office. We’re going to be everywhere, on every platform. We want to make sure, whether it’s consoles, whether it’s the PC, whether it’s mobile, whether it’s cloud gaming, or the TV, so we just want to make sure the games are being enjoyed by gamers everywhere.”

Satya Nadella, CEO, Microsoft. (Bolding added. h/t

)

Xbox recently made its third major Game Pass overhaul in two years.

It is the most tangible proof that the firm is still searching for the right formula rather than confidently executing. By far the most telling change is its locking Call of Duty: Black Ops 6 behind a new $30-per-month Ultimate tier, a 50 percent price increase from the previous $19.99.

The growing evidence that premium subscription titles cannibalize unit sales, as reported by Bloomberg’s Cecilia D’Anastasio, tells us two things: first, Game Pass hasn’t delivered the immediate, explosive growth Microsoft anticipated after acquiring Activision Blizzard, and, second, it has realized its infrastructure costs don’t align with its pricing model. Worse, the rapid sequence of pricing updates makes for, as one former Xbox employee told me, “bad optics.”

This aggressive repricing reveals another uncomfortable truth: the service has what one might call ‘airline economics in reverse.’ In air travel, premium passengers subsidize economy fares. On Game Pass, every user effectively flies business class while paying economy prices, creating an inherently margin-thin model in which heavy users consume disproportionate resources without proportional revenue.

Microsoft is now trying to fix this structural problem by segmenting its user base. The $30 Ultimate tier targets power users—those who stream Call of Duty daily and download multiple new releases each month—whose infrastructure costs far exceed what the previous flat fee could cover. At the same time, management has also confirmed cheaper, ad-supported tiers coming for lighter users, particularly cloud-focused players.

It’s all part of Microsoft changing direction to accommodate a broader industry shift. It now aims to reach as many people as possible—or, in Xbox corporate speak, “reach people where they are,” which means abandoning its console-centric approach.

However, while subscriptions are a more established monetization strategy in other entertainment categories, such as streaming video and music, there is still precious little research on their viability and benefits in the context of console gaming. It partly explains why Microsoft seems to be making a series of uncertain decisions, leading critics to conclude its service isn’t performing well.

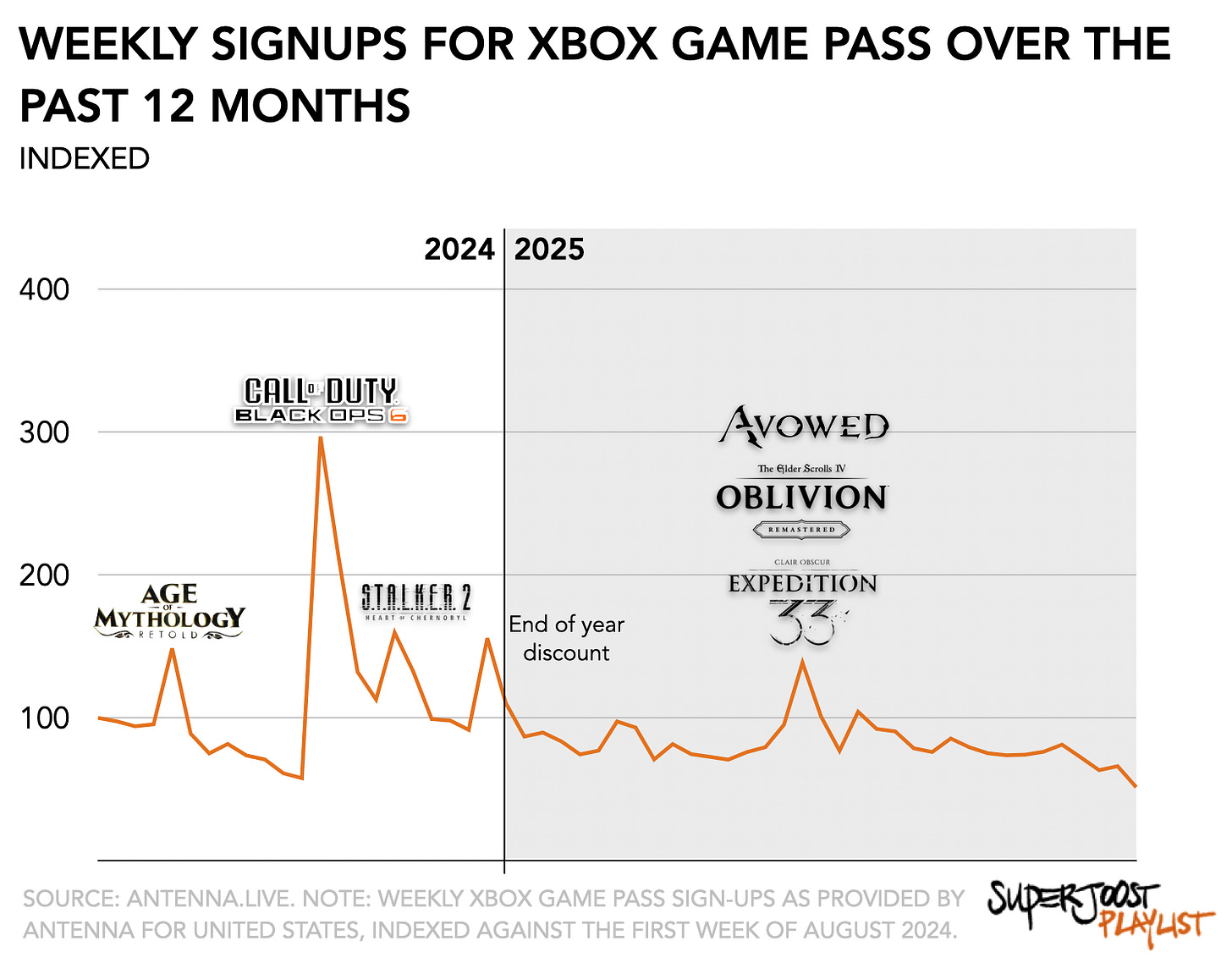

Based on data provided by Antenna (disclosure: I’m an investor), we can see that weekly signups for Xbox Game Pass have indeed been trending downward.

The Game Pass signup data exhibits a stable baseline of weekly additions, punctuated by distinct event-driven spikes. The overall trend shows declining signups over time. The most pronounced increase occurs in late October 2024, coinciding with the announcement and promotional campaign for Call of Duty: Black Ops 6 launching on Game Pass, which led to more than a threefold increase in new subscriptions relative to the baseline.

Smaller increases align with additional high-profile title releases and the holiday gifting period, while weeks without major content announcements or news coverage show a consistent return to baseline levels. Taken together, the pattern indicates that subscription growth is now primarily driven by specific high-visibility content releases, rather than the intrinsic appeal of the subscription model itself.

It is that shift that underscores why Microsoft is transitioning to differentiated pricing tiers: usage intensity and value realization are unevenly distributed, and the previous single-price structure did not adequately reflect the different playing habits within the subscriber base. (Coincidentally, it matches the analysis and conclusion I did a few years ago on Ubisoft’s game subscription.)

The pricing restructuring attempts to address a fundamental mismatch: Game Pass operates like an all-you-can-eat buffet where the biggest eaters quickly make it unprofitable. Unlike streaming services, where bandwidth costs are relatively predictable, gaming’s infrastructure demands—from high-resolution streaming to massive day-one downloads—scale dramatically with usage intensity. The inclusion of Fortnite Crew and Ubisoft+ Classics in the new Ultimate tier represents an attempt to justify the price jump through bundling. Still, fundamentally, Microsoft needed to charge power users more because subscriber volume alone wasn’t delivering necessary returns.

But a combination of research and available data suggests that, perhaps, Microsoft isn’t that far off.

Microsoft is repricing its gaming service based on actual usage patterns rather than projected subscriber growth. Die-hard fans, who play Call of Duty from the moment it’s available and stream dozens of hours every month, create disproportionate infrastructure costs. At $19.99, Ultimate was underpricing this heavy-usage segment.

If constant restructuring suggests Microsoft is still searching for the right formula, emerging research offers clues about what might actually work. The shift from a single-price to a multi-tier structure may, in fact, be the key to making subscriptions viable in gaming.

Who really benefits from Game Pass

The first piece of evidence comes from a study from the University of Washington. Based on proprietary Xbox gameplay data, it finds that introducing differentiated Game Pass tiers increases overall player value (the benefit consumers get above what they pay) by 16 percent.

But if Xbox shifted to a single “Grand Bundle” subscription that includes every title, similar to Netflix or Spotify, consumer surplus would drop by 38 percent compared to the traditional pay-per-title model. The very thing that feels more generous actually makes the player experience worse, because it forces light users to subsidize heavy users and players with narrow tastes to subsidize more ravenous players.

More generally, subscriptions make sense when the audience is highly varied and when players bounce between multiple titles. When players concentrate their attention, say, on flagship titles purchased at a high premium, they struggle.

How subscriptions reshape the console business

While the Washington study examined player value, a second piece of evidence looks at platform-level impacts.

The second piece of evidence comes from a 2025 empirical analysis of Xbox Game Pass and PlayStation Plus in the U.S. console market. Researchers from Erasmus University in the Netherlands examined what happened to both platforms after their respective subscription services launched. They found a counterintuitive pattern: subscriptions did not cannibalize the traditional console business. In fact, they strengthened it. As the researchers noted:

“the introduction of […] subscription models in proprietary video game console markets: (1) enhanced console revenue, (2) had limited impact on video game revenue (contrary to the cannibalizing effects observed in the music, movie and TV industry), and (3) created a healthier video game supply.”

Following the launch of Game Pass, Xbox console revenue increased by 66 percent relative to the prior trend. In comparison, PlayStation’s launch of PS Plus drove an even larger 122 percent increase in console revenue in the month following launch.

At the same time, the study found only limited evidence of cannibalization in video game sales, a notable departure from what we’ve seen in music and streaming video, where subscription adoption tends to hollow out unit sales. Instead, subscriptions reshaped supply: Xbox saw a reduction in the total number of new games introduced after Game Pass launched, but the drop concentrated among lower-quality titles, raising the platform’s average catalog quality. PlayStation, conversely, saw an increase in game supply following the launch of PS Plus, particularly in the number of new third-party titles featured on the platform. In short, subscriptions acted less like a blunt “Netflix for games” and more like a platform health intervention—boosting hardware revenue, stabilizing software revenue, and improving the overall quality and visibility of the catalog.

This finding appears to contradict Bloomberg’s report on cannibalization. The discrepancy likely stems from different measurement approaches: Bloomberg focused on individual title performance, while the academic study examined platform-wide revenue. Additionally, the studies cover different time periods—the Erasmus research predates the Activision acquisition and the aggressive push into day-one AAA releases.

But it nevertheless leads to the perhaps counterintuitive observation that subscriptions are, in fact, both an improvement for the player and the platform, even if few seem to perceive it that way.

Of course, both studies offer only a partial perspective, and their limitations are apparent. The first focused solely on internal Xbox data for the first two years of Game Pass, from 2017 to 2019. The second builds on platform-level revenue and supply data rather than individual play patterns, looking at what changed after the launches of Game Pass and the revamped PlayStation Plus, but without visibility into who was playing what and why.

What these studies suggest, combined with Microsoft’s pricing evolution, is that the company is moving from a growth-at-all-costs strategy to a more sustainable, segmented approach. This shift becomes even clearer when we look at the broader competitive landscape.

A new center of gravity

Since 2018, we’ve come full circle.

Services like Google’s Stadia have come and gone, unable to establish themselves as the future-proof solution or technological disruptors of the legacy console model. It’s been a central part of Big Tech’s push to claim dominance through a recurring revenue model. The question here is what type of games will prove most suitable.

These competitors are betting that gaming’s future lies not in AAA blockbusters but in accessible, social experiences. Amazon’s GameNight, which I recently tested, exemplifies this approach: simple party games that prioritize low barriers to entry over production values. Unable to justify any acquisition of equal size to Activision Blizzard, tech competitors instead focus on accessibility and low cost to sway consumers to their services. This casual approach contrasts with Microsoft’s premium-tier strategy, highlighting two divergent bets on gaming’s future.

Does that mean that Xbox is getting out of the console business? Yes. And more accurately, it means that the console is no longer the economic center of gravity in Microsoft’s gaming strategy. Hardware sales are now a low-priority, pass-through business rather than a subsidized growth driver.

Consider, for instance, that the Series X price has risen roughly 30 percent since launch, and major U.S. retailers have at the same time scaled back shelf space. In earlier console cycles, those moves would have been unthinkable: manufacturers sold hardware at cost (or a loss) to maximize install base and recoup through first- and third-party software royalties. Microsoft no longer plays that game. It’s deliberately passing tariff and component costs through to consumers, even if that limits unit volume.

That shift tells you that Xbox is decentralizing the hardware layer—outsourcing chipset design to AMD, licensing its brand to ASUS for handheld devices, and building Game Pass into smart-TV partnerships like Samsung’s. Moreover, the Halo remaster relied on Epic Games’ Unreal Engine rather than its own proprietary software. Xbox has clearly made a course correction, developing a profitable distribution model that leverages its strengths as a large-scale data infrastructure operation.

The evidence suggests Microsoft isn’t abandoning Game Pass but transforming it. By shifting from a one-size-fits-all subscription to a segmented model that better aligns price with usage, Microsoft may have found the formula that eluded Stadia and others. It is here that Microsoft can lead: if this pivot from growth to profitability succeeds, it will determine both its own service’s future and whether gaming subscriptions can ever truly rival their entertainment counterparts.

All it needs now is for Game Pass not to fail.

EVENTS CALENDAR

NYU Tandon’s Game Design Future Lab is hosting its inaugural cohort launch party on Thursday, November 6, in Brooklyn—don’t miss it! (Registration required.) Its recently appointed Associate Director, Mitu Khandaker, is also scheduled to appear on the Unboxing podcast in the coming weeks.

I’m headed to Gamesbeat Next in San Francisco for the week of November 10. Come through!

On Thursday, November 13, I’m hosting a fireside chat with Unity’s CEO & President, Matthew Bromberg, to discuss the firm's recent turnaround and his expectations for the years ahead. Register here.

PLAY/PASS

Play. Take-Two CEO, Strauss Zelnick, threw some cold water on the current AI fever, calling it “a combination of metadata with a parlor trick.”

Pass. After Valve released a seemingly innocuous update, the trade value of digital items for Counter-Strike 2 fell by 48 percent, erasing around $3 billion in value. I’m going with Hanlon’s razor on this one.

UP NEXT

I’m working on a few different pieces simultaneously. The first analyzes how middleware is about to change drastically. The second focuses on what the games industry’s current approach to AI says about what’s to come, especially as the word ‘bubble’ keeps showing up in my timeline. Let me know which you think I should cover first!