Having a ball

GameStop self-identifies as meme stock

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

The 2024 Euro Cup is in full swing. There are few greater pleasures than watching a month-long soccer tournament in the summer.

I live in the United States partly because I was formally asked to leave the Netherlands. I ranked absolute last across the entire country in terms of soccer abilities. There was a ceremony and everything. It was “for the good of Dutch soccer,” they said.

But now my two-year-old daughter has taken a liking to the sport. A few weeks ago, she joined the Fort Greene Falcons and now sports the cutest little jersey. She gleefully kicks her purple soccer ball through the house and showing skills that clearly prove soccer talent occasionally skips a generation.

I don’t have much to offer in terms of technique or tactics. But I can cheer. And cheer I will. Because if there's one thing I learned from my Dutch exile, it's how to watch soccer from the sidelines with flair.

Let’s gooooo, Holland!

On to this week’s update.

BIG READ: GameStop self-identifies as meme stock

To save itself, the specialty video games retailer has embraced a novel business strategy. It consists of one part costs-savings and one part unconventional accretive revenue.

Since his appointment, CEO Ryan Cohen has focused largely on reducing the firm’s overhead. GameStop faces a clear and present danger since the digitalization of interactive entertainment. It triggered a very public mid-life crisis a few years ago, which was understandable considering that many of its peers—Twin Records, Macy’s, Radio Shack, Toys ‘R Us—all went under due to a lethal combination of worsening market conditions and piss-poor financial management.

In its most recent earnings, GameStop reported a decrease in its quarterly losses from $51 million to $32 million, for one. It has cut back its store count to 4,000, down from well over 9,000 at its peak a few years ago.

However, the company lacks a plan for clear growth or a fully loaded management team for that matter. It dabbled in a bunch of ventures that were dead on arrival (e.g., in-store esports events, NFTs) and none of it could credibly future-proof the company. Instead of revitalizing its business model, it has been playing the stock market instead, with its own shares.

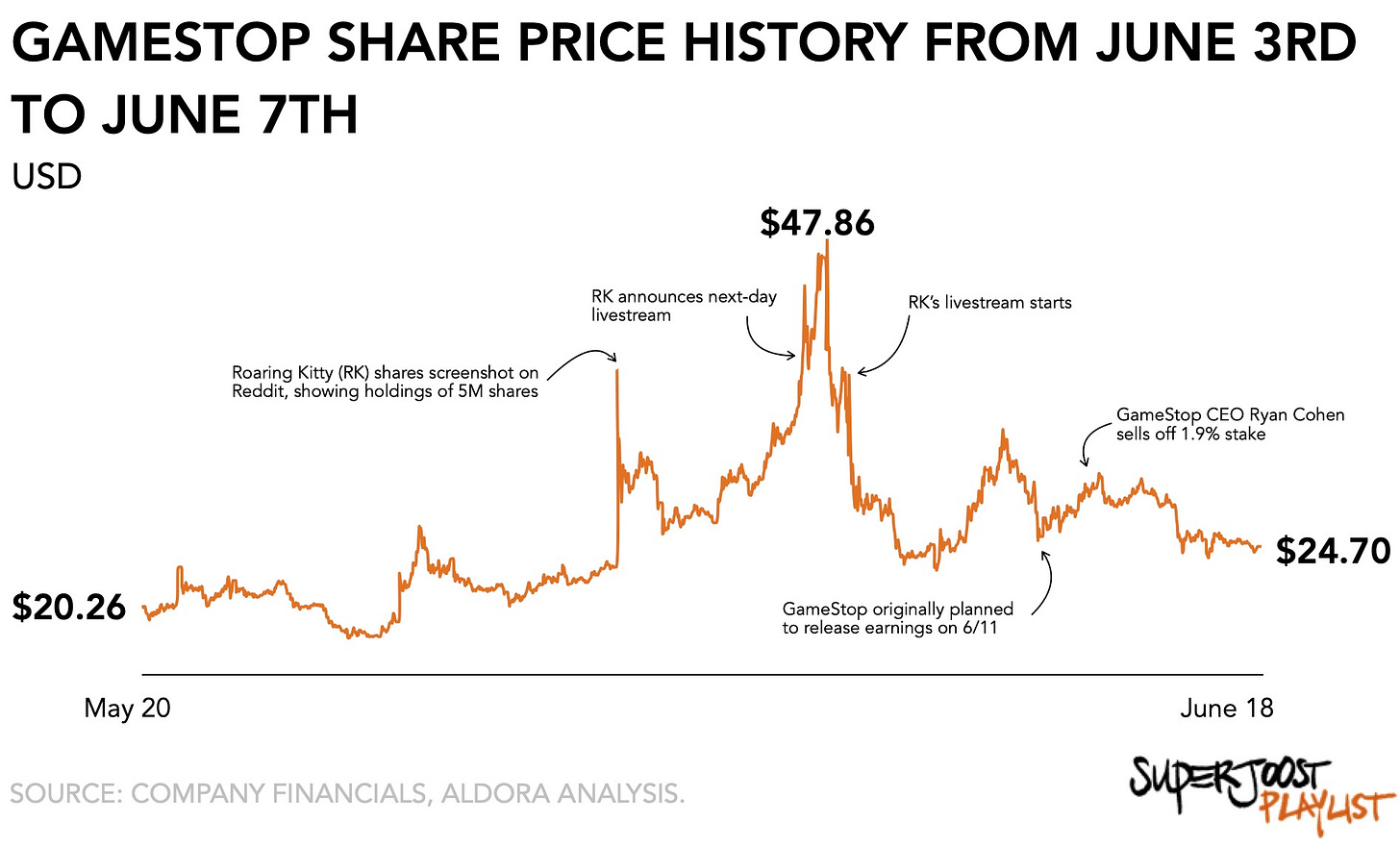

Last week, GameStop announced its quarterly earnings results ahead of schedule, revealing a decline in net sales but a narrowing of net losses compared to the previous year. The timing of this announcement coincided with a highly anticipated livestream by Keith Gill, aka "Roaring Kitty," a popular YouTuber who has been a key figure in the meme stock frenzy surrounding the company. GameStop capitalized on the momentum generated by Gill's live stream and raised cash by selling its shares.

And it worked.

Instead of selling the remaining inventory of consoles and games in its stores, GameStop sold 75 million shares at an average price of $28.50, raising $2.1 billion. That gives it a total cash pile of around $4 billion. At an assumed annual return of 4 percent, GameStop will be able to cover its operational losses for years to come.

That doesn’t mean it has a plan, though. GameStop’s future trajectory remains uncertain, as it has not announced any concrete plans for business growth. Instead, it appears to be focusing on reducing costs and increasing its cash position, which is not a sustainable long-term strategy. The departure or termination of the company's management team has left GameStop in the hands of an absentee landlord, with its future seemingly dependent on the influence of a YouTuber rather than a clear executive vision.

As for pursuing a Reddit-based investment strategy, much of the initial value has since dissipated. Yes, the 2021 short squeeze indeed worked. It created a brief moment in financial history that allowed small individual investors to reap outsized returns right from under the noses of the big funds. Since then, however, the cat is out of the bag as retail investors have exacerbated their own risk profile.

According to one study, “the GameStop event altered the culture of [WallStreetBets], leading to a deterioration in investment quality that adversely affected smaller investors.” Its crowd-sourced investment research got diluted when the GameStop short squeeze’s massive profits drew millions more individual investors who squarely focused on attention-grabbing stocks.

The two main beneficiaries so far seem to be both Roaring Kitty, who held around $450 million in GameStop shares at its recent peak, and GameStop CEO, Ryan Cohen, who has very successfully failed at saving the company while profiting personally. As of Monday, he holds an 8.6% stake in the company, down from his prior stake of 10.5% in May. He clearly has no intention, or plan, to turn the company around. Soon GameStop will be another private equity fund that hosts LAN parties.

Welcome to the meta.

NEWS

Surprisingly plumb slate revitalizes transition year

The announcements over the past weeks from Microsoft, Nintendo, and Ubisoft were, in honesty, a pleasant surprise. In the vacuum between the end of the current and the upcoming hardware cycle, the focus has been on leveraging existing franchises. And that’s shaping up well.

Microsoft kicked off strong with its 2024 Showcase. Accompanied by The Prodigy’s Firestarter, the headline obviously went to Call of Duty: Black Ops 6. The game’s release via Game Pass is part of Phil Spencer’s big plan to grow the current 100 million monthly active player base by making the game available, including its expansions, available at launch. But my personal favorite here was, as you may have guessed, DOOM: The Dark Ages.

Next, Nintendo Direct featured the unexpected announcement of The Legend of Zelda: Echoes of Wisdom with a September 26 release date. Instead of Link, Princess Zelda will be the main protagonist, and judging by the preview the game features a clever continuity of some of the game mechanics explored in Tears of the Kingdom. Similarly, Mario & Luigi: Brothership showcased novel co-op play and a delicious art style. And combined with the announcement of Metroid Prime 4, the current hardware generation isn’t over yet. Following Nintendo’s reduced forecasts a few months ago, the general expectation had been to see mostly remakes as the firm saved up any major franchise releases for the new device. Not so, it turns out.

And, lastly, the Ubisoft Forward 2024 event opened with Star Wars Outlaws and closed with the hotly anticipated Assassin’s Creed Shadows. I’m not going to lie, both games looked pretty good. After going through the recent teardown of the Star Wars hotel, the environments and NPCs shown in the Outlaws preview were detailed and credible. As for Shadows, the sanctimonious self-talk was a bit much. Hearing your character say: “Such beauty, shadowed by suffering,” to reiterate their motivation feels straight from a telenovela. But it’s more than made up by the fighting system.

The combined luster of all these announcements aligns with the anticipated emphasis on existing franchises to offset a softened market. But across the board, each showcase surprised and offered more than you’d expect.

PLAY/PASS

Pass. NVIDIA is now more valuable than Microsoft and Apple. Its success is well-deserved, yes, but before it reaches the new goalpost of a $4 trillion market cap, it will likely have to contend with more rivals, a rush to control chip manufacturers like TSMC, and uncertainty around how to monetize AI applications.

Play. The UNBOXING podcast is back with a new season! Laine and I have been having a lot of adventures out in the world, but we’ve returned to tell you all about it. You can find the first episode of season 5 here.

Joost, I like your content but parts of your take on Gamestop above are off the mark. e.g. "Ryan Cohen, who has very successfully failed at saving the company while profiting personally." and "He clearly has no intention, or plan, to turn the company around." Did you know that Cohen takes zero salary? So how is he profiting? He is incentivized to grow equity value of the millions of shares that he bought and seems pretty vocal that this is a longer-term play. So, my personal opinion - it seems to me that he at least will have intentions to try to turn the company around.