Immersion interrupted

Straddling the space between the real and the virtual is harder than it looks

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Over the weekend I watched the four-hour breakdown by Jenny Nicholson titled “The Spectacular Failure of the Star Wars Hotel” in which she presents a detailed rundown on why Disney’s attempt at a premium-themed experience failed.

To answer the two immediate obvious questions: (1) yes, it’s worth it, and (2) the reason one would watch the whole thing is that it lays out in detail how conventional entertainment firms are struggling to develop quasi-virtual, play experiences.

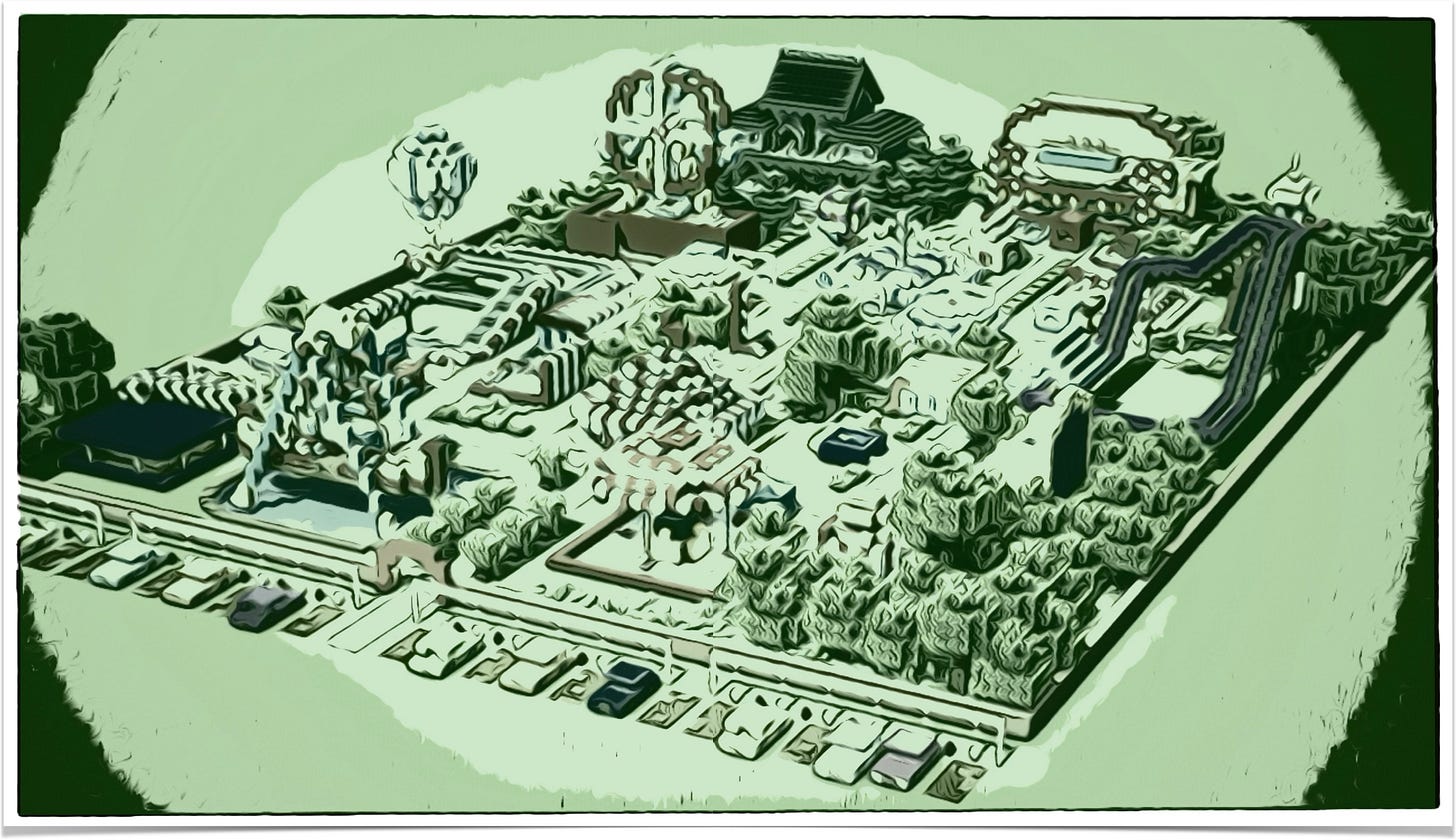

Brand and IP holders increasingly leverage interactive entertainment to develop novel ways to engage audiences. Disney’s Star Wars: Galactic Starcruiser experience—Star Wars hotel, as it is colloquially known—similarly borrowed from live-action roleplaying, escape-the-room game elements, a mobile gaming app, and scavenger hunts to offer what it called an “immersive” experience. Marketed as a luxurious, interactive, and story-driven adventure, the two-night stay promised guests the opportunity to live their own Star Wars story, complete with unique characters, live performances, and exclusive activities.

Understandably, since the pandemic the theme park business is still recovering. According to the most recently available figures, in 2022 the ten largest parks in North America were still down ten percent on average since 2019. Renewal and catering to new consumer habits, while costly, is essential to regain momentum.

Nevertheless, despite working with one of the strongest brands globally, Disney shut down its new offering within 18 months. Its failure offers insight into how even the biggest entertainment companies are just figuring out how to integrate games as a business strategy.

For one, the experience was rather pricey. Charging somewhere between $4,800 to $6,000 for a two-night stay that doesn’t even include a pickup from the airport logically narrows the addressable audience to a subset of die-hard fans. Sure enough Star Wars can command a high price point, but you must also deliver. According to Nicholson, many guests felt that the small rooms, limited amenities, and inconsistent quality of the interactive elements did not justify the cost.

Another issue centered on the buggy and unsatisfying interactive gameplay, which had been marketed as a key selling point of the experience. Guests reported problems with the app, inconsistencies in the story, and a lack of meaningful choices that affected the narrative. The repeated failure of the app that served to help navigate the different narrative threads, as Nicholson shows, breaks the suspense of disbelief. Anywhere from poor coordination to simply getting the ‘wrong’ result following a series of in-game decisions is frustrating.

The games themselves also seemed boring. Elementary gameplay mechanics, like having to repeat specific sequences of pressing buttons, or endlessly scanning crates to advance the storyline quickly become tedious. Worse, it interrupts a sense of immersion.

It adds up to an admission that Disney isn’t good at gaming yet. Its cast of characters that hosted the experience was undoubtedly excellent. In fact, Nicholson repeatedly mentions that the hosts went “above and beyond”. And from the looks of it, the food was wonderful.

However, incorporating game elements can be deceivingly difficult. I’d argue that the Star Wars hotel’s failure casts a new light on Disney’s recent $1.5 billion investment in Epic Games. It suggests Big Mouse is being honest about not being the best developer of immersive experiences. As consumer-facing brands and entertainment companies push into digital environments, Disney’s ability to develop novel experiences is best complemented by Epic’s world-building software, Unreal Engine.

Change is hard. And no amount of “imagineering,” as Disney calls its creative process, will satisfy the growing digital appetite of contemporary audiences. To do well in these newly emerging spaces, even the most established brands and creators of interactive consumer experiences to learn a few new tricks.

Imagine that.

NEWS

Call of Duty Black Ops 6 Game Pass release

Following an accidental leak, Microsoft has now confirmed that it will release the next installment of the popular Call of Duty franchise via its Game Pass subscription. It has been a debate, both inside and outside of the firm, whether doing so makes sense.

As a premium title, an average Call of Duty release sells around 20 million units. At $70 a pop, that amounts to $1.4 billion. Distributing it ‘day and date’ via Game Pass means players must sign up for either a PC subscription at $9.99 a month or an Ultimate for console at $16.99 a month. The expectation is that people will sign up for the new shooter title and keep the subscription long enough for Xbox to make more than that overall.

It’s not a bad play.

Most entertainment streaming services draw in audiences with a few highlighted releases (e.g., Stranger Things on Netflix, Game of Thrones on Max) and hope to retain them with a slew of additional content. After completing the $69 billion acquisition of Activision Blizzard late last year, team Xbox has added several high-profile titles to its Game Pass subscription, including Diablo IV and, just last week, Senua’s Saga: Hellblade II. The announced release of Call of Duty Black Ops 6 is arguably the culmination of Microsoft’s effort to position itself as a dominant gaming destination across PC and console. The firm owns several of the most popular first-person shooter franchises, including Doom and Halo. Against softer consumer demand, team Xbox is well positioned with its expansive library of well-known titles, as strong intellectual property will signal value to more thrifty consumers.

Microsoft’s gaming division seems under mounting internal pressure to showcase positive results from the pricey purchase. As part of the broader industry’s push for profitability, it recently announced several painful layoffs and is now focused on generating revenue. Documents obtained in a leak last September suggested that Microsoft has assigned itself the lofty goal of attracting 100 million Game Pass subscribers by 2030. The costs associated with streaming content currently exceed the service’s income, which suggests it will deploy an additional service on mobile at a lower price point to reach that goal. Two weeks ago in an interview at Bloomberg Tech Summit, Xbox president Sarah Bond announced the company’s plans to release a web-based mobile app store. In addition to its first-party content, I predict Xbox will also release a Game Pass version on this new mobile app store.

In the short run, releasing Call of Duty Black Ops 6 via Game Pass may impact physical game sales, but it suggests a fair trade-off as consumers gain access to more content, and Microsoft benefits from transitioning more users to a recurrent revenue model.

The release is Call of Duty Black Ops 6 is scheduled immediately following its planned showcase on June 9th.

Amazon Games gears up with new racing title

Aiming to deliver a “narrative-led open-world driving game,” Amazon Games signed an agreement with studio Maverick Games this week. It suggests the online retailer is still in play to become a publisher of note.

Big tech has spent a lot of time and money trying to enter interactive entertainment. Despite bolstering their existing service offerings in other categories like audio and video, gaming has proven to be a harder nut to crack. Google’s push into cloud gaming with the ill-fated Stadia service showcased a shallow commitment to gaming from large tech firms that overpromised and underdelivered. However, as the industry is awaiting an ecosystem-wide reset with the coming of a new console generation, a narrow window of opportunity has opened.

For one, Maverick Studios is founded by the former creative director, Mike Brown, behind Forza Horizon, the most popular racing game in the category, and has a dedicated player base. Across PC and mobile, Forza reached over a million players in April and generated $6.5 million in revenues. My guess is that Amazon is banking on players switching over to the new title in a direct challenge to Microsoft’s incumbency in racing.

More generally, large game makers have been re-organizing themselves in response to a softening market and have become more risk-averse. The relentless layoffs over the past year indicate the industry’s shift from fast growth to profitability. In the wake of a series of acquisitions that began at the start of the pandemic, most major firms have shut down any studios or projects that failed to meet internal financial expectations.

While they circle the wagons, newcomers have started their engines. Vrooooooom.

PLAY/PASS

Play. Happy 15th birthday, Minecraft!

Play. The Washington Post’s Department of Data finds that we’ll all prefer music from our late teens forever.

NEXT UP

Since it finally released a new title for the first in five years, next week I’ll be taking a closer look at Finnish mobile game maker Supercell, how it’s going, and what it says about mobile gaming more generally. Your homework, should you choose to accept it, is to play its new title Squad Busters.

P.S. I’ll be in Los Angeles for a few days. No, I’m not attending any of the major news events in person, but if you’re around, hit me up.

🌟

Narrative open world racing game… That sounds interesting, but probably not very easy to pull off