Layoffs for what

Letting go of talent to improve share price performance works, most of the time

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Raising kids is a lot like managing intellectual property.

At a base level, you’re constantly cultivating the successful appreciation of this living thing. Protecting it is key. As is deploying it in different places in the hopes of finding a strong connection with a (market) environment hoping it will thrive.

As such, we decided to return to the Dominican Republic this summer.

By now we have accepted the absence of economies of scale that comes with having both a 10- and 2-year franchise. For any international rollout that means we bring a full array of underage accoutrements: collapsable stroller, baby monitor, toys, books, iPad, snacks, a week’s worth of diapers size 7, and ever so many wipes.

Watching them run and play and swim upon arrival instantly makes the effort worthwhile Providing a different environment (e.g., pool, beach) compared to what they’re used to at home (e.g., city, park), proved to be the right move. Raising offspring that can find a connection on foreign soil is, I think, an early indicator of future success in a global economy.

Especially our latest release seemed particularly excited to meet a new audience. Our family there, which rolls about twelve people deep, was happy to provide our budding startup project with endless attention. Every day a large crowd gathered to cook and eat and play. Seeing everyone congregate and engaging with her provided a deep sense of successful parental management.

Until she took a shit in the pool. That wasn’t like managing intellectual property at all.

On to this week’s update.

BIG READ: Layoffs for what

After a rally over the past few years, the games industry has been going through somewhat of a slowdown. That was to be expected, of course, but has also led to a string of layoff announcements. As it has become harder to show growth each quarter, publishers are forced to focus on profitability to retain market momentum.

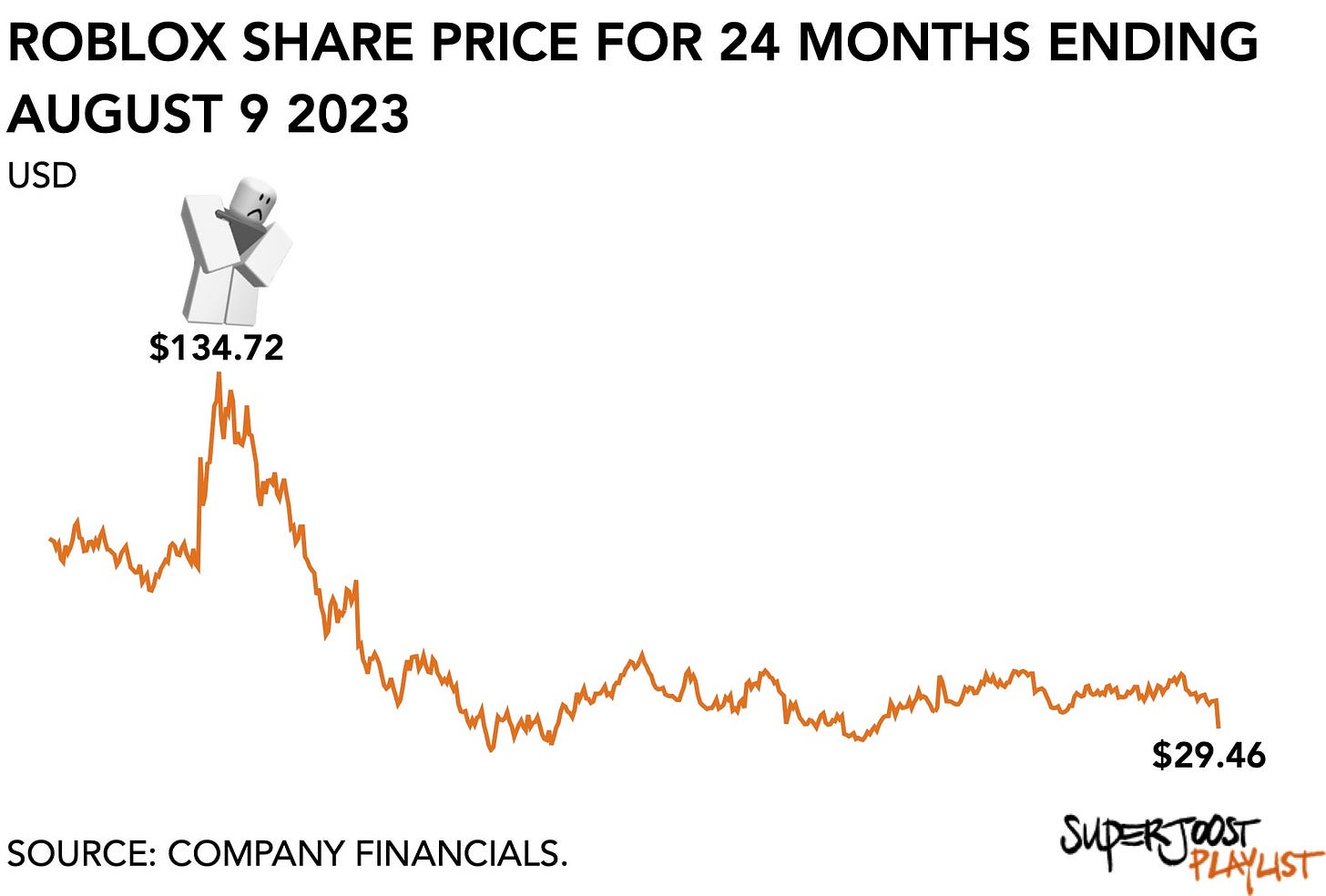

One current theory is that investors love efficiencies and cost reductions because they directly impact profitability. For instance, despite Roblox increasing revenue and engagement in its most recent earnings, its share price still dropped because it does not seem to be anywhere near profitability (more below).

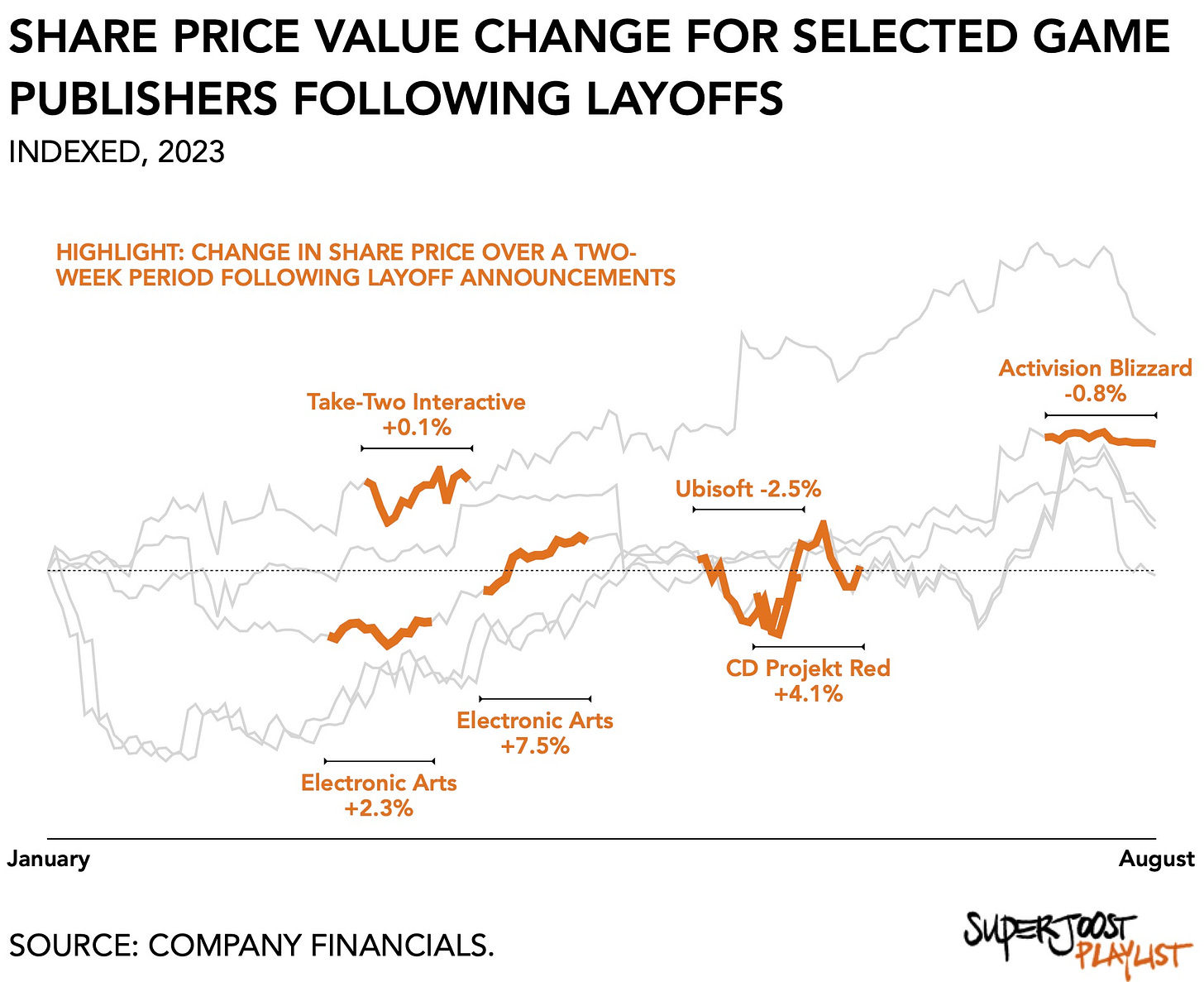

It leads me to the question whether a reduction in workforce corresponds with an increase in share price value.

In the two week period following the announcement that it was letting go of 200 people in February, EA’s share price went up +2.3 percent. After cutting another 780 jobs, or 6 percent of its workforce, one month later, it went up another +7.5 percent. Similarly, CD Projekt Red saw its share price go up +4.1 percent after letting go of 60 employees in May.

Of course, this is merely an exploration and insufficient to conclusively establish causality. There are lots of other reasons why, for instance, neither Take-Two Interactive nor Activision Blizzard experienced a similar impact. The former had just completed its acquisition of Zynga, which means that redundancies are to be expected and that the jury is still out as to whether the purchase is going to make a material impact on its finances (more below). The latter’s fate is entirely wrapped up in the legal onslaught around its acquisition by Microsoft. In both cases, external factors appear to drive share price more prominently than any internal pursuit of efficiency.

A final thought on this is the sheer lack of transparency we observe elsewhere. We know damn well that Embracer is in the process of letting people go. Its communication around this process, however, is shrouded in corporate speak. And it is only due to an observing eye that picked up a “personal update” from an executive producer at Campfire Cabal on LinkedIn that we can confirm, indeed, that the once-aspiring European conglomerate has started letting go of creative staff.

Compared to the start of the year, all of the firms shown have managed to grow their value to investors, or at the very least bring it back to where it was before. The implication is that despite an overall strong performance by publicly-traded video game companies, talent continues to hold the short end of the stick. Given how poorly that is working out in other creative industries where strikes are, rightfully, necessary to claim better treatment and compensation, perhaps interactive entertainment would be wise to update its game plan, too.

MONEY, MONEY, NUMBERS

Roblox gets clobbered despite $681 million (+15% y/y) earnings

The reason Wall Street dropped Roblox shares like a hot potato is a matter of financial opinion. On the one hand, the firm missed earnings (adjusted EBITDA), which came in at $38 million compared to a consensus estimate of $48 million. Bookings, however, were up +22 percent y/y at $781 million, compared to a consensus of $785 million. Analysts had expected Roblox to see more progress of its “expense control” to get its operation into the black. In its most recent quarter, the firm ran an operating loss -$314 million. Yes, its finances aren’t quite there yet. But on the other hand, the number of average daily active users was up +26 percent y/y at 65.5 million. Similarly the total number of average monthly unique payers reached 13.5 million, up +19 percent y/y. It has payer conversion that is consistently well over 20 percent of its entire audience base. And engagement was up +24 percent on an total hours basis. Seems to me that Roblox continues to build critical mass, while running at a loss for investors.

Depending on whether you focus on the short- or long-term, you’ll have a negative or positive opinion on the firm. Disregarding shareholders to ensure its financial future is a practice that has worked out well for others. Take-Two (see below) has absolutely no scruples when its comes to delaying new titles, especially around its popular Grand Theft Auto and Red Dead franchises, to make sure they pop. Roblox is clearly doing the same. And more so than delivering on investor expectations, which tend to be fickle and quarterly, catering instead to its audience and, especially, creative community by expanding the range of possible revenue models available to the Roblox economy sounds like a vastly more sustainable plan.

For now, however, investors scattered, causing the stock to drop -21 percent from $38.28 to 29.46 within the same day.

Take-Two quarterly earnings total $1.2 billion

Beating its own guidance of $1,150 - 1,200 million, but missing Wall Street’s consensus of $1,214 million, Take-Two Interactive reported a solid quarter. Take-Two’s digital net bookings reached $1.2 billion, slightly down from $1.3 billion in the last quarter but up +22 percent from last year. Digital distribution accounts for 97 percent of total. Approximately $1.0 billion of its digital earnings are what it calls “recurring digital” net bookings, or 87 percent of total digital revenue.

Its newly acquired mobile front, Zynga, performed well. Overall mobile bookings reached $680 million, which included $189 million in advertising revenue (a novel revenue stream that is rapidly becoming more relevant to gaming firms). Mobile in-app purchases were down -5 percent q/q and advertising revenues were up +5 percent q/q. The acquisition which closed on May 23 last year is proving its value as Zynga accounted for $600 million of Take-Two’s overall mobile revenue, leaving $80 million for the publisher’s mobile titles. The expectation is that a further integration and release of Star Wars Hunters will add another $100 million in revenue, bringing its closer to Zynga’s peak revenue from 2021 of $726 million.

Finally, team Zelnick repeated it was confident that 2025 would show a revenue bump, which pretty much everyone takes to mean Grand Theft Auto 6 is going to drop around that time. Personally, I’m a bit more skeptical since, historically, Take-Two’s Rockstar studio has repeatedly delayed blockbuster releases to ensure quality (which is good). Yes, I am all in on the anticipated size of Take-Two’s imminent prosperity bomb, but, no, I am unconvinced it will go off as scheduled.

Nintendo reports $3.2 billion in earnings record

The Japanese game maker’s strategy of launching its Tear of the Kingdom expansion to the Zelda franchise (as opposed to closer to the end-of-year holiday season) proved to be a winner. The game sold 10 million copies in its first three days, and a total of 18.5 million sold-in units by the end of the quarter, roughly six weeks after launch. Further adding to the momentum was The Super Mario Bros. Movie with an estimated 168 million viewers and generating $1.3 billion in box office revenues as of late-July. That makes it the highest ever for an original film based upon a video game and the second-highest ever for an animated film.

Analysts salivate over the added success of the The Super Mario Bros. Movie and expect the firm’s momentum to sustain throughout the year. In particular the category of “Mobile, IP related income” saw a notable increase of +190 percent y/y, from $77 million to $220 million for the quarter. Digital sales increased by +36 percent year-on-year to $840 million, and accounted for 47 percent of total software sales. Finally, a robust slate of upcoming releases later in the year—including Detective Pikachu Returns (October 6), Super Mario Bros. Wonder (October 20), and Super Mario RPG (November 17)—promises a strong finish, followed by a period of modest growth as Nintendo ramps up for the Switch’s successor.

Electronic Arts came in with mixed results

Despite a record quarter for FIFA, with daily active users for Ultimate Team up +15 percent y/y and FIFA Mobile adding a whopping 65 million new players, net bookings came in at $1.578 billion (+21% y/y) which was slightly below Wall Street’s consensus of $1.590 billion. Sigh. There’s no pleasing investors, I guess, which is why some publishers set a low bar for themselves so they can celebrate when they clear it.

An unwillingness to comment on sales performance for Star Wars Jedi: Survivor suggested the title had missed projections. Wall Street analysts estimated the most recent release sold around 5.5 million copies, compared to the 8 million for its predecessor in 20Q3, which had a two week shorter sales cycle and lower average selling price). EA’s mobile division was up +3 percent based on performance by FIFA Mobile, Star Wars: Galaxy of Heroes, and The Sims FreePlay. However, Apex Legends Mobile suffered a poorly performing Season 17, generating an estimated $140 million vs. $180 million expected, and disappointed EA’s internal forecasts.

PLAY/PASS

Play. Ralph Lauren is about to drop a real-life version of the digital boots it debuted in Fortnite. Are we in Web3 yet?

Pass. Being famous doesn’t mean you’re smart, so proved Twitch streamer Kai Cenat whose PlayStation 5 give-away led to a flash mob in New York’s Union Square that got completely out of hand, resulting in his arrest and that of 65 others.