The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

As per my last email, the FTC is losing its case against Microsoft.

The commission’s market definition fails to take the broader gaming landscape into consideration and ignores the different categories relevant to this case. Notably, during cross-examinations, the FTC’s legal team failed to recognize the relevance of, especially, Activision Blizzard’s mobile division, King Digital.

Its own expert economist, Robin Lee, seemingly forgot a key asset that would give Microsoft a prominent role in the duopoly that is mobile gaming. More generally, Professor Lee’s testimony did feel weaker and at times contradictory to the FTC’s position. He concluded that the Call of Duty franchise was, indeed, a critical asset and that any move by Xbox to make it exclusive would be detrimental to its rival, assuming we define the console market as only consisting of Microsoft and Sony. According to Dr. Lee, “The supply of new content is evidence that it’s scarce because AAA games don’t come out that frequently.”

Yes, Call of Duty is a massive franchise and immensely important to Sony. But today we also learned that both Valve’s Steam platform and the Nintendo Switch have managed just fine in its absence. In fact, Kotick testified that he didn’t see the point of providing a subscription service around his priced franchise. It suggests that post-acquisition Xbox’s move to offer it through its Game Pass offering would make the game available to more players than it has been thus far.

Said Microsoft’s CEO, Satya Nadella:

“If it was up to me I would love to get rid of the entire exclusives on consoles, but that's not for me to define especially as a low-share player in the console market. The dominant player there [Sony] has defined the market competition using exclusives, so that's the world we live in. I have no love for that world."

Microsoft’s experts, Daniel Carlton and Elizabeth Bailey, on the other hand, were more convincing. The former proved to have a better grasp of the subject matter and managed to pull much of Dr. Lee’s testimony into question. The latter seemed to be Microsoft’s most seasoned expert witness and did not give an inch by continuously returning the conversation to the data she analyzed. Among her more notable conclusions was the increase of Microsoft’s share of mobile gaming from 0.3 percent to 3.8 percent. Dr. Bailey argued that the FTC’s expert, Dr. Lee, relied on a market definition that is “too narrow” and does not conform with current market realities.

FWIW, while I disagree with the FTC’s allegations against Microsoft, I do support its overall agenda of a more aggressive approach to large-scale mergers. For some time now, the US has been stuck in a spiral toward ever-greater dominance by a dwindling number of Titanosaur-sized firms. Certainly, the $69 billion price tag and involvement of a big tech firm make this a textbook case that should not go unnoticed by any antitrust watchdog.

It has, however, been an absolute cringefest watching the generally authoritative news sources trying to wrap their heads around the mechanics of the video games industry. With a few exceptions, much of the mainstream coverage has been struggling to explain what’s going on and why it matters. A few hundred billion dollars later, most opinions on gaming are still only worth $0.25. The absence of a more mature understanding of how, exactly, the business of video games works is what has been most prominently on display throughout the case.

Some critics argue that the consolidation proposed by Microsoft will result in a similar crisis as currently exists in Hollywood. Matt Stoller, whose writing I wholeheartedly recommend, has a great perspective in favor of the FTC and against Microsoft. A key argument discusses how the abundance of emerging video streaming platforms and the wild growth of content in film and television production as a result of cheap capital silenced criticism just a few years ago. The possibility of rising consumer prices, dwindling options, and outright wage theft seemed unthinkable.

But that is now the state of Hollywood as incumbents and disruptors alike look for novel revenue models and ways to combat password sharing to keep their share price going up and to the right. One of the major reasons why the Writer’s Guild took to the streets is that its creatives don’t share equally in the plumb profits generated by new distribution models. The anxiety is that something similar will occur in gaming, post-acquisition.

However, interactive entertainment today does not revolve around the purchase of discrete content. The days of CD-ROMs and cartridges are well behind us. Most people today play online and in multiplayer settings. Unlike Netflix, which needs to sell as many logins as possible, a world in which free-to-play multiplayer games dominate (e.g., Fortnite, Roblox, PUBG, and League of Legends) is pushing the old model to its limits and, as a result, requires legacy firms to adopt. Some are. Some are not. The comparison with Hollywood breaks down because people may binge a show in a single weekend, but spend years in a game that connects them to a larger online world filled with continuous content updates and a rich social environment. Failing to understand such critical differences is precisely why some argue against the deal and in favor of the antitrust regulators.

Nevertheless, some cynicism is justified.

We learned, for instance, that Dr. Carlton has earned around $1.3 million in fees working for Microsoft, it becomes clear that wealthy trillion-dollar companies can retain the best and brightest, which makes regulation harder. In fact, Lina Kahn has repeatedly stated as much. Under her leadership, entire mergers have been abandoned before they even become public because of fear of antitrust intervention. And, in most cases, rightly so.

But I have to disagree with the FTC’s fundamental assumptions and narrow definitions of the video games industry.

On to this week’s update.

NEWS

Can’t find a job? Become an NPC!

I fully understand that in the absence of traditional alternatives, advertisers and their agencies are looking to colonize gaming with their messaging. In fact, I embrace it. Not everyone can afford to buy premium titles or spend limitlessly on microtransactions. It would be naive to expect video games to remain the only form of entertainment that does not take a check from sponsors and brands.

It is nevertheless wildly dystopian to encounter some of these tongue-in-cheek initiatives. This week saw the results of a Pringles campaign offering players to become a non-player character and restock vending machines in a train simulator. Wut.

According to WPP, the firm behind the effort, it was a cracking success:

“The campaign amassed 30.8m impressions and captivated Twitch users, who collectively dedicated 2.8m minutes to witnessing the transformation of the chosen individual into an NPC. Ultimately, the campaign drove Pringles' brand awareness by an impressive 38%.”

A skeptic would instead describe this as a textbook example of a large conglomerate advancing its corporate interests by dressing itself as a counter-cultural instigator to further normalize a low-nutrition, high-caloric lifestyle. Hasn’t this generation suffered enough?

Mythical Games raised another $37 million in funding

A consortium of investors has agreed to fund the Blankos Block Party maker, Mythical Games, with $37 million for its series C1.

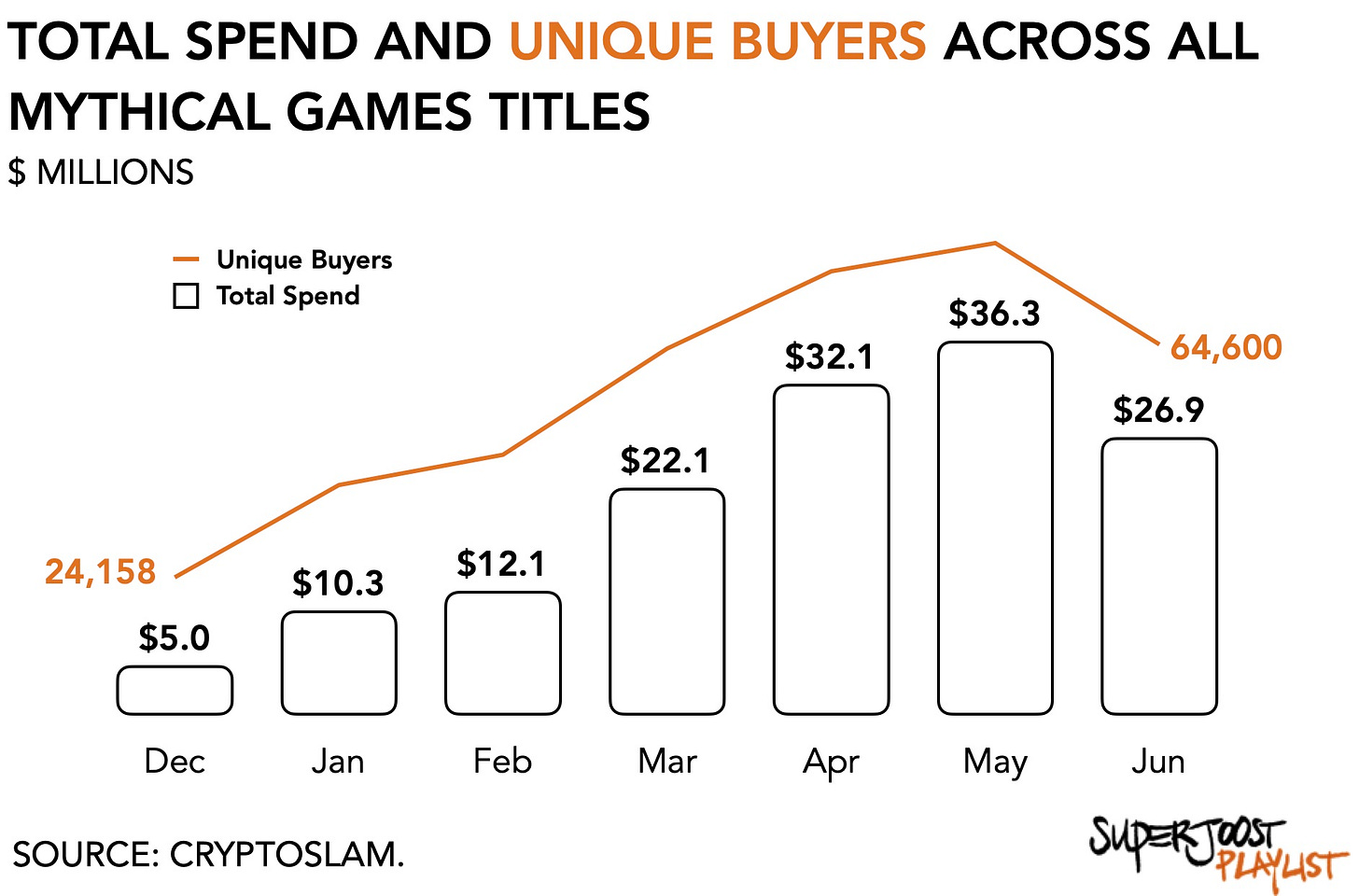

Across its entire portfolio, Mythical Games counts around 200,000 unique active wallets, according to CryptoSlam, an analytics firm. Over the past six months, cumulative spending has reached $145 million and the average sale value has increased from $13.29 to $16.94 today. During its previous funding round of $150 million led by a16z, investors valued the firm at $1.25 billion. Mythical Games expects an additional $20 to $30 million raise for its series C2 in the coming months.

As part of the announcement, the developer announced it is leaving Ethereum and migrating to Polkadot. High gas fees and network latency make Ethereum less suitable for the flurry of small micro-transactions typical in contemporary gaming. Switching to Polkadot will alleviate those shortcomings and facilitate easier cross-chain transactions. It is unclear to me whether consumer adoption of blockchain-based gameplay depends on faltering technology and high gas fees, or because most games of this ilk still suck.

Unity share price jumps on AI announcement

Following a fireside with CEO John Riccitielo at Gamesbeat a few weeks ago where we discussed AI’s impact on the games industry, Unity announced its AI marketplace this week. Seen as an accelerant for game development that is going to bring both efficiencies to the messy process of making games and elevate existing game mechanics, AI is widely expected to drive innovation in the games industry. I remain cautiously optimistic about all this potential, which will undoubtedly revolutionize everything but likely at an equal expense.

Unity shares traded at +15 percent following the announcement.

PLAY/PASS

Pass. Pickleball injuries are driving up insurance costs by $400 million annually. I told you it’s a scourge!

Play. Wizards announced a very rare card based on The Lord of the Rings franchise, “a traditional foil card printed in the Black Speech of Sauron using Tengwar letterforms.” It’s valued at $2 million already.

Holy moly your coverage of the FTC case is MILES above most everything I’ve read. What a breath of fresh air. Thank you Joost!

"Kotick testified that he didn’t see the point of providing a subscription service around his priced franchise."

I agree with this sentiment - putting COD on Gamepass would be to slaughter the golden goose. It makes little sense considering people are happy to pay to get the game. Why change that just to boost a lossmaker like Gamepass?