New Battlefields

Social anxieties manifest in dominant forms of play

The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author Joost van Dreunen.

Violence in the real world now reverberates instantly across gaming platforms.

Last week’s assassination of Charlie Kirk was a tragic event, and one whose shockwaves spilled into the industry. A senior character artist on Ghost of Yōtei lost her job over online comments. Epic Games CEO Tim Sweeney was pulled into a firestorm over free speech. And Roblox reported removing more than a hundred experiences tied to the incident, underscoring how quickly real-world turmoil propagates across digital play.

The ripple effects reached my classroom, too.

New York University, where I teach, was one of several campuses to receive a threat that included a manifesto targeting Black students with graphic promises of gun violence. Already under heightened security since pro-Palestinian protests last April, our campus saw some students stay home — a stark reminder that online extremism does not remain online for long.

These incidents feel overwhelming and immediate, and they’re part of a broader pattern that deserves closer scrutiny. Historically, social anxieties manifest in dominant forms of play. Today that means video games. To that end, parents and regulators have been increasingly vocal in expressing concern about gaming’s influence during people’s formative years, casting it as a halfway house between having a bad time and giving up. It raises the inevitable question: what is the role of online play and gamer culture in all this?

Academics and policymakers alike are starting to weigh in.

One area of investigation is the broader social isolation of mainly young men and how it has contributed to making some of them vulnerable to extremist ideas. To answer this, the US Department of Homeland Security has started funding research into the monitoring, detection, and prevention of extremist exploitation in gaming spaces. But, quite obviously, it is not the kind of attention an entertainment industry would want.

Elsewhere, another study adds an important nuance, concluding that “most radicalisation takes place not through playing video games themselves, but through gaming platform communication channels.” Here, extremists “establish connections with one another, and can leverage these connections for political recruitment.” It suggests that instead of pointing directly at games themselves, an interrogation of the broader social ecosystem will lead to better answers.

That is presumably why James Comer, chairman of the House Oversight Committee, has summoned Valve CEO Gabe Newell as part of a select ensemble of tech bosses to testify. His invitation notes that “Congress has a duty to oversee the online platforms that radicals have used to advance political violence.” The summons went to Discord, Steam, Twitch and Reddit.

Other research strikes a more hopeful note. A 2025 study by the University of Córdoba in Spain found that well-designed games can reduce support for extremist ideas, build empathy, and help players think more critically. That possibility—that play can inoculate as well as inflame—may prove the most important finding of all.

Online spaces, including gaming platforms, have always attracted bad actors seeking to amplify discord, recruit followers, take advantage of vulnerable others, or cause chaos. The existence of these threats is not new. But the speed with which they seem to metastasize and spread is overwhelming our ability to cope.

The gaming industry is grappling with this reality from a business perspective: employee conduct crises, platform moderation costs, advertiser concerns, and regulatory scrutiny. In an increasingly polarized world, a maturing medium like games has to weigh its broader social responsibilities against its profit motive. When online tensions spill into physical spaces, the operational challenges multiply rapidly.

But there’s also an opportunity here.

The Córdoba researchers hint at a way forward, stating that “educational video games can expose players to new experiences where they can interact with other contexts and social groups, which can promote tolerance and reduce prejudice.” Game makers that understand these dynamics and invest in positive applications will be better positioned as social tensions ebb and flow than those that react defensively.

The current problem set of how digital communities contribute to and cultivate extremism, how platforms manage content at scale, and how companies balance free expression with safety has evolved from an academic curiosity to a pertinent business necessity. For gaming companies, investors, and anyone building in digital spaces, recognizing these patterns is no longer optional.

Assassinations are immensely upsetting. Alleviating the sense of discomfort by quickly pointing to video games as a contributing factor is understandable. It is also our cue to take action.

As a $250+ billion industry, rather than being passive victims of extremist violence, we have the tools and moral obligation to actively counter these threats while building healthier, more resilient communities. Not for profit. For people.

On to this week’s update.

BIG READ: New Battlefields

Electronic Arts (EA) will release Battlefield 6 on October 10. For a franchise that has struggled to stay relevant, it represents an existential test. If successful, BF6 could restore Battlefield as a credible rival to Call of Duty. If it stumbles, the brand risks becoming irrelevant in a crowded shooter market that increasingly rewards only the very best performers.

The stakes are high because EA’s business remains unusually concentrated. Its annual sports franchises (FIFA/FC, Madden, NHL) continue to generate dependable revenue, but growth has flattened. Apex Legends, once EA’s breakout success in live-service gaming, is entering maturity: engagement has declined since its 2019 peak, and it lacks the cultural momentum of Fortnite or VALORANT.

EA needs another tentpole franchise. With development costs for AAA shooters often exceeding $500 million (Activision’s Black Ops 6 reportedly cost around $638 million), the economics of blockbuster game development are punishing. Publishers must place fewer, riskier bets. For EA, Battlefield 6 is one such bet.

The Battlefield franchise has a long pedigree, but its latest installment, Battlefield 2042, received a lukewarm reception. Critics and players criticized stripped-down features (including the absence of VOIP at launch), unbalanced gunplay, and technical instability. The result was a steep decline in active players within months, despite strong pre-launch marketing.

This failure illustrates the current state of competitive shooters: failing to deliver on fundamentals—tight gunplay, balance, and stable infrastructure—carries disproportionate penalties. Players are less forgiving than in other genres because switching costs are low: competitors like Call of Duty, Escape from Tarkov, or Fortnite are just a click away.

This dynamic is not unique to Battlefield. Ubisoft’s XDefiant and Sony’s Concord both demonstrate how poorly executed entries in the shooter category are quickly abandoned, regardless of budget or branding.

Battlefield faces an additional structural challenge because of its prominence: its business model is out of step with its biggest rival. Microsoft will release Call of Duty: Black Ops 7 directly on Xbox Game Pass, effectively lowering the cost of entry for millions of players. For Microsoft, the game’s purpose is not unit sales but subscriber growth and retention. EA, by contrast, still depends heavily on copies sold and digital extras. Without a subscription service of comparable reach, Battlefield 6 must justify its budget through strong upfront sales, which puts EA at a disadvantage.

The outcome of Battlefield 6’s release is significant to EA’s broader fortunes. The company still earns roughly 70 percent of earnings per share from its sports business—a mature segment with limited growth potential. Wall Street analysts argue that for the stock to break out of its seven-year trading range, EA must prove it can launch another mega-franchise capable of generating $1 billion in annual bookings consistently. Battlefield is the company’s best shot since Apex Legends in 2019.

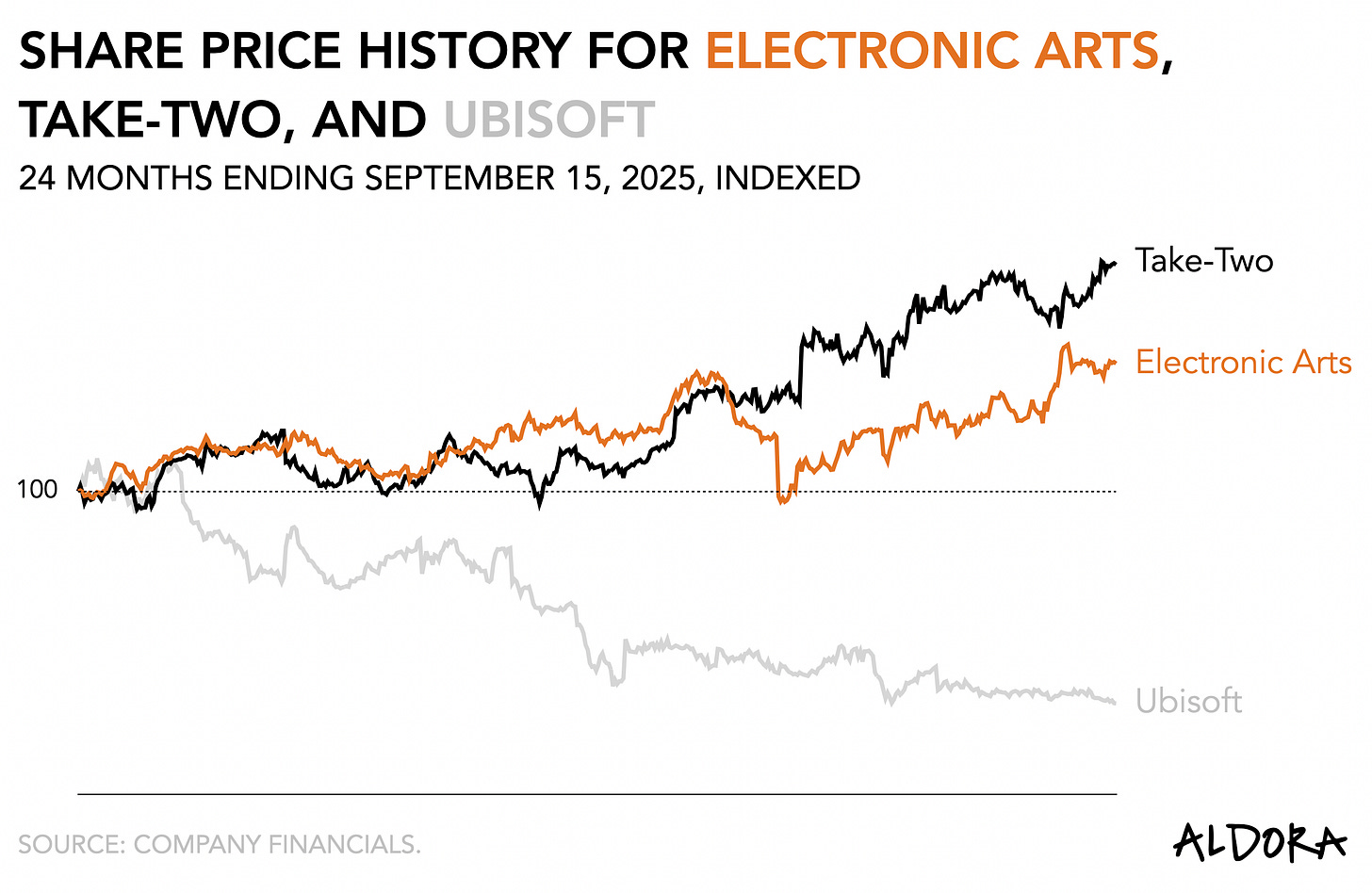

Investor expectations reflect this dependency. EA trades at a discount to Take-Two despite healthy fundamentals, and recent guidance assumes $7.8 billion in net bookings for FY26. It’s a financial goal that will be challenging to achieve without a strong Battlefield launch. A successful release could help lift both bookings and the multiple investors assigned to EA. However, failure risks reinforcing its reliance on sports and deepening its valuation gap with peers. Over the past two years, Take-Two’s share price rose by 75 percent, while Electronic Arts gained only about 20%, and Ubisoft fell by 70 percent. It underscores the market’s view that EA needs a breakout hit like Battlefield 6 to close the gap.

EA, the largest US-based games publisher, faces a critical moment. If BF6 nails execution and sustains a long-term player base, it could evolve into the second mega-franchise EA urgently needs. If not, EA will remain tethered to a single revenue pillar while rivals expand their portfolios and business models.

NEWS

Xbox hits the road

When Phil Spencer and Sarah Bond declared that everything’s an Xbox now, they apparently also meant cars.

Through a new partnership with LG Electronics, Microsoft is bringing Xbox Cloud Gaming into cars with LG’s webOS Automotive Content Platform. Passengers will be able to stream titles from Game Pass Ultimate, including Forza Horizon 5, Gears of War: Reloaded, and upcoming releases like The Outer Worlds 2, directly through the in-car infotainment system, provided the vehicle has an internet connection and data plan.

The move builds on Microsoft’s strategy of distributing Xbox beyond consoles and PCs, with cloud gaming already available on smartphones, tablets, and smart TVs. By embedding the service in cars, Xbox positions itself as an all-purpose entertainment platform—targeting downtime at charging stations or long trips as new gaming occasions.

If we’re already doing this with cars now, I expect to see in-flight Xbox integrations with Delta Airlines and United next year.

Sea shows the way

Talk about a flywheel.

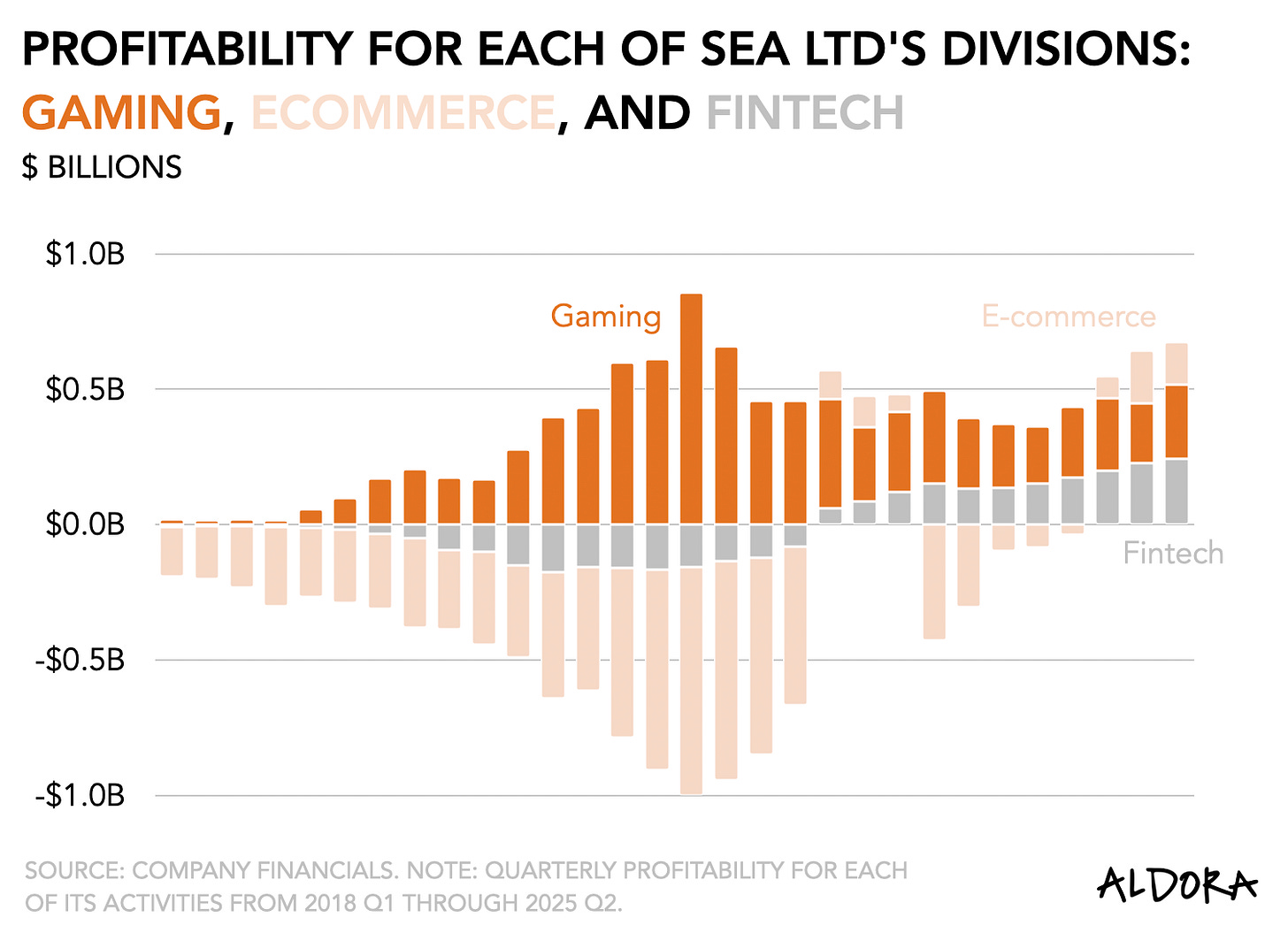

Sea Ltd is a Southeast Asian digital conglomerate that operates three different business components: (1) gaming, via its publishing wing Garena, serves as the profit engine to fund and scale its broader (2) e-commerce (Shopee) and (3) fintech (SeaMoney) ecosystem.

In its most recent earnings, Sea shows a 23 percent increase in second-quarter bookings for digital entertainment. Its most popular title, Free Fire, maintains a daily active user base of over 100 million. (Roblox has 118 million.) On a quarterly basis, it manages to convert 9.3 percent of players to spending an average of $10.70. Sea also distributes EA Sports FC Online and Call of Duty: Mobile.

Even as Shopee and SeaMoney move toward profitability, Garena remains the single most significant profit contributor—roughly double the annual operating income of SeaMoney and the only unit consistently generating billion-dollar surpluses. It means that gaming serves as the financial engine that funds Sea’s e-commerce and fintech expansion.

Main takeaways from 2025 Roblox dev conference

At this year’s Roblox Developer Conference (RDC), the company laid out the tools it believes will help it capture 10 percent of the global games market. The most important shift is the rollout of server authority, which moves multiplayer logic from individual players’ devices to Roblox’s central servers. It is expected to reduce cheating and create the technical foundation for competitive genres like shooters and sports games, where Roblox has historically been weak. In effect, the platform is positioning itself not just as a casual sandbox but as a serious competitor to Fortnite and Call of Duty.

Roblox also doubled down on generative AI, with new tools for creators and players to generate interactive 3D assets, and a roadmap toward “functional 4D asset generation” by year-end. The firm is building translation and safety features into this toolset, including AI-driven facial verification, open-source moderation software, and preparations for stricter COPPA compliance. Together with “Roblox Moments,” a short-form video capture tool to compete with TikTok and YouTube, these initiatives aim to expand Roblox’s cultural footprint while keeping user activity inside its ecosystem.

Finally, on the commercial side, Roblox raised developer payouts to 23.4% of bookings, absorbing an estimated $16 million annual cost. New licensing partnerships with Kodansha, Mattel, and Lionsgate extend the reach of its IP marketplace, while modest improvements to monetization and advertising expand the revenue mix. Analysts read the higher payout rate as a sign of maturity rather than weakness, since it was already factored into Roblox’s Q4 profit outlook. To Wall Street, the bigger story is that of Roblox becoming a more credible, multi-genre platform that could one day rival Xbox and PlayStation in market relevance.

Since the firm’s announcement on September 5th, Roblox’s share price has increased from $127.69 to $135.84, up 6 percent.

PLAY/PASS

Play. In honor of Mario’s 40th birthday, the BBC dug up some old footage of Nintendo, giving a rare glimpse into how its developers worked. Star of the segment is Shigeru Miyamoto, of course, donned in a company uniform, covering a suit and tie.

Pass. Somber tones on the Dutch games industry in this (Dutch) write-up. Already struggling due to a lack of government support, the Netherlands risks falling behind its European peers.

NEXT UP

This week, we’re launching the new game rankings for top anime and comic book franchises, and Laine and I discuss Nintendo’s success, Roblox’s challenges, and a preview of our Big Student Gaming Survey.

> It is also our cue to take action.

It absolutely is not. It's our cue to wade through razor-thin evidence yet again and reject poor arguments.

Great, as always. I appreciated the comments on Charlie Kirk and the industry. Outside of the heinous murder itself, I thought about what will be the reaction to the games industry from a governmental perspective. I imagine there will be one and, as you say, it’s better to make changes than have changes made for you