Quibi's collapse: an exercise in humility

Even the most famous and best-funded will fail. Can you?

Enough already.

I suppose the inevitable death of an obviously arrogant effort to dominate the streaming video category by spending a whopping $1.8bn is now a great source of schadenfreude for many. The announcement that Quibi is shutting down has galvanized a whole host of wannabe industry observers under a single mantra:

“Told you so.”

Get over yourself. It is easy enough to predict the failure of a startup. Most of them don’t make it. Especially the big bets that result in spectacular failure are easy to predict (WeWork anyone?).

More damning than the death of a company is the lack of carry-over of lessons learned. The noise distracts from establishing a better understanding of the way society interacts with media technology.

Always bet on black

Yes, formulating the development and launch of a streaming app at such high cost without applying common practices is naive. Every successful application or device has gone through a series of different iterations to establish ‘product market fit’ and best serve customers.

Sure enough, Steve Jobs would come down from the mountain to bestow on us his latest designs. But today his firm continues to struggle with the ways in which users and third-party content providers want to use it. For the sake of consumer protection Apple users live in a walled garden that prevents them from straying too far. And despite the pushbacks on both the Epic/Apple lawsuit and the changes to the IDFA to next year, it is clear that Apple wants to retain control over its technological ecosystem to maximize return. Similarly, in Henry Ford’s automative universe you could have any color car you wanted as long as it was black.

Technology, in this context, is a highly political method to encourage certain types of activity and discourage others. It develops outside of purview and, once perfected, is presented to us via a flawless press event that instructs us when it’s available, where to get it, and how much it costs.

That’s a terrible idea of technology. And we see it all the time.

The insurmountable problem with media technology is that most of its perceived value and disruption lives in the future. We constantly look for clues in the present to determine what new emergent form of dissemination or creation will be the next big thing.

In a world that is now largely mediated by video conferences and social media, the emphasis goes towards creating meaningful human exchange. Having some powerful multinational release a new device, app, or service purely on the basis of increasing its stock price or to discourage competition will result in a discouraged consumer market.

Consider virtual reality

Zuckerberg acquired Oculus for $2bn as part of Facebook’s broader effort to colonize even the most intimate spaces of social life. We were promised tailored ads in virtual reality as we watched movies together with friends. Exciting stuff because we were never able to do that before smh.

Nevertheless, VR has come a long way. Its price point has come down and the recently released Quest 2 is untethered and ready to mingle. Industry observers are asking whether its current configuration could be its “iPhone moment.”

Well, why would it need one? Is that the only acceptable metric of success? Do we now and forever express the level of disruption effected by a novel technology on a zero-to-iPhone scale?

Virtual reality has been in development for decades. If Quibi was so certain to fail, then who invested $3.5bn in Magic Leap only to watch that come undone? Perhaps its greatest contribution to the mythology surrounding technology is that VR forever lives in the future. As a perpetually nascent technology that will likely never have to hold up an entire firm financially, it is perfect.

But what I think these technologists are trying to say is that they’re hoping to create meaningful experiences. I get the novelty of VR and the persuasion of its immersion. However, it’s really just me surrounded by graphics from a decade ago trying to more-or-less interact with algorithmically-steered, synthetic antagonists.

Among y’all

Meanwhile, the sheer rush of watching an imposter outmaneuver an entire crew of clumsy space travelers in Among Us is infinitely more satisfying. No one believed Nintendo’s tech downgrade to the Wii compared to its space age rivals would amount to anything, only to have the device become its biggest success. And we all got something out of that TikTok video showing a grown man riding his skateboard, drinking juice and mouthing the words to Fleetwood Mac’s Dreams because, as Matt Ball points out, it hit the Billboard charts for the first time since 1977. But even he is mistaken when he points to technology as the singular cause of novel applications in how people consume media.

It is the unintended, clever ways in which humans use technology that gives it life. What we need then is not necessarily better or more expensive technology developed behind closed doors by big time execs and IP holders, but access for everyone.

Watching an effort like Quibi’s collapse is an exercise in humility, yes, but more importantly, it is a testament that even the most famous and best-funded will fail if they try to impose their interests onto everyone else. Building something meaningful requires embracing the cuts and bruises.

Where are yours?

On to this week’s update.

NEWS

Quick Maths: Microsoft saves GameStop? Naw.

Back in May I wrote about how entertainment retail is up for grabs and that one of the major platforms would find a way to build an analogue moat by buying (a piece of) GameStop. It seems that now has happened as Microsoft announced its arrangement with the specialty retailer which includes (1) GameStop committing to using Microsoft products and services in its stores and back office, and (2) receiving a rev share for new Xbox customers brought into the Xbox ecosystem.

It is unclear to me, however, whether this is a great idea in the long run.

Let’s say GameStop captures about the same share (35%) of total Xbox units sold as the current hardware generation (an estimated 30MM in the US) over its lifetime. Let’s call it 10MM units. Even if 20% of consumers convert to subscribers in GameStop, we’re talking about 2MM subscribers over the next 5-7 years. At an estimated 5% kickback, GameStop would generate (1) $21MM from convincing 500,000 of them to sign up for $35/month Xbox All Access (24 months), and (2) $54MM from the remaining 1.5MM for the $15/month Xbox Game Pass Ultimate (assuming a 4-year life cycle).

Next, that $75MM has to offset the expense of buying Microsoft gear and software for its operation (although likely at a discount). And, most importantly, it would be actively pushing people to digital subscriptions which will slow foot traffic at its stores everywhere.

Other than providing some cash upfront and lift in its share price (which hit a low point in March at $2.80 and is currently trading just under $14), none of this seems like a good deal for GameStop. It is, however, an excellent way for Microsoft to gain more leverage over what is still the most important games retailer with a new hardware cycle starting next month. We’ve certainly come a long way from GameStop trying to discourage console manufacturers from “pursuing a digital agenda.” Link

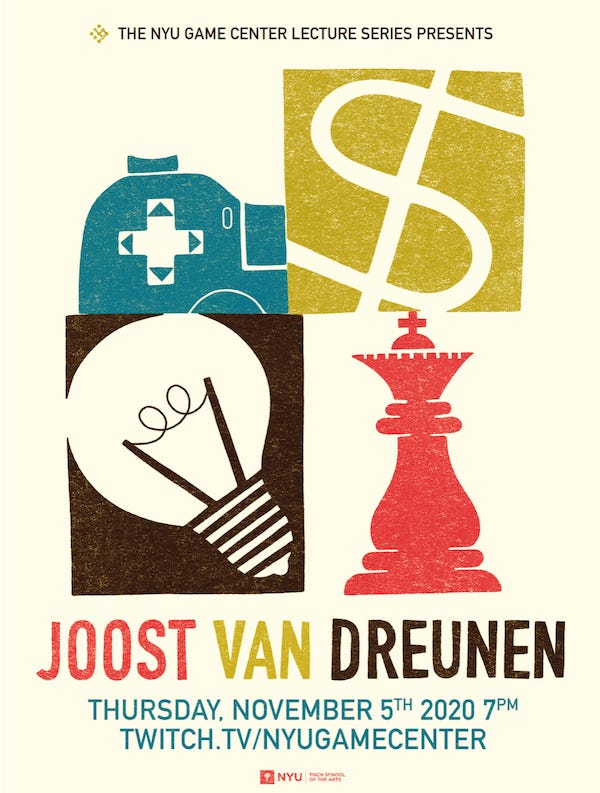

Promo: NYU Game Center Lecture Series

I’m doing a string of talks to help promote the book (of course). Here’s the link. Please come check it out.

VENN raises $26MM series A

Led by BITKRAFT Ventures, the former Riot/Blizzard exec team at VENN is hitting a stride. Its mission to become the Mtv of live streaming is further fortified by hiring, you guessed it, a former TV exec. Total funding is now at $43MM. Undoubtedly the pandemic played a role, too. But even without it, the category is quickly becoming a focal point among incumbent game publishers, esports teams, conventional media, and large tech firms. As the teeming community of content creators starts to gradually professionalize and find representation like CAA, predictable, programmatic content will become increasingly important to sway advertiser dollars. Link

Huya and DouYu merger is good for Tencent

The live streaming market is consolidating. In North America we recently saw the shutdown of Mixer by Microsoft and the passoff to Facebook, followed by an unsurprising return to Twitch for some of the top-tiered talent. Over in Asia, and especially China, Tencent has successfully merged two of the biggest live streaming platforms, Huya and DouYu.

Pre-merger, Tencent held a 36.8% stake with 50.9% of voting rights in Huya, and 38% of DouYu. Now with a combined 334MM monthly actives (mostly in China), Tencent will also integrate its Penguin esports brands, and have dominance over the category with a 67.5% voting share. Its two top-streamed titles, Honor of Kings and League of Legends, distribute (based on streaming hours) roughly as follows across platforms: 47% on DouYu, 41% on Huya, and 12% on Bilibili. It sets the stage for Tencent to now also control the marketing of content in the region.

Conference tip: History of Games

There’s an excellent conference happening this week with a focus on “Transnational Game Histories.” It’s very exciting to see a broader dialogue taking place around the way different politics, culture, and creative industries interacted. If everyone’s a gamer now and imminent technologies will provide access for all, demand heterogeneity will invariably increase. It’ll be a sweet release from the narrative clichés that characterize the cultural upbringing of many of us. Imagine using a novel form of expression to learn more about others. Register here, or watch here later if you miss it.

Gaming M&A

Here’s a worthwhile overview of all deals done in gaming for the first three quarters of 2020. It tracked no fewer than 437 deals, of which roughly half were content-related. But we already knew that content was in high demand, of course. Most interesting to me is slide 9, which shows the ranking of VC active in gaming by total deals lead. Big brand funds like Andreessen Horowitz are creeping up on category-specific funds like Makersfund, BITKRAFT, and London Venture Partners. They bring credibility to the space, of course, and higher valuations. In choosing your investment partners, however, you want to apply some scrutiny. As one fund manager likes to say:

“You can always take that Tencent money.”

The implication is that you’ll lose a lot more agency. Bigger doesn’t necessarily mean they’ll make a better strategic partner. Make sure to charge them for that.

PLAY/PASS

Doing a double-play, no pass this week because we all need a break. Yes, you too.

Play. Genshin Impact making $100MM in its first two weeks. I’ll have to agree with team DoF that we’re witnessing “The Birth of Chinese AAA.”

Play. Hades is the best thing that happened to me on the Switch since, well, the Switch. (Disclaimer: I worked with Supergiant’s studio lead Amir Rao on a project years ago. I am unapologetically biased.) After Bastion, Hades really knocked it out of the park for me. Praise Zeus. Link