Quick question re: Keanu

Have I got a pill for you.

For the second week in a row, Keanu made it onto my screen.

This time it was his cackle in response to a question from The Verge about NFTs. Succinctly, Keanu is not a fan.

Having garnered the popular vote on both the supply and demand side, Mr. Reeves is an important tastemaker in the current games business. He’s breathtaking, in fact. And, yes, I’m excited to see his new film. But first I have to ask:

Who gives a fcuk what Keanu Reeves thinks about NFTs?

It’s becoming increasingly difficult to discuss anything blockchain-related. The topic has saturated the airwaves and we’re only allowed to be in favor of, or against it. You’re either a self-indulgent social media exhibitionist showboating your digital wealth or a ‘true creative’ who prioritizes art over ownership.

Even the reaction of otherwise balanced writers is less than subtle, considering the Covid death toll has crossed 800,000 in the US alone.

It’s not entirely surprising. The news that Melanie Trump is releasing an NFT featuring watercolor art that “embodies Mrs. Trump’s cobalt blue eyes, providing the collector with an amulet to inspire” instantly gives blockchain naysayers a Bond-level villain. You can’t make this stuff up. In this black-and-white NFT matrix, Mr. Reeves represents the white hat, obviously.

Nevertheless, the centralized power structure found across different entertainment categories disadvantages creatives and benefits corporations. The music industry, for example, operates largely as a work-for-hire business. That means a singer is but a small cog in the music industrial complex. Figuring out who gets what part of the royalty payments is immensely complex and cumbersome, even if labels and producers generally agree on more or less the same terms.

The games industry is slowly adopting revenue and distribution models from the music business. Last week a rumor emerged that Sony is planning to launch a competing subscription service to Game Pass in the next few months. Relatedly, the Japanese giant has also been acquiring assets in the form of key studios. Its most recent prize is Valkyrie Entertainment, which is the studio behind the God of War franchise, Twisted Metal and inFAMOUS.

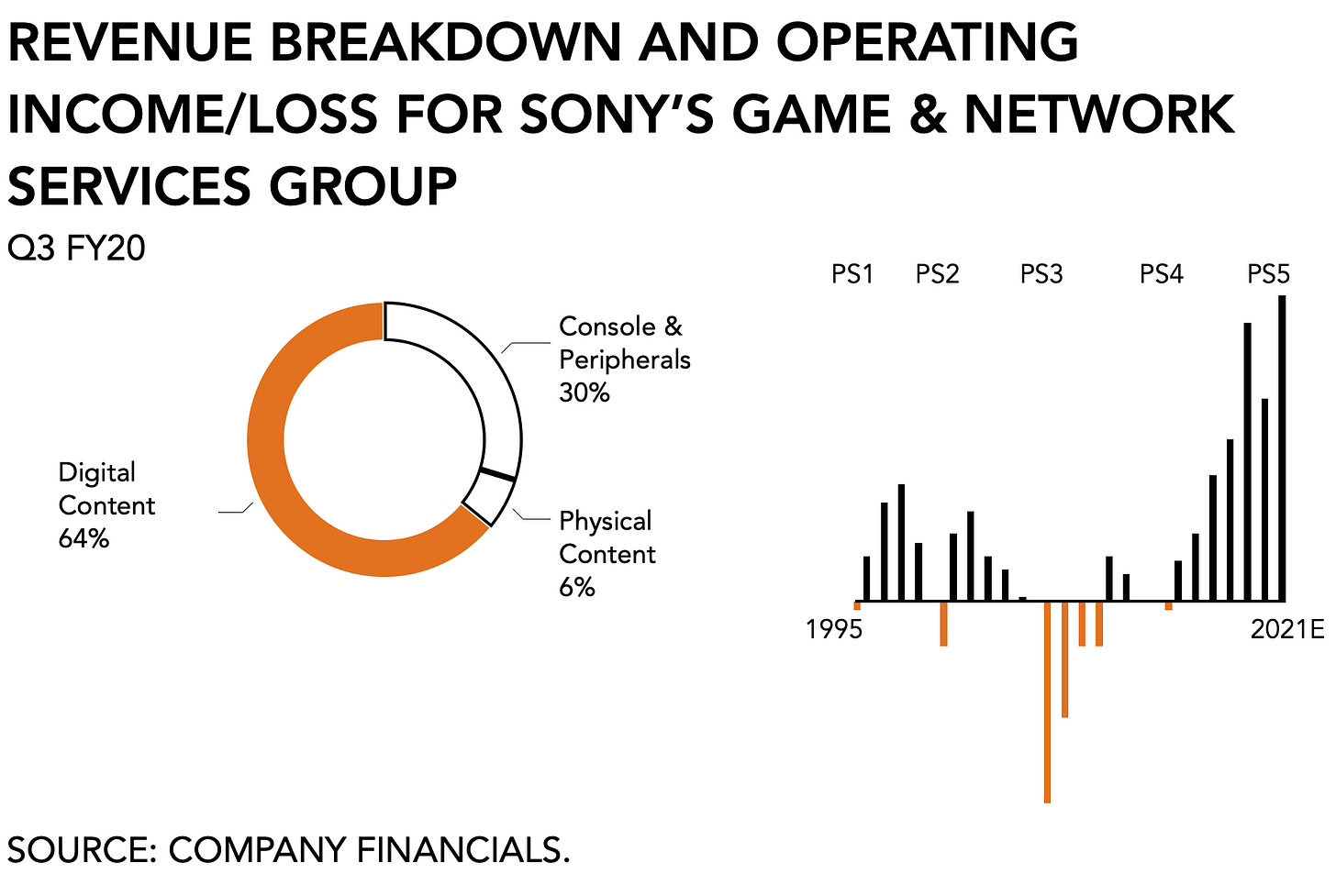

Given that the Japanese giant now generates two-thirds of quarterly revenue from digital content (e.g., full game downloads, micro-transactions, and services) it is incentivized to absorb some initial costs to lock in its users at the start of a new hardware cycle. More importantly, it’s proven to be the critical solution to breaking out of the cyclical curse of having to absorb losses at the start of a new hardware generation. For the first time in its history, Sony proved immediately profitable with the PlayStation 5. That has undoubtedly sent a strong signal to management.

It also mitigates the increasingly lackluster physical sales in key markets like North America. In November packaged good sales came in 12% below Wall Street estimates and were down -1% y/y.

The big players are acquiring content and investing in a service model that facilitates long-term lifecycles. But what options does this leave game makers? Are they expected to just sell their studio or IP and watch platform holders make all the money? Cost-plus pricing differs from value-based pricing in that it limits creatives and commoditizes their work.

Even Epic Games, which many think of as an industry maverick, is clearly looking to maximize return on the Epic Game Store it is building. Its focus is dead-center on expanding available IP, both by offering aggressive minimum guarantees and establishing the Epic Games Publishing group. Here’s Simon Carless’ excellent take on some recently unearthed documents. Sweeney spares little expense in pursuing a. “aggressive MG [minimum guarentee"] based strategy,” except, of course, when it comes to hiring. That’s where we learn that Epic plans to “keep staffing lean (hires MUST be multi-use).”

It seems therefore entirely too simplistic for the industry to remain on its current course toward optimizing value capture for large incumbents and aspiring platform holders without the natural emergence of a counterbalance. Developing revenue models lower on the totem pole would go a long way in an industry where platforms dominate and publishers don’t.

To that end, exactly a year ago, Microsoft expanded its “blockchain platform for royalties payments” in an effort to simplify existing complexity around compensating creatives. It certainly is one of the less-sexy aspects of blockchain. But getting everyone paid appropriately and on time is a growing issue if you’re dealing with an ever-expanding set of third-party content creators and transaction fees. Presumably, game designers and other creatives have to pay rent on time just like the rest of us.

With its latest lead in a $27 million investment of a crypto startup, Microsoft is going further down the rabbit hole by helping artists establish marketplaces around digital assets. It’s insufficient evidence to claim that the $2.5 trillion tech giant is going whole-hog on blockchain. But considering the involvement of Joseph Lubin, one of the co-founders of Ethereum, there may be more than meets the eye.

Lastly, free-to-play brought a lot of new players into the fold, especially the ones that couldn’t afford or didn’t want to spend $60 on a single game. The ever-increasing cost of games stifled innovation and ensured everyone catered to the same narrow demographic. That wheel keeps turning. Just this month Square Enix decided that $70 is the new normal with the release of the latest Final Fantasy. So basically, unless I’ve been a fan of the franchise from before, I’m now even less likely to jump in because there are ample and better-priced substitutes.

Add to this that contemporary titles are desperately dependent on multiplayer components and will therefore do anything to cultivate a thriving community. Giving players a bigger stake, a few unique items, or some type of recognition that they matter would go a long way.

If only there was a way to keep a digital ownership ledger!

Anyway, before we take Keanu’s business advice, at least he could actually play some of the games that featured him.

On to this week’s update.

NEWS

Embracer buys board game maker Asmodee in $3B deal

The more the world becomes digital, the more we will look for non-digital expressions and experiences. That’s my guardrail thesis for the future. Humans are, after all, sensory beings. Watch your opponent in Magic: the Gathering subconsciously flick their cards tells you what’s on their mind. See their eyes flit about in poker to know when to bluff or fold. Feel the weight of those little silver Monopoly pieces in your hand before you negotiate with your opponent. It’s all part of the game, and Asmodee is a powerhouse among board game makers.

For Embracer the acquisition of Asmodee is another channel that will facilitate a broader expansion of the growing IP portfolio. Its appetite has proven insatiable and exacerbated by low-interest rates. More so, Asmodee is also the owner of several successful board games including Ticket to Ride and Pandemic. Overall, tabletop gaming has been growing. Firms like Hasbro and Games Workshop have been reporting stellar figures all year and continue to expand their presence. This may prove to be Embracer’s most important purchase yet.

According to the announcement, €350 million would be paid to Asmodee's shareholders and about €2.4 billion is earmarked to be used for cash and debt refinancing.

Roblox reported November figures

Seems like the 3-day outage in October didn’t cause any real damage. Granted, November bookings came in a little lighter between $184 - 187 million for the month, up +84% - 87% y/y. Analysts had expected this to be around $220 million.

DAUs were up +35% y/y at 49.4 million and the estimated average bookings per daily active user were between $4.21 and $4.27, down -9% y/y. Its stock price dropped below $100 a share on the news, but Wall Street expects December to make up the difference. The last month of the year represents nearly 50% of the quarterly total.

Metaverse marriages aren’t as novel as you think

In a NY Times article, we were able to share the joy and love of a newly-wed couple that broadcast its vows in what we already have adopted as the metaverse. It’s cute, of course, and makes you feel warm and fuzzy. It’s also horribly researched. Getting hitched online has been around for years.

PLAY/PASS

Play. We finally have the first certified video game studio union in North America. It’s a baby step, considering the firm consists of only 13 people who all work remotely. But, it’s a start.

Pass. Bungie’s head of HR is leaving after 14 years. It is disappointing that it came to this only after a report on the firm’s toxic work culture, and not before and not years sooner.

Not meant to diminish your overall point, but two small notes: (1) PS already has a GP competitor; what the leak described was a bundle of their two existing services under a single name; and (2) they have been buying studios basically forever.