Gaming web 3

Following a third rail toward revolution

Watching goofy Keanu at the Game Awards last night reminded me how The Matrix was originally conceived as a video game. An entire worldview encapsulated in either a red or blue pill. In real life, we only ever get two options, too, it seems.

On the one hand, there’s the juvenile exuberance of a teeth-whitening, jet-setting crowd that travels from one crypto-conference to the next to appear on panels and take selfies at restaurants and clubs. It is this century’s roaring twenties, I get it. I’m also intimately familiar with the perpetual threat of new variants and associated vaccinations, which foregrounds one’s need to seize the day.

But the post-college crowd that is currently roaming the planet to spread their enthusiasm for a newborn technology like blockchain isn’t evangelizing much else beyond blatant self-indulgence. No amount of warm-colored Instagram filters can hide how politically cold their messaging is. We’re up against a generation of incumbent male decision-makers who so far prefer to talk about the metaverse instead of decentralization. We have to get a bit more serious.

On the other hand, the outright rejection of a novel technology is just as vapid. After several investments in blockchain game companies in recent years, French publisher Ubisoft has finally announced the integration in one of its major franchises. Starting with Tom Clancy’s Ghost Recon Breakpoint, the publisher hopes to add more depth to gameplay by allowing players to own and sell in-game items.

But it angered so many that Ubisoft had to delist its announcement video. Accusing the firm of being shallow and grabby, skeptics overlook a few things. For one, although Ubisoft is among the first legacy publishers to roll out an initiative around NFTs, it has also been experimenting the longest. During the before-times, Ubisoft launched Hashcraft in 2018 to explore the possibility “for the player to create their own Island and to share it with the community without any centralized servers.” Dismissing Ubisoft now shows a lack of historical context.

More so, the French publisher put a strong emphasis on the environmentally-friendly Tezos as its preferred blockchain protocol compared to the widely popular Ethereum. In recent weeks skeptics have pointed to the energy waste associated with maintaining decentralized ledgers and the outright cost-prohibitive nature of such currencies for average users. It echoes a sentiment expressed by CCP Games, which recently issued NFT tokens during its Alliance Tournament XVII tournament.

I had no idea that the games industry was so environmentally aware. Because It never was. We’re treated to climatological virtue-signaling that loops back to the whole ‘money is evil’ thing. In the GDC’s 2021 industry study, 35% of game devs fessed to their studio doing absolutely nothing at all about sustainability and according to another 26%, it was just ‘a little’, in response to the only question about the environment.

It leaves us with few options. The next generation in technological evolution and the way in which we communicate and transact with each other in a digital environment is beset by strong feelings. You’re either an airheaded enthusiast or a moronicly aggressive naysayer.

Neither narrative around web 3 is correct, of course. That’s because there are only two camps. Hyped by popular opinion and polarizing narratives, you can only be a maximalist or minimalist, depending on where you sit. There is no middle ground.

Purple pill

Historically, carefully studying a novel phenomenon is what has allowed us to better understand it and put it to good use. And, fortunately, some of the research is catching up to the hype.

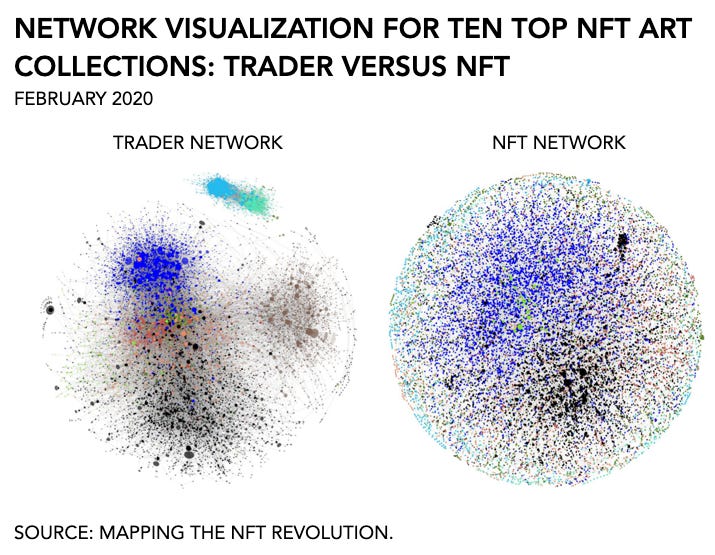

One example is the recent publication of “Mapping the NFT revolution: market trends, trade networks and visual features.” It lays out an accessible network analysis of people that own and trade NFTs. You should really read it for yourself but the summary goes as follows.

In response to the knowledge gap in the NFT market, researchers analyzed data concerning 6.1 million trades of 4.7 million NFTs between June 23, 2017, and April 27, 2021, on Ethereum and WAX. Among its findings:

the average sale price of NFTs is lower than 15 dollars for 75% of the assets, and larger than 1,594 dollars, for 1% of the assets;

NFTs categorized as Art, Metaverse, and Utility reached higher prices compared to other categories, with the top 1% of assets having average sale price higher than $6,290, $9,485, and $12,756 dollars respectively;

All assets considered in the study had a primary sale, but only ∼ 20% of them had a secondary sale;

We find that ∼ 75% of collections comprise less than 37 unique assets, and ∼ 1% have more than 10,400 unique assets; and

the top 10% of traders alone perform 85% of all transactions and trade at least once 97% of all assets.

Oh, and the entire data set is available here.

The reason you may have missed any of this is that the same outlets, publications, search algorithms, and pundits that feed you information are also the ones most intimately entrenched in the existing way of doing things. In academic terms, it’s how a cultural hegemony persists and dictates that the perspective of the most powerful organizations is to be considered the worldview of society at large.

By creating a polarized narrative around a potentially revolutionary novelty, it diminishes its long-term potential. To realize the promise of web 3, blockchain, the metaverse, and individual agency in a technological layer that runs parallel to everyday life, we have our work cut out for us. Because right now we’re destined to end up with the blockchain equivalent of a Fyre Fest: ripped-off opportunists eating a cheese sandwich from a styrofoam box for dinner while a generation of have-nots gloats from afar.

Or maybe we can think of a third option this time.

On to this week’s update.

🎙 I’m doing a talk at SXSW 2022

Excuse the flex. But be honest, it’s kind of cool to be a featured speaker. There’ll also be Reggie Fils-Aimé, Sarah Bond, and Tyler “Ninja” Blevins. But enough about them. I will be talking about blockchain, the metaverse, and what gaming has to do with any of it.

Come check it out.

BIG READ: Sony takes on Game Pass

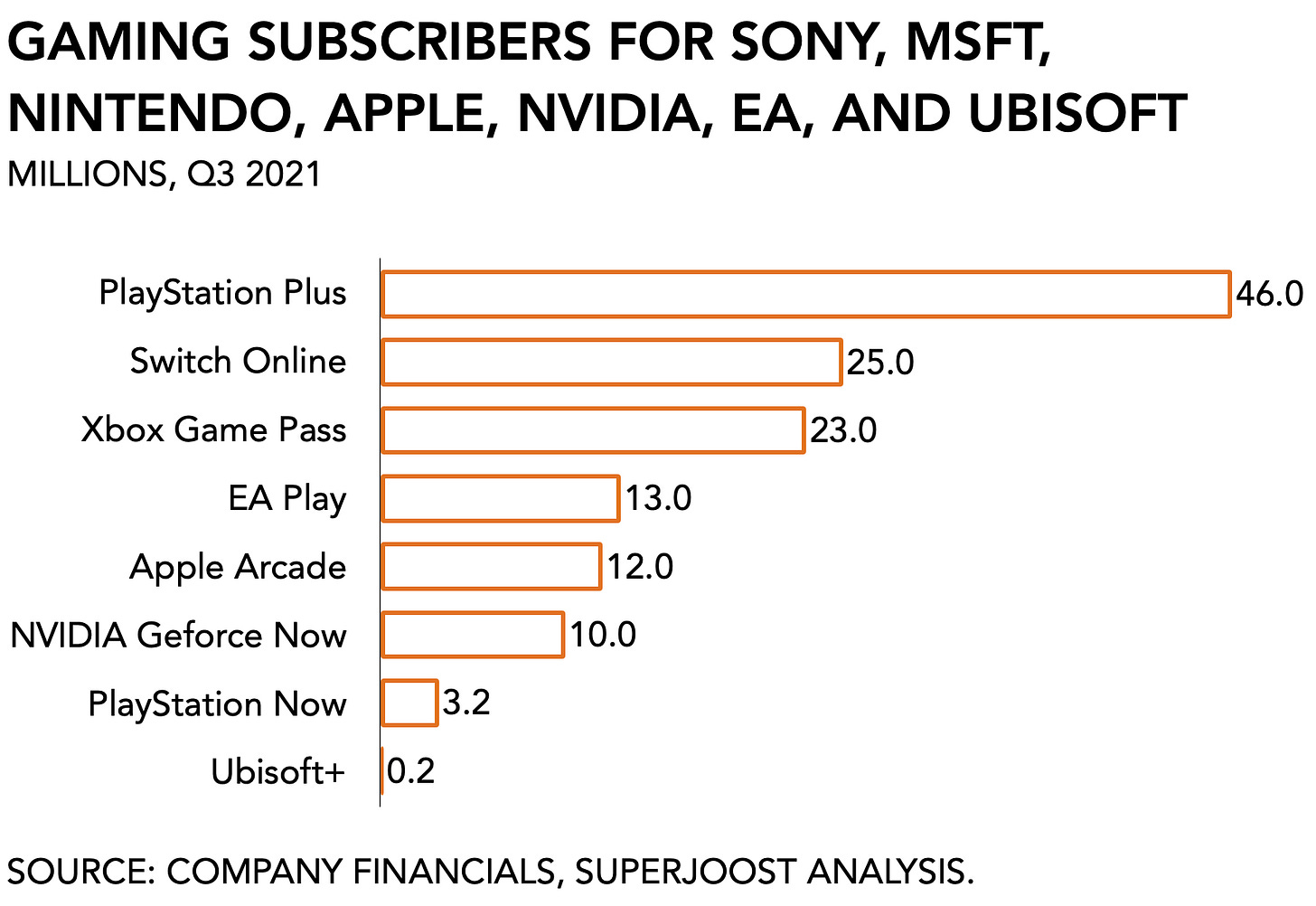

With a report by Bloomberg on Sony’s not-so-secret project Spartacus, a multi-tiered subscription service set to compete with Microsoft’s Game Pass, the subscription wars are in full swing. According to the article, Sony plans to merge its existing PlayStation Plus and PlayStation Now (which will be phased out) and is scheduled for launch in the spring.

It’s about time, of course. For one, the different content subscriptions offered by Sony are confusing. It echoes the same brand dilution we saw when HBO’s different internal divisions launched their own apps and services like HBO GO, HBO Max, and HBO Now.

Streamlining its offering will benefit Sony as it has come to rely on digital content for the bulk of its revenue. In its most recent earnings report, Sony PlayStation generated $2.8 billion in revenues from digital content, up +6% y/y, accounting for about half of the games division’s earnings and 13% of the Japanese giant’s total quarterly earnings.

The proposed subscription service is a turnaround from a year ago when CEO Jim Ryan stated that the firm would not "go down the road of putting new release titles into a subscription model. These games cost many millions of dollars, well over $100 million, to develop. We just don't see that as sustainable." After acquiring several of its first-party studios and bringing some of its marquee titles to PC (!), Sony has been expanding both its content portfolio and distribution channels.

The broader conversation around subscriptions is that they have become a critically important metric. Rather than measuring the monthly income that is more or less predictable, subscriptions are a proxy for loyalty. Certainly, there is a lock-in mechanism that discourages people from unsubscribing for fear of losing access to their library and achievements.

Meanwhile, Microsoft has been crushing it. It reported 18 million subscribers for its Game Pass service in January. But it hasn’t disclosed any updates since, except for realizing +37% growth in subscriber numbers (see: page 50), which puts the number for mid-2021 at around 20.6 million, based on the 15 million subscribers it reported in September 2020. My guess is that team Xbox has been waiting to report on the impact of its belated release of Halo Infinite on subscribers numbers to give us an update.

Not everyone has performed quite as well this year. The competitive services from big tech firms remain in their infancy. Amazon Luna has been largely invisible since its initial launch. The wild swings in failure and success for Amazon’s gaming division have likely claimed most of its attention internally, which is forgivable and boring. And Stadia started to gradually scale back all aspects of its service. After the departures of its two figureheads, Phil Harrison and Jade Raymond, came the announcement that it was moving to a less frequent marketing schedule and its list of new content additions has slowed to a trickle.

A few publishers have been trying to integrate vertically, as one would expect. Ubisoft’s ubiquity did not pay off. It courted Alphabet, Amazon, Microsoft, and your mother to host its content but current estimates from two different industry sources put the number of subscribers to the Ubisoft Plus service at around 200,000. EA Play fares much better here, with around 13 million subscribers. Its integration with Game Pass gives it broader exposure allowing it to monetize top titles using loot boxes.

Subscriptions are popular and present a timely option considering the broader set of trends in entertainment. The combination of a supply chain shortage, a chip crunch, and a growing list of delayed titles pushes consumers to services already in place and positions the industry for another couple of big fat quarters.

Assuming some overlap, the launch of Sony’s subscription would immediately put it in a leading position with an anticipated 50 million users compared to roughly half of that for Xbox. The question is, of course, whether Sony intends to make the same content acquisitions as Microsoft has with the $7.5 billion purchase of Zenimax Media. It’s unfathomable that it’ll make day-one release of its major franchises available via subscription. But perhaps Sony soon won’t have a choice.

NEWS

FaZe Clan jumps into the crypto maelstrom

And while Ubisoft is getting hammered, FaZe Clan, an esports and gaming lifestyle brand, announced its entry into crypto by launching Moonpay and its own NFTs. As part of its effort to go public via SPAC, it also listed the rather generic revenue category of “metaverse and NFTs,” which it believes will generate $92 million by 2025E. The vision is ”a physical manifestation of FaZe Clan’s forthcoming digital goods and NFT business titled “FaZe Forever.” In predictable fashion, the announcement came with an accouterment of posed photographs of mostly men in oversized clothing and meticulously groomed facial hair. For the fans.

The FTC blocks the proposed acquisition of Arm by Nvidia

Against a background of an already overwhelmed semiconductor landscape, the Federal Trade Commission has moved against the purchase of Arm by Nvidia. It argues that the proposed vertical deal would give the firm too much market power by effectively controlling the computing technology and the designs that competing firms rely on. Nvidia says it wouldn’t treat competitors unfairly but that also didn’t convince UK authorities.

Amazon outage derails precious game time

On Tuesday AWS let most of us on the east coast down. Among the biggest titles were League of Legends, League of Legends Wild Rift, PlayerUnknown's Battlegrounds, Valorant, Dead by Daylight, Clash of Clans, and Destiny 2. It raises more than a few questions around how reliable cloud gaming is going to be, even if we’ve seen similar outages on an application level with Gmail and Twitter in the past. According to PC Gamer, Amazon accounts for 32% of the $42 billion cloud computing market. Thoughts and prayers go out to Steve Peters in LA whose Roomba robot vacuum is now refusing service.

GameStop falls -5% after reporting wider losses

Supply chain issues were an obvious culprit to the specialty retailer’s disappointing figures. However, management pointed out it had started to improve logistics by shipping orders from Reno, Nevada, and increasing shipments from York, Pennsylvania, which translated in reduced shipping times and improve fulfillment. Total revenue came in at $1.297 billion, growing +29% y/y and slightly above a consensus of $1.189 billion. GameStop is exploring blockchain, non-fungible tokens, and Web 3.0 applications and started hiring specialists. Rumor has it that GameStop is offering very generous salaries to anyone actually willing to join the band on this Titanic, post-iceberg.

PLAY/PASS

Pass. This Senior VP at Sony Interactive, who is alleged of trying to meet up with a 15-year. Yuck.

Play. This prehistoric Fox News item on Second Life is rife with double entendres and virtual clichés. Can’t wait to see one of these on the metaverse ten years from now. (h/t @Sierra_OffLine)