As I slog through the last of this quarter’s earnings, I’m starting to think that legacy publishers are having somewhat of a midlife moment. Not a crisis, per sé, but a noticeable moment just the same. Specifically, after an intense 18-month long bull run during which valuations and balance sheets got fatter than ever before, a growing number of top brass game makers now find themselves unsure of what’s next.

Uh-oh.

One clear signal is the growing indecision across the industry. A contagious inability to press ‘send’ clearly haunts creatives in the wake of CD Projekt Red’s fumbled release of Cyberpunk 2077. So far no fewer than 52 titles have been delayed this year. Meanwhile, demand for interactive entertainment is at an all-time high. The $10.4 trillion in global stimulus spending has put consumer budgets for ‘things to do while stuck at home’ on steroids.

There is also the supply chain crunch that’s expected to slow shipment and distribution of physical goods (think: consoles, accessories) for the foreseeable quarters. It would certainly explain why Disney+ isn’t losing any subs despite having clearly taken a whole month off from releasing new content.

And working from home in a creative industry is perhaps not ideal. People generally rely on a personalized blend of being left the hell alone and interacting with peers to test their most intimate ideas and get inspiration. According to Albert Säfström, CEO at Coffee Stain which published the massively popular Viking Minecraft fantasy Valheim,

“The Pandemic has made it harder to make games, but easier to sell them.”

He should know. Valheim sold 6.8 million copies in its first few weeks following its launch. But now it’s raining delays all around with no end in sight. According to Nick Statt at Protocol Gaming, the year of the game delay won’t end with 2021.

Bummer.

Make hay while the sun shines

In an industry plagued by crunchtime and riddled by risk, it is understandable that the first thing creatives do when the getting is good is to catch their breath. But now is not the time to forego creative instinct. Abundance should oxygenate an industry, allow it to take risks, and fund innovative new projects. Taking some cream off the top is well-deserved, of course, but only if it is matched by an investment in R&D to secure the future.

Instead, game makers are riding the brake.

Rather than exploring novel technologies, many have jumped on the “just say no to crypto” bandwagon. It is far too early to take such a stance, but it’s worthwhile to observe how people are choosing to respond as the crypto-critical choir swells louder each day. Much of the naysaying stems from a sense of insecurity and a lack of historical context. I suppose it must be rather salty to watch a new generation of creatives fluent in blockchain hoist all that VC money into their coffers.

Granted, many of these new would-be gaming giants are more focused on finance than fun. From Amazon to Zed Run, a pervasive spreadsheet-based logic seems to dominate contemporary game design. Is that fun? Maybe. It probably is if you’re making bank. And, more broadly, what if this is what The People want?

The thing to remember about disruptive change is that, well, no one is going to ask you beforehand if you think it’s okay. It simply steamrolls you and everything you know. It clumsily lurches forward like my now 3-month old daughter trying to grab a rattler. Disruption at its core isn’t some tech mogul’s latest device release. Things are broken for quite some time. And it’s important to remember that disruption isn’t only what the marketing people tell us. It most certainly also includes the cataclysmic collapse of financial markets that no one ever seems to believe are going to happen and then do.

The major shift happening in games today is that after it became mainstream, it is now becoming the connective tissue in a world where home and office are no longer mutually exclusive, digital and physical bleed into each other, and both private and public spheres are increasingly the same.

After reading about how the ultra-rich got ultra-richer over the past 2,753 months of the pandemic while we sat home trying to not get depressed, people are looking for something FUN. That same pandemic has delivered us to a new cultural consciousness where the exchanges of social capital and digital money are invariably tied into the way we now play. Playing for keeps both invigorates gameplay and connects it to a larger cultural framework. As Geertz would have it a story we tell ourselves about ourselves.

Neither the strategy teams at large legacy firms nor the ever-contrarian indies have so far drafted a strong next chapter. They don’t have to. As long as demand exceeds supply, existing franchises capture value (I mean, that GTA Remaster looks sick) and offer greater leverage in negotiating with platforms and non-endemic partners (e.g., music labels, brands) as they find their way into interactive.

But you can see the shape of things to come in the waffling that’s going on. In response to investor questions, EA’s CEO Andrew Wilson said:

“I think that in the context of the games we create and the live services that we offer, collectible digital content is going to play a meaningful part in our future. So, it's still early to tell, but I think we're in a really good position, and we should expect us to kind of think more innovatively and creatively about that on a go-forward basis.”

I’m sure both investors and fans everywhere “should expect you to kind of think more innovatively and creatively.” But right now you’re just saying words without making any sense.

It tells everyone that you don’t have a plan. And indecision is always the wrong decision.

On to this week’s update.

NEWS

Niantic opens up Lightship to devs to build a “real world” metaverse.

It is fairly unlikely that this was part of their original plans and CEO Hanke did not mince words calling the metaverse a “dystopian nightmare.” Consistent with his vision from way before Pokémon Go, Niantic will focus on creating an interactive layer on top of the real world.

Some skepticism is warranted. In the wake of a failed Harry Potter experiment and the closure of its “Wizards Unite” one has to wonder if Pokémon Go was really the only successful application of AR technology as entertainment. And, if Niantic is proving unable to replicate its success with other franchises, giving the tech away for free seems like it’s merely outsourcing innovation while retaining a royalty.

But optimism is warranted. Hanke is an idealist. In his view, AR serves to incentivize and motivate people to look at the world around them from a new perspective. Many of us made a lot of friends during the height of the Pokémon Go craze. Link

EVE Online maker CCP Games offers its own take on NFTs

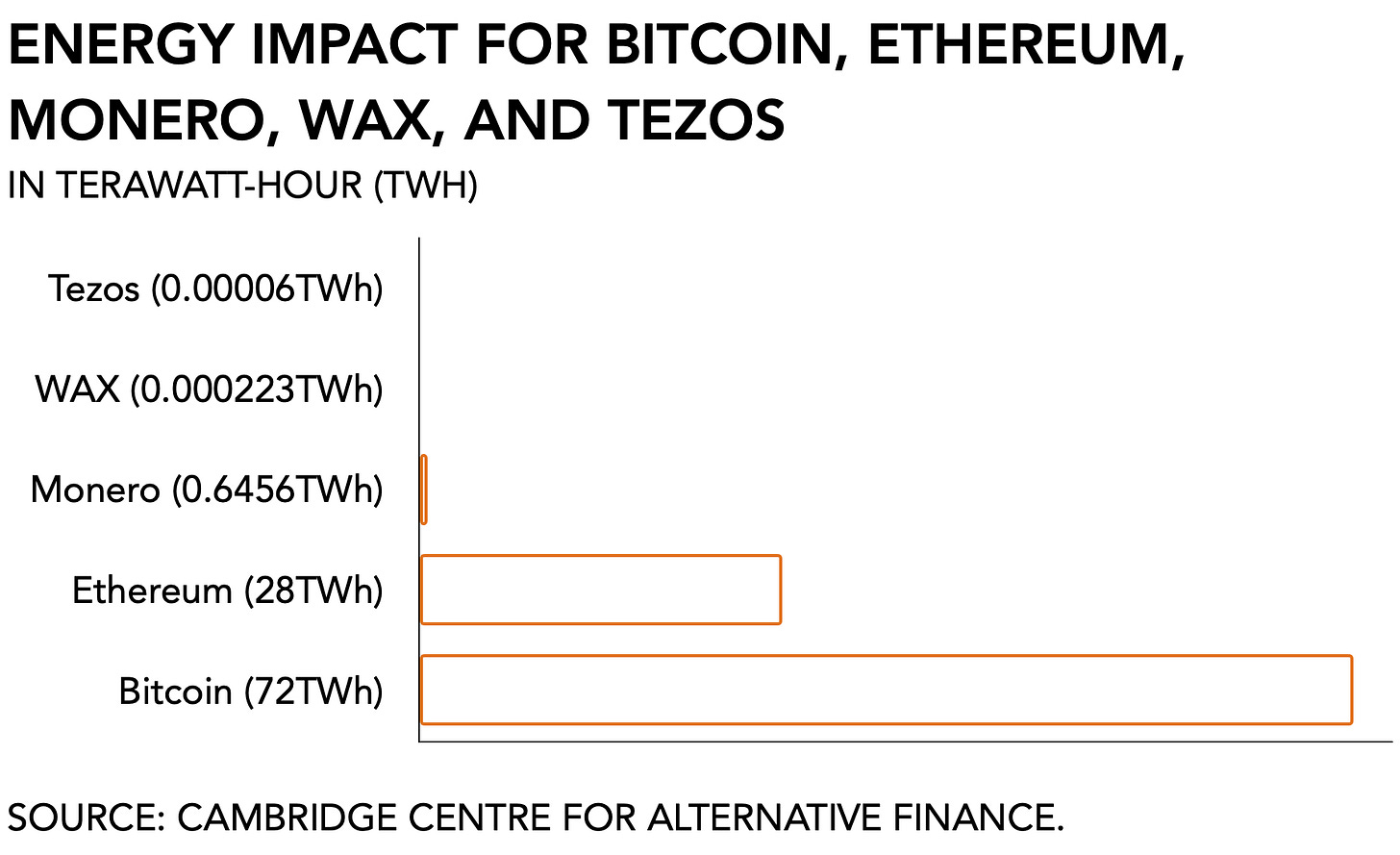

In case you’re still reading, you may be excited to learn that one of the most legendary independent publishers, Iceland-based CCP Games, will be issuing NFT tokens for kills during its Alliance Tournament XVII tournament to be minted as NFTs. Think Top Shots, but with space ships. By relying on Tezos, CCP Games is deliberately taking a stance against the energy inefficiency involved with other protocols, saying that it is “keenly aware of the environmental impact of cryptocurrencies.” Imagine that.

[BTW, you can find the full analysis here.]

MONEY, MONEY, NUMBERS

Earnings season is almost done. Hang in there.

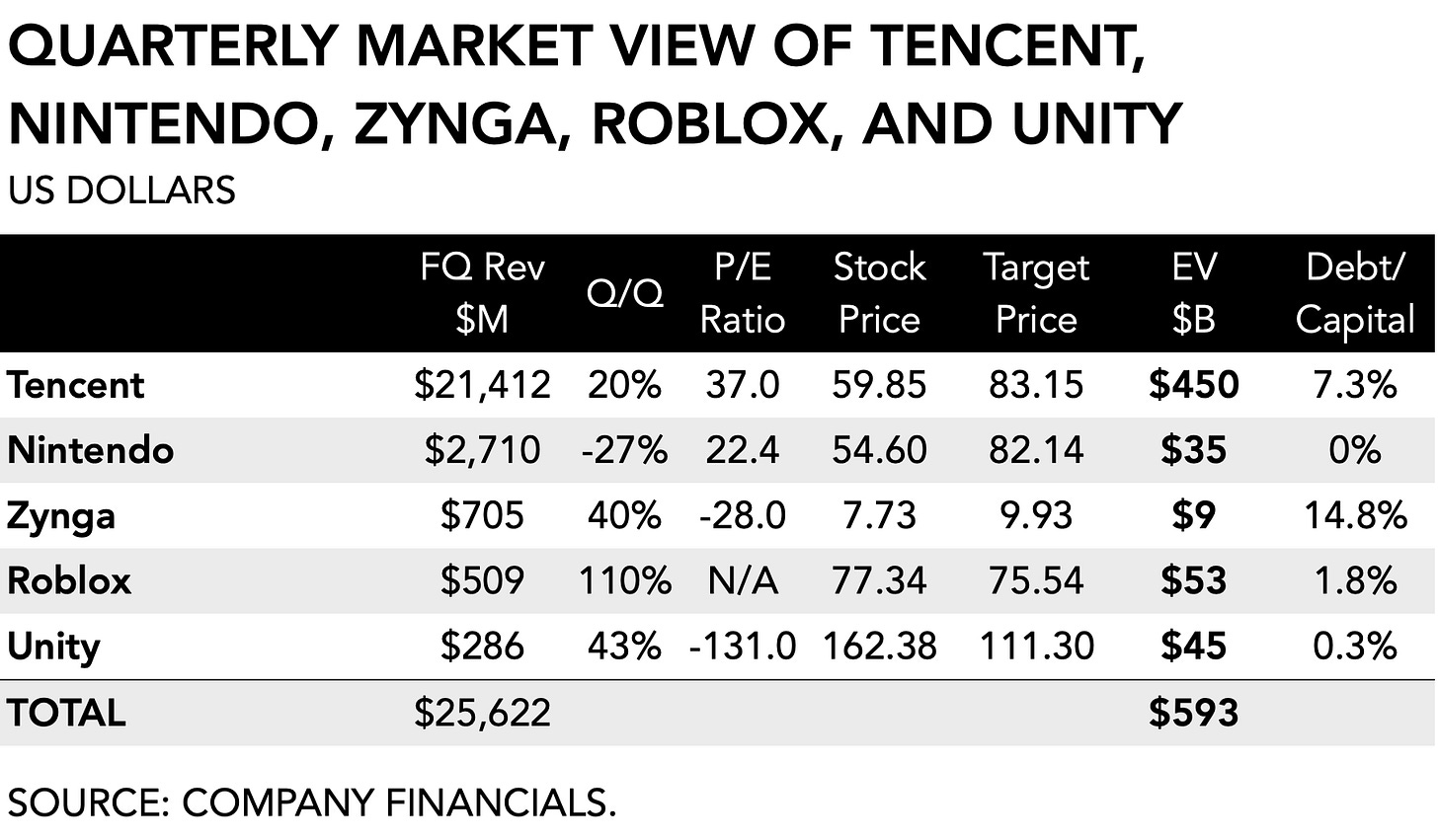

Zynga reported $668 million in bookings, up +6% y/y. Online games revenue was slightly down (-5%) at $534 million, but a strong performance by Rollic, the Istanbul-based hyper-casual game maker it acquired late last year, made up the difference with a +99% increase y/y in advertising revenue. Two of Rollic’s titles, Arrow Fest and Text or Die managed to reach the #1 most downloaded slot on the iOS App Store during 21Q3.

Zynga’s average mobile daily active user count was up +21% y/y at 38 million. Forward-looking results are promising as Zynga has managed to deflect any negative impact from volatility in user acquisition costs and a successful launch of FarmVille 3 (11/4) which Sensor Tower tells us saw over a million downloads in its first week and an ARR of $50 million. Another big draw for investors is Star Wars Hunters (beta launch scheduled for next week), which represents Zynga’s its first cross-platform game that will sync purchased items between mobile platforms and the Nintendo Switch. Finally, the firm also announced it is hiring a VP of blockchain gaming.

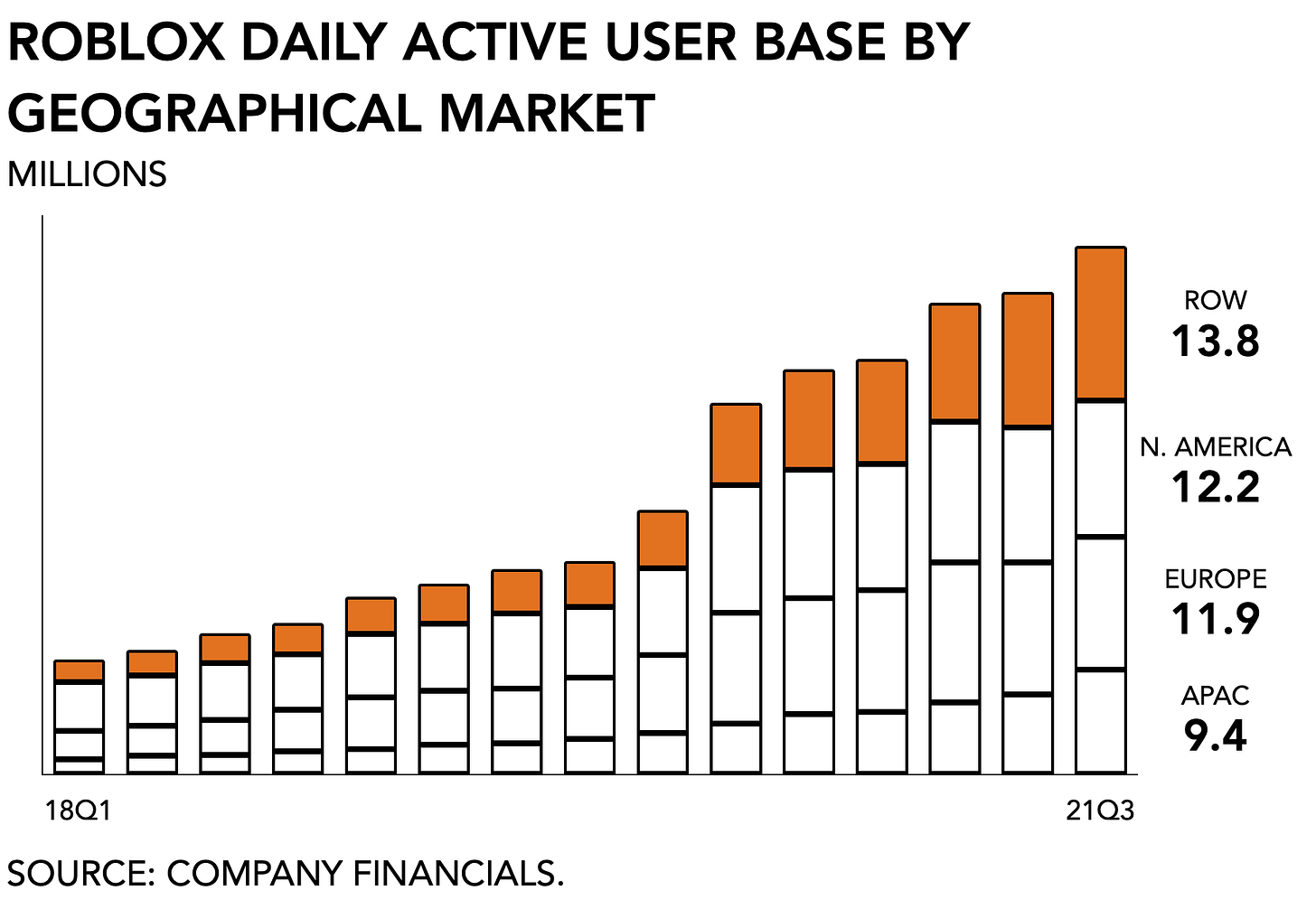

Roblox surprised everyone by reporting $509.3 million in revenues for 21Q3, up +102% compared to the same quarter last year. Wall Street analysts had previously estimated a $25 million loss as a result of the 3-day outage at the end of last month. Roblox’s average daily active user count came in at 47.3 million, an +31% increase y/y, which made everyone feel warm and fuzzy after they had feared a greater impact of the back-to-school period in August and September. The Asia Pacific region showed the biggest increase from 7.2 million in 21Q2 to 9.4 million in 21Q3, or +31% q/q.

What struck me about this quarter’s numbers is that for the first time in its history, Roblox’s audience now comes from the amorphous geography called Rest-of-World, or ROW. It’s a typical add-on found in earnings reports and generally represents a grab bag of countries that individually don’t contribute to a firm’s numbers. In aggregate, however, ROW is now Roblox’s biggest geographical market and counts 13.8 million daily active users.

We find one explanation in the fine print. The graph above is based on its charts on page 34 in the 10-k; however, on page 3 it explains that it does

“not collect the geographic location of our Xbox users, which are grouped into Rest of World DAUs for the purposes of our reporting.”

Chances are that Microsoft tried to acquire Roblox before it exploded to the size it is today, especially since it’s been keen on buying big things like Minecraft (which it did) and Discord (which it didn’t). Seems ironic that the firm that once wanted to become its parent owner now lives hidden in an aggregate category. Console, of course, is not the most intuitive device for a cross-platform title like Roblox. According to its S-1 filing in November last year (p. 122), consoles only represented around 3% of its player base based on “users’ sign up platform.” Link

Unity beat expectations with $286 million in revenues (+43% y/y) by growing its customer base (above $100k in annual spend) from 739 in 20Q3 to 973 in 21Q3.

The firm also acquired Weta Digital, a company you’ve never heard of before, for $1.625 billion, split between $1 billion in cash and $625 million in Unity stock. It’s a visual effects tech company founded by Peter Jackson. You’ve seen it in action with Neyriti, the giant blue Zoe Saldana in Avatar (before she turned green for MCU), Gollum in LotR, Caesar in Planet of the Apes. The general idea is to democratize special effect tools and thereby to snub competitor Epic Games’ Unreal Engine. Analysts were optimistic about the purchase to bolster Unity’s position and subsequent ability to deliver on a “true Metaverse,” whatever that is.

Nintendo came up light with $2.6 billion in revenues, compared to a consensus of $3.2 billion and $3.6 billion for the same period last year. Sell-through of its Switch reached 3.83 million units, which was well below the 6.9 million units from a year ago, but on the higher end of the implied range of 3.0 to 4.0 million. The shortage in semiconductors was the big culprit, in combination with a likely “draining” of retail channels to maximize sales for its recently released OLED model. Software sales reached 48.6 million, down -2.5% year-over-year. Nintendo reduced its FY22 forecasts of the Switch from 25.5 million to 24 million units. Link

Tencent reported its slowest growth since its IPO and a total of $22 billion in quarterly revenue, up +13% y/y. It nevertheless beat analyst expectations of a decline. Meanwhile, the Chinese government is all over Tencent. Minors accounted for 0.7% of domestic games time in September this year, down from 6.4% in the same month last year as a result of new limits imposed by the Chinese government. And considering that same government hasn’t approved any new titles since August (!) investors are getting worried we’ll see a repeat from 2018 when it lost an estimated $3 billion in revenues. Link

PLAY/PASS

Play. Apple’s request to delay (!) making the necessary changes to its App Store was denied.

Pass. Apple totally just allowed Netflix to refer to itself as a store for its games but links in the app just take you to the App Store. That’s 100% unfair to all the other apps and ad networks it shut down for doing exactly that. (h/t Sadin)