At long last, I return to the Netherlands for the first time in over two years.

During the pandemic, of course, I’ve tried to visit virtually. I watched all the canal boat tours available in 360 degrees on YouTube’s VR section. It served as somewhat of a bandaid for my nostalgia. Sure enough, it feels like I’m there but no one is interacting with me. And, quite honestly, I’m unsure that my first choice of activity back in the NL would be to take a cheesy boat tour. There are also lots of places I’d rather visit but we’re still eons away from a Google Maps Streetview equivalent for virtual reality.

The closest thing I’ve encountered in the US that teleports me back to the Netherlands are sensory experiences that are difficult to reproduce. For instance, there are those few days in the year when the weather is absolute shit. I’ll set out for the day and walk straight into a gloomy overcast that slowly pisses miserly rain on my head. Oh, it takes me back, alright. But not in the best of ways. And despite increasingly alarming climatological changes, controlling the weather remains a fantasy.

Perhaps the metaverse then will ultimately help me stay connected to my place of birth. In a recent conversation, someone pointed out that geographical borders will be one of the major considerations in the metaverse.

I fully expect governments everywhere to soon start subsidizing cultural outposts in virtual reality to ensure that just in case the entire world economy transitions they’re properly represented. The digital version of the Netherlands will undoubtedly offer an exuberant read on its rich history and deep cultural roots, minus the Apartheid, of course. My infantile mind immediately started imagining a Dutch metaverse that somehow resembles Mario Galaxy but is completely made up of cheese and littered with tulips. Rembrandt will be there, probably in 3D like Van Gogh was recently. Everyone gets a pair of non-fungible clogs (NFGs) and you need to buy DigiGuilders to pay for consumables like blockchain-based black licorice and crypto-pickled herring. It’ll be a post-modern theme park riddled with windmills, bikes, and fried foods covered in mayonnaise. It will be better than the real thing, a hyper-verse.

Maybe before we all set off on our new digital adventure, we ought to take one last analog look around. Because we can never go home.

On to this week’s update.

BIG READ: Sony’s plans clearer with latest Epic investment

Following recent speculation that Sony was about to make a big purchase, the Japanese giant announced this week that it invested $1 billion in Epic Games. Together with Kirkby, the investment company behind the LEGO group, which also invested $1 billion, the most recent round values Epic Games at $31.5 billion. It marks Sony’s third investment after providing $250 million in funding in July 2020 and $200 million in April 2021, for a combined total of $1.45 billion.

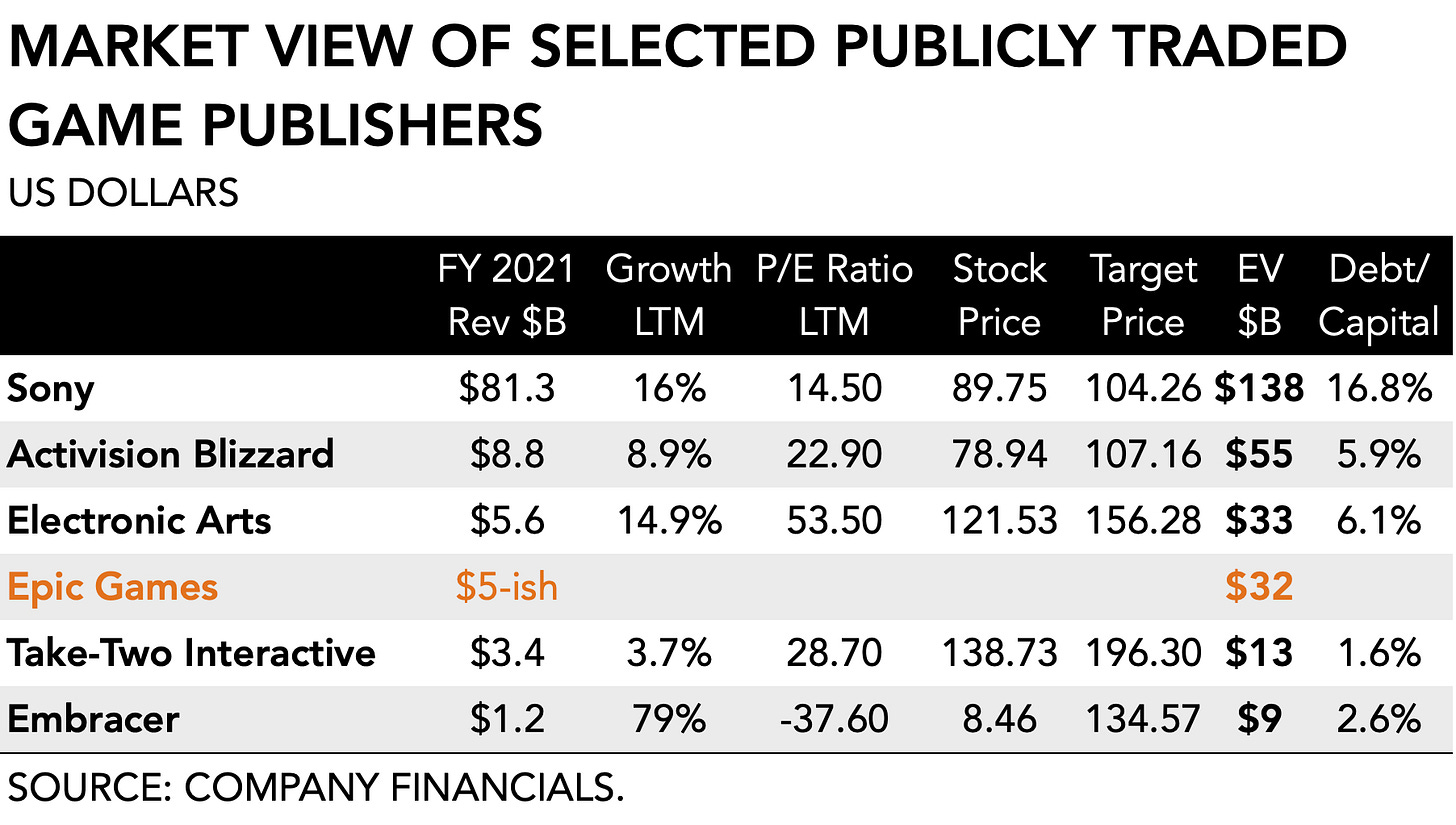

Even for the big dogs in an industry that’s running hot, those are eye-popping numbers. Epic Games, we learned from its legal battle with Apple, generated $5.6 billion in 2018, $4.2 billion in 2019, and $5.1 billion in 2020. If we assume a similar revenue figure for last year, 2021, it puts Epic Games roughly in the valuation range as Electronic Arts (see below). The only difference is, of course, its new and improved Unreal Engine 5 (UE5).

Succinctly, the new game engine offers at least five major improvements. First, Lumens enables global illumination and replaces conventional workarounds like path tracing and light baking which are computationally much more demanding. Second, Nanite is a novel way to calculate billions of polygons dynamically. It lowers the number of polygons on distant objects thereby making it feasible to insert highly-detailed assets. Third, with Megascans, creatives can insert 3D models of real-world structures and objects in a virtual environment. UE5 offers a library of over 16,000 objects that are free to use. MetaHumans are a fourth feature that will make animation easier, both in terms of importing real-life people into a synthetic world and animating them. Finally, everything that was available in the previous version, Unreal Engine 4, is easily usable and backward compatible with UE5. It provides a more powerful creative tool to, especially, smaller teams and has the potential to elevate the quality of productions coming out of small and medium-sized studios. (Here’s a helpful overview.)

Meanwhile, Sony is formulating a strategy that hinges on diversified content. Unable to follow Microsoft into the cloud, the firm previously struck a partnership with its rival console-maker to explore novel innovations and user experiences around AI and direct-to-consumer entertainment. The investment in Epic Games also serves as Sony’s main tether to what many believe to become the metaverse, which, by the way, Citibank valued somewhere between $8 and $13 trillion. Epic’s game engine software, Unreal Engine, plays an increasingly important role across entertainment categories and will help Sony maintain efficiencies and cross-platform capabilities.

Despite the extensive coverage of Sony’s announcement two weeks ago that it is consolidating its PlayStation subscription services, ostensibly in response to the success of Microsoft’s Game Pass (which it isn’t), the most recent Epic investment is more informative. For one, now that it owns 3% of Epic shares, Sony is in a position to leverage its library of interactive entertainment, film productions, and music rights for use in the publisher’s breakout title, Fortnite. Two weeks ago the game announced a ‘zero build’ version which will make it more accessible to a broader audience.

Overall, game makers and platform holders are bulking up following a period of high demand, accelerated technological innovation, destigmatization of gaming, cheap capital, and the entry of big tech. It has forced especially incumbents to future-proof their businesses. And so they have. Among its recent corporate developments, Sony invested $400 million in Chinese live streaming service Bilibili in 2020, acquired Crunchyroll in August 2021 for $1.2 billion, took minority stakes in instant messaging platform Discord, invested $500 million in mobile-first developer Scopely, bought 5.03% of outstanding shares in indie developer Devolver Digital, acquired Jade Raymond’s one-year-old dev shop Haven Studios, and, oh right, acquired Bungie for $3.6 billion.

Sony is looking to position itself at the intersection of not one but three different content categories. By carefully building a portfolio of interrelated properties that could benefit from each other in the context of a service-based offering, the firm is mitigating the risk conventionally associated with singular, high-profile successes. It allows Sony to develop rich intellectual property across an array of consumer experiences. I fully expect it to follow a similar course to another consumer electronics firm, Apple, which announced back in 2017 that it was going to double its services revenue. Which it did, of course.

As for Sony, it’s unlikely they will, for instance, double the install base of its PS5 compared to the previous generation. Outside of supply chain issues and semiconductor shortages, there are simply too many cheap substitutes available now that the games market has quadrupled in size. Already does digital content account for two-thirds of Sony’s Game & Network Services division. Increasing the value of an individual user in their ecosystem is the plan.

Maintaining its position as a premium provider of consumer electronics and associated content services will be key to Sony’s long-term success. And it will keep spending to keep that edge. But at some point, even a giant is going to run out of things to buy and will invariably have to look inward for innovation and fresh content.

NEWS

Fanatics raises $1.5 billion for digital acquisitions

Consolidation is well underway across all entertainment categories, including sports merchandise. Fanatics, a US-based that calls itself the “leading global digital sports platform,” just raised another $1.5 billion to push further into digital collectibles and trading cards. The move further validates the concept of collecting digital assets as an emerging category.

Previously, Fanatics doled out $500 million to acquire the Topps trading card business. A central tenet in the firm’s expansion is launching trading cards and non-fungible tokens, in addition to sports betting. According to CEO Michael Rubin,

“Just have a little imagination about what we can do with the fan experience. You can start putting merchandise and collectibles together, you include NFTs and trading cards, sports betting, sports rights, some kind of ticketing integration. The experience we can give you as a sports fan could be spectacular.”

With this most recent round, Fanatics is valued at $27 billion. Notably, the NFL was the “single biggest investor” in the latest round announced by the company which saw its valuation jump +50% since its previous round in August.

The growing confidence among IP holders and large entertainment firms to continue their push into blockchain-related categories, especially those centered on NFTs, are likely to fuel further enthusiasm. However, it is also raising the table stakes and focusing the bulk of strategies around consolidating assets and IP. A few weeks ago, blockchain-native Yuga Labs announced a seed round of $450 million that valued the NFT marketplace builder at $4 billion, after it acquired the assets of popular NFT projects CryptoPunks and Meebits from Larva Labs.

Nintendo and Sony adjust their autorenewal policies

An investigation by the UK’s Competition and Markets Authority (CMA) into online gaming services that automatically renew membership resulted in “a number of changes have been made across this sector to protect customers.”

Specifically, Sony agreed to put in place measures to protect customers who haven’t used their memberships for a long time but are still paying, will contact active subscribers that haven’t been using the service in a while, remind them how to stop payments, and, if they continue not to use their memberships, to ultimately stop taking further payments. Similarly, Nintendo Switch Online Service is no longer sold with automatic renewal set as the default option, according to a statement. What the specific thresholds are is not described. The changes follow a January 2022 change in Microsoft’s Xbox policies.

As the world moves to subscriptions, reducing churn is going to be increasingly important. Arguably, committing oneself to any entertainment service—whether it is music, podcast, news, video, or games—is the digital equivalent of loyalty. You can incentivize people to try something. You can encourage them to stay, and you can even discourage them from leaving by increasing switching costs, etc. But you can’t buy me love.

Crypto goes after esports

Blockchain gaming companies are starting to realize that a healthy social community is a key component to sustainable popularity in digital gaming.

After a spectacular rise in popularity, Axie Infinity saw its player count drop once the game could no longer provide players with earnings that exceeded minimum wage. The mindset of a play-to-earn player is exactly that: Pay. Me.

Once the numbers started to fall, so, too did Axie’s userbase. Worse, a costly $650 million hack exposed the firm’s failure to properly secure its validation process. Despite quickly raising $150 million to compensate its community, owner Sky Mavis must have realized that a slower, gradual path may give it more time to scale appropriately and establish the key interpersonal relationships that are traditionally associated with business models relying on network effects.

For their next act, blockchain game companies are looking to expand their talent pool on the supply side and build competitions and tournaments on the demand side. This week, Animoca acquired French game maker Eden Games for $15.3 million. According to the announcement, parent company Engine Gaming & Media (disclosure: I’m an advisor) sold off its 96% ownership of Lyon-based Eden Games. The 25-year-old studio that worked, among other things, on Formula 1, a racing game that became central to the success of Codemasters and its eventual acquisition of $1.2 billion by Electronic Arts.

Animoco Brands, a blockchain-focused gaming firm, has been on a tear lately in terms of investing and acquiring assets. With about 60 people on staff, the acquisition is a prime example of a broader industry trend of blockchain-focused game companies and conventional game makers increasingly competing over talent.

Back in 2017, when Engine Gaming & Media was still operating under the name Millennial Esports, it acquired the studio. At the time, management argued the purchase was part of its strategy to “take part in the significant growth in Mobile Esports gaming revenue globally.”

One thing that became clear when FaZe clan announced its proposed IPO is that the model does not rely on tournament winnings but rather on the successful curation and creation of experiential events around talent. Fans follow a player, even if that person switches games or platforms.

Just this week, Community Gaming, an “esports earnings platform,” raised a $16M Series A. Led by SoftBank, the rest of the investors are a whos-who of blockchain bigshots: Animoca Brands, Binance Labs, CoinFund, Hashed, Multicoin Capital, Shima Capital, Polygon Studios, and ConsenSys Mesh. It also includes angel investors Jeff Zirlin, the co-founder of Axie Infinity, and Gabby Dizon, co-founder of Yield Guild Games.

As blockchain game companies use some of those quick-gotten gains to hire talent, their emphasis may yet move away from the financialization of play toward the accidental subsidization of something fun.

PLAY/PASS

Pass. Is it a market correction when your $2.9 million NFT now sells for a measly $277?

Play. Props to the NY Times article on Elden Ring that got everyone talking about investing more resources in games journalism.

Thanks for looking at Sony. Just a reminder market cap seems to be 110B, and your target price is too low I believe (at 104). At least the street average is much higher than 104, if that is your target than fair enough :). ATVI target seems unusual too, as it is acquired for 95 a share and it will certainly trade lower than that if the deal fails (market price implies a %50 failure possibility). Back to Sony, or in console space in general, do you think there is a crisis? I read your book and in there you were explaining how Nintendo saved the space back in 80s by introducing a new business model and focusing on quality. Looking at the space today, publisher stocks are sideways/south for years now, heck Ubisoft is trading at levels seen in 2007. Everyone is interested in big AAA projects but they are too risky. And the rest of the smaller stuff is not generating excitement among most. At one perspective, looking at what Unreal 5 engine promises and what Sony studios are able to achieve, I like to think the best is still ahead. But at the same time looking at the business side of things, I see little upside for publishers (and platform holders) in the console space. At the end of the day, how much more can you milk a single customer? If he spends more on Sony's services/games then he will spend less on CallOfDuty/Fortnite which will lower Sony's platform fee gain as well. I don't know, maybe a bust is needed as in the 80s but I don't know how that can play out.

You should take a look at VZfit for continouse motion through Google Streetview in VR may be better than those 360 videos or Wander for clicking through.