The SuperJoost Playlist is a weekly take on gaming, tech, and entertainment by business professor and author, Joost van Dreunen.

Whenever I encounter an unexpected result, I go back and review the numbers.

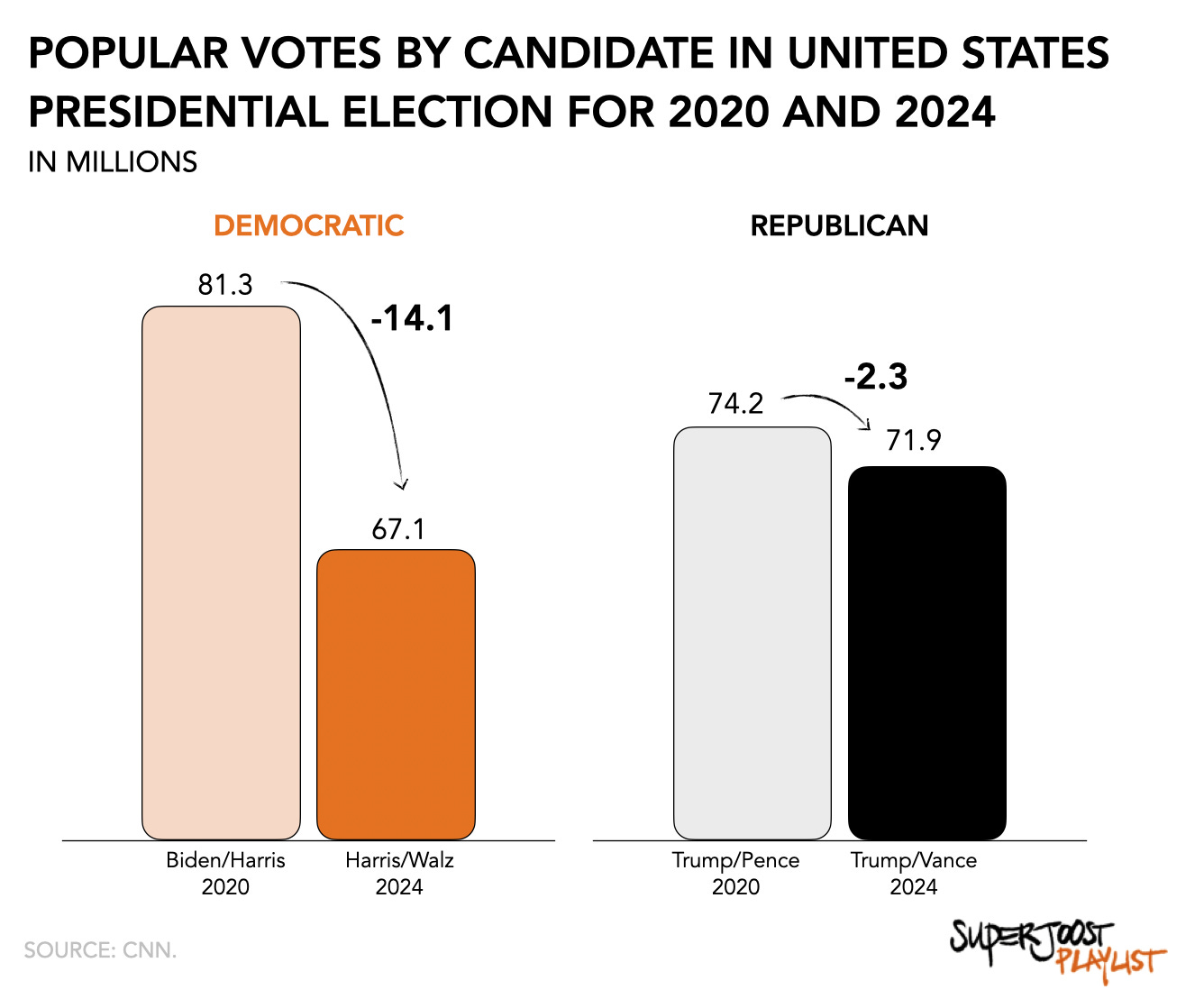

Often, in my experience, I missed something. In the case of the US elections, it turns out, we missed 14,194,157 votes for Kamala Harris, giving her a paltry total of 67.1 million votes, according to CNN, compared to the 81.3 million Biden won in 2020. Their Republican rival saw a drop, too, from 74.2 million to 71.9 million.

Despite the odds and relevance of this election, a group of people, roughly the same in number as the entire population of the Netherlands, did not vote for whatever reason.

I did not expect that.

On to this week’s update.

BIG READ: Subject, to change

It’s been a week of turmoil and distractions. For this one, I’ll stick with the facts and, hopefully, make some sense of what’s to come.

Interactive entertainment is in the middle of a pivot from content to distribution innovation, and major publishers are exploring novel channels and revenue models to drive growth. The latest earnings reports reflect this transition, as firms adapt their strategies to capture value through innovative distribution rather than solely focusing on content creation.

For instance, last night Take-Two delivered strong second-quarter results with net bookings of $1.47 billion, reaching the top end of their guidance range, while demonstrating its strategic patience with GTA VI's release timeline.

The company showcased the enduring strength of its key franchises, with Grand Theft Auto V surpassing 205 million units sold worldwide, Red Dead Redemption 2 reaching 67 million units, and NBA 2K25 selling nearly 4.5 million units. While awaiting GTA VI's launch in the fall of 2025, the company is focused on organizational optimization and efficiency, evidenced by the strategic sale of Private Division to concentrate resources on its core blockbuster franchises and mobile business. Historically, it prioritizes the quality of the player experience over investor interest because, as it has proven repeatedly, making great games provides the greatest benefit to shareholders. During the earnings call, Take-Two’s CEO, Strauss Zelnick stated:

“Yes, it's harder and harder to make big hits, and we're so grateful to our creative teams because that's exactly what they focus on every day. We get to do the easy stuff like talk to you all. They have to do the hard stuff, which is make the hits that drive this industry."

Mobile revenues were up 9% y/y at $723 million as Zynga as titles like Match Factory! and Toon Blast drove 23% y/y growth, despite a $50 million headwind (-30% y/y) in mobile advertising. Take-Two's upcoming slate includes major releases like GTA VI, Borderlands 4, and Mafia: The Old Country, reinforcing its proven strategy of focusing on blockbuster releases despite associated risks, as demonstrated by its willingness to support the Borderlands franchise even after a disappointing film adaptation. The company maintained its full-year guidance of $5.55-5.65 billion in net bookings and expressed confidence in achieving record net bookings levels in fiscal 2026 and 2027.

Disappointing results from Nintendo, with total sales declining -17% y/y to $1.84 billion, fell well short of analyst estimates of $2.19 billion. Hardware sales dropped 15% to $724 million, with the Switch selling 2.6 million units and software sales decreasing to $977 million from $1.2 billion in the same period last year.

The company has lowered its fiscal year 2025 guidance, reducing projected net sales to $8.5 billion from $9 billion while maintaining its net income forecast of $2 billion. The decline is largely attributed to tough comparisons against last year's successful releases of The Super Mario Bros. Movie and The Legend of Zelda: Tears of the Kingdom, as well as the Switch entering its eighth year in the market.

Analysts remain optimistic about Nintendo's future, based on high expectations for the Switch 2's launch in the first quarter of 2026. The successor console is anticipated to maintain the hybrid form factor of the original Switch with an initial price point of $400 or below. While Nintendo has not officially announced the new console, management indicated news will come between now and March, likely after the holiday season to maintain focus on current Switch sales. Analysts project first-year hardware sales in the range of 14 to 16 million units and software sales of 60+ million units for the Switch 2, highlighting Nintendo's strong position in the gaming market with its diverse first-party game lineup, particularly as competitors focus on annual iterations of existing franchises.

Electronic Arts reported net bookings of $2.08 billion, up +14% year-over-year, leading the company to raise its full-year guidance. Live services now account for 74% of the business on a trailing 12-month basis.

With the successful release of EA Sports College Football 25, the publisher’s combined American Football business, which includes the Madden NLF franchise, is expected to generate over $1 billion annually. Total player count more than doubled, with half consisting of new or previously lapsed Madden players, indicating that the College Football release was largely additive and not cannibalistic as initially feared by skeptics. Success in sports offsets EA’s struggles in the shooter market where Apex Legends has failed to drive revenue despite recent changes to its Battle Pass offering. The overall shooter category is blood red, with many similar titles competing for market share.

Notably, EA also announced a change in strategy with its popular The Sims franchise by moving away from traditional sequential releases to a more diversified platform approach. A few weeks ago I moderated a panel The franchise continues to perform well after nearly 25 years and, according to management, “500 million [players] have joined the community.” That’s a generous way of saying a lot of people have played the game over the years, but it nevertheless shows the franchise’s strength. As relatively novel categories like cozy games and nostalgia become growth drivers, The Sims is well-positioned to benefit from distribution innovations like creator kits, expansion to new channels like the release on the Switch, and the announced film adaptation with Amazon MGM Studios. Analysts expect The Sims to generate just under $400 million annually in 2025E.

Next, Mattel's third quarter shifted focus from top-line growth to profitability and margin expansion, as it navigated the expected tough comparison against last year's Barbie movie success. According to Box Office Mojo, the Barbie Movie has accumulated $1.4 billion in worldwide sales. Nevertheless, Mattel’s net sales declined 4% to $1.84 billion, even as the company reported margin improvements. The company's Vehicles category ($580M), led by Hot Wheels, delivered strong 12% growth, while its Infant, Toddler, and Preschool category ($350M, -3%) led by Fisher-Price showed signs of recovery together with Action Figures, Building Sets, and Games ($364M, +2%), helping to offset the anticipated decline in Dolls ($757M, -14% y/y). Mattel further reduced its ad spending, from $124 million in 23Q3 to $105 million in 24Q3, as part of a plan to ramp up later in the year.

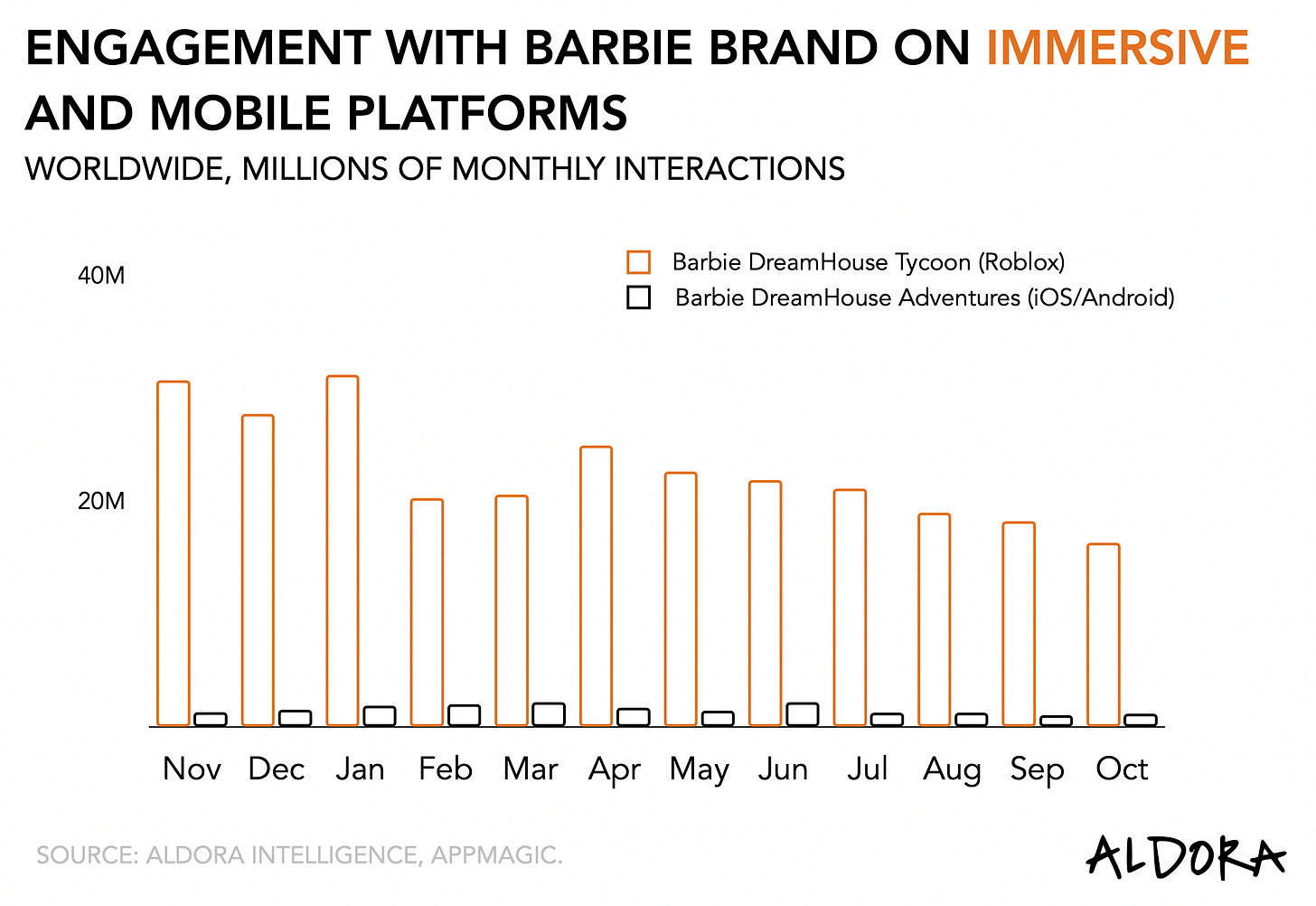

Over the past twelve months, there has been a steady decline in overall interactions with the Barbie brand, which declined from a high of 31.2 million in January this year to 16.3 million in October. Immersive experiences on platforms like Roblox still outperform more traditional digital strategies like mobile apps, which hover between 1.2 and 2.2 million on a monthly basis, according to mobile data provider App Magic.

Following the success of the Barbie movie, Mattel is pushing deeper into Hollywood. Notably, the firm’s CEO has a TV and film background having worked for Endemol and Makers Studios). After reshuffling its gaming division, the logical next move seems to advance its entertainment strategy, and it has announced several new initiatives including the Masters of the Universe movie set for 2026 and a Matchbox movie starring John Cena.

Finally, I also learned a new word: according to CEO Ynon Kreiz, Mattel is expecting growth in part due to a “toyetic” theatrical slate. It means that something or someone is suitable for merchandising licensed toys, games, and novelties. According to Mattel’s own Scrabble franchise, however, toyetic is not a legal word. So there’s that.

And as expected, Ubisoft reported challenging first-half fiscal 2025 results, with net bookings declining -21.9% year-over-year to approximately $690 million, and a significant operating loss of $271 million compared to a profit in the same period last year.

The French publisher’s performance was impacted by underperformance of key titles like Star Wars Outlaws, though engagement metrics showed some positive signs with Monthly Active Users up 3% to 37 million and increased playtime across its portfolio. The company highlighted the long-term strength of its key franchises, with Assassin's Creed generating around $4.3 billion in lifetime revenue, Rainbow Six Siege exceeding $3.8 billion, and Far Cry reaching approximately $2.2 billion. I’d note, however, that past performance offers no guarantee for future results.

Even so, Ubisoft maintained its full-year guidance, targeting net bookings of around $2.1 billion. The company emphasized its progress on cost reduction initiatives, having achieved over $215 million in annualized savings and reducing its employee count to 18,666 from 19,410 last year, or 3.8% of its workforce. Management acknowledged the need to improve execution while highlighting ongoing efforts to transform the company, including taking additional time to polish upcoming releases like Assassin's Creed Shadows. The company maintains a cash position of about $1 billion, with management indicating they are exploring the sale of non-core assets to enhance financial flexibility and focus on core verticals in Open World Adventures and Games-as-a-Service experiences.

Over the past few days, Ubisoft shares have been trading up as financial analysts reiterate the firm’s potential for upside, either in the form of a successful release or buyout. Accordingly, short-seller interest, another indicator of what investors think the stock will do, is down 57%.

And finally, Roblox delivered exceptional third-quarter results, with bookings surging +34% y/y to $1.1 billion and revenue growing 29% to $919 million, both exceeding guidance. The platform demonstrated strong user growth with daily active users reaching 88.9 million, up +27% y/y, while engagement climbed 29% to 20.7 billion hours.

Notably, the platform showed robust international expansion, particularly in Asia Pacific markets, with Japan and India seeing daily active user growth of 59% and 55% respectively while maintaining strong momentum in its core markets, including 26% user growth in the U.S. and Canada.

One notable quote from Roblox’s CFO, Mike Guthrie:

"Five quarters ago, the operating cashflow of the company was 28.4 million. Today, it was 247.4 million. Five quarters ago, free cashflow was negative 95.5 million. Today, it was 218 million. So, the business has, in fact, great unit economics."

The company further highlighted several strategic initiatives driving its performance, including improvements to its virtual economy through dynamic pricing and new monetization tools, as well as the continued evolution of its content ecosystem.

Developer payouts reached an all-time high of $231.5 million, reflecting the platform's commitment to its creator community. Roblox outlined ambitious goals, including targeting 10% of the global gaming software market (up from the current ~3%), while emphasizing its focus on AI integration and expansion into underserved genres. Consequently, financial analysts almost unanimously raised their price targets.

In total, earnings indicate that the current cycle is moving toward finding new ways to monetize and distribute gaming experiences. Take-Two's sale of Private Division signals a focus on blockbuster releases while exploring mobile advertising through Zynga, EA is expanding beyond traditional gaming with its sports media app initiative, Mattel is leveraging its gaming IP for Hollywood productions, and Roblox is revolutionizing its virtual economy through dynamic pricing and creator tools. Success in gaming's next phase will depend less on who can create the most content and more on who can most effectively connect their intellectual property with audiences across multiple channels and revenue streams.

PLAY/PASS

Play. Snoop Dogg performed at New York’s Times Square as part of a larger showcase by Epic Games for its ambition to host more online concerts and musical acts. Snoop is so toyetic.

Pass. The US Copyright Office announced it would not grant a new exemption in the Digital Millennium Copyright Act in support of video game preservation.

Play. 600 members of The New York Times Tech Guild have gone on strike and ask people to “not cross [the] digital picket line by playing any of the NYT Games (Wordle, Connections)”.

UP NEXT

I’m drafting a write-up on my recent meetings with some of the new management at King Digital and PlayStation. Stay tuned!

"Toyetic" is a toy industry term we've used for decades. When we work with entertainment or game companies, it's a word used to describe characters, costumes, vehicles, worlds that are easily translated into successful toys that deliver on traditional and successful "play patterns".

For example, when I made toys on Star Wars Episode 1, we begged Lucasfilm to add visible cannons or weapons to the yellow Naboo Starfighter which didn't have nearly the toyetic appeal that an X-Wing had with the cannons on the wings. Additionally, Darth Maul's double sided lightsaber was incredibly toyetic and was the best selling lightsaber for years.

Toyetic is also why you see many costume changes for main characters, so there can be multiple versions or accessories sold to build out the collection.

When i made WWE toys, we begged John Cena to change is in-ring costume more frequently so we can sell more John Cena actions figures. No shock, he was the most successful WWE action figrue for years.

We added ATVs to the Power Rangers toy line and TV show when ATV had a moment in the mid 2000s.

An so many more stories....

And Snoop is toyetic. Here's why - constant costume changes, unique and ownable dance moves, iconic vehicles, vast music slate, recognizable team / friends (Eminem, Martha, West Coast Rappers), highly aspirational, famous and rich.

So, welcome to the toy world vocabulary of Toyetic, Play Pattern, Price-Value, Deco, Re-Deco and countless other fun words. Happy to help with toy industry training anytime. :)

Counting down the days until the Switch 2 comes out! Super interested to see if that will change the landscape for more casual gamers. Would be interested to hear your take on the indie game dev scene (especially on Roblox) as well as we approach 2025!